Single Entry System 11th BK Commerce Chapter 10 Solutions Maharashtra Board

Balbharti Maharashtra State Board Bookkeeping and Accountancy 11th Solutions Chapter 10 Single Entry System Textbook Exercise Questions and Answers.

Class 11 Commerce BK Chapter 10 Exercise Solutions

1. Answer in One sentence only.

Question 1.

What do you mean by a Single Entry System?

Answer:

A system of bookkeeping in which an accountant or businessman records only one aspect of business transaction (either debit or credit and ignores the other aspect is called ‘Single Entry System’.

Question 2.

What is a Statement of Affairs?

Answer:

A list of all assets and liabilities prepared under a single entry system to find out capital balance is called a statement of affairs.

![]()

Question 3.

Which type of accounts are normally not kept under the Single Entry System?

Answer:

Under a single entry system, records of impersonal accounts i.e. real accounts and nominal accounts are not maintained.

Question 4.

Which statement is prepared under the Single Entry system to ascertain the capital balances?

Answer:

A statement of Affairs is prepared under a single entry system to ascertain capital balances.

Question 5.

How Opening Capital is calculated under the Single Entry System?

Answer:

Under a single entry system, opening capital is ascertained by preparing the opening statement of affairs.

Question 6.

Which types of accounts are maintained under the Single Entry System?

Answer:

Under a single entry system, all personal accounts and cash accounts are maintained.

Question 7.

Can a Trial Balance be prepared under a Single Entry System?

Answer:

A trial balance cannot be prepared under a single entry system.

![]()

Question 8.

Which type of organizations generally follow the Single Entry System?

Answer:

Organizations having small sizes of business such as sole trading concerns and partnership firms follow a single entry system.

2. Write a word, term, or phrase which can substitute each of the following statements.

Question 1.

A statement that is similar to the Balance Sheet.

Answer:

Statement of Affairs

Question 2.

The system of Accounting is normally suitable for small business organizations.

Answer:

Single Entry System

Question 3.

A statement similar to the Balance Sheet is prepared to find out the amount of opening capital.

Answer:

Opening Statement of Affairs

Question 4.

An excess of assets over liabilities.

Answer:

Capital

![]()

Question 5.

Excess of closing capital over opening capital of proprietor under Single Entry System.

Answer:

Profit

Question 6.

Name of the method of accounting suitable to firms having limited transactions.

Answer:

Single Entry System

Question 7.

A System of accounting that is unscientific.

Answer:

Single Entry System

Question 8.

Further capital introduced by the proprietor in the business concern over and above his existing capital.

Answer:

Additional Capital

3. Select the most appropriate answer from the alternatives given below and rewrite the sentence.

Question 1.

The capital balances are ascertained by preparing _______________

(a) Statement of Affairs

(b) Cash Account

(c) Drawings Accounts

(d) Debtors Accounts

Answer:

(a) Statement of Affairs

![]()

Question 2.

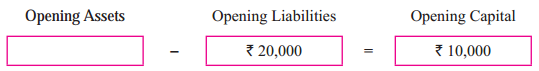

Under Single Entry System, Opening Capital = Opening Assets less _______________

(a) Opening Liabilities

(b) Closing Liabilities

(c) Debtors Account

(d) Creditors Account

Answer:

(a) Opening Liabilities

Question 3.

Additional Capital introduced during the year is _______________ from closing capital in order to find out the correct profit.

(a) Added

(b) Deducted

(c) Divided

(d) Ignored

Answer:

(b) Deducted

Question 4.

Single Entry System may be useful for _______________

(a) Sole traders

(b) Company

(c) Government

(d) None of these

Answer:

(a) Sole traders

Question 5.

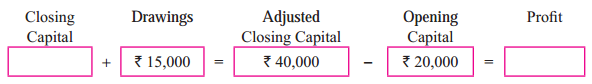

In order to find out the correct profit, drawings is _______________ from closing capital.

(a) Multiplies

(b) Divided

(c) Deducted

(d) Added

Answer:

(d) Added

![]()

Question 6.

