Balbharti Maharashtra State Board Class 9 Marathi Solutions Kumarbharti Chapter 4 नात्यांची घट्ट वीण Notes, Textbook Exercise Important Questions and Answers.

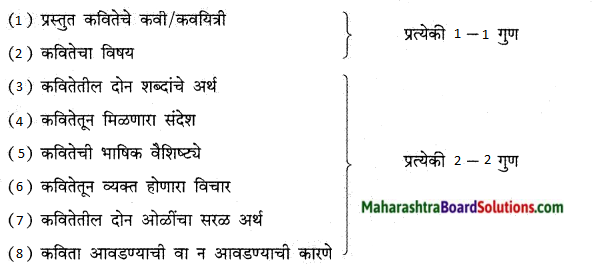

Class 9 Marathi Kumarbharati Chapter 4 नात्यांची घट्ट वीण Question Answer Maharashtra Board

नात्यांची घट्ट वीण Std 9 Marathi Chapter 4 Questions and Answers

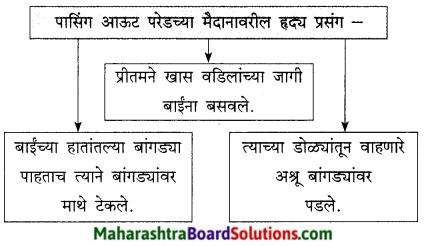

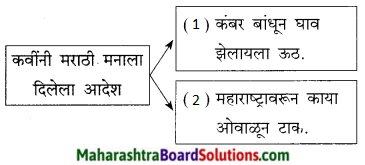

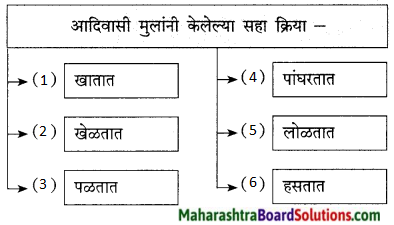

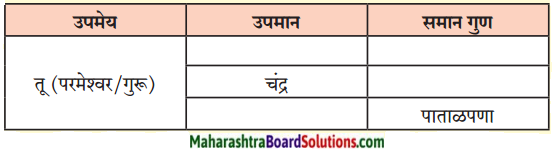

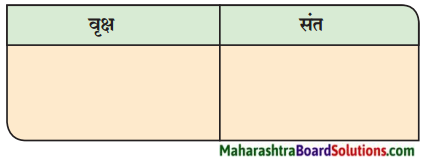

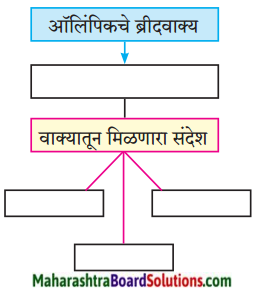

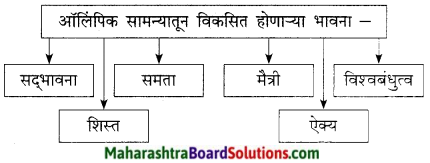

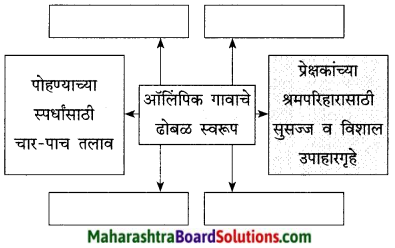

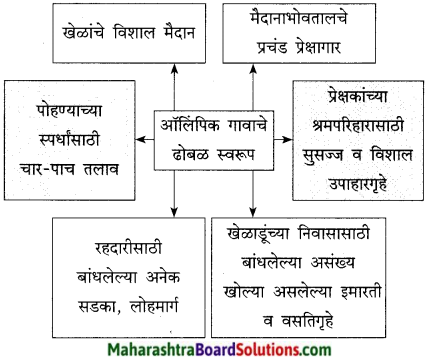

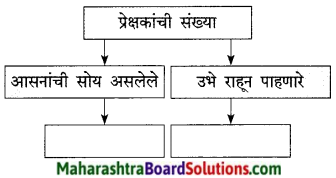

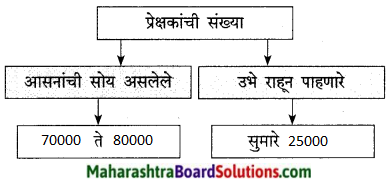

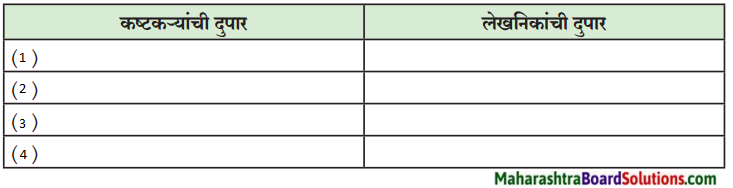

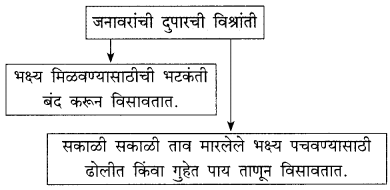

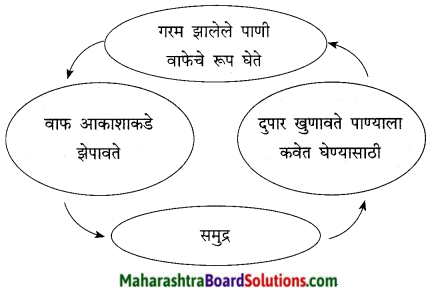

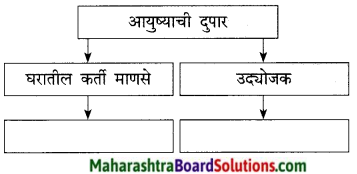

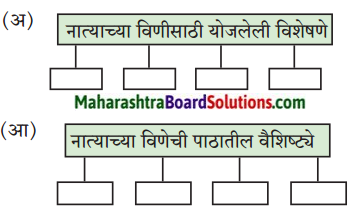

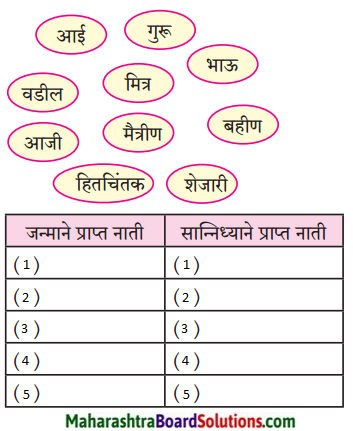

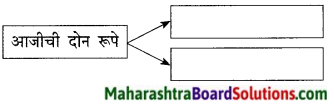

1. आकृती पूर्ण करा:

प्रश्न 1.

आकृती पूर्ण करा:

उत्तर:

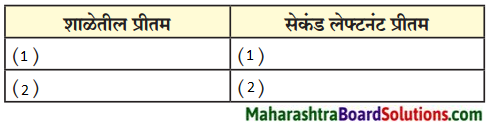

(अ)

(आ)

![]()

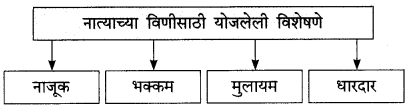

2. ‘नातं’ या अमूर्त संकल्पनेतून व्यक्त होणाऱ्या विविध भावना लिहा.

प्रश्न 1.

‘नातं’ या अमूर्त संकल्पनेतून व्यक्त होणाऱ्या विविध भावना लिहा.

उत्तर:

