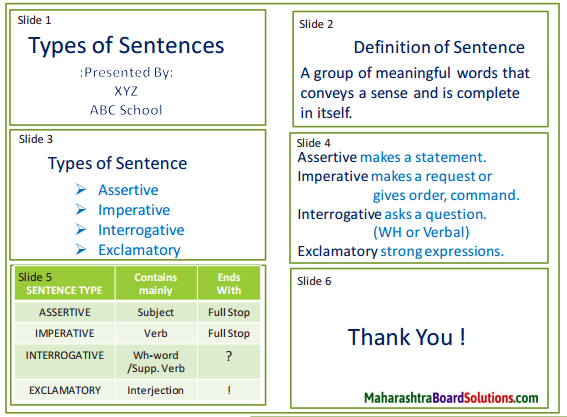

Class 10 English Chapter 3.5 Question Answer Maharashtra Board

Balbharti Maharashtra State Board Class 10 English Solutions My English Coursebook Chapter 3.5 The Alchemy of Nature Notes, Textbook Exercise Important Questions and Answers.

The Alchemy of Nature Poem 10th Std Question Answer

My English Coursebook Standard Ten Guide Chapter 3.5 The Alchemy of Nature Textbook Questions and Answers

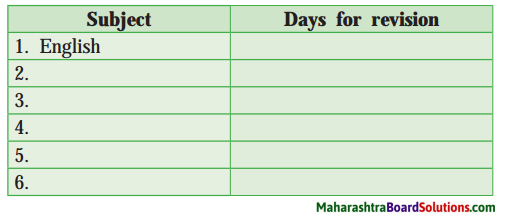

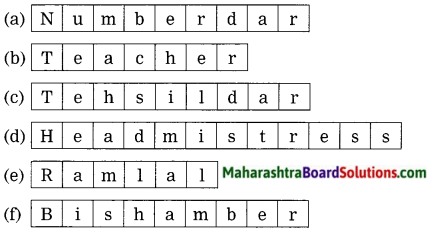

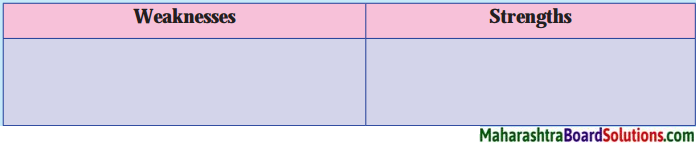

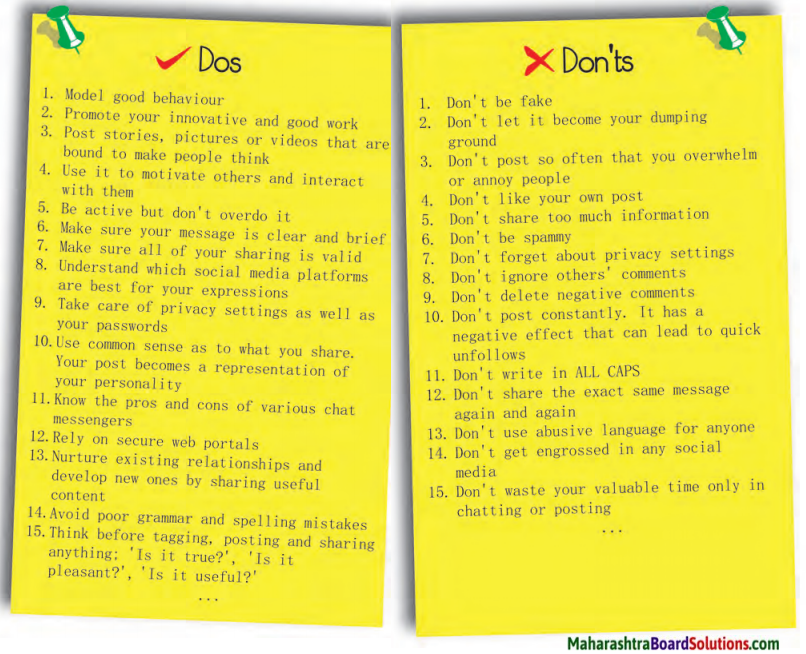

Warming up:

Chit-chat:

1. Divide the class into five groups. Discuss in the group the following topics. (One question for each group.)

Question (a)

Seeds regenerate from another seed.

Answer:

Regeneration is the renewal of germplasm accessions by sowing seeds which will possess the same characteristics as the original population.

Question (b)

Plants and flowers wilt and become one with the other.

Answer:

Wilting is the loss of rigidity of non- woody parts of plants if they do not get water to thrive and soil is too dry.

![]()

Question (c)

Cacti (-Pidgd ) thrive in the desert region.

Answer:

Cacti (plural of cactus) lack leaves, instead they have spines which help preventing the loss of water and mineral content in the desert plants.

Question (d)

Bare nature turns green in spring.

Answer:

As temperatures warm and days get longer, forest ecosystem begins the transition from winter to spring.

Question (e)

Caterpillar turns into butterfly.

Answer:

It is truly a fantastic mechanism developed by nature. For a caterpillar to turn into a butterfly, it digests itself using enzymes triggered by hormones.

(Each group will present their discussion in front of the class.)

