Sociology Class 12 Passages Answers Maharashtra Board

Balbharti Maharashtra State Board Class 12 Sociology Solutions Passages Answers.

Maharashtra State Board Class 12 Sociology Passages Answers

Passage 1

Read the passages and answer the questions given below.

This is a real-life story of Rukmini Devi who lives in a small hut in Gaigotha Village in Wada Taluka of Palghar District in Maharashtra State. She belongs to the Warli tribe. Her husband is a marginal farmer who cultivates on two acres of land. They have two children, one daughter aged 10 years and an I son aged 6 years. Both the children walk to school and back daily (located about 3 miles away).

When cultivation season is over, (or if the rice crop is damaged due to heavy rains or pests) they face many hardships. A section of the crop is kept for their personal use, for the year. Tur Dal (lentil) is also grown in one small area, again for personal use. Ina small backyard, they grow vegetables like chilies, cucumber, and bitter gourd (karela).

During the off-season, both husband and wife go to the brick kilns (about 7 miles away) to do piece-rate work (That is, they get paid for each brick that they make.) While the men earn Rs. 300 per day, the women earn Rs. 150-200. Rukmini Devi stated that they prefer to walk the 7 miles both ways because the bus fare is Rs. 35/- per head one way. They cannot afford it.

Question 1.

Identify any three problems that the family of Rukmini Devi has to face.

Answer:

The main problem of the family of Rukmini Devi is poverty. The productivity of their economic activities is very less as they cannot use modern production techniques like fertilizers, pesticides, etc., their agriculture depends upon monsoons and there is a lack of adequate irrigation facilities. Due to the seasonal nature of agriculture, they have to face hardships and exploitation by non-tribal people. They are also being exploited by their employers who take maximum work from them and pay them minimum wages.

Question 2.

Point out and discuss briefly, gender discrimination in this setting.

Answer:

We find Rukmini Devi facing wage discrimination i.e., discrimination on the basis of sex in the payment of wages, where Rukmini Devi and her husband perform work of similar skill, effort, and responsibility for the same employer under similar working conditions but they don’t earn the same amount of money. This implies discriminative employers save on the cost by employing the tribal females. Rukmini Devi is working in, informal labour market where there is an absence of policies to safeguard gender rights.

Question 3.

Discuss the nature of the economy of the Warli tribes.

Answer:

The economy practiced by Warli Tribe is subsistence economy and simple. They use out model techniques therefore their production is insufficient. They cannot fulfill their basic needs. They try to fulfill their needs by collective efforts. Thus, the simple and collective economic life is an important characteristic of the tribal economy. The main occupation of the Warli tribe is agriculture which is in a state of backwardness. They live below the poverty line.

Passage 2

Read the passages and answer the questions given below.

Education, since the coming of the British to India, has been secular in content. By this we mean, the content of education did not include the study of sacred texts. Schools were open for all – to learn and climb the ladder of vertical mobility. The study of the English language, as well as the opportunity to study in the English medium, was available.

It is true that several Indians from certain social and economic strata were the first to access an English education. Many of them later constituted the intelligentsia of our society. We refer to many of them as social reformers, such as Raja Rammohan Roy, Ishwar Chandra Vidyasagar, Pandita Ramabai, Maharshi Dhondo Keshav Karve. They worked for religious, social, and educational reform in Indian society.

Such visionaries of society continue even in the post-Independence era, to the present time.

Educational opportunities have grown by leaps and bounds in the last 73 years since Independence. One questions if the educated have merely acquired education or if the education has helped citizens become gainfully employed and more importantly, enlightened enough to transform society at the micro-level.

It is necessary for the government to consider the interests of all sections of society.

Each citizen can play a dynamic role in the development of all people in our society.

Question 1.

Explain the impact of the introduction of a new education system by the British on Indian society.