नाते म्हटले की अमूक एकच व्यक्ती किंवा वस्तू डोळ्यांसमोर येत नाही. आई-बाबांपासून ते इमारती, डोंगरदऱ्यांपर्यंत अनेक गोष्टी डोळ्यांसमोर तरळतात. रात्रभर आपला तान्हुला उपाशी रडत राहील, म्हणून जिवाची पर्वा न करता रायगड किल्ल्याच्या बुरुजावरून उड्या घेत घेत बाळाजवळ धाव घेणारी हिरकणी आठवते.

एखादया परीक्षेत/स्पर्धेत मुलाला अपयश आले, तर घायाळ होणारे एखादे बाबा आठवतात. मी काही चांगले केले की, ताई-दादा ती गोष्ट सर्वांना कौतुकाने सांगतात. नातेवाइकांनाही कौतुक वाटते. कधी कंटाळा आला, तर शेजारी जाऊन बसावेसे वाटते. एखादया दिवशी गाठभेट घडली नाही, तर मित्रमैत्रिणी व्याकूळ होतात. .

आपल्या आवडत्या खेळाडू-कलावंतांना मिळालेल्या यशाने त्यांच्यापेक्षा आपल्यालाच आनंद होतो. आवडते प्राणी, झाडे यांना जवळ घेऊन प्रेमाने कुरवाळावे असे वाटते. आवडती ठिकाणे, इमारती तर मनात घरच करून टाकतात, अशी ही नाती म्हणजे दुधावरची सायच!

3. खालील वाक्यांसाठी समान आशयाच्या ओळी पाठातून शोधून लिहा:

प्रश्न 1.

खालील वाक्यांसाठी समान आशयाच्या ओळी पाठातून शोधून लिहा:

(अ) ‘पारितोषिक आणि शिक्षा’ या तंत्राचा उपयोग आई मुलाला घडवताना करते.

(आ) जीवनाच्या प्रवासात वडिलांचे मार्गदर्शन घेतले जाते.

उत्तर:

(अ) असे घडवताना कधी कुंचल्याच्या हळुवारपणे रंग रेखत, तर कधी छिन्नीचे कठोरपणे घाव घालत तिचे काम चालूच असते.

(आ) मुलाची जगण्याची वाट थोडी कमी खडतर व्हावी म्हणून ‘बाप’ नावाचं वल्हं हातात धरून भवसागर पार करण्याचा प्रयत्नही केला जातो.

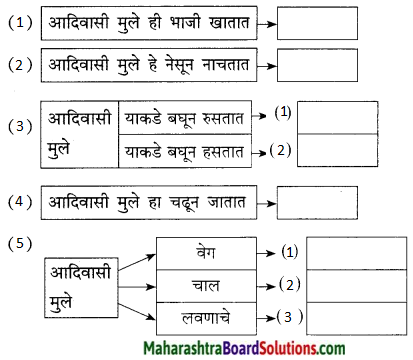

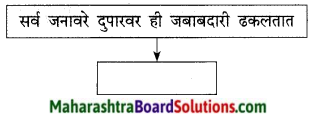

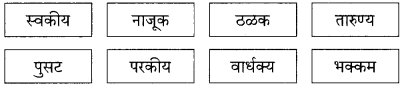

4. वर्गीकरण करा:

प्रश्न 1.

