Forms of Business Organisation – I 11th OCM Chapter 4 Solutions Maharashtra Board

Balbharti Maharashtra State Board Organisation of Commerce and Management 11th Textbook Solutions Chapter 4 Forms of Business Organisation – I Textbook Exercise Questions and Answers.

Class 11 OCM Chapter 4 Exercise Solutions

1. (A) Select the Correct option and rewrite the sentence

Question 1.

A sole trading concern ensures ……………….. business secrecy.

(a) maximum

(b) minimum

(c) limited

Answer:

(a) maximum

Question 2.

The members of Hindu undivided family business are called ………………..

(a) carpenter

(b) co-parcener

(c) parceners

Answer:

(b) co-parcener

![]()

Question 3.

The head of Joint Hindu Family Business is called as ………………..

(a) KARTA

(b) owner

(c) manager

Answer:

(a) KARTA

Question 4.

Registration of partnership firm is ………………. in Maharashtra.

(a) voluntary

(b) compulsory

(c) easy

Answer:

(b) compulsory

Question 5.

The liability of the shareholders in Joint Stock Company is ………………

(a) limited

(b) unlimited

(c) restricted

Answer:

(a) limited

Question 6.

A Joint Stock Company is an artificial person created by ………………….

(a) Law

(b) Articles

(c) Memorandum

Answer:

(a) Law

Question 7.

Registration of a Joint Stock Company is ………………..

(a) compulsory

(b) free

(c) not required

Answer:

(a) compulsory

Question 8.

Liability of member of a Co-operative Society is ………………

(a) limited

(b) restricted

(c) maximum

Answer:

(a) limited

Question 9.

Indian Co-operative Society’s Act was passed in ………………

(a) 1912

(b) 1913

(c) 1911

Answer:

(a) 1912

Question 10.

…………………. acts as a signature of the company.

(a) Common seal

(b) Common sign

(c) Common image

Answer:

(a) Common seal

1. (B) Match the pairs

| Group A | Group B |

| (a) Private Company | (1) Karta |

| (b) Public Company | (2) Local Market |

| (c) Common Seal | (3) 1932 |

| (d) Partnership Act | (4) Maximum 200 members |

| (e) Joint Hindu Family Firms | (5) One Man Show |

| (F) Subject-matter of insurance | (6) Minimum Seven members |

| (7) Minimum 10 members | |

| (8) Signature of Company | |

| (9) Maximum 100 members | |

| (10) Manager |

Answer:

| Group A | Group B |

| (a) Private Company | (4) Maximum 200 members |

| (b) Public Company | (6) Minimum Seven members |

| (c) Common Seal | (8) Signature of Company |

| (d) Partnership Act | (3) 1932 |

| (e) Joint Hindu Family Firms | (1) Karta |

1. (C) Give one word/phrase/term.

Question 1.

An elected body of representatives of co-operative Society for its day to day administrations.

Answer:

Managing Committee

Question 2.

The owner is the sole manager and decision maker of his business.

Answer:

Sole Trader

Question 3.

One man show type of business organisation.

Answer:

Sole trading concern

Question 4.

The members of the Joint Hindu Family firm.

Answer:

Co-parceners

Question 5.

A partner who gives his name to partnership firm.

Answer:

Nominal partner

Question 6.

There is free transferability of shares in this company.

Answer:

Public Company

![]()

Question 7.

A partnership agreement in writing.

Answer:

Partnership Deed

Question 8.

The motto of the co-operative society.

Answer:

Service

Question 9.

An organization which is service oriented.

Answer:

Co-operatives Society

1. (D) State True or False

Question 1.

Sole trader is the decision maker of the business.

Answer:

True

Question 2.

Sole trading concern operates in local markets.

Answer:

True

Question 3.

Sole proprietorship is useful for small business.

Answer:

True

Question 4.

The liability of KARTA is unlimited.

Answer:

True

Question 5.

The maximum number of members is unlimited in Joint Hindu Family Firm.

Answer:

True

Question 6.

Joint Stock company can raise huge amount of capital.

Answer:

True

Question 7.

There is a separation of ownership and management in Joint Stock Company.

Answer:

True

Question 8.

Board of Directors manage the business of Joint Stock Company.

Answer:

True

Question 9.

Partnership agreement may be oral or written.

Answer:

True

Question 10.

In partnership firm, the liability of every partner is limited, joint and several.

Answer:

False

Question 11.

The main motto of co-operative society is to render services to its shareholders.

Answer:

False

Question 12.

The membership of a co-operative society is compulsory.

Answer:

False

1. (E) Find the odd one

Question 1.

Sole proprietorship, Joint Hindu Family, Non-Government Organization (NGO), Partnership firm.

Answer:

NGO

Question 2.

Active partner, Shareholder, Nominal partner, Secret partner.

Answer:

Shareholder

1. (F) Complete the sentences

Question 1.

Private sector enterprises are owned and managed by the …………………

Answer:

Private entities

Question 2.

There is only one owner in …………………

Answer:

Sole Trading Concern

Question 3.

Admission of new individual into existing business has given birth to …………………

Answer:

Partnership Firm

Question 4.

A partner who takes active participation in the day to day working of the business is known as …………………

Answer:

active partner

Question 5.

When there is no provision in partnership agreement regarding time period for partnership then it is known as …………………

Answer:

Partnership at will

Question 6.

The property of JHF business is jointly owned by the …………………

Answer:

KARTA

Question 7.

The management of Co-operative society is based on …………………

Answer:

democratic principles

Question 8.

The rule for voting in Co-operative society is …………………

Answer:

one member one vote

Question 9.

The rule for voting in Joint Stock company is …………………

Answer:

one share one vote

Question 10.

The face value of the shares of Co-operative society is very …………………

Answer:

less

![]()

Question 11.

Consumer’s co-operatives are formed by the …………………

Answer:

consumers

Question 12.

Registration of Joint Stock Company is compulsory according to the Companies Act …………………

Answer:

2013

1. (G) Complete the following table

Question 1.

(Public company, Private company, Co-operative Society, Partnership Firm, Sole Trading Concern)

| Group A | Group B |

| (i) Minimum 2 and maximum 200 | …………….. |

| (ii) Minimum 10 and maximum no limit | ……………. |

| (iii) ……………… | Minimum 7 and maximum unlimited |

| (iv) Form of business organisation having only one member | ………………… |

| (v) Minimum 2 and maximum 50 | ……………….. |

Answer:

| Group A | Group B |

| (i) Minimum 2 and maximum 200 | Private Limited Compmay |

| (ii) Minimum 10 and maximum no limit | Co-operative Society |

| (iii) Public company | Minimum 7 and maximum unlimited |

| (iv) Form of business organisation having only one member | Sole Trading Concern |

| (v) Minimum 2 and maximum 50 | Partnership Firm |

1. (H) Answer in one sentences

Question 1.

What is Sole Trading Concern?

Answer:

Sole Trading Concern is a type of business which is owned, managed and controlled by one person.

Question 2.

What do you mean by partnership firm?

Answer:

A business owned and managed by two or more persons sharing profits and losses is called a partnership firm.

Question 3.

What is the meaning of Joint Stock Company?

Answer:

Joint Stock Company is an artificial person created by law, having an independent legal status, owned by shareholders and managed by Board of Directors.

Question 4.

What is Joint Hindu Family business?

Answer:

A Joint Hindu Family is a form of business organization which runs from one generation to another according to the Hindu Law.

Question 5.

What do you mean by Co-operative Society?

Answer:

Co-operative Society is a voluntary association of individuals which is formed for providing services to members.

Question 6.

What do you mean by minor partner?