Answer:

According to the new liberal education policy introduced by the British, education was not restricted to special sections of society. The spread of secular-based education widened the minds of the people living in India. Well-educated Indians were influenced by western values. They recognized that various customs and traditions were unjust and unfair. Therefore, they started various religious and social movements to reform Indian society.

Question 2.

Explain the role of education in the transformation of society at the micro-level.

Answer:

The role of education is effective to bring change at the individual level i.e., micro-level. The role of education as an agent or instrument of social change and social development is widely recognized today. Education can initiate social changes by bringing about a change in the outlook and attitude of man. It can bring about a change in the pattern of social relationships and thereby it may cause social changes Education has brought about phenomenal changes in every aspect of men’s life. Education is a process that brings about changes in the behaviour of society. It is a process that enables every individual to effectively participate in the activities of society and to make a positive contribution to the progress of society.

Question 3.

Discuss education as an instrument of social change.

Answer:

Education changes the outlook and traditional approach towards social and economic problems. It sharpens the skills, and knowledge of the children. Technical education helps in the process of industrialization which helps to bring a vast change in society. Education not only preserves the cultural traditions of the society but helps to transmit them from one generation to the next. Education fulfills needs of the society and propagates ideas to promote social change in all fields of life.

Passage 3

Read the passages and answer the questions given below.

Indian society is a melting pot of cultures. The history of Indian society gives enough evidence of the process of accommodation. From early times migrants integrated into Indian society and influenced its culture. Our historical past is testimony to this fact of cultural diffusion.

Today, we describe our society as a composite whole that includes tribal, rural, and urban communities. The way of life in these segments have their unique characteristics. However, is it also an observation that no one segment or community can be seen in its “pure” state. On the one hand, there is interdependence between communities and on the other, this would imply a certain extent of loss of cultural elements such as language, beliefs, customary practices, etc. Have we not seen how, for example, Warli or Madhubani Art has made it to T-shirts and wall hangings in many urban households? Also, how technology has reached the remotest corners of our country?

A question that may cross your mind may be, ‘Is there anything such as ‘pure culture? What constitutes “Indian culture”? ‘Can cultural extremism be valuable in the present world? These questions are valid

as they set us thinking. Perhaps there is no single “answer”?

Question 1.

What constitutes “Indian culture”, discuss with respect to cultural diffusion in Indian society.

Answer:

Over the years, India has changed a lot in terms of living standards and lifestyles, but even then the values and traditions are still intact and remain unchanged. Another aspect of India’s culture can be seen when someone is facing deep trouble. Irrespective of the class, tribe, or religion, everyone will step forward to provide help and support. Culture in India is a dimension that has been composed by its long history and its unique way of accepting customs and traditions, right since the Indus valley civilization took birth. India is a melting pot of various religions and cultures and it is the very nature of the unity in diversity, which has largely shaped the growth of Indian culture as a whole. The property of togetherness among people of various cultures and traditions has made India, a unique country.

Question 2.

Discuss tribal art and its role in cultural identity.

Answer:

Tribal art has progressed considerably due to the constant developmental efforts of the Indian government and other organizations. Tribal art generally reflects the creative energy found in the tribal areas. Tribal art ranges through a wide range of art forms, such as wall paintings, tribal dances, tribal music, and so on. Folk art in India apparently has great potential in the international market because of its traditional aesthetic sensibility. Some of the most famous folk paintings of India are the Madhubani paintings of Bihar, Warli folk paintings of Maharashtra

Question 3.

How interdependence between communities has resulted to a certain extent loss of cultural elements?

Answer:

Though the interdependence of communities connects all the cultures of the country it has also weakened cultural bonds of tribal and rural communities and also lead to the loss of cultural identity. It also makes one forget their own values, customs, and traditions. Although it has played an immense role in the unification of our country, a great amount of cultural identity and traditional values have also been lost.

Passage 4

Read the passages and answer the questions given below.