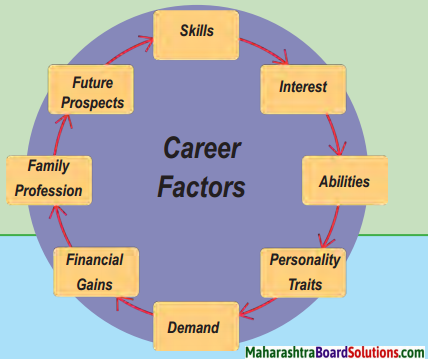

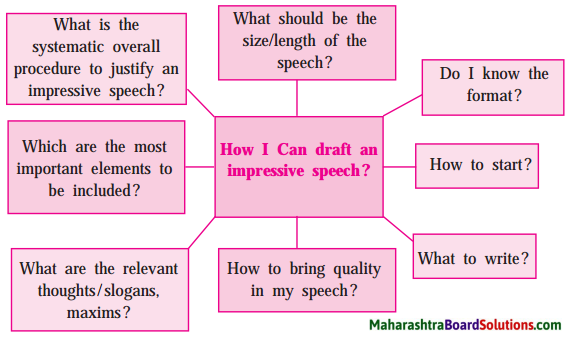

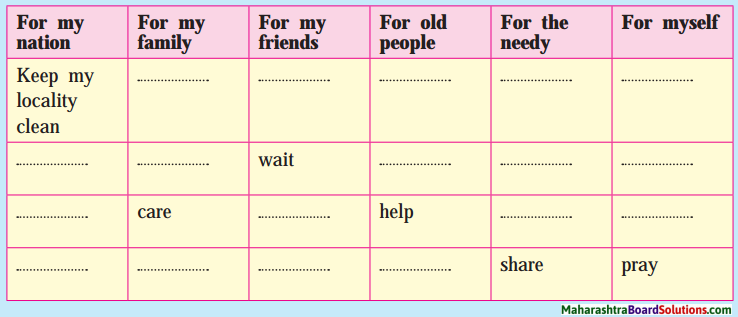

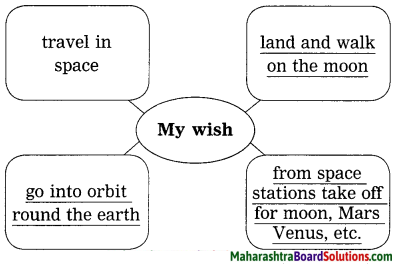

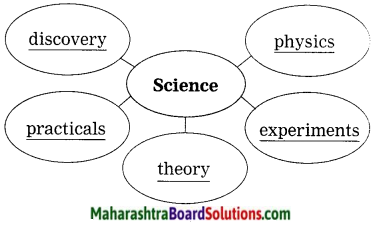

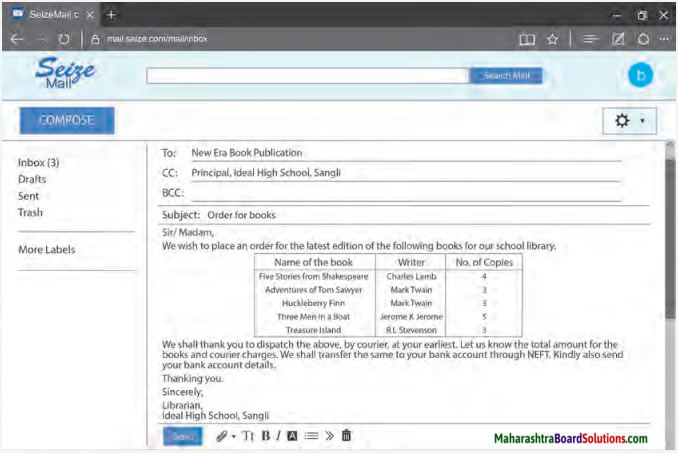

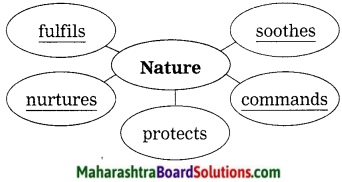

2. Role of Nature:

Question 1.

Role of Nature:

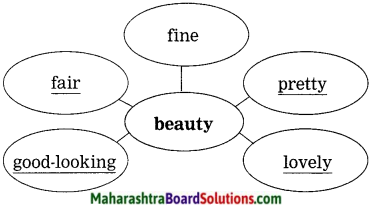

Discuss in pairs, the role played by nature and complete the web-diagram.

Answer:

3. Look at the following things. Discuss with your friend, what you learn from them.

Question 1.

Look at the following things. Discuss with your friend, what you learn from them.

(a) A bee …………………..

(b) An eagle ……………….

(c) A creeper ……………..

(d) The river ………………

(e) Rainfall ………………..

(f) Sun ………………………

Answer:

(a) A bee – teamwork and hard work

(b) An eagle – a strong vision/far-sightedness

(c) A creeper – perseverance

(d) The river – go with the flow/to face calamities

(e) Rainfall – dedication

(f) Sunlight up the lives of others/to give light and energy to others.

![]()

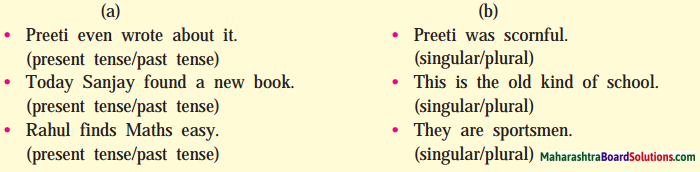

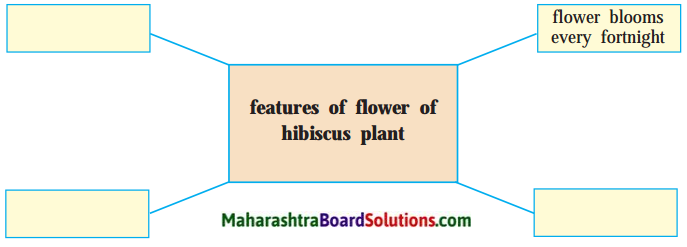

English Workshop:

1. Go through the text again and complete the web that highlights the various features of flower of ‘hibiscus’ plant. One is done for you.

Question 1.

Go through the text again and complete the web that highlights the various features of flower of ‘hibiscus’ plant. One is done for you.

Answer:

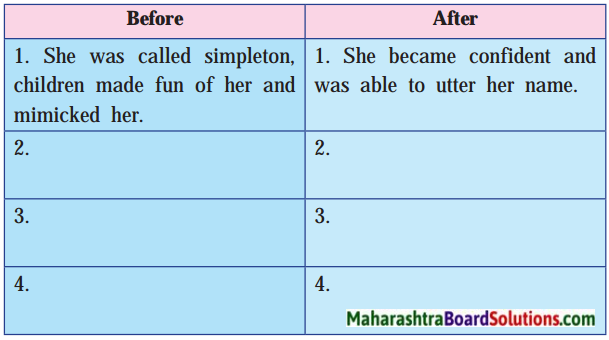

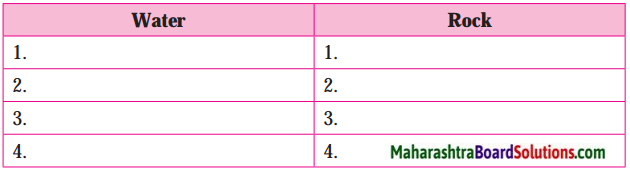

2. The writer explains the contrast features of ‘water’ and ‘rock’ in the text. Write all the features of both water and rock in the given table:

Question 1.