Answer:

A minor partner is a partner who is admitted into the partnership firm for the benefit of the firm with the consent of all partners.

Question 7.

What is Quasi Partner?

Answer:

Quasi partner is a partner of the partnership firm who has retired from the firm but has left his capital behind in the firm.

Question 8.

What do you mean by partner-in-profits only?

Answer:

A partner-in-profits only is a partner who gets into an agreement to share only the profits of the partnership firm and not the losses.

Question 9.

What do you mean by general partnership?

Answer:

General partnership is a form of partnership where, the liability of all the partners is unlimited, joint and several. Every partner has an equal right and it can be formed under the Partnership Act of 1932.

Question 10.

What is the meaning of Private company?

Answer:

A Private Limited company is a company which by its articles restricts the right to transfer share, limits the maximum number of members to 200.

Question 11.

What do you mean by Public company?

Answer:

A public company means a company which is not a private company.

1. (I) Correct the underlined word and rewrite the following sentences.

Question 1.

In Public company, shares are not freely transferable.

Answer:

In Private company, shares are not freely transferable.

Question 2.

In Private company, there are minimum 3 (Three) directors.

Answer:

In Private company, there are minimum 2 (Two) directors.

![]()

Question 3.

Registration of Joint Stock company is not compulsory.

Answer:

Registration of Joint Stock company is compulsory.

Question 4.

There is less secrecy in Sole Trading concern.

Answer:

There is maximum secrecy in Sole Trading concern.

Question 5.

In Partnership firm, minimum three members are required.

Answer:

In partnership firm, minimum two members are required.

Question 6.

In Joint Hindu Family business, the senior most member of family is called as Co-parcener.

Answer:

In Joint Hindu Family business, the senior most member of family is called as Karta.

Question 7.

Indian Partnership Act, 1940 is applicable in India.

Answer:

Indian Partnership Act, 1932 is applicable in India.

2. Explain the following terms/concepts

Question 1.

Sole Trading Concern.

Answer:

- It is a form of business organization which is owned, managed and controlled by one person.

- It need not be registered.

- It does not have a legal status i.e. It does not have a stable life.

- Maximum secrecy can be maintained in Sole Trading concern.

Question 2.

Partnership Firm.

Answer:

- It is a voluntary association of two or more persons with a common objective.

- It is formed by an agreement called Partnership deed.

- It is governed by Indian Partnership Act, 1932.

- Registration of partnership firm is optional as per Partnership Act, 1932.

- In Maharashtra, registration of partnership firm is made compulsory.

Question 3.

Joint Hindu Family Firm.

Answer:

- It is a form of business organization which is carried from one generation to another generation.

- It comes into existence by operation of Hindu Law.

- This form of organization is found in India only.

- The seniormost member of the family is called ‘Karta’ while other members are called ‘Co-parceners’.

Question 4.

Co-operative Society.

Answer:

- It is a voluntary association of individuals which is formed for providing services to members.

- Its main motto is ‘service’ rather than ‘profit’.

- It runs on principle of ‘One member One Vote’.

- It enjoys an independent legal status, distinct from its members.

Question 5.

Joint Stock Company.

Answer:

- It is an incorporated association created by law, having an independent legal status, owned by shareholders and managed by Board of Directors.

- The main motive of Joint Stock company is maximisation of profit.

- It works as principle of “One share One vote”.

- It has to follow Indian Companies Act, 2013.

Question 6.

Karta.

Answer:

- Karta is a seniormost member of the family, who runs the Joint Hindu Family Business.

- The Karta has unlimited liability in such type of business.

- Karta has the right to manage the business.

- Karta need not consult any body about business decisions.

Question 7.

Managing Committee.

Answer:

- Managing committee is a group of members of a Co-operative society, who looks after the working of Co-operative society.

- They are elected by the shareholders of Co-operative society.

- All important decisions are taken by the managing committee.

- In short, they look after day to day administration of the Society.

Question 8.

Nominal Partner.

Answer:

- A partner who only lends his name and reputation to the partnership firm is called as nominal partner.

- He is simply obliging his friends by allowing the firm to use his name as a partner.

- He may or may not be given any share in the profits of the firm.

- He does not contribute to the capital of the business.

- He is liable to the debts of the firm.

3. Study the following case/situation and express your opinion

1. Mr. Raghunath is running business from last 30 years. This business is ancestoral business of Mr. Raghunath. Kiran and Naman, two sons of Mr. Raghunath are helping him along with their wives.

Question 1.

Find out the type of business.

Answer:

Joint Hindu Family Firm.

Question 2.

Who is Raghunath?

Answer:

Raghunath is the Karta.

![]()

Question 3.

What Kiran and Naman are called?

Answer:

Kiran and Naman are called as co-parceners.

2. Mr. Sawant a Chartered Accountant by profession and Mrs. Tambe, an Architect by profession running a firm namely ‘ST Firms’ in Nagpur.

Question 1.

Identify the form of business organisation in the above examples.

Question 2.

Is it a registered organisation?

Question 3.

What is the Profession of Mr. Sawant?

4. Distinguish between the following

Question 1.

Private Limited Company and Public Limited Company

Answer:

| Private Limited Company | Public Limited Company | |

| (1) Meaning | A Private Limited Company is a company which by its articles, restricts the right to transfer share, limits the maximum number of members to 200 and prohibits the issue of prospectus. | A Public Company means a company, which is not a Private Company. |

| (2) Name of the Company | Name of the company must end with the word ‘Private Limited’. | Name of the company must end with the word ‘Limited’. |

| (3) Number of Members | There are minimum 2 members. Maximum members are 200. | There are minimum 7 members. Maximum members are unlimited. |

| (4) Transfer of Shares | Shares of the company are not freely transferable. | Shares of the company are freely transferable. |

| (5) Issue of Prospectus | The company cannot issue prospectus. Statement in lieu of prospectus is issued. | The company has to issue prospectus compulsory. |

| (6) Number of Directors | Minimum 2 Directors are needed in a Private Limited Company. | Minimum 3 Directors are needed in a Public Limited Company. |

| (7) Statutory Meeting | A Private Limited Company need not hold a Statutory Meeting. | A Public Limited Company must hold a Statutory Meeting compulsorily. |

| (8) Capital | Minimum paid up capital is one lakh rupees. | Minimum paid up capital is five lakh rupees. |

| (9) Commencement of Business | The business can be started after getting ‘Incorporation Certificate’. | The business can be started after getting ‘Commencement Certificate’. |

Question 2.

Sole Trading Concern and Partnership Firm.

Answer:

| Sole Trading Concern | Partnership Firm | |

| (1) Meaning | Sole proprietorship is owned and controlled by one person. | Partnership firm is owned and controlled by two or more persons called as ‘Partners’. |

| (2) Formation | Sole trading concern can be formed easily. It is started as soon as the owner decides. | Partnership firm is formed by an agreement between two or more persons. |

| (3) Numbers of Members | Sole trading concern is owned by a single person. | Minimum 2 members are needed for starting business. The maximum number is 50. |

| (4) Registration | There is no need for registration of sole trading concern. | A partnership firm may or may not be registered. However, it is always desirable for the firm to be registered. It is compulsory in Maharashtra. |

| (5) Secrecy | It is possible to have maximum business secrecy. | Secrecy is shared among all the partners. |

| (6) Liability | Liability of a sole trader is unlimited | Liability of a partner is unlimited, joint and several. |

| (7) Management | The sole trader looks after management of business. He is manager of the business. | All partners take part in management of the firm according to their skills. |

| (8) Capital | The entire capital is contributed by the sole trader, comparatively limited. | Partners contribute capital to the firm, comparatively more. |

| (9) Act/Law | There is no special Act governing the Sole Trading concern. | Partnerships are governed by the Indian Partnership Act, 1932. |

| (10) Sharing of Profit | The sole trader alone enjoys all the profits of business. | Partners share the profits of business as per the ratio given in the agreement. |

| (11) Risk | In this form of business organization, the risk is assumed by sole trader alone. | In partnership firm, the risk is shared by all the partners. |

| (12) Disputes | There is no room for disputes among owners, as there is only a single owner. | There can be disputes among partners. |

Question 3.