The causes of disharmony and strife are several-fold. Resistance to social change is one among many. Problems of contemporary Indian society include domestic violence, sexual abuse, child rights, problems of senior citizens, migrants, ethnocentrism, religious fundamentalism, linguistic fanaticism, environmental degradation, substance abuse and addiction to devices, mob lynching, and so on.

Given the varied types of social problems and their changing nature, there emerges a need to examine them in a scientific manner. The applicability of Sociology in its widest sense includes the exploration of various themes that cut across fields such as Masculinity Studies, Minority Studies, Film and Media Studies, Sociology of Sports, Environmental Sociology, Forensic Sociology, Gerontology, Sociology of Music, Medical Sociology, Marketing Sociology and so on.

Various government departments and voluntary organizations include sociologists on their panels to help steer policies and programmes. As Sociology is a people-centered discipline, it tends to create awareness and dialogue regarding human relationships. This is a valuable asset in governance and conflict resolution.

Question 1.

How does sociology perceive social problems in a scientific manner?

Answer:

Sociology views social problems as problems which arise out of the functioning of systems and structures in a society, or which are the result of group influences. They are also concerned with social relationships which emerge and are sustained because of the social problems. Thus, in analyzing alcoholism, a sociologist will be concerned with its effects on social relations and roles, that is, the relations with family members, with colleagues in the office, and with neighbours and friends as well as its effect on work efficiency, status, and so on. The study of social problems in sociology aspires toward a body of valid and logically related principles to get solutions for the social problems.

Question 2.

Discuss how resistance to social change leads to disharmony in society.

Answer:

Certain resistance to change is there everywhere. In no society, all the changes are welcomed by the people without questioning and resistance. To some extent, the removal of evil practices such as child marriage, human sacrifice, animal sacrifice, untouchability, taboos on inter-caste marriages, etc., could be achieved after a long struggle in India. Due to ignorance people often oppose new changes. Habit is another obstacle to social change. Individuals are very much influenced by habits and customs. People dislike or fear the unfamiliar. They are not ready to give up a practice to which they have been habituated and adopt a new one. Hence, the new practice is looked down upon or rejected which leads to social harmony.

Passage 5

Read the passages and answer the questions given below.

Given below is a make-believe scenario.

Yogini and Yogita are twins of the Patkar family who live in a small room measuring 225 sq. ft. in a

small town. Yogini is brilliant in studies and Kabbadi. Yogita is an outstanding cricketer who represents the Western India region; she also was a topper in the State-level Marathi language Competition.

Their parents come from a small village in Marathwada; they were farmers. For the sake of their daughters, they shifted to a small town to facilitate their children’s further education and sports training.

Their relatives and others in their village have heard of the Patkar girl’s success and are also encouraged to send their children to big cities with the hope that they too will become successful and famous one day.

Today, if one visits the village you will notice that in many homes, there are only the elderly folk. The youth seem to have migrated to better their prospects. Can you imagine the effect of such migration on the local village community?

Question 1.

What are the challenges faced by rural people while sending their children for higher education?

Answer:

Rural people migrate to cities for a better standard of living and better future prospects. They face lot of hardships, face all sorts of exploitations for survival and to shape the lives of their children. They work hard to meet the needs of their children and try to give them better education so that they have a decent life. Patkar’s family come from a small village in Marathwada, live in a small. For the sake of their daughters, they shifted to a small town to facilitate their children’s further education and sports training.

Question 2.

What makes rural people migrate to cities?

Answer:

Rural people are plagued with various problems of agriculture, the ownership of land, lack of cottage industries, lack of educational facilities like schools and colleges, lack of health care centers, unemployment, traditionalism, and conservatism all these factors force rural people to migrate to cities. Cites attract rural people with better job opportunities, education, and a better lifestyle. Cities are centers of opportunities for the rural people so they migrate in hope of having a better standard of livings.

Question 3.

What are the effects of migration on rural communities?