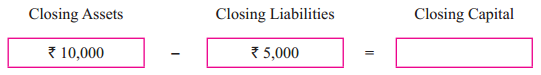

The difference between assets and liabilities is called _______________

(a) Capital

(b) Drawings

(c) Income

(d) Expenses

Answer:

(a) Capital

Question 7.

When Closing Capital is greater than the Opening Capital, the difference is _______________

(a) Profit

(b) Loss

(c) Assets

(d) Liabilities

Answer:

(a) Profit

Question 8.

Opening Capital is ₹ 30,000; Closing Capital is ₹ 60,000; Withdrawals are ₹ 5,000; and further capital brought in is ₹ 3,000; Profit is _______________

(a) ₹ 45,000

(b) ₹ 35,000

(c) ₹ 32,000

(d) ₹ 22,000

Answer:

(c) ₹ 32,000

4. State True or False with reasons:

Question 1.

The double Entry System of Book-keeping is a scientific method of books of accounts.

Answer:

This statement is True.

In the double-entry system of book-keeping, there are two-fold effects. Both the effects are recorded simultaneously with an equal amount. This system also follows principles and rules of debit and credit. Due to this, there are very fewer chances of mistakes. So double entry system of Book-Keeping is a scientific method of the book of accounts.

Question 2.

Preparation of Trial Balance is not possible under the Single Entry System.

Answer:

This statement is True.

Under the single entry system, only cash and personal accounts of debtors and creditors are open. So it is not possible to prepare. Trail balance under single entry system as it has incomplete information of Accounting.

Question 3.

Statement of Affairs and Balance Sheet are one and the same.

Answer:

This statement is False.

There is a difference between a statement of Affairs and the Balance sheet. Statement of Affair shows estimated values of assets and liabilities.

![]()

Question 4.

The single Entry System is not useful for large organizations.

Answer:

This statement is True.

Under the Single Entry System, only the cash book and personal account of Debtor and Ciygditor are maintained. Real and Nominal accounts are not maintained. It has no proper set of rules to be followed. It is useful for small organisations and not for a large organisations.

Question 5.

Only Cash and Personal accounts are maintained under the Single Entry System.

Answer:

This statement is True.

The single Entry System is an ancient and unscientific method of recording business transactions. This system maintains minimum accounts so it is easy for traders to write books of accounts. This system does not follow any accounting rules. To know the cash collections and amount payable or receivable only cash and personal accounts are maintained under a single entry system.

5. Do you agree with the following statements?

Question 1.

Further capital introduced during the year increases profit.

Answer:

Disagree

Question 2.

Interest in Drawings decreases the amount of profit under the Single Entry System.

Answer:

Disagree

Question 3.

Real and Nominal accounts are not maintained under the Single Entry System.

Answer:

Agree

Question 4.

The single Entry System is based on certain rules and principles.

Answer:

Disagree

![]()

Question 5.

Statement of Profit is just like Profit and Loss Account.

Answer:

Disagree

6. Fill in the Blanks.

Question 1.

Statement of Affairs is just like _______________

Answer:

Balance Sheet

Question 2.

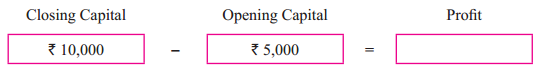

Under Single Entry System, Profit = Closing Capital Less _______________

Answer:

Opening Capital

Question 3.

In order to find out the correct profit, drawings are _______________ to the closing capital.

Answer:

Added

Question 4.

In _______________ Book Keeping System, in every business transactions we find two effects.

Answer:

Double Entry System

Question 5.

The difference between Assets and Liabilities is called _______________

Answer:

Capital

![]()

Question 6.

Single Entry System is more popular for _______________

Answer:

Sole Trader

Question 7.

Additional Capital introduced during the year is _______________ from Closing Capital in order to find out the correct profit.

Answer:

Deducted

Question 8.

Single Entry System is Suitable for _______________ business.

Answer:

Small

7. Find the odd one:

Question 1.

Interest on Drawings, Outstanding Expenses, Undervaluation of Assets, Prepaid Expenses.