जन्माने प्राप्त नाती व सान्निध्याने प्राप्त नाती.

उत्तर:

| जन्माने प्राप्त नाती | सान्निध्याने प्राप्त नाती |

| 1. आई | 1. गुरू |

| 2. वडील | 2. मित्र |

| 3. बहीण | 3. मैत्रीण |

| 4. भाऊ | 4. शेजारी |

| 5. आजी | 5. हितचिंतक |

![]()

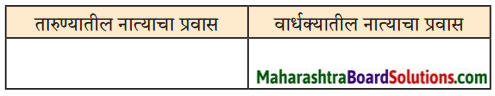

5. खाली दिलेल्या मुद्द्यांच्या आधारे फरक स्पष्ट करा:

प्रश्न 1.

खाली दिलेल्या मुद्द्यांच्या आधारे फरक स्पष्ट करा:

उत्तर:

| तारुण्यातील नात्याचा प्रवास | वार्धक्यातील नात्याचा प्रवास |

| तारुण्यात अहंगंड, मान-अपमान, प्रतिष्ठा वगैरे साऱ्या बाह्य भावनाविकारांनी मन व्यापलेले असते. | विविध भावनाविकारांचे बाह्य आवरण गळून पडते आणि मन निखळ, निकोप बनून जाते. |

6. स्वमत:

प्रश्न (अ)

माणसाच्या जडणघडणीत असलेलं नात्याचं महत्त्व सोदाहरण स्पष्ट करा.

उत्तर:

लहानपणी बाळाला स्वत:चे पालनपोषण करता येणे, संरक्षण करता येणे शक्यच नसते. तेवढी क्षमता त्याच्याकडे नसते. त्या काळात आई-बाबा व आजी-आजोबा त्याला मदत करतात. म्हणजे बालवयात ही नाती खूप महत्त्वाची असतात. तरुण वयात अनेक उपक्रम करावे लागतात, अनेक कार्ये पार पाडावी लागतात.

त्या काळात मित्र, शेजारी व तत्सम नाती उपयोगी पडतात. मार्गदर्शन करण्यासाठी गुरूची गरज असते. वृद्धपणी माणूस कमकुवत बनत जातो. त्या काळात त्याची तरुण मुले त्याची देखभाल करतात. अशा प्रकारे जीवन चालू राहण्यासाठी वेगवेगळ्या टप्प्यांवर वेगवेगळी नाती मदत करतात. नाती नसतील, तर मानवी समाज अस्तित्वात येऊ शकणार नाही.

प्रश्न (आ)

तुमच्या सर्वांत जवळच्या मित्राचे / मैत्रिणीचे नाव काय? मैत्रीचे नाते तुम्ही कसे निभावता ते सविस्तर लिहा.

उत्तर:

मिथिला ही माझी सर्वांत जास्त आवडती मैत्रीण. ती दिवसातून एकदा जरी भेटली नाही, तरी माझा दिवस सुना सुना जातो. मिथिला आणि मी शिशुवर्गापासून एकत्र आहोत. एकाच वर्गात आहोत. एकाच बाकावर बसतो. मधल्या सुट्टीत एकत्र डबा खातो. दररोज शाळेत भेटतो. तरीही शाळेबाहेर कधी भेट झाली की आम्ही गप्पांत रंगून जातो. माझी आई नेहमी मला विचारते, “काय ग, इतका वेळ कशाकशाबद्दल बोलता? विषय संपत नाहीत का?” मग मला खूप हसू येते.

मिथिलेला एखादे गणित सुटले नाही की मीच ते सोडवून देते. मला एखादा निबंध जमला नाही की, मी तिच्याकडे धावते. मिथिलेला चिंच खूप आवडते. मी अधूनमधून आठवणीने तिच्यासाठी चिंच घेऊन जाते. गेल्या वर्षी संपूर्ण फेब्रुवारी महिना ती टायफॉइडने आजारी होती. मी रोज तिच्याकडे जात असे आणि शाळेत शिकवलेले सर्व पाठ तिला वाचून दाखवीत असे. तिचा सगळा अभ्यास मी करून घेतला. त्या काळात वर्गातली खडान्खडा माहिती मी तिला सांगत असे. अशी आमची मैत्री कधी कधीही संपू शकत नाही.

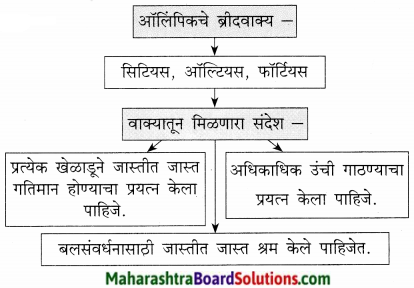

![]()

भाषा सौंदर्य:

पाठातील वाक्यांत परस्पर विरोधी शब्द वापरून केलेली रचना हे लेखिकेच्या लेखनाचे वैशिष्ट्य आहे. ही रचना म्हणजे समृद्ध भाषेचे उत्तम उदाहरण आहे.

उदा.,

1. कधी आई आपल्यासाठी ऊबदार शाल असते, तर कधी कणखर ढाल असते.