Partnership Firm and Joint Hindu Family.

Answer:

| Partnership Firm | Joint Hindu Family | |

| (1) Meaning | Partnership firm is controlled by two or more persons called as ‘Partners’. | In Joint Hindu Family Firm, the Joint Hindu Family conducts business according to Hindu Laws. |

| (2) Number of Members | Minimum two members are needed for starting business. The maximum number is fifty. | Membership of the firm depends upon the birth and death in the family. There is no limit on membership. A person adopted into the family also becomes a member. |

| (3) Registration | Registration is not compulsory in India, but it is compulsory in Maharashtra. | Registration is not compulsory. |

| (4) Liability | The liability of partners is unlimited, joint and several. | Karta has unlimited liability and Co-parceners have limited liability. |

| (5) Capital | Comparatively more, as it is contributed by all partners. | The whole capital comes from ancestral property. |

| (6) Secrecy | Secrets share by all partners. | Secrecy can be maintained within family. |

| (7) Management | All partners takes part in management of the firm according to their skills. | Karta looks after the management of the business. All Co-parceners follow his decision. |

| (8) Stability | Stability of business is affected by death, lunacy or insolvency of a partner. | Comparatively, more stable as business is not affected by death of Karta or Co-parceners. |

| (9) Act | Partnerships are governed by the Indian Partnership Act, 1932. | Joint Hindu Family firm follows the Hindu Succession Act, 1956. |

| (10) Formation | Partnership firm is formed by an agreement between two or more persons. | Joint Hindu Family Firm comes into existence by operation of Hindu Laws. |

| (11) Sharing of Profits/ Losses | The profits and losses are shared by partners as per the ratio given in the agreement. | The profits and losses are shared between Karta and Co-parceners. |

| (12) Inspection of books of Accounts | A partner has a right to inspect books of accounts of the firm. | A co-parcener has no right to inspect books of accounts of the firm. |

| (13) Implied | Authority Every partner has implied authority to act on behalf of the other partners. | Karta has implied authority to act on behalf of the firm. |

![]()

Question 4.

Co-operative Society and Joint Stock Company.

Answer:

| Co-operative Society | Joint Stock Company | |

| (1) Meaning | Co-operative Society is a voluntary association of individuals which is formed for providing services to members. | Joint Stock Company is an incorporated association created by law, having an independent legal status, owned by shareholders and managed by board of directors. |

| (2) Number of Members | Minimum ten members and maximum number of members is unlimited. | Private company-

Minimum – 2 Maximum – 200 Public company- Minimum – 7 Maximum – No limit |

| (3) Capital | A Co-operative society has less capital as compared to Joint Stock company. | Joint Stock company has large capital. |

| (4) Management | Managing Committee manages Co-operative society. | Board of Directors manages Joint Stock company. |

| (5) Act | Co-operative Societies have to follow Co-operative Societies Act, 1912. In Maharashtra, the societies have to follow Maharashtra State Co-operative Societies Act, 1960. | Companies have to follow Indian Companies Act, 2013. |

| (6) Formation | Formation of a Co-operative society is comparatively cheaper and easier. | Formation of a Joint Stock Company is costly, difficult and time – consuming. |

| (7) Voting Right | The principle of “One member One vote” is followed. | The principle of “One share One vote” is followed. |

| (8) Motto | The main motto of a Co-operative society is to give services to the people. | The main motto of Joint Stock company is to make maximum profit. |

| (9) Transferability of Shares | Shares are not transferable. They can be surrendered to the society. | Shares of a Public Company are freely transferable. |

| (10) Remuneration | Members of Managing Committee work on honorary basis. | Board of Directors are paid salary and given fees for attending board meetings. |

| (11) Area of Business | Normally, the co-operatives have a limited area of business. | Companies have a larger area of business operation. |

| (12) Proxies | In a Co-operative society, proxies are not allowed in the meetings. | In a Joint Stock company, proxies are allowed to vote in the meetings. |

Question 5.

Joint Hindu Family Firm and Joint Stock Company.

Answer:

| Joint Hindu Family Firm | Joint Stock Company | |

| (1) Meaning | In Joint Hindu Family Firm, the Joint Hindu Family conducts business according to Hindu Laws. | Joint Stock Company is an incorporated association created by law, having an independent legal status, owned by shareholders and managed by Board of Directors. |

| (2) Number of Members | Membership of the firm depends upon the birth and death in the family. There is no limit on membership. | Private company-

Minimum – 2 Maximum – 200 Public company- Minimum – 7 Maximum – No limit |

| (3) Registration | Registration is not required | Registration is compulsory. |

| (4) Liability | Karta has unlimited liability and Co-parceners have limited liability. | The liability of shareholders is limited upto the extent of unpaid amount on shares by them. |

| (5) Capital | The whole of ancestral property used as capital. | The company has huge capital. |

| (6) Secrecy | Secrecy can be maintained within the family. | Books of accounts have to be published. Business secrecy cannot be maintained. |

| (7) Management | Karta manages the business and he is assisted by co-parceners. | Board of Directors manages the Joint Stock company. |

| (8) Government Control | There is limited government interference. | There is strict government control. |

| (9) Act | Joint Hindu Family Firms are governed by the Hindu Succession Act, 1956. | Joint Stock Companies are governed by Indian Companies Act, 2013. |

| (10) Formation | It is comparatively easy to form. | Formation of a Joint Stock Company is difficult, costly and time-consuming. |

| (11) Legal Existence | A Joint Hindu Family firm does not have a separate legal existence independent of its members. | A Joint Stock Company has a separate legal existence. It is distinct from its members. |

| (12) Minor Member | Minors can become a member of the firm. | Minors cannot become a member of the company. |

Question 6.

Co-operative Society and Partnership Firm.

Answer:

| Co-operative Society | Partnership Firm | |

| (1) Meaning | Co-operative Society is a voluntary association of individuals which is formed for providing services to its members. | Partnership firm is formed by two or more persons to do business and share profits. |

| (2) Number of Members | Minimum ten persons and maximum no limit. | Minimum two persons and maximum fifty persons. |

| (3) Registration | It is compulsory. | It is not compulsory in India, but compulsory is Maharashtra. |

| (4) Liability | Liability of members is limited upto the extent of unpaid amount on shares held by them. | Liability of partners is unlimited, joint and several. |

| (5) Secrecy | It is not possible to maintain secrecy in a Co-operative Society. | It is possible to maintain secrecy to some extent in the firm. |

| (6) Management | Managing Committee manages the society according to its bye-laws. | All partners are involved in the management of the firm. |

| (7) Stability | Stability is not affected by death, insolvency or lunacy of a member. | Stability of a firm is affected by death, insolvency or lunacy of a partner. |

| (8) Government Control | There is a lot of government supervision and control. | There is minimum government supervision for a partnership firm. |

| (9) Act | Co-operative Societies have to follow Partnership firms are governed by the Indian Co-operative Societies Act, 1912. In Maharashtra, the societies have to follow Maharashtra Co-operative Societies Act, 1960. | Indian Partnership Act, 1932. |

| (10) Motive | The motive is to give maximum services to the people | The motive is to earn profits. |

| (11) Legal Status | A Co-operative Society enjoys an independent legal status, distinct from its members. | Partnership firms do not have an independent legal status. Partners and the firm are one and the same. |

| (12) Transfer of Shares | Members can surrender shares to the society. | Partners cannot transfer the shares without the consent of other partners. |

5. Answer in brief

Question 1.