Answer:

Outstanding Expenses

Question 2.

Interest on Capital, Interest on Loan, Overvaluation of Liabilities, Depreciation on Assets.

Answer:

Overvaluation of Liabilities

Question 3.

Creditors, Bills Payable, Bank Overdraft, Stock in Trade.

Answer:

Stock in Trade

8. Complete the following table:

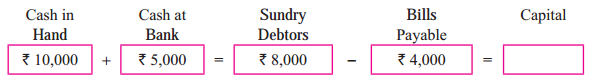

Question 1.

Answer:

₹ 5,000

Question 2.

Answer:

₹ 30,000

![]()

Question 3.

Answer:

₹ 5,000

Question 4.

Answer:

₹ 25,000, ₹ 20,000

Question 5.

Answer:

₹ 19,000

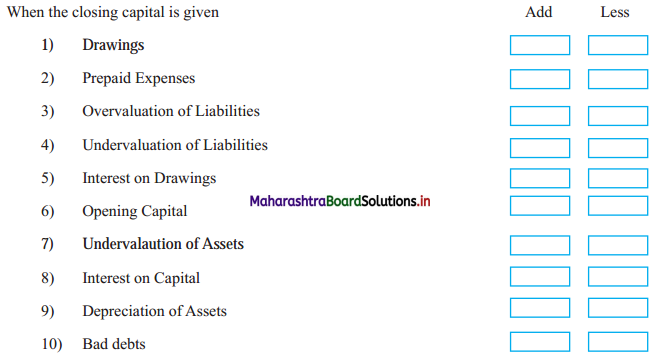

9. Complete the following table. Put Proper mark in Box.

Question 1.

Answer:

- Add

- Add

- Add

- Less

- Add

- Less

- Add

- Less

- Less

- Less

Practical Problems

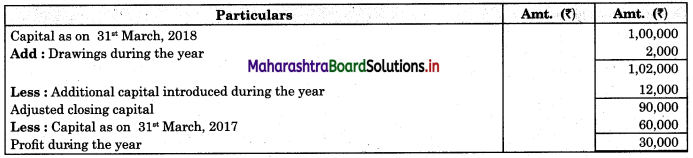

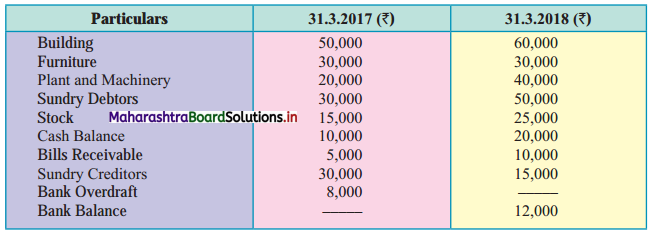

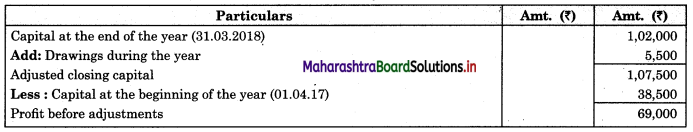

Question 1.

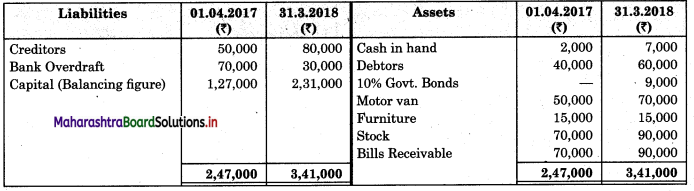

Mr. Poonawala keeps his books under the Single Entry System and gives the following information.

Capital as of 31.3.2017 – ₹ 60,000

Capital as on 31.3.2018 – ₹ 1,00,000

Drawings made during the year ₹ 2,000

Additional capital introduced during the year ₹ 12,000

Calculate Profit or Loss during the year.