2. शेजारधर्माचा एक धागा जुळला तर स्नेहाच्या मर्यादा ओलांडतो आणि धागा तुटला असेल तर वैराच्या मर्यादा ओलांडतो.

3. आपल्या हातून काही निसटत चालल्याची ही हुरहूर असली तरी त्याच शेवटामध्ये एक सुरुवातही असते आपल्याला पुढे नेणारी.

अशा उदाहरणांतून तुम्ही तुमचे लेखन कौशल्य वाढवू शकता, भाषा समृद्ध करू शकता. त्यांतून तुमचे भाषिक कौशल्य विकसित होणार आहे. याप्रमाणे इतर वाक्यांचा शोध घ्या. या प्रकारची वाक्ये स्वत: तयार करा.

Marathi Kumarbharati Textbook Std 9 Answers Chapter 4 नात्यांची घट्ट वीण Additional Important Questions and Answers

उतारा क्र. 1

1. पुढील उतारा वाचून दिलेल्या सूचनांनुसार कृती करा:

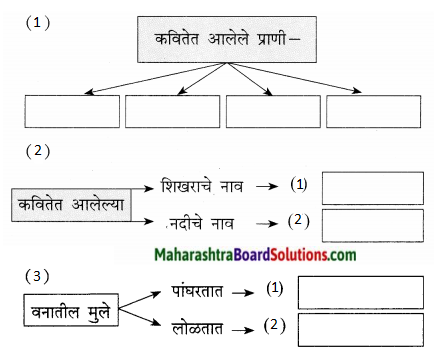

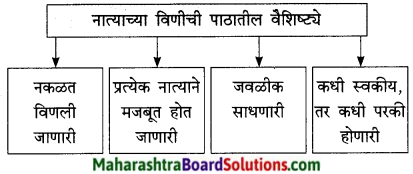

कृती 2 : (आकलन)

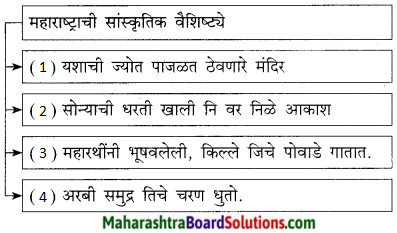

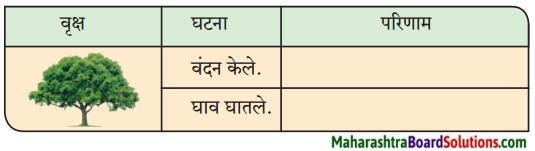

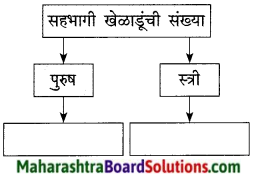

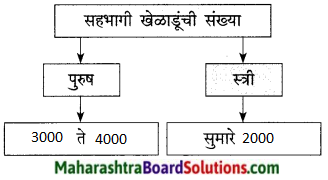

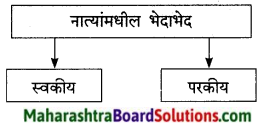

1. वर्गीकरण करा:

प्रश्न 1.

आकृती पूर्ण करा:

उत्तर:

कृती 3: (स्वमत/अभिव्यक्ती)

प्रश्न 1.

नात्यांची तुम्हांला जाणवलेली वैशिष्ट्ये लिहा.

उत्तर:

आपला जन्म होतो, त्याच क्षणी आपल्याला काही नाती मिळतात. आई-वडील, मुलगा-मुलगी, बहीण-भाऊ, नात-नातू, आजी-आजोबा ही नाती आपल्याला जन्माने मिळतात. ही नाती मिळवण्यासाठी आपल्याला कोणतेही प्रयत्न करावे लागत नाहीत. ही नाती आपोआप मिळतात. सुरुवातीच्या काळात तर हीच नाती, म्हणजे या नात्यांनी बांधलेली माणसे ही आपली, स्वकीय व अगदी जवळची असतात. शेजारी किंवा मित्र-मैत्रिणी ही नाती सहवासातून निर्माण होतात. हळूहळू विविध प्रसंगांतून किंवा एकमेकांशी होणाऱ्या वागण्यातून ही माणसे जवळची होतात किंवा दूरची होतात. वेगवेगळ्या व्यक्तींच्या स्वभावामुळे, त्यांच्या वागण्यामुळे त्यांचा सहवास सुखद बनतो, हवाहवासा वाटतो. त्यामुळे त्यांच्याशी असलेले नाते मृदुमुलायम बनते. नात्यांना असे विविध रंग असतात, विविध आकार असतात.

![]()

उतारा क्र. 2

पुढील उतारा वाचून दिलेल्या सूचनांनुसार कृती करा:

कृती 1 : (आकलन)

प्रश्न 1.

रिकाम्या चौकटी भरा:

1. [ ]

2. [ ]

3. [ ]

उत्तर:

1. [उबदार शाल]

2. [कणखर ढाल]

3. [सुंदर चाल]

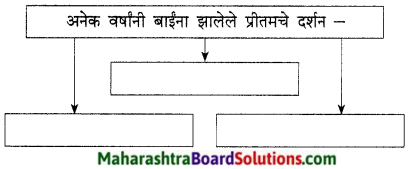

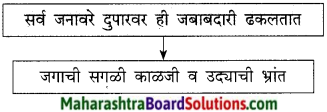

कृती 2 : (आकलन)

प्रश्न 1.