Answer:

When rural people migrate to urban areas for better prospects leaving behind everything. The negative impact of migration on rural communities are there is labour shortage in farms, only senior citizens, women and children are left behind, increase in child labour, children’s are forced, to work in fields, increased workload for women’s decreased population, disorganization of family, customs and in this way rural culture slowly fades away.

Passage 6

Read the passages and answer the questions given below.

Social movements arise generally from needs felt by one or more members of any given society. Through social interactions, these needs and concerns are communicated to many more persons. A network of people who share these concerns becomes the driving force for change in that particular society. Movements are usually guided by some underlying philosophies and goals. Indeed, several movements are associated with a founder or a core group. It can take several years, or even decades for a social movement to become very wide and expansive, across vast geographical territories.

Social movements such as the Social Reform Movement, Trade Union Movement, Tribal Movement, Dalit Movement, Women’s Movement, Chipko Movement, LGBT Movement, Civil Rights Movement, Rationalist Movement and so many more have emerged and grown.

As a social movement gains momentum, greater awareness is created in society. In fact, the study of several movements has found its way into the academic curriculum as well as research. For example, courses on Labour Studies, Gender Studies, minority’ Studies, and Environmental Studies. Social movements can stimulate critical thinking about social issues in the wider society of which we are apart. Some of these concerns lead to the passing of legislation. Every era or generation has its share of concerns from which may emerge new social movements.

Question 1.

What do you understand by social movement and discuss how it functions?

Answer:

Social Movement is a collection of a large group of people, who come with the desired objective to create a change or resist change. Through social interactions, individuals communicate and show their concern on various issues where they feel it necessary to change. Social movements arise generally from needs felt by one or more members of any given society. A network of people who share these concerns becomes the driving force for change in that particular society. Movements are usually guided by some underlying philosophies and goals. Indeed, several movements are associated with a founder. It can take several years, or even decades for a social movement to become very wide and expansive, across vast geographical territories.

Question 2.

How does the social movement arise in Society?

Answer:

Social movements arise in the society when certain issues bring unrest and discontent like unwanted social order and outdated norms like early child marriage, women emancipation, human rights, LGBT rights, etc., in the society. At this junction groups of people organize themselves, raise their voices and feelings and opinions set to influence the opinion and emotions of others, and prepare for reform. The need of society to bring changes in the existing system leads to a social movement.

Question 3.

Discuss any three social movements in the given passage.

Answer:

The three types of social movements are Social Reform Movements, Trade Union Movement, and Chipko Movement.

The social Reform Movement started in the 19th century. The movement promoted to change the traditional and conservative Indian society. Issues of main concern were religion, untouchability, early child marriage, sati, widowhood, exploitation of poor, etc. With the help of various social reformers and British legislative systems, changes took place.

Trade Union Movement was organized to fight against the exploitation of workers like they worked for long hours and were paid less, poor working conditions, lack of promotions, management disputes, strikes, etc.

Chipko movement took place in Uttarakhand, where Sunderlal Bahuguna and villagers came together and hugged the trees protected them from being chopped by the contractors. This was a protest to save forests and preserve the environment. The government set up a committee to look into the matter eventually ruled in favour of the villagers.

Question 4.

In what ways do you think the social movement is beneficial for society?

Answer:

Through social movements, various issues have been raised, which has brought changes. It has changed the mindset, attitudes and, behaviour patterns for instance women’s education, acceptance of transgender, etc. As a social movement gains momentum, greater awareness is created in society. The study of several movements has found its way into the academic curriculum as well as research.

For example, courses on Labour Studies, Gender Studies, minority’ Studies, and Environmental Studies. Social movements can stimulate critical thinking about social issues in the wider society of which we are apart. Some of these concerns lead to the passing of legislation like the untouchability removal act 1955, the sati act of 1829, the marriage act of 1954, the factory act of 1948, the child labour act 1986, and many more to go.

Passage 7

Read the passages and answer the questions given below.

Can human societies be flawless? What is considered acceptable, desirable, valuable varies from time to time, place to place, and in different contexts.