State any four features of Sole Trading Concern.

Answer:

(i) Suitable for some Special Business : Sole trading concern is suitable for business where personal attention and individual skill is needed e.g., Beauty parlour, groceries, fashion designing, sweet shops, tailoring, restaurants etc.

(ii) Unlimited Liability : Liability of the sole trader is unlimited. In case business assets are not sufficient to meet business expenses, private property of the sole trader will be used. There is no difference made between private property and business property of sole trader.

(iii) No Sharing of Profits and Risks : A sole trader enjoys all the profits of business. As he is the single owner of business he assumes full responsibility in business. He alone bears all the losses or risks involved in business.

(iv) Business Secrecy : Maximum business secrecy can be maintained in a sole trading concern. A sole trader is responsible only to himself. He need not discuss any matter of business with outsiders. Moreover, there is no legal compulsion for sole trader to publish books of accounts of business.

Question 2.

State any four types of partners.

Answer:

The different types of partners are:

(i) Active or Working Partners : In practice one or two partners take active part in the management. Such partners are called active or working partners. They contribute capital, shares profits or losses, and has unlimited, joint and several liability. They take an active interest in the day to day working of the firm. These partners are also known as ordinary / general / actual partners.

(ii) Dormant or Sleeping Partners : A dormant or sleeping partner is one who contributes capital to the firm. He does not take any active part in the management of the firm. He shares the profits and losses of the firm like any other partner. He voluntarily surrenders the right of management. However, he is liable for the debts of the firm.

(iii) Nominal Partners : A nominal partner is one who does not contribute any capital to the firm. He lends his name to the firm. He is simply obliging his friends by allowing the firm to use his name as a partner. He may or may not be given any share in the profits of the firm. His goodwill is used to attract business. However, he is liable for the debts of the firm.

(iv) Minor as Partner : According to the Indian Contract Act 1872, a person below 18 years is called a minor. But according to the Indian Partnership Act 1932, a minor can be admitted for the benefit of the firm with the consent of all other partners. He has a right to inspect the books of accounts. Minor partner has limited liability and is not liable for losses. He has the option to continue as a full-fledged partner or discontinue as a partner on attaining the age of majority. If he wishes to discontinue, he must give a public notice within 6 months from the age of majority.

Question 3.

Describe any four types of Co-operative Society.

Answer:

Types of Co-operative Society are as follows:

(i) Consumer Co-operative Societies : A consumer co-operative is a business owned by its customers. They purchase in large quantities from wholesalers and supply in small quantities to customers. Goods are provided to buyers at reasonable prices and also provide services to them. Members get a share in the profit. The consumer society is formed to eliminate middlemen from distribution process e.g.-Apana Bazar, Sahakari Bhandar.

(ii) Credit Co-operative Societies : Members pool their savings together with the aim of obtaining loans from their pooled resources for productive purposes and non-productive purposes. They may be established in rural areas by agriculturist or artisans called as a Rural Credit Society. They may be established by salary earners or industrial areas called as Urban Banks, Salary Earners Society or Workers Society.

(iii) Marketing Co-operatives Societies : These co-operatives find better markets for members produce. They also provide credit and other inputs to increase members production levels. They perform marketing functions such as standardising, grading, branding, packing, advertising etc. The proceeds are then distributed among members depending on the quantities sold.

(iv) Co-operative Farming Societies: Farmers voluntarily come together and pool their land. The agricultural operations are carried out jointly. They make use of scientific method of cultivation.

![]()

Question 4.

State any four merits of Joint Hindu Family Firm.

Answer:

Merits of Joint Hindu Family are as follows:

1. Easy Formation : Joint Hindu Family Firm can be easily formed. The formation is simple. Registration is also not compulsory. There is no limit on minimum or maximum members in the business. Family members become co-parceners by birth in the family.

2. Quick Decision : Only the Karta is involved in the decision making process. This helps to take quick decisions in business. If decisions are taken quickly there can be prompt actions.

3. Business Secrecy : Complete business secrecy can be maintained. All decisions are taken by Karta only. Co-parceners cannot even inspect books of accounts. There is no compulsion to publish books of accounts.

4. Co-parceners Liability : The liability of co-parceners is limited. It is to the extent of their share in Joint Family Business. Private property of co-parceners cannot be attached to business property.

Question 5.

State any four demerits of Joint Stock Company.

Answer:

The demerits of Joint Stock Company are as follows:

1. Rigid Formation : The formation of a joint stock company is lengthy, difficult and time consuming. There are many legal formalities for starting business. Promoters have to prepare documents like Articles of Association, Memorandum of Association, etc. A private company has to go through two stages in formation. A public company has to go through four stages in formation.

2. Delay in Decision Making Process : In company form of organization no single individual can make a policy decision. All important decisions are taken by Board of Directors. Decision taking process is time consuming. Business may lose opportunities because of delay in decision making.

3. Lack of Secrecy : The management of companies remain in the hands of many persons. Everything is discussed in the meetings of Board of Directors. All important documents are available at registered office for inspection. Thus, there is no secrecy in business matters.

4. Excessive Government Control: A large number of rules are framed for the working of companies. The companies will have to follow rules for internal working. The government tries to regulate the working of the companies because large public money is involved. In case regulations are not complied with, large penalties are involved.

6. Justify the following statements

Question 1.

The Liability of a ‘Sole trader’ is Unlimited.

Answer:

- One of the main features of a sole traders is unlimited liability.

- If the sole trader becomes insolvent and if his business assets are insufficient to pay off his business debts, he will have to use his private property in order to pay off his creditors.

- There is no distinction between business property and private property in case of a sole trading concern.

- Thus, liability of a sole trader is unlimited.

Question 2.

Karta is the sole manager of‘Joint Hindu Family Business’.

Answer:

- The Karta is the eldest or senior most person in the family business.

- Karta has unlimited liability.

- He has the entire decision making power and he is not binding on the views of the co-parceners.

- Thus, the Karta is the sole manager of Joint Hindu Family business.

Question 3.

The main objective of Co-operative society is to provide services to its members.

Answer:

- The Co-operative Society is a voluntary association of persons formed for the purpose of promoting the interest of its members. It is different from all other organizations.

- The main objective of a co-operative organization is not to make profit but to give service to its members.

- The co-operative society is formed for the welfare of the people.

- Co-operative societies are rightly called as service oriented organization. Maximisation of profit is not the aim.

- Thus, the main objective of Co-Operative society is to provide services to its members.

Question 4.

A Joint Stock Company can raise huge capital.

Answer:

- A Joint Stock Company is an incorporated association.

- It has a legal status independent of its members.

- A Joint Stock Company has large membership. There is no maximum limit.

- Shares are available in the open market.

- Large number of investors are interested in buying shares.

- Shares are freely transferable and members have limited liability.

- Thus, a Joint Stock Company can raise huge capital.

- Capital can also be raised by company from financial institutions.

Question 5.

The liability of Co-parceners is limited in ‘Joint Hindu Family Business’.

Answer:

- In a Joint Hindu Family Business, there are two types of members – Karta and Co-parceners.

- The karta has unlimited liability and he is the only decision making authority. The co-parcerns have limited liability and therefore cannot take part in the management of the firm. They can only share the profit but cannot challenge decisions taken by the Karta.