The writer explains the contrast features of ‘water’ and ‘rock’ in the text. Write all the features of both water and rock in the given table:

Answer:

| Water | Rock |

| gentle | hard |

| command | gives in (humble) |

| flows over stone (perseverance) | takes the shape that water commands (obedient) |

![]()

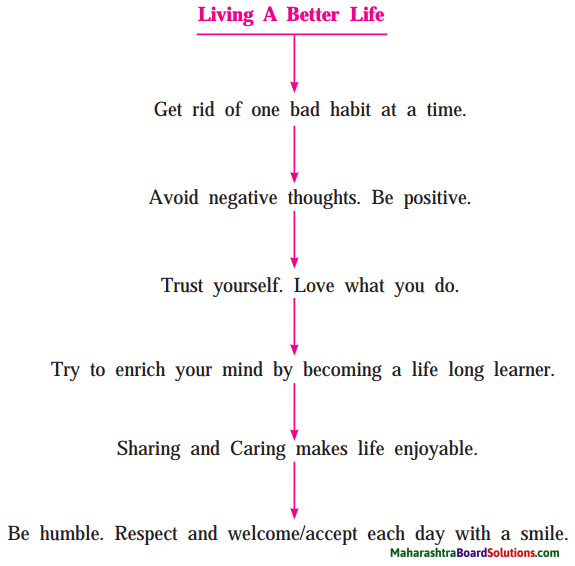

3. Impossible itself says ‘I M possible’. Do you agree? Justify your answer by citing some examples from the text and some that you have experienced or heard from someone.

Question 1.

Impossible itself says ‘I M possible’. Do you agree? Justify your answer by citing some examples from the text and some that you have experienced or heard from someone.

Answer:

Yes I agree, it is possible to do the most difficult of things, provided we have the will and conviction to do so. We can clearly know this from the passage. The bits of grass, the tree in the winter and the tiny ants, etc. are the examples from the passage.

The example that comes to my mind as justification is that of Sudha Chandran, the dancer. Though her leg was amputated below the knee, with great grit and determination, she restarted dancing and went on to become a famous dancer and actress. This shows that one can do things which seem to be impossible.

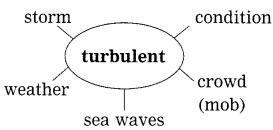

4. Find synonyms from the text for the following words/phrases.

Question 1.

Find synonyms from the text for the following words/phrases.

Answer:

- a strong feeling of fear or respect – awe

- to direct authoritatively – command

- to peer through – peep

- large and impressively beautiful – majestic

- easily broken or damaged – delicate

5. How can you prove this maxim to be incorrect-’Too many cooks spoil the broth.’ Write a counterview on the given topic. (clue-teamwork)

Question 1.

How can you prove this maxim to be incorrect-’Too many cooks spoil the broth.’ Write a counterview on the given topic. (clue-teamwork)

Answer:

The maxim says when there are too many people involved in trying to do the same thing, the final result will not be good. But I believe that the teamwork is always good. We all know that unity is strength and it is of great value in every walk of life. If we come together and work, definitely our strength gets increased.

When there are a lot of people working on a project, then that project may not be completed to such a high standard because an individual can work better than many. It is the common perception of the people. But I think if a lot of people are working on a project, every one will use his talent, calibre, strength to take that project to higher level. So it will be completed on time with good standard.

Even when many cooks come together and try to make a single dish with their experience in different fields, it will become fantabulous. One dish will be prepared in variety of taste, colour and with varieties of combination. So it never gets spoiled. So I think the maxim too many cooks spoil the broth, is totally wrong in fact it adds flavour to that dish.

![]()

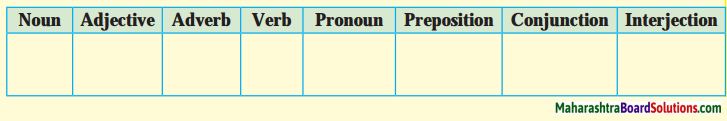

6. Make a list of all the words related to the word Ocean:

Question 1.

Make a list of all the words related to the word Ocean:

Answer:

Fishers, fish, salty, saline water, species, different water, high tide, low tide, pacific, gulf, bay, ships, pirates, piracy, warships, cruisers, oceanic currents.

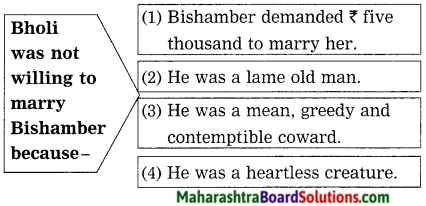

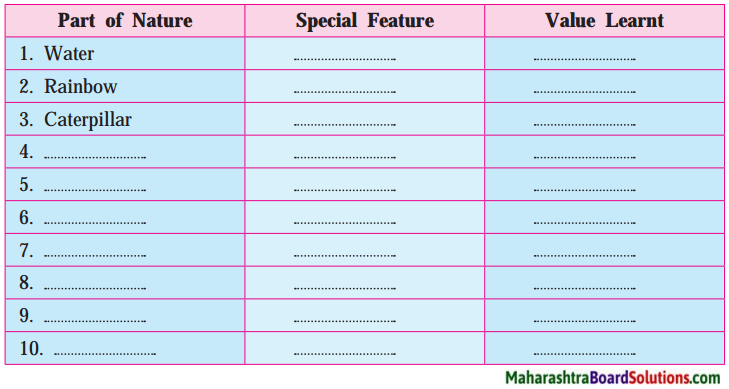

7. The author has very positively described the different things in nature. Add the special features of each one of them:

Question 1.

The author has very positively described the different things in nature. Add the special features of each one of them. Add on the list.