Solution:

In the books of Mr. Poonawala

Statement of Profit or Loss for the year ended 31st March 2018

![]()

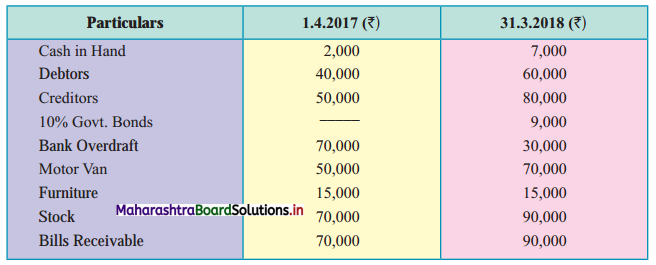

Question 2.

Sujit a small trader provides you with the following details of his business.

Additional information:

1. Sujit withdraws ₹ 5,000 for his personal use, on 1st Oct. 2017.

2. He had also withdrawn ₹ 30,000 for rent of his residential flat.

3. Depreciation Furniture by 10% p.a. and writes off ₹ 1,000 from Motor Van.

4. Charge interest on Drawings ₹ 3,000.

5. 10% Govt. Bonds were purchased on 1st Oct. 2017.

6. Allow interest on capital at 10% p.a.

7. ₹ 1,000 is written off as bad debts and provides 5% p.a. R.D.D. on Debtors.

Prepare Opening Statement of Affairs, Closing Statement of Affairs, and Statement of Profit or Loss for the year ending 31st March 2018.

Solution:

In the books of Sujit

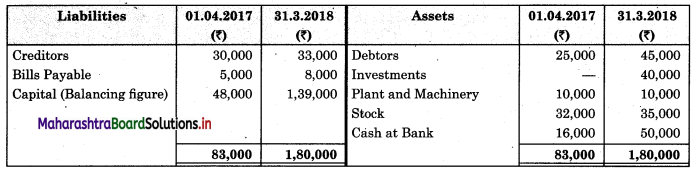

Opening and closing statement of Affairs as on _______________

Statement of Profit or Loss for the year ended 31st March 2018

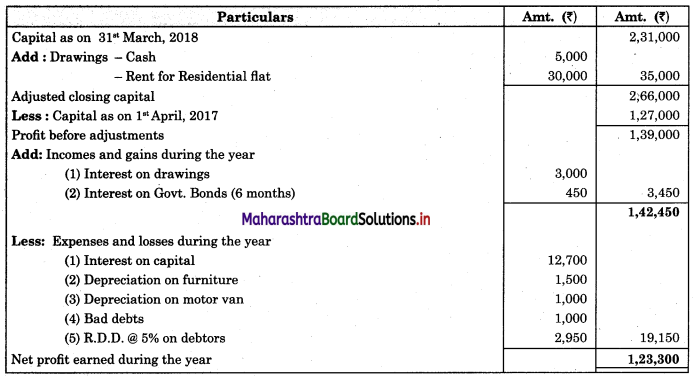

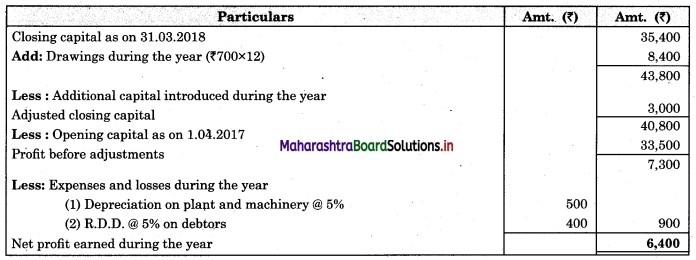

Question 3.

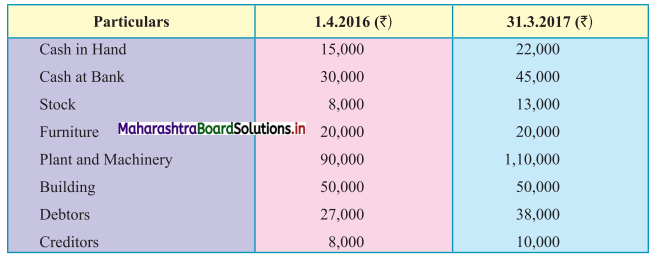

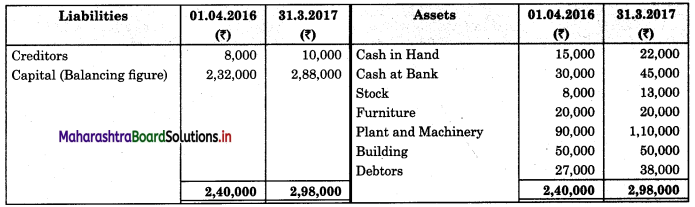

Anjali keeps her books by the Single Entry System. Her position on 1.4.2016 was as follows.