- The liability of co-parceners is limited upto the extent of their share in the Joint Hindu Family Business.

- The personal property of co-parceners is not used for payment of the liability of the Joint Hindu Family business.

- Thus, the liability of Co-parcerners is limited in ‘Joint Hindu Family Business’.

Question 6.

Sole proprietorship is useful for small business.

Answer:

- Sole trading concern is owned by only one person.

- He uses his own skill and intelligence for his business.

- Sole trader brings capital from his own savings. He may borrow from friends and relatives. However, capital collected is limited.

- He alone takes decisions of business. Therefore, managerial ability is also limited.

- Because of limited capital and limited managerial ability, it is not possible to expand business beyond a certain limit.

- Thus, sole proprietorship is useful for small business where limited capital and less managerial ability is needed.

Question 7.

Co-operative society follows democratic principles.

Answer:

- The members of a Co-operative organisation form the general body which manages the co-operatives. This body exercises the power through annual general meetings. They elect their representatives who look after the day to day management which is collectively known as Managing Committee.

- ‘One member One vote’ is the principle followed by Co-operative Societies.

- All these denote that it follows democratic principles.

- Thus, Co-operative society follows democratic principles.

Question 8.

There is separation of ownership and management in Joint Stock Company.

Answer:

- The shareholders are the owners of the company. The company is managed by the Board of Directors who are elected representatives of the shareholders.

- There is separation of ownership and management because of the following reasons:

(a) Scattered membership (b) Large membership (c) Disinterested shareholder (d) Heterogenous members (e) Separate legal entity. - Thus, ownership is in the hands of shareholders and the management is with the Board of Directors who are paid employees of the company.

Question 9.

Shares of Private Limited company are not freely transferable.

Answer:

- According to the Companies Act, the right to transfer shares is restricted by its articles.

- Only a public limited company has right to transfer shares freely.

- Thus, shares of Private Limited company are not freely transferable.

Question 10.

All partners are joint owners of Partnership firm.

Answer:

- According to the Indian Partnership Act, 1932, all the partners are joint owners of the property of the partnership firm.

- No partner can use the property of the firm for his personal interest.

- No partner is allowed to take any decision without the consent of all the partners.

- No partners can make any secret profit in the business.

- Profits and losses are shared among the partners in the profit sharing ratio mentioned in the deed.

- Thus all partners are joint owners of Partnership firm.

Question 11.

Active partners take active part in day to day management of partnership firm.

Answer:

- Active partner is also called a working partner. He brings in capital and also takes active part in the business of the firm.

- He has unlimited liability and shares the profits and losses of the firm. He is also called a managing partner.

- Thus, active partners take active part in day to day management of partnership firm.

7. Attempt the following

Question 1.

Explain various types of Co-operative Society.

Answer:

Types of Co-operative Society are as follows:

(i) Consumer Co-operative Societies : A consumer co-operative is a business owned by its customers. They purchase in large quantities from wholesalers and supply in small quantities to customers. Goods are provided to buyers at reasonable prices and also provide services to them. Members get a share in the profit. The consumer society is formed to eliminate middlemen from distribution process e.g.-Apana Bazar, Sahakari Bhandar.

(ii) Credit Co-operative Societies : Members pool their savings together with the aim of obtaining loans from their pooled resources for productive purposes and non-productive purposes. They may be established in rural areas by agriculturist or artisans called as a Rural Credit Society. They may be established by salary earners or industrial areas called as Urban Banks, Salary Earners Society or Workers Society.

(iii) Producer’s Co-operatives : Producer’s Co-operatives are voluntary associations of small producers and artisans who come together to face competition and increase production. These societies are of two types:

(a) Industrial Service Co-operatives : This society supply raw materials, tools and machinery to the members. The producers work independently and sell their industrial output to the co-operative society. The output of members is marketed by the society.

(b) Manufacturing Co-operatives : In this type, producer members are treated as employees of the society and are paid wages for their work. The society provides raw material and equipment to every member. The members produce goods at a common place or in their houses. The society sells the output in the market and its profits is distributed among the members.

(iv) Marketing Co-operatives Societies : These co-operatives find better markets for members produce. They also provide credit and other inputs to increase members production levels. They perform marketing functions such as standardising, grading, branding, packing, advertising etc. The proceeds are then distributed among members depending on the quantities sold.

(v) Co-operative Farming Societies: Farmers voluntarily come together and pool their land. The agricultural operations are carried out jointly. They make use of scientific method of cultivation.

(vi) Housing Co-operative Societies : Housing Co-operatives are owned by residents. The society purchases land and develops it. Houses are constructed for residential purpose on ownership basis. They aim at establishing houses at fair and reasonable rents to members. For construction purposes loans are made available from Governmental or Non-Governmental sources. The society also looks after the maintenance of its buildings.

![]()

Question 2.

Explain the features of Joint Stock Company.

Answer:

The features of Joint Stock Company are as follows:

(i) Common Seal : A company being an artificial person cannot sign on its own. The law requires every company to have a seal and have its name engraved on it. Common seal is a symbol of company’s incorporate existence. As common seal is the signature of the company, it has to be affixed on all important documents of the company. When the seal is used it has to be witnessed by two Directors of the Company. The common seal is under the custody of Company Secretary.

(ii) Registration : The registration of Joint Stock Company is compulsory. All the companies have to be registered under Indian Companies Act, 2013. A private limited company can start its business immediately after getting ‘Incorporation Certificate’ while public limited company has to obtain. “Certificate of Commencement of Business” before it starts business.

(iii) Artificial Legal Person : A company is an artificial person created by law. It has an independent legal status. It has a separate name. It can enter into contracts, buy and sell property in its name. The company is distinct from its members.

(iv) Membership : A company is an association of persons. A private limited company must have atleast two persons and a public limited company must have atleast seven persons. The maximum limit of members for private company is 200. A public company can have unlimited members.

(v) Perpetual Succession : A Joint Stock company enjoys a long and stable life. There is continuity in existence, which means perpetual existence. Life of the company is not affected by life of the shareholders. If a shareholder dies, becomes insolvent or insane, the company will not be closed down. “Members may come and members may go but a company goes on forever”.

(vi) Separation of Ownership and Management: Persons investing in the shares of the company are called as shareholders. They are the owners of the company. They receive a share in the profits of the company called “dividend”. The large number of shareholders cannot manage business. They elect representatives who are collectively called as Board of Directors. They manage business of the Company.

(vii) Registered Office : Registered office of the company is a place where all the important documents of the company are kept e.g., Register of Members, Annual Returns, Minute Books, etc. All correspondence work of the company is done through registered office. The address of the registered office has to be mentioned in the domicile clause of the company.

(viii) Transferability of Shares : Shareholders are the owners of the company. Shares of a public limited company are freely transferable. There is a high degree of liquidity involved in buying shares of the company. Members can buy or sell shares as needed. However, there are restrictions on transferability of shares of a private company.

(ix) Voluntary Association : Any person can purchase shares and become a member of the company. The company is a voluntary association. No difference is made on the basis of religion, caste, creed, etc.

(x) Limited Liability : The liability of shareholders is limited. It depends upon the unpaid amount of shares held by them. Shareholders cannot be held personally liable for the debts of the company.

(xi) Separate Legal Status : The company is created by law. It has a separate legal entity. A company acts independently. The company can take legal action against anybody in its individual capacity.

Question 3.

Describe the features of Co-operative Society.

Answer:

(i) Limited Liability : The liability of members is limited. It depends upon the value of shares purchased by members. Therefore, their personal property is not used for payment of society’s debt.

(ii) Management : Elected representatives of members form the Managing Committee. The Managing Committee works according to bye-laws. Collective decisions are taken after conducting meetings. The organisation is managed on democratic principles.