There is sometimes a tendency to encourage excessive ethnocentric attitudes about one’s culture or group to which one belongs. Ethnocentrism in its extreme form is an obstacle to social harmony. For the sake of social solidarity, respect of other cultures, self-criticism, critical appraisal, reflection, and introspection is necessary. This may help to develop a pluralist way of appreciating the diversities within which we live. The life stories of people are a useful means to understand underlying feelings, beliefs, threats, and so on.

Civil society can play a part in this process to eliminate or minimize factors that hinder progress, or those which divide us.

Question 1.

Explain the term Ethnocentrism. How it is an obstacle to social harmony?

Answer:

Ethnocentrism makes one feel that one’s own culture and way of life are superior to all others. Ethnocentrism can lead to a biased understanding of other cultures. The ethnocentric group feels their culture is superior, this creates a negative outlook which can lead to arrogance and hatred for others. Ethnocentrism in its extreme form is an obstacle to social harmony as there is sometimes a tendency to encourage excessive ethnocentric attitudes about one’s culture or group to which one belongs leading to antagonism and hatred among various religions and cultures.

Question 2.

What can one do to bring social solidarity to society?

Answer:

The term social solidarity means various social groups bind together as one in society.

We need to throw away prejudices, self-interest, self-criticism, learn to respect other’s cultures, reducing inequality and injustice in society. Solidarity can be cultivated through education. Promote new policies or initiatives to eradicate poverty, volunteering and practicing in charity events, donating money, food, clothes, etc. This brings empathy towards others encourages people to bring equality, justice, and peace.

For the sake of social solidarity, respect for other cultures, self-criticism, critical appraisal, reflection, and introspection is necessary. This may help to develop a pluralist way of appreciating the diversities within which we live. The life stories of people are a useful means to understand underlying feelings, beliefs, and threats, and so on.

Question 3.

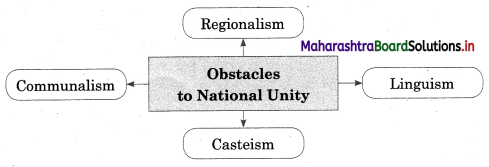

What are the divisive forces that hinder the progress of Indian society?

Answer:

India is a secular, multilingual, and multicultural country. These diversities become at times challenges that hinder the progress of society. Various divisive forces like regional disputes, language problems, discrimination on the basis of caste, communal conflicts, terrorism, unequal distribution of wealth, poverty, etc. This divisive force obstructs progress and disturbs the peace and harmony in society.

Passage 8

Read the passages and answer the questions given below.

All of you have been studying Sociology for over a year. Sociology is the scientific study of human social behaviour. However, it is not the only discipline that studies human behaviour. The study of human behaviour is of interest to historians, psychologists, sociologists, economists, political scientists, etc. Surely, this question may have crossed your mind, or your family or friends might have asked you – ‘What is the use of studying Sociology? What work will you do with a degree in Sociology? Perhaps you too have wondered about the same.

As a start, you could surely consider a career in teaching. However, you must be prepared to read extensively, be creative and develop a learner-centric personality. Indeed, you would have to be passionate about teaching and interacting with learners. For some, a career in research is another possibility, though that route is a long journey to attain the status of ‘sociologist’. Many sociology students and others too, choose to offer Sociology as their subject of special study for Civil Service Examinations like UPSC (Central Services) and MPSC (in Maharashtra). To clear these highly ‘ competitive examinations, it is necessary to read widely and be well aware of the totality of Indian society – its past, present; goals, and plans for the future.

Then, of course, there are many allied occupations where a degree in Sociology can provide insights that are useful to take on other people-oriented professions such as Policy and Programme Development, Social Work with specialization in Family and Child Welfare, Community Development, Medical and Psychiatric Social Work, School Social Work, etc.