Cash at Bank ₹ 4,000, Cash in Hand ₹ 1,000, Stock ₹ 6,000; Sundry Debtors ₹ 8,400, Plant and Machinery ₹ 7,500, Bill Receivable ₹ 2,600, Creditors ₹ 3500; Bills Payable ₹ 4,000

On 31.3.2017 her position was as follows; cash at Bank ₹ 3,900, Cash in Hand ₹ 2,000. Stock ₹ 9000, Sundry Debtors, ₹ 7,500; Plant and Machinery ₹ 7,500; Bills Payable ₹ 2,200, Bills Receivable ₹ 3,400; Creditors ₹ 1,500.

During the year Anjali introduced further Capital of ₹ 1,500 and she spent ₹ 700 per month for her personal use.

Depreciation Plant and Machinery by 5% p.a. and create Reserve for Doubtful debts @ 5% p.a. on the debtor. Prepare Opening and Closing Statement of Affairs and Statement of Profit or Loss for the year ended 31.3.2017.

Solution:

In the books of Anjali

Opening and closing statement of Affairs as on _______________

Statement of Profit or Loss for the year ended 31st March 2017

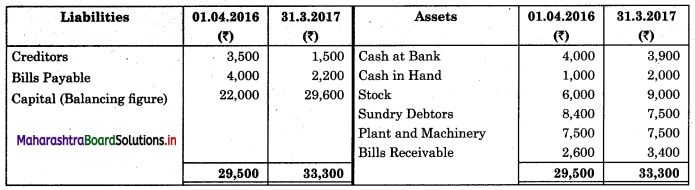

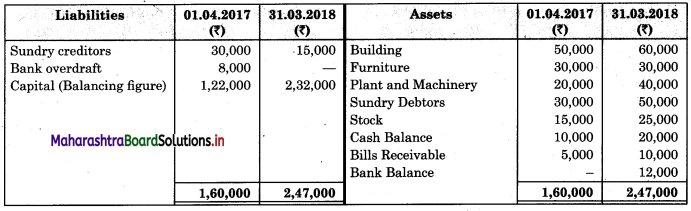

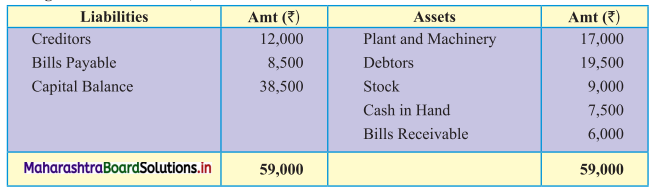

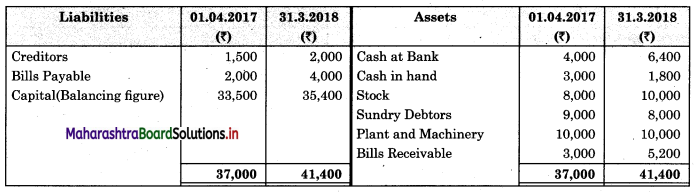

Question 4.

Mr. Vijay is dealing in the business of fruits. He maintains an accounting record with a single entry. The following figures are taken from his record.