(iii) Service Motive : The main motive of co-operative organisation is to give service to the people. It is not profit oriented. Utmost importance is given to the welfare of the people. In that sense, a co-operative society differs from other forms of organisation.

(iv) Surplus Profit: Profits are made in the course of business after payment of dividend to shareholders. A percentage of profit is always used for welfare of the people. Bonus is given to employees and as bonus on purchase made by members.

(v) Separate Legal Status : A Co-operative Society is formed according to Co-operative Societies Act, 1912, which gives it independent legal status. It is distinct from its members. Therefore it can enter into contract purchase property, etc. in its name.

(vi) Equal Voting Rights : All the members in a Co-operative Societies have equal voting rights irrespective of number of shares held by them.

(vii) Number of Members : Minimum 10 members are required for the formation of Co-operative Society. There is no limit on maximum number of members.

(viii) Democratic Principle : Democracy is followed in the working of co-operatives. Equality of voting rights is the main principle of the organisation. The principle of ‘One member One vote’ is followed. All members are equal in society.

(ix) Voluntary Association and Open Membership : Co-operative organisation is a voluntary association of individuals. Membership is voluntary. Any person can become a member of the organisation. No difference is made on the basis of language, religion, caste, etc. There is open membership. A person can become a member on his own free will and terminate membership whenever he wants.

(x) Registration : Registration of a Co-operative organisation is compulsory under Co-operative Society’s Act, 1912. Registration is done according to the Act of every state. In Maharashtra, Societies are registered under Maharashtra State Co-operative Societies Act, 1960.

(xi) State Support : Co-operatives receive support from the government. They are under the control and supervision of the State. All of them are registered under the Co-operative Societies Act, 1912. They get a corporate status. They get concessions from government in purchase of land, payment of tax etc. They get legal and financial assistance also.

8. Answer the following

Question 1.

Explain the features of Sole Trading Concern.

Answer:

A sole trading concern is one of the oldest and simplest form of organisation. An individual owns the entire business. The individual is the owner, controller and manager of the firm. Such an individual is called a Sole Trader or Sole Proprietor. This type of business is a one-man show.

(1) According to Prof. J. Hanse, “Sometimes known as one man business, it is a type of business unit where one person is solely responsible for providing the capital, for bearing the risk of the enterprise and for the risk of ownership”.

(2) According to Prof. James Lundy : “The sole proprietorship is an informal type of business owned by one person.” The features of Sole Trading Concern are as follows:

(i) Suitable for some Special Business : Sole trading concern is suitable for business where personal attention and individual skill is needed e.g., Beauty parlour, groceries, fashion designing, sweet shops, tailoring, restaurants etc.

(ii) Unlimited Liability : Liability of the sole trader is unlimited. In case business assets are not sufficient to meet business expenses, private property of the sole trader will be used. There is no difference made between private property and business property of sole trader.

(iii) No Sharing of Profits and Risks : A sole trader enjoys all the profits of business. As he is the single owner of business he assumes full responsibility in business. He alone bears all the losses or risks involved in business.

(iv) Business Secrecy : Maximum business secrecy can be maintained in a sole trading concern. A sole trader is responsible only to himself. He need not discuss any matter of business with outsiders. Moreover, there is no legal compulsion for sole trader to publish books of accounts of business.

(v) Local Market Operations : A sole trader has limited capital and limited managerial skills, which forces him to operates in local are market only.

(vi) Individual Ownership : A sole trader is the single owner of business. He owns all the property and assets of the concern. He brings in the required capital for business. A sole trading concern is a ‘One man show”.

(vii) No separate legal status : Sole trader and his business are considered one and the same in the eyes of . law. Thus, it does not enjoy separate legal status.

(viii) Direct Contacts with Customers and Employees : A sole trader directly deals with customers and employees. A sole trader can pay personal attention to his customers. This helps him to maintain good relations with his customers. He can serve customers according to their likes and dislikes. As there are less number of employees, he can build good relations with them. He can listen to their grievances and try to solve them.

(ix) Self-employment : Such business form is best suitable for self-employment. Instead of being remaining unemployed one can start such business as it requires low capital and has less legal formalities.

(x) Freedom in Selection of Business : A sole trader has freedom to select any type of business. Business selected must be allowed legally. A sole trader can use any method of maintaining books of accounts.

(xi) Minimum Government Regulations : Sole trading concern need not follow any special Act. There are not much legal formalities needed for forming and closing a sole trading concern. Only the general law of the country has to be followed.

Question 2.

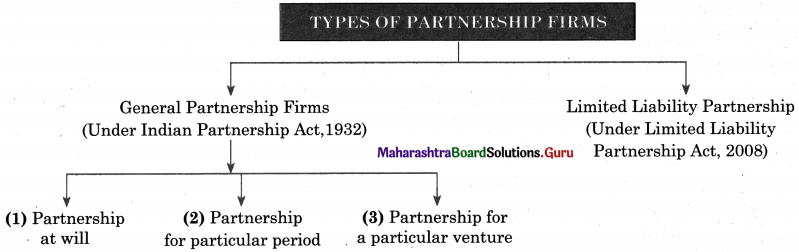

Explain different types of Partnership Firms.

Answer:

(i) General Partnership : These partnership can be formed under the Indian Partnership Act, 1932, where the liability of all partners are unlimited, joint and several.

General Partnership can be divided into three Kinds:

(a) Partnership at will: Such partnership are formed and continued as per the will of the partners. They are formed for an indefinite period. Any partner can terminate the partnership by giving a notice to the firm. Such firms exists so long as there is mutual trust and co-operation among the partners.

(b) Partnership for a particular period : Such partnerships are formed for a particular period of time. On the completion of the duration, the partnership firm automatically dissolves irrespective of the venture being complete.

(c) Partnership for a venture or particular partnership : Such partnerships are formed for a particular venture or job. It comes to an end on the completion of the venture. For e.g. construction of roads, dams, bridges, buildings, etc.

(ii) Limited Liability Partnership : This kind of partnership is formed under the Limited Liability Partnership Act 2008. There are 2 kinds of partners.

- Designated Partner : Limited liability partnership is one where there are atleast two partners of which one must be a resident of India.

- General Partner : In limited liability partnership a apart from the designated partners all other partners have limited liability. They are called general partners.

Question 3.

Explain different types of Partners.

Answer:

The different types of partners are:

(i) Active or Working Partners : In practice one or two partners take active part in the management. Such partners are called active or working partners. They contribute capital, shares profits or losses, and has unlimited, joint and several liability. They take an active interest in the day to day working of the firm. These partners are also known as ordinary / general / actual partners.

(ii) Dormant or Sleeping Partners : A dormant or sleeping partner is one who contributes capital to the firm. He does not take any active part in the management of the firm. He shares the profits and losses of the firm like any other partner. He voluntarily surrenders the right of management. However, he is liable for the debts of the firm.

(iii) Nominal Partners : A nominal partner is one who does not contribute any capital to the firm. He lends his name to the firm. He is simply obliging his friends by allowing the firm to use his name as a partner. He may or may not be given any share in the profits of the firm. His goodwill is used to attract business. However, he is liable for the debts of the firm.

(iv) Minor as Partner : According to the Indian Contract Act 1872, a person below 18 years is called a minor. But according to the Indian Partnership Act 1932, a minor can be admitted for the benefit of the firm with the consent of all other partners. He has a right to inspect the books of accounts. Minor partner has limited liability and is not liable for losses. He has the option to continue as a full-fledged partner or discontinue as a partner on attaining the age of majority. If he wishes to discontinue, he must give a public notice within 6 months from the age of majority.