उत्तर:

प्रश्न 2.

कोष्टक पूर्ण करा:

| पाठ्यपुस्तकातील शब्द | अर्थ |

| 1. बघता बघता पंख पसरून उडायला सुरुवात करतं. | |

| 2. त्याची झेप सातासमुद्रापलीकडे जायला लागते. |

उत्तर:

| पाठ्यपुस्तकातील शब्द | अर्थ |

| 1. बघता बघता पंख पसरून उडायला सुरुवात करतं. | मूल मोठं होता होता स्वतंत्र बनतं. |

| 2. त्याची झेप सातासमुद्रापलीकडे जायला लागते. | मोठ्या कालावधीसाठी ताटातूट होते. |

![]()

कृती 3: (स्वमत/अभिव्यक्ती)

प्रश्न 1.

‘आईवडील व मुले यांच्यातील नाते परस्परविरोधी भावनांनी भरलेले असते.’ हे विधान स्पष्ट करा.

उत्तर:

आईचे मुलावर अपार प्रेम असते. ती त्याला हळुवारपणे आंजारते, गोंजारते. पण प्रसंगी अत्यंत कठोरपणेही वागते. मुलाचा मार्ग सुकर व्हावा, म्हणून आईवडील जणू काही वल्हे बनतात. मुलाला मार्ग तयार करून देतात. येथे मुलगा अजून कमकुवत आहे व वडील अत्यंत सक्षम आहेत, असे चित्र दिसते. पण त्याच वेळी त्या दोघांमध्ये संवाद नामक सेतू बांधला जातो, म्हणजे त्यांच्यात मैत्रीचे, बरोबरीचे नाते निर्माण होते. आई-वडील मुलाला अत्यंत मायेने, आत्मीयतेने वाढवतात. पण थोड्याच अवधीत मुलगा पंख पसरून स्वतंत्रपणे उड्डाण करू लागतो. म्हणजे तो हळूहळू दूर जाऊ लागतो आणि तो सातासमुद्रापलीकडे जातो, तेव्हा तर फार मोठ्या काळासाठी ताटातूट होते. मुलाला वाढवताना आईवडील आनंदी असतात. पण काही काळातच तो दूर गेल्यामुळे दुःखी होतात. अशा प्रकारे आईवडील व मुले यांच्यातील नाते परस्परविरोधी भावनांनी भरलेले असते.

प्रश्न 2.

‘असे घडवताना कधी कुंचल्याच्या हळुवारपणे रंग रेखत, तर कधी छिन्नीचे कठोरपणे घाव घालत तिचे काम चालूच असते.’ या विधानाचा अर्थ स्पष्ट करून सांगा.

उत्तर:

प्रत्येक आईला आपले बाळ सद्गुणी, कर्तबगार व्हावे, असे वाटत असते. म्हणून ती त्याच्यावर सतत चांगल्या गुणांचा संस्कार करीत राहते. मूर्तिकार, शिल्पकार जशी सुंदर मूर्ती घडवण्याचा प्रयत्न करतात, तशी आई बाळाला सुंदर माणूस घडवण्याचा प्रयत्न करते. शिल्पकार ओबडधोबड दगडावर छिन्नीचे घाव घालतो. अशा वेळी त्या दगडाला किती वेदना होत असतील! आपल्याच देहाचे अनेक तुकडे आपल्यापासून विलग होऊन पडतात, हे पाहताना त्याला दुःख होतच असणार; पण तो हे सगळे सहन करतो. आईचे आपल्या बाळावर अतोनात प्रेम असते, पण प्रसंगी ती कठोरपणे शिक्षा देते. शिक्षा देताना तिला दुःख होतेच, तसे त्या बाळालाही दुःख होते. दोघेही ते दु:ख गिळतात, सहन करतात. त्यामुळे त्या बाळाच्या व्यक्तिमत्त्वाला चांगला आकार मिळतो. तो सद्गुणी माणूस बनतो. हे सर्व लेखिकांना त्या विधानातून व्यक्त करायचे आहे.

उतारा क्र. 3

पुढील उतारा वाचून दिलेल्या सूचनांनुसार कृती करा:

कृती 1 : (आकलन)

प्रश्न 1.

जन्माबरोबर निर्माण होणाऱ्या नात्यांखेरीज दोन नवीन नात्यांची नावे लिहा.

1. ………………

2. ………………

उत्तर:

1. मैत्री

2. शेजारधर्म.

प्रश्न 2.

पुढील वाक्याचा एका वाक्यात सुबोध अर्थ लिहा:

ते नातं ‘अनादि अनंताचं, नव्या अभिनव सृजनाचं’ होतं.

उत्तर:

हजारो वर्षांपासून माणसामाणसांत चालत आलेल्या मैत्रीच्या नात्याची नवनवीन रूपे निर्माण होतात.