The fact remains: it is not merely an obtaining degree in sociology that matters today, but the skill sets, sensitivity, and personality that you develop; your ability to modify and adapt to new needs and challenging situations of even daily living. Also, your ability to have a humanistic perspective whether dealing with research or creating empowerment programmes, or programmes for social change.

Question 1.

What is the scope of sociology?

Answer:

Sociology is the scientific study of human social behaviour. The scope of sociology is wide they are: It studies social relationships, social institution patterns of human behaviour in society. Sociology deals with social changes, development, and analysis of various social problems like poverty, crime, suicide. Gender inequality population etc., and suggest various measures to solve them. One can surely consider a career in teaching; however, one must be passionate about teaching and interacting with learners.

A career in research is another possibility, one may choose to offer Sociology as their subject of special study for Civil Service Examinations like UPSC (Central Services) and MPSC (in Maharashtra). There are many allied occupations where a degree in Sociology can provide insights that are useful to take on other people-oriented professions such as Policy and Programme Development, Social Work with specialization in Family and Child Welfare, Community Development, Medical and Psychiatric Social Work, School Social work, etc.

Question 2.

Discuss the uses of Sociology in present society?

Answer:

In today’s changing world the importance of sociology is growing day by day.

It makes a scientific study of society detects and solves various social problems.

Helps in planning and development. The knowledge of sociology, its application is increasing in the field of industry, social work, law, competitive examinations like UPSC and MPSC, management studies public relations, journalism, etc.

Present time sociology has become useful in framing policies and programme for development like family and child welfare schemes, community development, etc.

Question 3.

Discuss how studying Sociology is beyond obtaining a degree.

Answer:

Today, it is not merely obtaining a degree in sociology that matters, but the skill sets, sensitivity, and personality that you develop; your ability to modify and adapt to new needs and challenging situations of even daily living. Also, your ability to have a humanistic perspective whether dealing with research or creating empowerment programmes or programmes for social change plays an important role.

Passage 9

Read the passages and answer the questions given below.

Read the make-believe speech made by a representative of the Governing Body to its Executive Committee meeting, in a well-known international firm located in Pune.

“Good morning. The Board of Directors has asked me to communicate with you all a policy decision that has been taken by the higher management. Two policies have been taken by our company. One, there shall be a confidential, two-way appraisal of all employees from the coming financial year. Every employee will be assessed by one’s immediate senior, one’s team members, and by oneself through self-appraisal. Juniors will also assess the seniors to whom they report. There are specific criteria on which assessment will take place. A second policy decision is for the company to make every effort to Go Green’s keeping with the international commitment towards a cleaner and greener environment. You may please share this decision with members of your respective departments today, through our e-portal systems. Feedback from all employees is welcome but they must be made within a week from today to the Human Resource Department, via the e-portal. ”

Question 1.

Explain the 1st policy decision that has been taken by the higher management.

Answer:

Two policies have been taken by the higher management. One, there shall be a confidential, two-way appraisal of all employees from the coming financial year. Every employee will be assessed by one’s immediate senior, one’s team members, and by oneself through self-appraisal. Juniors will also assess the seniors to whom they report. There are specific criteria on which assessment will take place.

Question 2.

Discuss the action to be taken by the employee with respect to ‘Go Green’.

Answer:

A second policy decision is for the company to make every effort to ‘Go Green’ in keeping with the international commitment towards a cleaner and greener environment which they can share with members of their respective departments, through the company’s e-portal systems.

Question 3.

Explain the advantages of appraisal.

Answer:

It is said that performance appraisal is an investment for the company. Performance appraisal helps the supervisors to chalk out the promotion programmes for efficient employees.

Passage 10

Read the passages and answer the questions given below.

Indian films have a history of their emergence, growth, and development. There were the days of silent films where viewers interpreted visuals on screen and constructed their own understanding of what the films may have tried to communicate. Then came the days of audio-visual films, black and white films, and later, colour films.