Answer:

| Part of Nature | Special feature | Value learnt |

| 1. Water | It gently flows every day and for years. | Keep on working gently for the well-being of the people. |

| 2. Rainbow | Beauty | Add colours to the surroundings, make all happy. |

| 3. Caterpillar | Sacrifice for creating new life. | Changing (turning) for better results. |

| 4. Hibiscus | one day life. | We should live our life to its fullest. |

| 5. Rocks | Though hard, it does not dominate or offer resistance. | Be humble and stay still and endure unpleasant things without complaining. |

| 6. Grass | Evergreen | There is always an opening even when the things seem to be impossible. |

| 7. Tree | Stands firmly in cold winter. | Wait resolutely in difficult times. |

| 8. Ants | Organized | Teamwork and perseverance are always rewarded. |

| 9. The wind | Flow | Make people happy with your activities and passion. |

| 10. Spider webs | Delicate | Be strong in every situation and difficulty. |

![]()

8. Your friend has his board exam. He studies for 14 hours a day, sitting at one place. Write a letter to him giving him tips to relax and be stress-free.

Question 1.

Your friend has his board exam. He studies for 14 hours a day, sitting at one place. Write a letter to him giving him tips to relax and be stress free.

Answer:

Vikas Shinde

16, Malhar Sankul,

Hadapsar,

Pune,

12th Jan., 2021.

Dear Mahesh,

I received a call from aunty telling about your preparations for forthcoming board examinations. I am shocked to hear that you study for 14 to 15 hours a day sitting at one place. I don’t understand how do you bear it?

You might have heard about “All work and no play makes Jack a dull boy.” It means without time off from work a person becomes both bored and dull. I know the board’s exams are around the corner, but if you work as usual with your tension, anxiety and pressure, it is going to be harmful to your health. Our body is not a machine. It needs some rest. It’s my advice to you to take some rest after certain l intervals. Watch T.V. for sometime, listen to music to refresh your mind, chat with your family members and friends, play with your friends. It will refresh your mind.

Take a break after 2-3 hours and give essential time to your mind and body. It will be good for you. I know you are a scholar and always get good marks in exam. But it doesn’t mean that you should ignore your health. Health is wealth. So concentrate on it, too. Hope you will try to understand what I mean to say and follow my tips rigorously.

Convey my regards to uncle and aunt and love to little Riya. Be in touch on mobile.

Your loving friend,

Vikas

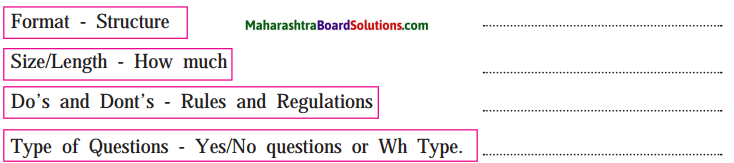

9. You have an Environment Protection Week to be celebrated in your school. You have invited an environmentalist. You have to interview him/her about how to save environment. Frame about 10-12 questions for the interview.

Question 1.

You have an Environment Protection Week to be celebrated in your school. You have invited an environmentalist. You have to interview him/her about how to save environment. Frame about 10-12 questions for the interview.

Answer:

Good morning Sir/Madam. Happy to see you here in our school. I welcome you on behalf of our school.

- Will you please tell us about your work in this field?

- Were you really interested in this field from the beginning?

- As an environmentalist, when did you start your work? What exactly do you do?

- What do you think about diminishing percentage of trees and forest?

- What is your ‘end of the world prediction’, If we don’t keep global temperature below 1.5°C?

- What do you think the Government should do?

- What will you tell the people who do not believe in widely discussed climate change?

- Being a citizen of our country, what do you expect from every citizen about this intense problem?

- If there’s one thing that everyone could do today to help protect the environment, what would that be?

- What advice would you give to young generation at this moment?

![]()

10. Write a news report on ‘Environment Day’ celebrated in your school.

Question 1.

Write a news report on ‘Environment Day’ celebrated in your school.

Answer:

Environment Day Celebrations

Nagpur, June 7: ‘World Environment Day’ was celebrated in New Era School with great funfare on June 5. The main purpose of the celebration was to spread awareness among people and students about the need to protect the environment and the ways to do it.

The day was flagged off by a tree plantation drive in the locality. 300 quick-growing trees, which do not need much water on a daily basis, were planted near the school compound wall and in the surrounding area. An eminent environmentalist, Mr. A. T. Ali, spoke on the ways to protect the environment. He also judged the ‘Posters and Photographs’ exhibition organized by the school students and gave away prizes for the best entries.

Environment-friendly articles, like disposable plates and cups made from bamboo and banana stem, bags made from leaf wastes, etc. were on sale. Students gave continuous power-point presentations on the threats to the environment. Last but not the least, was the spirited debate on the topic. ‘Man: The worst enemy of the Environment’.

All in all, the day was a great success, and has certainly made a difference to the way people view our environment.

11. Develop a story with the given ending. Give a suitable title and moral.

Question 1.

Develop a story with the given ending. Give a suitable title and moral.

……………….. and so, Aditi decided to plant more trees.

Answer:

Save trees, save earth

It was the world earth day celebration in Aditi’s school. Aditi was attending it with a least interest as she was not interested in listening to such a boring subject from anybody. She was sitting forcefully for the guest’s lecture with her friends.

The chief guest, who was a renowned environmentalist started with a good slogan based on the earth and emphasised that the earth is the only known planet in this universe where we get all the necessary requisites of life, but the healthy survival is possible for years and years only when we take care and love our earth. Aditi suddenly became curious and started listening with apt attention.

He continued saying “because of the advancement in the life style, industrialization and deforestation; the condition of the earth is deteriorating day by day. It is being full of pollution, global warming and greenhouse gases. There is an urgent need to save our earth because it is the planet where we live. We need to do nothing more in order to maintain the greenery of the earth.

We just need to plant more trees, grow them well, to reduce the pollution level, to maintain the temperature level and to save our mother planet. We should understand our responsibility towards our mother earth and the future of the next generations. As they would not survive on this earth if there will not be a clean and natural climate.”