![]()

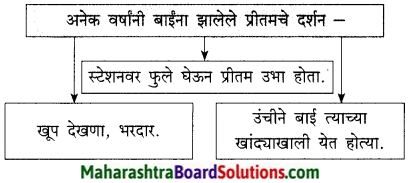

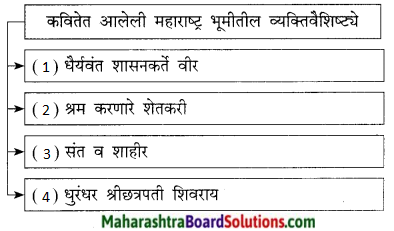

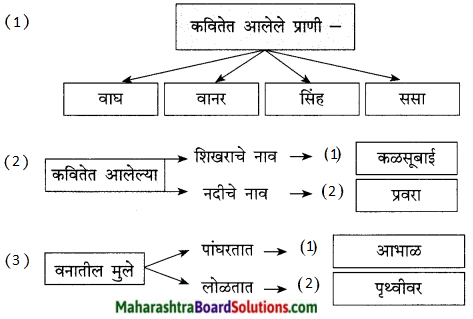

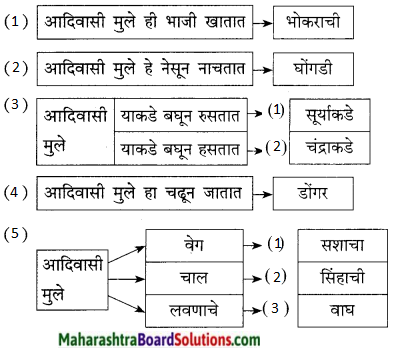

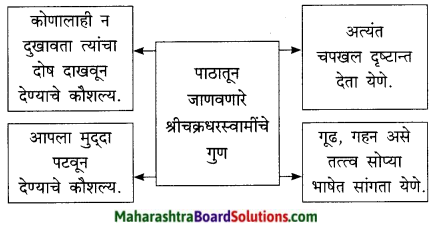

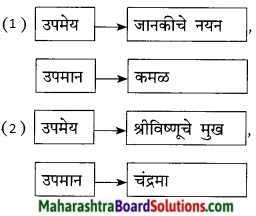

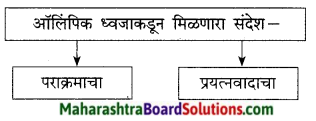

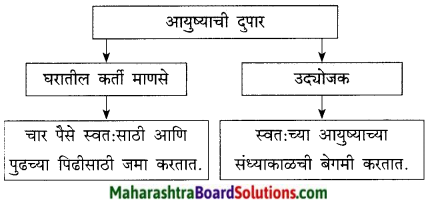

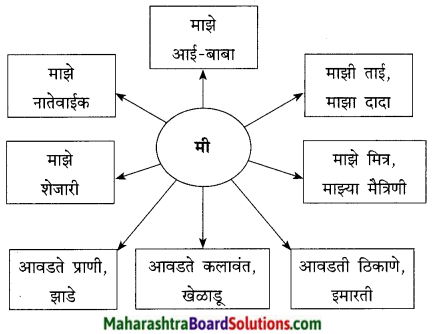

कृती 2 : (आकलन)

प्रश्न 1.

आकृती पूर्ण करा :

उत्तर:

प्रश्न 2.

सहसंबंध लक्षात घेऊन उत्तर लिहा :

शिष्य : गुरुदक्षिणा : : गुरू : [ ]

उत्तर:

शिष्य : गुरुदक्षिणा : : गुरू : कानमंत्र

प्रश्न 3.

विधान पूर्ण करा :

कानमंत्र म्हणजे ………………

उत्तर:

कानमंत्र म्हणजे आणीबाणीच्या परिस्थितीवर मात करण्यासाठी गुरूने शिष्याच्या कानात सांगितलेला मंत्र.

कृती 3 : (स्वमत/अभिव्यक्ती)

प्रश्न 2.

‘मित्र दिसला तरी मैत्रीचं नातं दिसत नाही.’ या विधानाबाबत तुमचे मत स्पष्ट करा.

उत्तर:

आई-वडील, बहीण-भाऊ ही नाती जन्मत:च मिळतात. ती स्वीकारावी लागतात. त्यांत निवड करता येत नाही. काही नाती सान्निध्याने निर्माण होतात. ती लादलेली नसतात. मैत्री हे एक असे सान्निध्याने, सहवासाने निर्माण होणारे नाते आहे. मैत्रीचे नाते अत्यंत तरल व सूक्ष्म असते. दोन व्यक्तींमध्ये मैत्रीचे नाते का निर्माण होते, याची कारणे, स्पष्टीकरणे देता येत नाहीत. काही कारणे देता येतात, हे खरे. पण सर्व कारणे किंवा पूर्ण स्पष्टीकरण कधीच देता येत नाही. मित्राशिवाय किंवा मैत्रिणीशिवाय जीवन निरस बनते. मित्राचे असणे जाणवते, पण दाखवता येत नाही. मित्र दिसतो. दाखवता येतो. त्याच्याकडे बोट करता येते. पण मैत्री या भावनेचे स्वरूप सांगता येणे अशक्य असते. ते दिसत नसले, तरी आहे हे मान्य करावे लागते.