People who can afford to watch films at theatres and those who can do so on their television screens at home are entertained by the stories that films tell us. There are all kinds of ideas, ideologies, tragedies, themes, and values that films communicate. Today one can watch films on the internet on one’s mobile phone. Sometimes the explicit and implicit messages are received by viewers, but they can also be lost on them.

Besides actors’ abilities to ‘play varied roles or characters, there are a whole lot of persons involved with the production process as well as its marketing. This may include the film director, screenplay writers, designers, sound engineers, make-up artists and stylists, casting experts, musicians and so on.

Fields like Visual Sociology, Sociology of Mass Communication, and Marketing Sociology have a role to play in the study of these varied dimensions. Films as a source of knowledge play multiple roles even today. The storylines and types of films are ever-increasing. Films are not limited to nor bound by standard themes, love stories, or gender stereotyping. Films can cause much upheaval on the one hand and generate much interest on the other. Regional films and international films have been added to the list of viewing possibilities and multiple interests.

Question 1.

Write an account of the popularity of Indian cinema.

Answer:

Indian cinema was always enjoyed, whether it was the days of silent films where viewers interpreted visuals on screen and constructed their own understanding of what the films may have tried to communicate. Then came the days of audio-visual films, black and white films, and later, colour films. People entertained themselves by the stories that films conveyed either by watching films at theatres or on their television screens at home. The Hindi language film industry of Mumbai also known as Bollywood, it is the largest and most popular branch of Indian cinema. Hindi cinema initially explored issues of caste and culture in films such as Achhut Kanya (1936) and Sujata (1959). The audience’s reaction towards Hindi cinema is distinctive with involvement in the films by the audience’s clapping, singing, reciting familiar dialogue with the actors.

Question 2.

What do you understand by explicit and implicit messages of films?

Answer:

The film’s main message is loud and clear through the majority of films is known as an explicit message. It also has underlying morals for its audience known as implicit messages which are not so obvious. For example, morals such as, it’s not what’s on the outside, it’s on the inside that counts.

Question 3.

Discuss types of movie genres.

Answer:

Movies consist of many genres and categories like drama, comedy, action, thriller, horror, romance, experimental, documentaries, etc. The producers, directors try to create new genres experimenting with their creativity. The storylines and types of films are ever-increasing. There is no limitation to the subject matter of the films.

Question 4.

Discuss the impact of Indian cinema on society.

Answer:

Indian cinema is no longer restricted to India and is now being well appreciated by international audiences. The contribution of the overseas market to Bollywood box office collections is quite remarkable. Indian cinema has become a part and parcel of our daily life whether it is a regional or a Bollywood movie. It has a major role to play in our society. Though entertainment is the keyword of Indian cinema it has far more responsibility as it impacts the mind of the audiences.

Passage 11

Read the passages and answer the questions given below.

How does one tackle social problems? How do societies deal with the social problems that they have to confront? Why do social problems arise? These are some questions that learners of Sociology need to address.

Societies have culture; both of these are created by people, cumulatively, through the network of relationships over thousands of years. Every society has its normative system – customs, folkways, fashions, mores, taboos, fads, laws. Social norms are guidelines for human behaviour. They tell us what is expected of us and at the same time, what to expect from others.

Are these expectations permanent and unchanging? When can they change? Who changes them? Why must they change? Again, these are questions that one might ask. Social problems can arise when the expectations are not communicated effectively, or when individuals or groups choose to disagree with the expectation. This can lead to situations of conflict – not just ideological but also a conflict that leads to hurting others’ sentiments, abuse, violence, injustice, upheavals, normlessness, and even war.

Question 1.

What do you understand by normative aspects of culture, are these expectations permanent? When do they change?