Aditi realised it and thought a lot and decided to take a positive step very seriously to save the earth. She thought seriously over the solution and that was planting more and more trees. She decided to create awareness among the people as well. She told everyone…

Save earth; save life

No earth… No life

No earth, No birth

Plant trees, Save mother earth

She understood that there will be no human beings on this earth if there will be no trees. If we have to save our lives, we have to plant more and more trees. So, Aditi decided to plant many trees after listening to that effective lecture of the chief, guest.

![]()

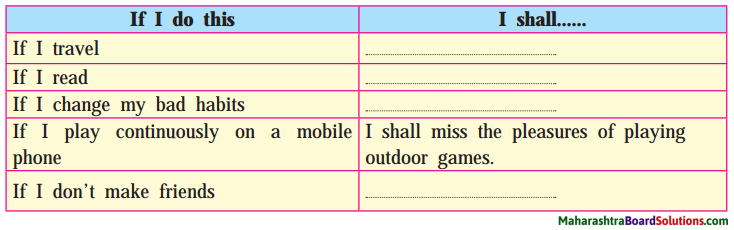

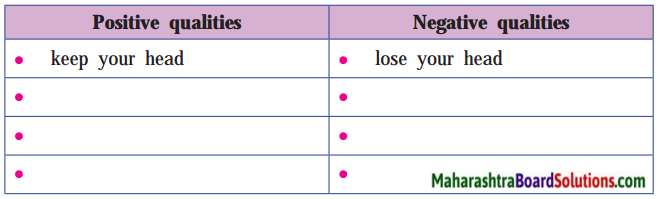

12. Just for laughs!

Question 1.

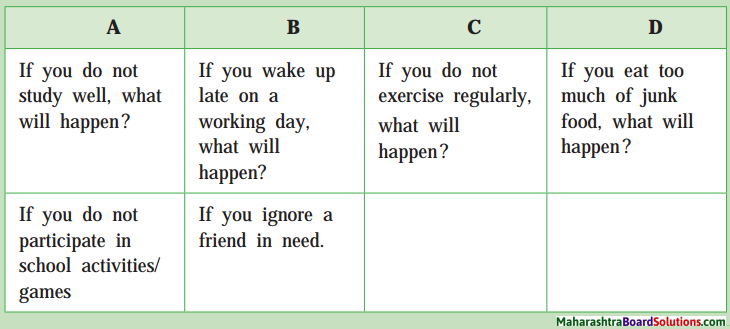

Divide the class into two groups : On 12 to 15 slips of paper, Group A writes 12 to 15 conditional clauses beginning with ‘if’.

(For example: If I work hard, I shall have a pizza. (Group B write 12 to 15 main clauses)

Now one student from Group ‘A’ reads the first conditional clause (possibility) and one student from Group ‘B’ reads the first main clause. It forms crazy sentences, just for laughter and fun. Enjoy.

Answer:

| Group ‘A’ | Group ‘B’ |

| 1. If I read a book, | my mother will shout at me. |

| 2. If I do not study hard, | I will become the chief minister. |

| 3. If you do not come to school, | teacher will come to your home. |

| 4. If she gets a new mobile | she will run away from her home. |

| 5. If the boys get freedom in the class, | they will keep silence in the class. |

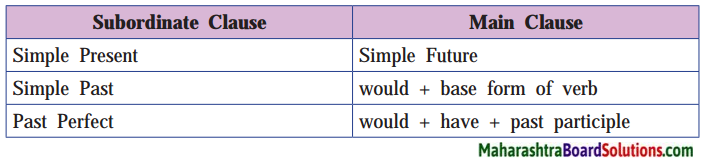

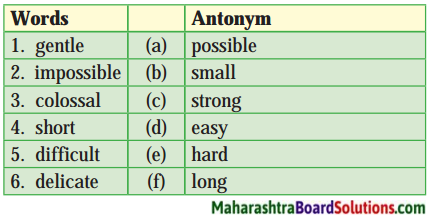

Language Study

Question 1.

Match the pairs of antonyms:

Answer:

- gentle × hard

- impossible × possible

- colossal × small

- short × long

- difficult × easy

- delicate × strong

Question 2.

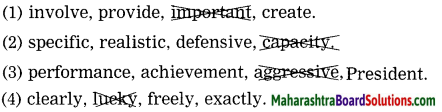

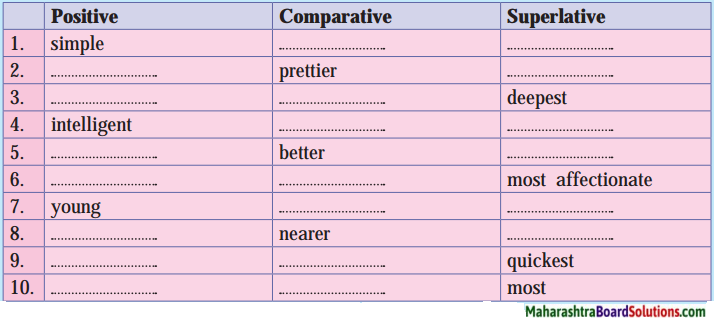

Complete the table:

Answer:

| Noun | Verb | Adjectives | Adverb |

| strongness, strength | strengthen | strong | strongly |

| passion | × | passionate | passionately |

| change | change | changeable | × |

| organization | organize | organizational | organizationally |

Live English

Be a Netizen

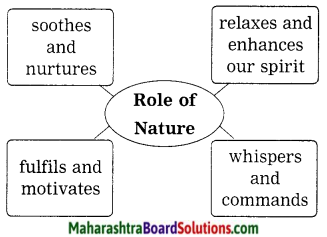

Question (a)

Read the extract and underline the words which suggest that emails are fast, cheap and an easy communication tool.

Answer:

Email stands for electronic mail. Slowly and gradually email has replaced the old postal mails or snail mails. Having an email address is like having a postal address in a global village of internet. If you do not have one, you do not exist in today’s virtual world.

The reasons for popularity of emails are many. Emails can be achieved, saved, retrieved. Email is eco-friendly as people rarely take printouts of the mails. The main reason is its ease of access as anybody can access it on phone at the cost of cheap internet, anytime, anywhere.