![]()

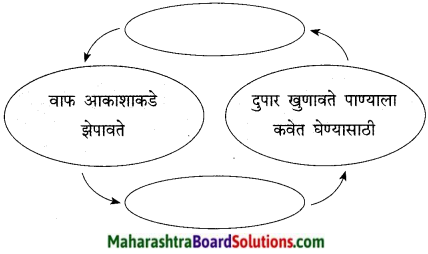

उतारा क्र. 4

1. पुढील उतारा वाचून दिलेल्या सूचनांनुसार कृती करा:

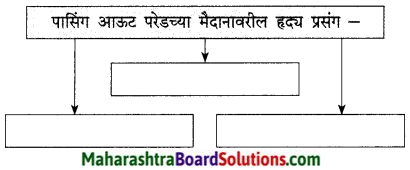

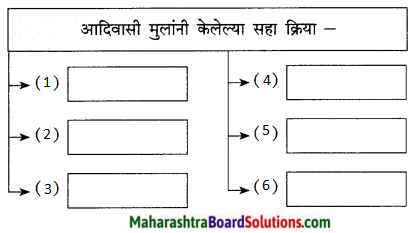

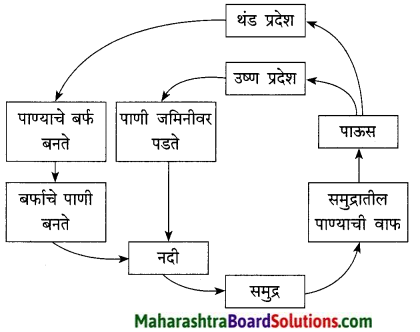

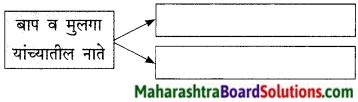

कृती 1 : (आकलन)

प्रश्न 1.

आकृतिबंध पूर्ण करा:

उत्तर:

प्रश्न 2.

कोष्टक पूर्ण करा:

| निर्माण होणारी मन:स्थिती | आजीचे रूप |

| (य) आनंदी | |

| (र) | वृद्धाश्रमात राहणारी |

उत्तर:

| निर्माण होणारी मनःस्थिती | आजीचे रूप |

| (य) आनंदी | झोपताना रोज नवी गोष्ट सांगणारी |

| (र) दुःखी | वृद्धाश्रमात राहणारी |

कृती 2 : (आकलन)

प्रश्न 1.

विधाने पूर्ण करा:

- पिकले पान गळणे म्हणजे …………………….

- (या पाठात ) उंबरठा ओलांडणे याचा अर्थ …………………

- नवी पालवी फुटणे म्हणजे …………………..

उत्तर:

- पिकले पान गळणे म्हणजे मृत्यू येणे.

- उंबरठा ओलांडणे याचा अर्थ मृत्यू पावणे हा आहे.

- नवी पालवी फुटणे म्हणजे नवीन जीव जन्माला येणे.

![]()

प्रश्न 2.

उताऱ्यात सांगितलेला निसर्गाचा नियम लिहा.

उत्तर:

पिकलेले पान गळून पडल्यावर नवीन पालवी फुटतेच; म्हणजे काही माणसे मरण पावत असली, तरी नवीन जीव जन्माला येतात, हा निसर्गाचा नियम आहे.

प्रश्न 3.

लेखिकांनी अभिप्रेत अभिन्न नाते स्पष्ट करा.

उत्तर:

जन्मापासून सुरू झालेल्या प्रवासात आपले वेगवेगळ्या व्यक्तींशी नाते निर्माण होते. पण वृद्धत्वात गेल्यावर, आपण या संपूर्ण निसर्गचक्राचे भाग आहोत, ही जाणीव होते. आपण वेगळे, सुटे नाही. संपूर्ण निसर्गाला घट्ट चिकटलेलाच भाग आहोत. यालाच लेखिकांनी अभिन्न नाते म्हटले आहे.

कृती 3 : (स्वमत/अभिव्यक्ती)

प्रश्न 1.

‘मागे वळून पाहिल्यानंतर आजपर्यंतचा प्रवास एका वेगळ्या स्वरूपात समोर येतो.’ या विधानाचा भावार्थ समजावून सांगा.

उत्तर:

बालपण, तारुण्य, प्रौढपण असे टप्पे पार करीत करीत माणूस वार्धक्याच्या टप्प्यात प्रवेश करतो. या अखेरच्या टप्प्यात आल्यावर आपल्या पूर्वीच्या आयुष्याकडे तो वळून पाहतो, त्या वेळी त्याची दृष्टीच पार बदललेली असते. आधीच्या टप्प्यांमध्ये माणूस अहंगंड, मान-अपमान, प्रतिष्ठा या भावभावनांमध्ये पूर्ण बुडालेला असतो. त्याचे मान-अपमान तीव्र असतात. अनेकदा स्वत:चे मानअपमान जपता जपता तो इतरांचा अपमान करतो, त्याला वेदना देतो. ते सर्व वार्धक्याच्या टप्प्यात आठवते. आपल्या चुका कळतात, साहजिकच, तो या भावविकारांना बाजूला सारतो. त्याचे मन निर्मळ बनते, सगळ्या माणसांकडे, सगळ्या जगाकडे तो निर्मळपणाने पाहू लागतो. जग आता त्याला नव्या रूपात दिसू लागते. नवा आनंददायी प्रवास सुरू होतो.