Additional information:

1. Mr. Vijay introduced ₹ 7,000 as fresh capital.

2. He spent ₹ 40,000 from his business for his daughter’s marriage.

3. Depreciate Building by ₹ 6,000.

4. Create a 5% reserve for doubtful debts on Sundry Debtor.

Prepare:

1. Opening Statement of Affairs.

2. Closing Statement of Affairs

3. Statement of Profit or Loss for the year ended 31.3.2018.

Solution:

In the books of Mr. Vijay

Opening and closing statement of Affairs as on _______________

Statement of Profit or Loss for the year ended 31st March 2018

![]()

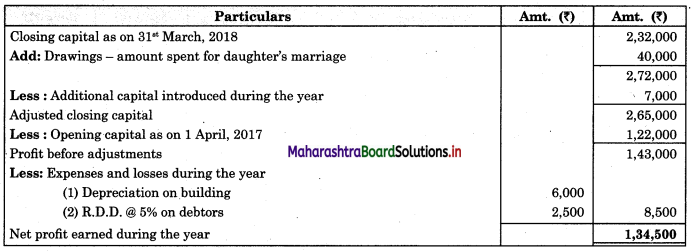

Question 5.

Miss. Fiza keeps her books on the Single Entry System and disclosed the following information about her business.

Additional information:

1. Miss. Fiza transferred ₹ 2,000 per month during the first half-year and ₹ 1000 per month for the second half-year from a business account to her personal account.

2. She sold her private asset for ₹ 40,000 and brought the proceeds into her business.

3. She also took goods worth ₹ 12,000 for private use.

4. Plant and Machinery is to be depreciated by 10% p.a.

5. Provide R.D.D. on debtors at 5% p.a.

Prepare:

1. Opening Statement of Affairs

2. Closing Statement of Affairs

3. Statement of Profit or Loss for the year ended 31.3.2018

Solution:

In the books miss Fiza

Opening and closing statement of Affairs as on _______________

Statement of Profit or Loss for the year ended 31st March 2018

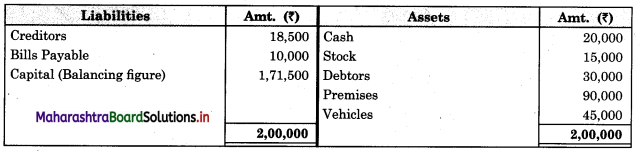

Question 6.

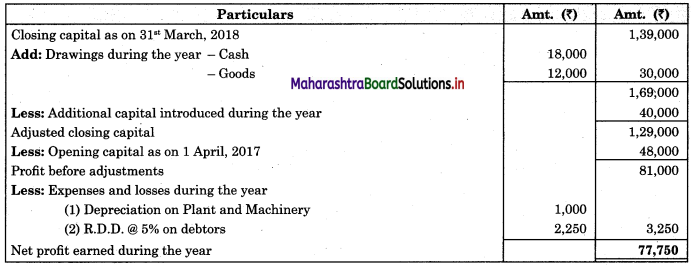

Miss. Sanika keeps her books on the Single Entry System. The statement of affairs is given on 31st March 2018.

On 31st March 2018 their Assets and Liabilities were as follows:

Plant and Machinery ₹ 42,000, Stock ₹ 38,000, Cash in Hand ₹ 10,000, Creditors ₹ 7,000, Debtors ₹ 25,000, Bills Payable ₹ 6,000

Drawings during the year were ₹ 5,500, Plant and Machinery were found Overvalued by 5% p.a. and Stock was found Undervalued by 20% p.a., R.D.D. was to be created at 10% p.a. on Debtors, Interest on Capital was allowed at 10% p.a.

Prepare:

1. Closing Statement of Affairs.

2. Statement of Profit or Loss for the year ended 31st March 2018.

Solution:

In the books of miss Sanika

Closing statement of Affairs as on 31.03.2018

Statement of Profit or Loss for the year ended 31st March 2018.

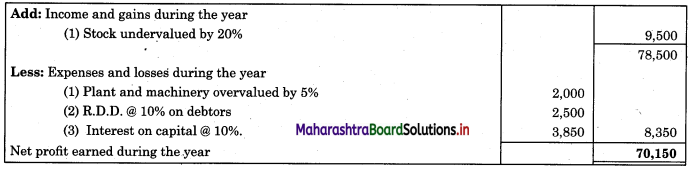

Question 7.