Email writing is easy but it’s different from writing text messages. Text message is informal and rapid sharing of thoughts between two acquaintances. Emails are written and read by professionals, however, both arrive in inbox.

Like a citizen has his own home address, let’s sign up for the email and be a netizen. There are many free email service providers like Google, Yahoo, Outlook, Rediff, icloud, etc.

Question (b)

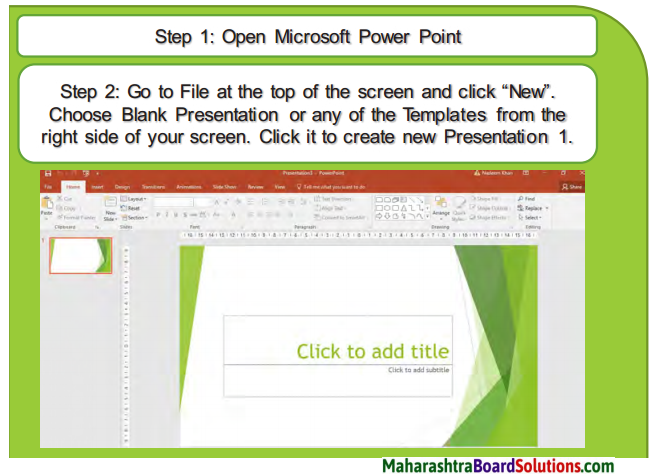

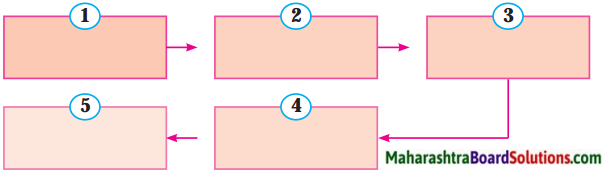

Follow these five simple steps to write an effective email. Click Compose to start writing email.

Answer:

Steps for Writing a Formal E-Mail:

1. Begin with a greeting.

Example: ‘Dear Sunil”, “Dear Sir/Madam”

2. Thank the recipient.

If you are replying, say Thank you for contacting”, If you got a reply, say Thank you for your prompt reply”

3. State your purpose.

For new email, begin by saying “I am writing in reference to..”

4. Add your closing remarks.

Example: Thank You for…”, I look forward to hearing from you.”

5. End with a closing.

Example: “Best Regards, Sincerely, Thanks and Regards etc.,”

Steps for sending an email:

Question 1.

Steps for sending an email:

1. Write proper mail ID in ‘To’

2. Use a short and accurate ‘subject’ line.

3. Click ‘Send’ button to send the email.

Answer:

1. Log in to your gmail account so that you are on the dashboard (main page) of your mail account.

2. Click ‘Compose’.

3. A new blank email window will open up in the

‘To’ box, type in the email address of the recipient.

4. Write the ‘Subject’.

5. Type your message in the main body field of your email.

6. Click the ‘Send’ button at the bottom of the composed window.

7. You will receive a message i.e. ‘Sent mail’.

Question (c)

Read the following sample email formats and prepare your own.

Sample Email formats

Answer:

My English Coursebook 10th Digest Chapter 3.5 The Alchemy of Nature Additional Important Questions and Answers

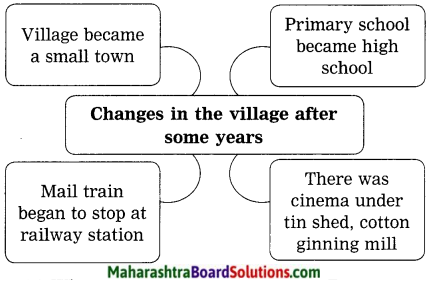

Simple Factual Activities:

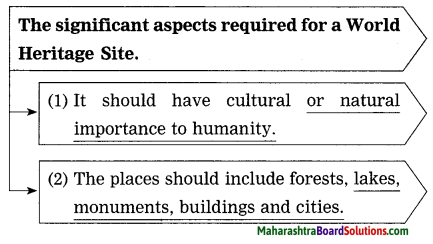

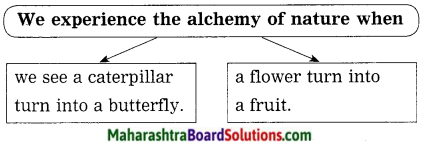

Question 1.

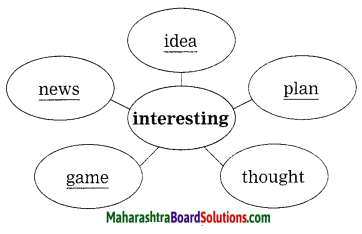

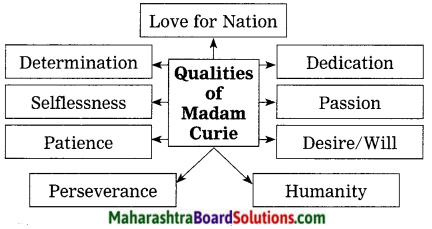

Complete the following web: (Answers are directly given.)

Answer:

Question 2.

State whether the following are True or False:

Answer:

- On the rocky beach the writer found rocks curved and sculpted by the water – True

- When we listen to the Nature, it leaves us in complete awe. – True

- We should not live our life to its fullest. – False

- The water was shaped by the rocks. – False

![]()

Question 3.

Choose the correct alternatives and complete the following sentences :

(Answers are directly given and underlined.)

Answer:

1. In the cold winter month, the tree was bare of all leaves.

(a) full

(b) withdrew

(c) bare

(d) short

2. We find innumerable stars in the infinite sky.

(a) clouds

(b) crowds

(c) stars

(d) moons.

3. There is always an opening even in impossible things.

(a) opening

(b) closing

(c) enjoying

(d) singing

4. Water without hint of ego, changes its form according to the dictates of the sun and the wind.

(a) the earth

(b) the sun

(c) the moon

(d) the horizon.

Question 4.

State who/what:

Answer:

- Colours the entire sky. – Rainbow

- Takes new shapes with every passing moment, – Clouds

- Makes trees dance. – The wind

- Changes its form according to the dictates of the sun and the wind. – Water

![]()

Question 5.