Answer:

The normative aspects of culture consist of customs, folkways, fashions, mores, taboos, fads, laws. Social norms are guidelines for human behaviour. They tell us what is expected of us and at the same time, what to expect from others. These expectations are not permanent as appropriate and inappropriate behaviour often changes dramatically from one generation to the next. Norms can and do change over time. Karl Marx believed that norms are used to promote the creation of roles in society which allows people of different levels of social class structure to be able to function properly, hence any change in social structure may lead to change in the normative aspect of culture.

Question 2.

How does the social problems arise in society?

Answer:

Although not considered to be formal laws within society, norms still work to promote a great deal of control. Norms are more specific and they are rules of conduct that guide people’s behaviour. Therefore, when an individual or a group of people behave and act in a certain way that is in contradiction to society’s values or norms, it can create a social problem. Social problems can arise when the expectations are not communicated effectively, or when individuals or groups choose to disagree with the expectation. This can lead to situations of conflict – not just ideological but also a conflict that leads to hurting others’ sentiments, abuse, violence, injustice, upheavals, normlessness, and even war.

Passage 12

Read the passages and answer the questions given below.

Sarva Shiksha Abhiyan (SSA) is a Government of India programme that makes education for children between the ages 6-14 free and compulsory. This programme was pioneered by the former Indian Prime Minister Shri Atal Behari Vajpayee in 1993-94. It became totally operational from 2000-2001. This programme made education a Fundamental Right.

Along with this, the Government of India also launched the National Programme of Nutritional Support to Primary Education (NP-NSPE) on 15th August 1995. From here emerged the concept of free ‘Midday Meal’for for children going to schools which were managed by local bodies like Gram Panchayats and Municipal Corporations. The Midday Meal is mandatory. It is taken for granted that the children should be given good, nutritious food on a daily basis. A lot of organisation goes into the cooking and delivering of these meals to the schools on time.

Universal Education goes hand in hand with Nutrition. Children of the village and municipal schools look forward to this meal. For several of them, it is perhaps the main meal of the day.

Question 1.

Discuss the various child welfare programmes launched by the government of India.

Answer:

Sarva Shiksha Abhiyan (SSA) is a Government of India programme that makes education for children between the ages 6-14 free and compulsory. This programme was pioneered by the former Indian Prime Minister Shri. Atal Behari Vajpayee in 1993-94. It became totally operational from 2000-2001. This programme made education a Fundamental Right.

The Government of India also launched the National Programme of Nutritional Support to Primary Education (NP-NSPE) on 15th August 1995.

Free ‘Midday Meal’ for children going to schools which were managed by local bodies like Gram Panchayats and Municipal Corporations was also launched later. The Midday Meal is mandatory. It is based on the fact that the children should be given good, nutritious food on a daily basis.

Question 2.

What is the objective of the Midday Meal Scheme? Where does the responsibility of implementation of midday meal scheme lie?

Answer:

The Midday Meal Scheme is a school meal programme of the government of India designed to improve the nutritional status of school children nation wise. The objective of the Midday Meal Scheme is to provide a cooked meal to the children as should be given good, nutritious on a daily basis. The meal is mandatory.

A lot of organisation goes into the cooking and delivering of these meals to the schools on time. Universal Education goes hand in hand with nutrition. Children of the village and municipal schools look forward to this meal. For several of them, it is perhaps the main meal of the day.

The responsibility of implementation of the Midday Meal Scheme lies with local bodies like Gram Panchayats and Municipal Corporations.

Question 3.

How effective are the children’s welfare programmes in India?

Answer:

Keeping in view the problems and challenges faced by children various programmes and policies are implemented for the welfare of children in India. Sarva Shiksha Abhiyan (SSA) is a Government of India programme that makes education for children between the ages 6-14 free and compulsory. As a result, the enrolment percentage of school children has gone up. Similarly, Mid-day Meal is mandatory. A lot of organisations goes into the cooking and delivering of these meals to the schools on time. Universal Education goes hand in hand with Nutrition. Children of the village and municipal schools look forward to this meal. For several of them, it is perhaps the main meal of the day.

Class 12 Sociology Textbook Solutions Digest

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()