Mr. Suhas commenced his business with the Capital of ₹ 1,50,000 on 1st April 2017. His financial position was as follows as on 31st March 2018, Cash ₹ 20,000, Stock ₹ 15,000, Debtors ₹ 30,000, Premises ₹ 90,000, Vehicles ₹ 45,000, Creditors ₹ 18,500, Bills Payable ₹ 10,000.

Additional information:

1. He brought additional capital ₹ 10,000 on 30th Sept. 2017, Interest on capital is to be provided at 5% p.a.

2. He withdrew ₹ 15,000 for personal use on which interest is to be charged at 5% p.a.

3. Write off Bad debts ₹ 500.

Prepare:

1. Closing Statement of Affairs

2. Statement of Profit or Loss for the year ended 31.3.2018.

Solution:

In the books of Mr. Suhas

Closing statement of Affairs as on 31.3.2018

Statement of Profit or Loss for the year ended 31st March 2018.

![]()

Question 8.

Ganesh keeps his books by the Single Entry Method. Following are the details of his business:

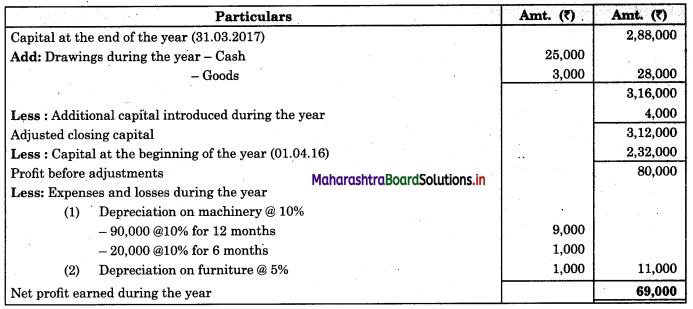

During the year he has withdrawn ₹ 25,000 for his private purpose and goods of ₹ 3,000 for household use. On 1st Oct. 2016. He sold his household furniture for ₹ 4,000 and deposited the same amount in a business Bank Account.

Provide Depreciation on Plant and Machinery at 10% p.a. (assuming additions were made on 1st Oct. 2016) and Furniture at 5%.

Prepare:

1. Opening Statement of Affairs

2. Closing Statement of Affairs

3. Statement of Profit or Loss for the year ended 31.3.2017.

Solution:

In the books of Ganesh

Opening and Closing statement of Affairs as on _______________

Statement of Profit or Loss for the year ended 31st March 2017

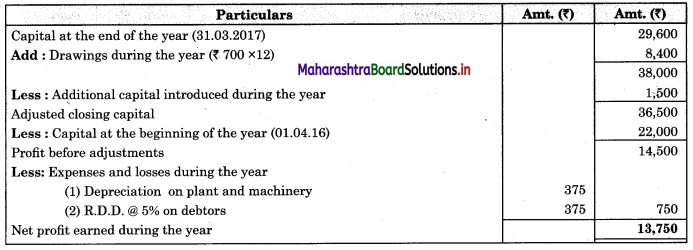

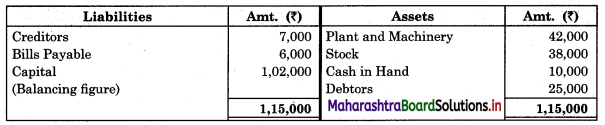

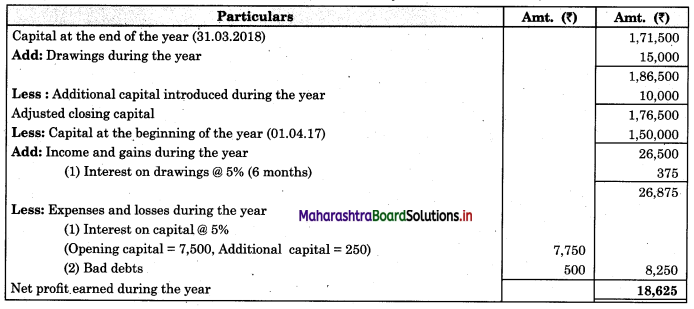

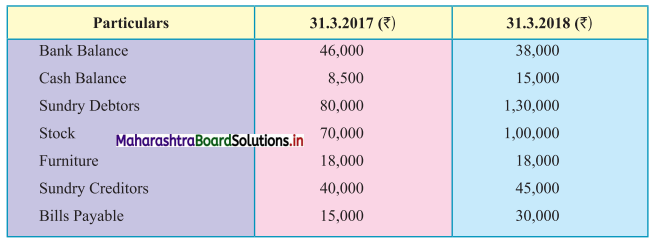

Question 9.