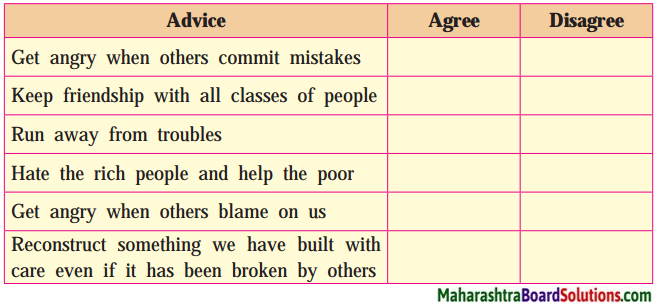

State whether you Agree or Disagree with the following statements:

Answer:

- ‘There is always an opening even in impossible things’-we learn it from small bits of grass. – Agree

- Our difficult time never changes. – Disagree

- The team work and perseverance of the ants were impressive. – Agree

- Clouds take new shapes with every passing moment. – Agree

Complex Factual Activities:

Question 1.

Complete the following sentences: (Answer is directly given.)

Answer:

- Hibiscus flower smiles with the sun and dances with the wind.

- ‘However short our life is, we should live to its fullest’ is the lesson we learn from the hibiscus plant.

- The rock on the beach was curved, sculpted and shaped.

- The poet William Blake tells us to hold infinity in the palm of our hand and eternity in an hour.

Question 2.

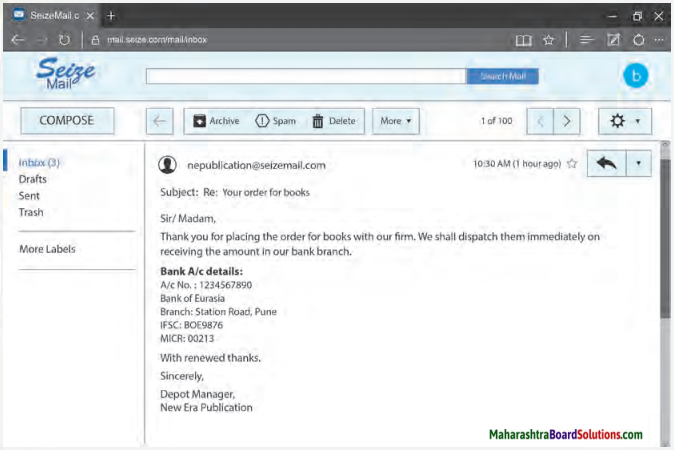

Complete the following web: (Answers are directly given.)

Answer:

Question 3.

Who teaches us that hard times do not 1 last forever? How?

Answer:

Bits of grass peeping through small cracks in concrete pavement and the green leaves on a tree in spring teach us that hard times do not last forever.

The grass is destroyed by the concrete but comes to life again. The tree is bare all through the cold winter months, but when the spring sets in, it is full of leaves, regaining its green majesty.

![]()

Question 4.

What are the alchemies of nature mentioned in the extract?

Answer:

The alchemies of nature mentioned in the extract are-

- Grass peeps through small cracks of a concrete pavement.

- A rainbow colours the entire sky.

- Oysters take in a grain of sand they open up with a pearl.

- Innumerable stars shine across the infinite sky.

- The wind makes trees dance with unhindered passion.

- A caterpillar turns into a butterfly.

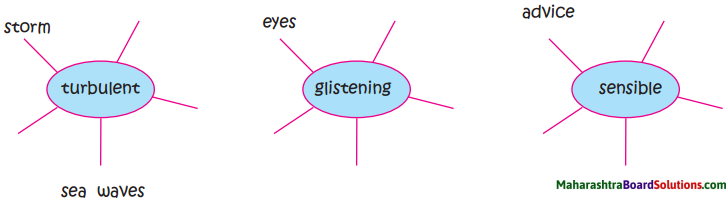

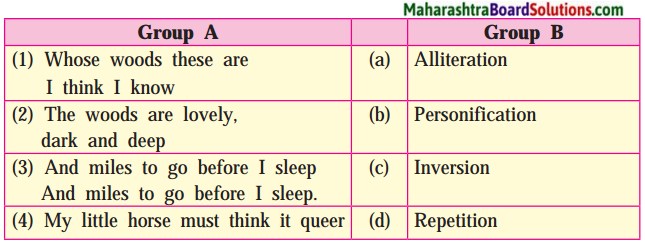

Activities based on Vocabulary:

Question 1.

Match the pairs of antonyms.

Answer:

1. remember × forget

2. persist × quit

Question 2.

Find out synonyms from the text for the following words/phrases:

Answer:

1. mysterious power – alchemy

2. drag with great efforts – lugging

Question 3.

Frame meaningful sentences by using the given words:

1. impressive

2. passion

Answer:

1.The show put up by the street children was really impressive.

2. One could see the passion and emotion in the artist’s work.

Question 4.

Find from the passage the antonyms of:

Answer:

- weak × strong

- easy × difficult

- hot × cold

- unimpressive × impressive

![]()

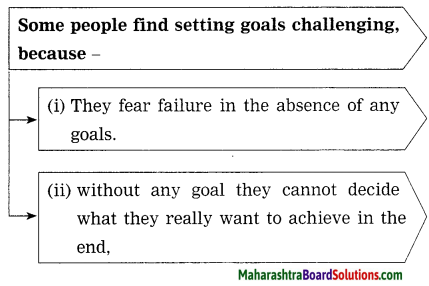

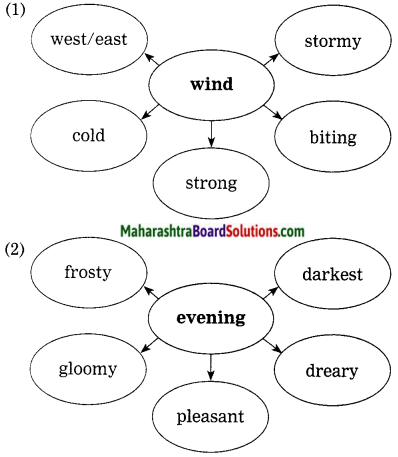

Activities based on Contextual Grammar:

1. Frame Wh-questions to get the underlined parts as answers:

Question 1.