(v) Partner in Profits only : A partner may clearly state that he will have a share only in the profits of the firm and that he will not share losses. Such a partner is known as “Partner in Profits Only”. He has no rights of management. He may not take active participation in the management of the firm.

(vi) Partner with Limited Liability : A limited partner has limited liability. A partner whose liability depends upon the extent of investment is called a limited partner. He has no right to take part in the day to day work. But such a partnership must have at least one partner having unlimited liability.

(vii) Secret Partner : A person is a partner of the firm and not known to general public is a secret partner. Secret partners have all the features like other partners. He brings capital to the firm and also gets a share in profit. He has unlimited liability. He can take part in the working of the business.

(viii) Sub-Partner : A partner when agrees to share his own profit derived from the firm with third person, it is known as sub-partner. A sub-partner cannot call himself as a partner in the firm.

(ix) Quasi Partner : A retired partner leaving his capital with the firm is called as Quasi Partner. He does not participate in the working of the firm, but share profit of the firm. He is also liable for the debts of the firm.

![]()

Question 4.

Explain the five features of Joint Stock Company.

Answer:

The features of Joint Stock Company are as follows:

(i) Common Seal : A company being an artificial person cannot sign on its own. The law requires every company to have a seal and have its name engraved on it. Common seal is a symbol of company’s incorporate existence. As common seal is the signature of the company, it has to be affixed on all important documents of the company. When the seal is used it has to be witnessed by two Directors of the Company. The common seal is under the custody of Company Secretary.

(ii) Artificial Person : A company is an artificial person created by law. It has an independent legal status. It has a separate name. It can enter into contracts, buy and sell property in its name. The company is distinct from its members.

(iii) Registration: The Registration of Joint Stock Company is compulsory. All companies have to be registered under Indian Companies Act, 2013.

(iv) Membership : A company is an association of persons. A private limited company must have atleast two persons and a public limited company must have atleast seven persons. The maximum limit of members for private company is 200. A public company can have unlimited members.

(v) O wnership and Management: Persons investing in the shares of the company are called as shareholders. They are the owners of the company. They receive a share in the profits of the company called “dividend”. The large number of shareholders cannot manage business. They elect representatives who are collectively called as Board of Directors. They manage business of the Company.

(vi) Limited Liability : The liability of shareholders is limited. It depends upon the unpaid amount of shares held by them. Shareholders cannot be held personally liable for the debts of the company.

Question 5.

Explain the merits of a Co-operative Society.

Answer:

The merits of a Co-operative Society are as follow:

(i) E asy Formation: It is easy to form a Co-operative organisation. Minimum ten members are needed to form the organisation. It does not involve much legal formalities. It is compulsory to register the organisation. However, the procedure for registration is simple and the fees are nominal.

(ii) Tax Concession : Co-operatives always get support of the government. As they play an important role in economic and social development, government gives them concessions in payment of tax.

(iii) Open Membership : Membership of a Co-operative organisation is open to all. A person can become a member by purchasing shares. No difference is made on the basis of language, religion, caste, etc. A person can become a member whenever he wants and terminate membership at his own will. Membership is voluntary.

(iv) Stability : A Co-operative organisation enjoys a long and stable life. The life of the organisation is distinct from the life of its members. If any member dies, becomes insolvent or insane, business is not closed.

(v) Self Financing and Charity : After providing 15% dividend to members, surplus amount is used for self-financing by the Co-operative Societies. Some amount of leftover profit is used for charity, social activities and for the growth of the co-operative society.

(vi) Less O perating Expenses: Cost of operation is low as salary is not paid to members who manage business. Members of Co-operative organisations work on honorary basis. They are not given any remuneration for their services. There are no expenses on advertising and publicity. This helps to increase profit.

(vii) Limited Liability : The liability of members is limited. It depends upon the value of shares purchased by members. Therefore, people are interested in investing in a Co-operative organisation.

(viii) Democratic Management: Democracy is followed in the management of co-operative organisation. All members are equal. The principle of “One member One vote” is followed. Members elect representatives who form the managing committee. They work according to bye-laws. The managing committee looks after day to day administration. Decisions are taken collectively in meetings.

(ix) Supply of Goods at Cheaper Rate : Goods are sold at lesser price through a Co-operative store. This is because the organisation is service – oriented. The store does not make use of services of middlemen and there are no expenses on advertising. So goods are sold at cheap rates.

Question 6.

Explain the demerits of Partnership firm.

Answer:

The demerits of Partnership firm are as follows:

(i) Non-transferability of Interest: In a partnership firm no one partner can transfer his share of interest to another outsider without the consent of all the partners.

(ii) Limited Capital: There is a limitation in raising additional capital for business. The business resources are limited to personal funds of the partners. Borrowing capacity of partners is limited. The maximum number of partners is fifty only. So financial capacity is less.

(iii) Absence of Legal Status : The Indian Partnership Act, 1932 does not give a legal status to a partnership firm. There is no independent legal status. The firm and its partners are one and the same.

(iv) Problem of Continuity : The partnership firm is not a separate legal entity. The firm is dependent oh mutual trust between partners. If a partner dies, becomes insolvent or insane, the firm has to be dissolved compulsorily whether the partners wish or not.

(v) Risk of Implied Authority : A partner works in two capacities. He has a dual role – Principal and Agent. He acts as an agent of the business. He can enter into contract with third party. However, a wrong decision can result in heavy losses, which has to be borne by all partners.

(vi) Limitations on Number of Partners : No partnership can go beyond maximum number prescribed (i.e. 50 members) by Indian Partnership Act. This restriction effects the raising of capital for further expansion.

(vii) Disputes : It is difficult to maintain harmony among partners. They may have different opinions and may not agree on certain matters. Partners may have conflicts if some partners work for self interest. This reduces team spirit and may finally lead to dissolution of the firm.

(viii) Difficulty in Admission of Partner : As consent of all partners is required to take any decision in the partnership firm, it becomes difficult to admit a new partner. This is a disadvantage to the firm as it cannot bring in new talent if the other partners are not agreeing to it.

(ix) Unlimited Liability : The liability of partners is unlimited. There is no difference between business property and personal property of partners. If business assets are not enough to meet business expenses, personal property can be used.

(x) Problem of Secrecy : Partnership firms lack complete business secrecy as some secrets may be disclosed by some partner to the competitor for personal benefit.

Question 7.

Explain the merits of Joint Stock Company.

Answer:

The merits of Joint Stock Company are as follows:

(i) Transferability of Shares : Shares of a public company can be transferred easily and freely. There is a high degree of liquidity in shares. Permission of directors or members need not be taken for buying and selling shares. This helps to attract investors to public company.

(ii) Relief in Taxation : The tax burden in the company is less. Provisions of Income Tax Act says that companies have to pay tax at flat rate. This is less than taxes paid by individuals earning very high income. If company is started in backward areas, the company gets relief in the form of tax holding.

(iii) More Scope for Expansion : The capital raising capacity of the company is high. The company has a lot of funds at its disposal. A part of the profit is also ploughed back for business. This enables growth and expansion of business.

(iv) Public Confidence : Joint Stock Company has to publish books of accounts. Which is audited by CA. Annual reports of the company have to be published. The activities of the Company are regulated by the provision of Companies Act, 2013. Therefore, the company gets public support.

(v) Limited Liability : The liability of shareholders is limited. It is to the extent of unpaid value of shares. Shareholders cannot be liable for the debts of the company. Features of limited liability attract more investors to business.

(vi) Expert Services : Joint Stock Company an appoint experts for managing their huge business operations. They appoint experts like Legal advisors, management experts, auditors, consultants, etc.