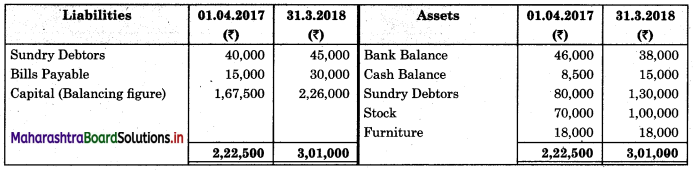

Peter keeps his books on the Single Entry System. From the following particulars, Prepare Opening and Closing Statement of Affairs and Statement of Profit or Loss for the year ending 31st March 2018.

Additional Information:

1. Peter has withdrawn ₹ 15,000 from the business for his personal use.

2. He has introduced additional capital of ₹ 10,000 in the business on 1st January 2018.

3. Depreciate furniture @ 10% p.a.

4. Maintain reserve for doubtful debts @ 5% on Sundry Debtors.

5. Closing Stock is overvalued by 25% in the books.

Solution:

In the books of Peter

Opening and closing statement of Affairs as on _______________

Statement of Profit or Loss for the year ended 31st March 2018

![]()

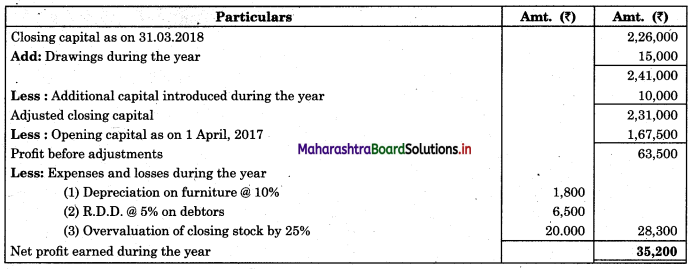

Question 10.

Suresh keeps his books by the Single Entry System. His position on 1.4.2017 was as follows.

Cash at Bank ₹ 4,000, Cash in Hand ₹ 3,000; Stock ₹ 8,000; Sundry Debtors ₹ 9,000; Plant & Machinery ₹ 10,000; Bills Receivable ₹ 3000; Creditors ₹ 1500; Bills Payable ₹ 2000.

On 31st March 2018, his position was as follows:

Cash at bank ₹ 6,400; Cash in Hand ₹ 1,800; Stock ₹ 10000; Sundry and Debtors ₹ 8,000; Plant & Machinery ₹ 10,000; Bills Payable ₹ 4,000; Bills Receivable ₹ 5,200; Creditors ₹ 2,000 During the year Suresh introduced further capital of ₹ 3,000 and his drawings were ₹ 700 per months. Depreciate Plant & Machinery by 5% and create a reserve for bad doubtful debts @ 5%.

Prepare:

1. Opening Statement of Affairs

2. Closing Statement of Affairs

3. Statement of Profit or Loss for the year ended 31.3.2018.

Solution:

In the books of Suresh

Opening and closing statement of Affairs as on _______________

Statement of Profit or Loss for the year ended 31st March 2018

Class 11 Commerce BK Textbook Solutions Digest

- 11th Bk Chapter 1 Practical Problems

- 11th Bk Chapter 2 Practical Problems

- 11th Bk Chapter 3 Practical Problems

- 11th Bk Chapter 4 Practical Problems

- 11th Bk Chapter 5 Practical Problems

- 11th Bk Chapter 6 Practical Problems

- 11th Bk Chapter 7 Practical Problems

- 11th Bk Chapter 8 Practical Problems

- 11th Bk Chapter 9 Practical Problems

- 11th Bk Chapter 10 Practical Problems