The flower comes to life only for a day.

Answer:

How long does the flower come to life?

Question 2.

We saw the spread of the majestic ocean.

Answer:

What did we see of the majestic ocean?

Use ‘not only……….but also’.

Question 1.

Outdoor activities enhance and relax our well-being.

Answer:

Outdoor activities not only enhance but also relax our well-being.

Question 2.

Nature whispers and commands.

Answer:

Nature not only whispers but also commands.

![]()

Personal Response:

Question 1.

Explain the line ‘Nature whispers and commands.

Answer:

Nature is continually enticing us to spend time in her embrace; through the calling of birds, the babbling of brooks and streams, the fragrance of flowers and the whispers of trees as the wind blows through their branches. It commands us not to go against it otherwise it will curse us.

Question 2.

The rock is hard but is it dominating? Give reason for your answer.

Answer:

Even though the rock is hard, it is not dominating. I think water is stronger than rocks. It wears down the hard rock by its gentle patience, persistence and perseverance. Rock takes the shape that water commands. It shows that it is not dominating like water whereas it is ready to accept any change.

Question 3.

How can learning from nature help human beings?

Answer:

- Limitless sky with trillions of galaxies reminds us how insignificant we humans are in this vast universe.

- Water always flows from high to low in the same way knowledge should be transferred from the learned to ignorant.

- Trees provide shade selflessly to everyone, we should be selfless in our life too.

- Nature does not hurry; yet everything is accomplished.

- Trees stand deeply rooted in the ground even though seasons change. We should face any difficulty in our life with patience.

Question 4.

‘Nature is our best teacher’ – Explain.

OR

According to the writer we learn many things from the nature. Do you agree with this sentence? Support your answer.

Answer:

Nature is a great teacher. No wonder our ancestors used to look up to nature to understand about life itself. The things like the sun, moon, trees, rivers, etc. all were treated as divine beings. We learn a lot from them and they teach us a lot about how to live happy life. Divinity exists in all aspects of life. When we are aware of ourselves, we become aware of God in everything big or small. We then learn to live life well and become complete. So Nature is always treated as our best teacher.

![]()

Do as directed:

Question 1.

Complete the words by using correct letters:

- d a _ c e

- s h _ p e

- f r u _ t

- b i _ d s

Answer:

- d a n c e

- s h a p e

- f r u i t

- b i r d s

Question 2.

Put the words in alphabetical order:

1. splendour, colossal, alchemy, frail

2. consistent, caterpillar, command, complete.

Answer:

1. alchemy, colossal, frail, splendour.

2. caterpillar, command, complete, consistent

Question 3.

Punctuate the following sentences :

1. I asked my teachers why is he working outside

2. he asked me is the world so poor that it cannot give me a toy and a book, instead of forcing me to take a gun or a tool

Answer:

1. I asked my teachers, “Why is he working outside?”

2. He asked me, “Is the world so poor that it cannot give me a toy and a book, instead of forcing me to take a gun or a tool?”

![]()

Question 4.

Make four words each (minimum 3 letters) using the letters in the given word: “perseverance”

Answer:

- reserve

- presence

- peer

- seven

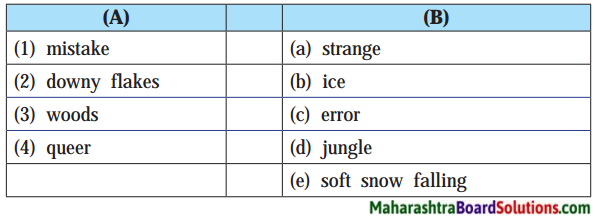

Question 5.

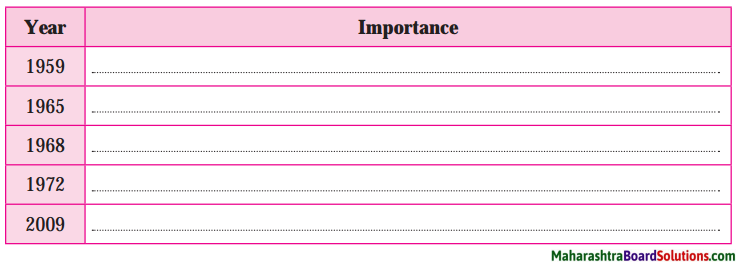

Write related words as shown in the example:

(Answers are directly given and underlined.)

Answer:

Question 6.

Complete the word-chain of ‘Nouns’. Add four words, each beginning with the last letter of ‘ the previous word:

Pavement, → t……….., ……….., ……….., ………..

Answer:

Pavement, → treasure, editor, roughness, sheep.

1. Attempt anyone:

Question (a)

Make a meaningful sentence by using the phrase: ‘in full splendour’

Answer:

The morning sun appeared in the sky, in its full splendour.

OR

Question (b)

Add a clause to expand the following sentence meaningfully: we saw a small tree …………….

Answer:

We saw a small tree which was full of flowers and fruits.

![]()

2. Attempt anyone:

Question (a)

Add prefix or suffix to make new words.

1. continue

2. pleasant

Answer:

1. discontinue, continuous

2. unpleasant, pleasantly

OR

Question (b)

Make a meaningful sentence using any one of the following words:

1. continue

2. pleasant

Answer:

1. This exhibition will continue till the end of this month.

2. The pleasant atmosphere in the morning attracts many birds.

Question 3.

Do as directed:

We saw an army of ants. (Choose the correct sentence of passive voice.)

(a) An army of ants was seen by us.

(b) An army of ants were seen by us

(c) An army of ants is seen by us.

(d) An army of ants are seen by us.

Answer:

(a) An army of ants was seen by us.

![]()

Question 4.

We touch it. (Rewrite the sentence in ‘Past Perfect Tense.)

Answer:

We had touched it.

Question 5.

Identify the tenses:

Answer:

- We saw an army of ants – Simple Past Tense

- We experience the alchemy of nature – Simple Present Tense

- It will not remain so for ever – Simple Future Tense

- Ants were lugging a fly. – Past Continuous Tense

My English Coursebook Standard Ten Digest Answers Pdf Unit 3