(vii) Democratic Management: Management of a company is democratic. Shareholders elect representatives called as Board of Directors. They manage business. Directors are accountable to shareholders. Policy decisions are taken by Directors but have to be approved by shareholders. The shareholders can also remove inefficient Directors.

(viii) Perpetual Succession : Joint Stock Company enjoy long and stable life. Its stability is not affected by death insolvency or retirement, of any of its members.

(ix) Professional Management : Large funds are at the disposal of the companies. Therefore, experts can be appointed in different areas of business. As good salaries can be paid, highly qualified personnel like Cost Accountants, Sales Experts, Market Experts, etc. can be appointed. Even Board of Directors have competent persons who manage business efficiently.

(x) Large Amount of Capital: A company can collect large amount of capital. There is no limit on maximum number of members. Due to features of limited liability, transferability of shares and liquidity, many investors are attracted to become shareholders of the company. Loans are also available to Joint Stock Companies.

Question 8.

Explain the features of partnership firm.

Answer:

The features of partnership firm are as follows:

(i) Lawful Business : Business undertaken by partnership should be lawful. It cannot undertake business forbidden by state. The definition of partnership also does not permit any association like club or charitable institution. Illegal business like smuggling or gambling is not allowed.

(ii) Agreement : Partnership is a result of agreement between partners. There could be a written or oral agreement between partners. A written agreement is preferred so that it can be used as a proof in the court of law if needed.

(iii) Number of Partners : Minimum two members are needed to start a partnership firm. The maximum number of members is 50.

(iv) Dissolution : A Partnership Firm can be dissolved through agreement between partners. If a partner wants, he can dissolve the firm by giving 14 days notice to the firm. The firm can be dissolved if a partner dies, becomes insolvent or insane.

(v) Sharing of Profits and Losses : The purpose of partnership is to earn profit. Its object cannot be a charitable one. Partners have to share profits and losses according to the ratio given in the agreement. If the agreement is silent about the proportion then profit and loss sharing will be equal.

(vi) Termination of Partner : A partner may resign by giving proper notice in writing to the other partners. A partner can also be removed if he has been found doing any fraudulent activities.

(vii) Joint Ownership : Each partner is the joint owner of the property of the firm. All partners are equal owners of business property. No partner can use property for personal use.

(viii) Registration : It is not compulsory as per Indian Partnership Act, 1932. However, in the State of Maharashtra, it has been made compulsory to get register with ‘Registrar of Firms’ of the state.

(ix) Joint Management: All partners have equal rights in managing the firm. Some partners take interest in management of the firm and others voluntarily surrender their management rights. However, all partners are jointly responsible for the management of the firm.

(x) Unlimited Liability : The liability of partners is unlimited joint and several. If assets of business is not sufficient to pay liabilities, personal property of partners can be used. If any one of the partners is declared insolvent, his liability will be borne by the solvent partners.

(xi) Principal and Agent : Each partner works in two capacities – Principal and Agent. A partner acts as principal when within the firm and acts as an agent while dealing with outsider. The partners play a dual role.

(xii) Restriction on Transfer of Interest : A partner cannot transfer or sell his interests in the firm to outsider without the prior consent of all other partners in the firm.

Question 9.

Explain the types of co-operative societies.

Answer:

Types of Co-operative Society are as follows:

(i) Consumer Co-operative Societies : A consumer co-operative is a business owned by its customers. They purchase in large quantities from wholesalers and supply in small quantities to customers. Goods are provided to buyers at reasonable prices and also provide services to them. Members get a share in the profit. The consumer society is formed to eliminate middlemen from distribution process e.g.-Apana Bazar, Sahakari Bhandar.

(ii) Credit Co-operative Societies : Members pool their savings together with the aim of obtaining loans from their pooled resources for productive purposes and non-productive purposes. They may be established in rural areas by agriculturist or artisans called as a Rural Credit Society. They may be established by salary earners or industrial areas called as Urban Banks, Salary Earners Society or Workers Society.

(iii) Producer’s Co-operatives : Producer’s Co-operatives are voluntary associations of small producers and artisans who come together to face competition and increase production. These societies are of two types:

(a) Industrial Service Co-operatives : This society supply raw materials, tools and machinery to the members. The producers work independently and sell their industrial output to the co-operative society. The output of members is marketed by the society.

(b) Manufacturing Co-operatives : In this type, producer members are treated as employees of the society and are paid wages for their work. The society provides raw material and equipment to every member. The members produce goods at a common place or in their houses. The society sells the output in the market and its profits is distributed among the members.

(iv) Marketing Co-operatives Societies : These co-operatives find better markets for members produce. They also provide credit and other inputs to increase members production levels. They perform marketing functions such as standardising, grading, branding, packing, advertising etc. The proceeds are then distributed among members depending on the quantities sold.

(v) Co-operative Farming Societies: Farmers voluntarily come together and pool their land. The agricultural operations are carried out jointly. They make use of scientific method of cultivation.

(vi) Housing Co-operative Societies : Housing Co-operatives are owned by residents. The society purchases land and develops it. Houses are constructed for residential purpose on ownership basis. They aim at establishing houses at fair and reasonable rents to members. For construction purposes loans are made available from Governmental or Non-Governmental sources. The society also looks after the maintenance of its buildings.

![]()

Question 10.

Explain the demerits of Joint Stock Company.

Answer:

The demerits of Joint Stock Company are as follows:

1. Rigid Formation : The formation of a joint stock company is lengthy, difficult and time consuming. There are many legal formalities for starting business. Promoters have to prepare documents like Articles of Association, Memorandum of Association, etc. A private company has to go through two stages in formation. A public company has to go through four stages in formation.

2. Delay in Decision Making Process : In company form of organization no single individual can make a policy decision. All important decisions are taken by Board of Directors. Decision taking process is time consuming. Business may lose opportunities because of delay in decision making.

3. Lack of Secrecy : The management of companies remain in the hands of many persons. Everything is discussed in the meetings of Board of Directors. All important documents are available at registered office for inspection. Thus, there is no secrecy in business matters.

4. Excessive Government Control: A large number of rules are framed for the working of companies. The companies will have to follow rules for internal working. The government tries to regulate the working of the companies because large public money is involved. In case regulations are not complied with, large penalties are involved.

5. High Cost of Management : The management of joint stock company form of organization is costly. Services of experts like share brokers, underwriters, solicitors, bankers is needed which is costly. Highly qualified staff is needed. They are paid good salaries. Dissolution of the firm is also costly.

6. Reckless Speculation: Directors look after management of the company. They have full information about the progress of the company. They use these details for speculation in shares. This results in fluctuations in share prices. This affects public confidence.

7. No Personal Contact : There are large number of employees in the organization. There is no personal contact of owners and managers with employees. Lack of appreciation demotivates employees. Similarly, managers and directors are not able to maintain personal contacts with their customers. Thus, customers likes and dislikes are ignored.

8. No Direct Effort Reward Relationship : Joint Stock Company is owned by shareholders and managed – by Board of Directors. Board of Directors are paid for managing and profit is shared by shareholders. There is no direct relation between efforts and rewards. Directors may not take a lot of interest in the working of the company.

OCM 11th Commerce Textbook Solutions Digest

- 11th OCM Chapter 1 Practical Problems

- 11th OCM Chapter 2 Practical Problems

- 11th OCM Chapter 3 Practical Problems

- 11th OCM Chapter 4 Practical Problems

- 11th OCM Chapter 5 Practical Problems

- 11th OCM Chapter 6 Practical Problems

- 11th OCM Chapter 7 Practical Problems

- 11th OCM Chapter 8 Practical Problems