भाषाभ्यास:

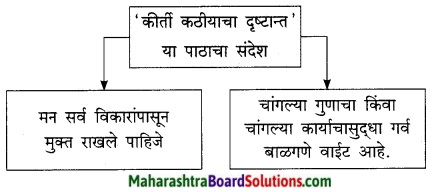

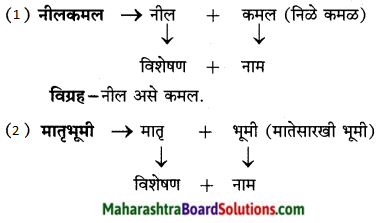

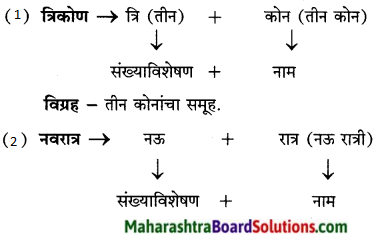

1. समास:

प्रश्न 1.

पुढील विग्रहावरून सामासिक शब्द तयार करा :

उत्तर:

- भूमी हीच माता → मातृभूमी

- तीन कोनांचा समूह → त्रिकोण

- आई आणि वडील → आईवडील

- सुख किंवा दुःख → सुखदुःख

![]()

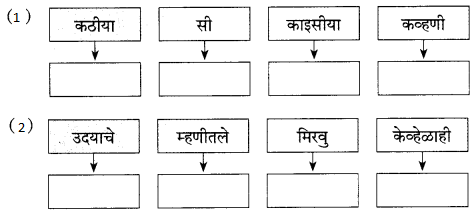

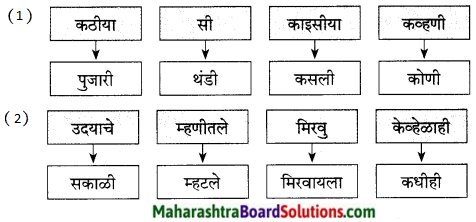

2. शब्दसिद्धी:

प्रश्न 1.

पुढील शब्द उपसर्गघटित की प्रत्ययघटित ते ओळखा:

- कौटुंबिक-प्रत्ययघटित

- जबाबदारी-प्रत्ययघटित

- अपमान-उपसर्गघटित

- अपूर्ण-उपसर्गघटित.

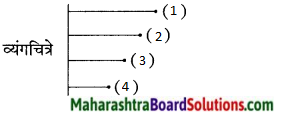

3. वाक्प्रचार:

प्रश्न 1.

पुढील वाक्प्रचारांचा अर्थ सांगून वाक्यांत उपयोग करा:

1. मात करणे

2. पाठीशी उभे राहणे.

उत्तर:

1. मात करणे – अर्थ: विजयी होणे.

वाक्य: भारतीय क्रिकेट संघाने विश्वचषक स्पर्धेत ऑस्ट्रेलिया क्रिकेट संघावर मात केली.

2. पाठीशी उभे राहणे – अर्थ : आधार होणे.

वाक्य : कोणत्याही कामामध्ये गावचे सरपंच गावकऱ्यांच्या पाठीशी उभे राहतात.

आ (भाषिक घटकांवर आधारित कृती):

1. शब्दसंपत्ती:

प्रश्न 1.

पुढील शब्दांत लपलेले चार अर्थपूर्ण शब्द लिहा:

1. भवसागरात

2. कणखर.

उत्तर:

1. (1) साव (2) साग (3) सात (4) रात.

2. (1) कण (2) कर (3) खण (4) रण.

![]()

प्रश्न 2.

वचन बदला:

- मंत्र

- बहिणी

- मुलगी

- स्त्रिया.

उत्तर:

- मंत्र – मंत्र

- बहिणी – बहीण

- मुलगी – मुली

- स्त्रिया – स्त्री.

प्रश्न 3.

विरुद्धार्थी शब्दांच्या जोड्या लावा:

उत्तर:

- स्वकीय × परकीय

- नाजूक × भक्कम

- ठळक × पुसट

- तारुण्य × वार्धक्य

2. लेखननियम:

प्रश्न 1.

अचूक शब्द ओळखा:

- निर्वीवाद, निर्विवाद, नीवीर्वाद, नीर्विवाद.

- हितचीतक, हीतचीतक, हीतचिंतक, हितचिंतक.

- मार्गदर्शक, मागदर्शक, मार्गदशक, मार्गद्रशक.

- गुरुदक्षिणा, गुरूदक्षिणा, गुरुदक्षिणा, गुरुदक्षीणा.

उत्तर:

- निर्विवाद

- हितचिंतक

- मार्गदर्शक

- गुरुदक्षिणा.

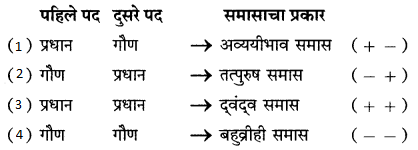

![]()

3. विरामचिन्हे:

प्रश्न 1.

चिन्हे लिहा:

उत्तर:

1. उद्गारचिन्ह → [!]

2. प्रश्नचिन्ह → [?]

नात्यांची घट्ट वीण Summary in Marathi

प्रस्तावना:

मीरा शिंदे या नव्या पिढीच्या लेखिका असून, अनेक नियतकालिकांमध्ये त्यांच्या कथा व कविता प्रसिद्ध झाल्या आहेत. त्यांचे लेखन प्रसन्न व प्रभावी असते. प्रस्तुत लेखामध्ये लेखिकांनी माणसामाणसांमधील नात्यांचे वर्णन केले आहे. जीवन जगत असताना या सर्व नात्यांचा माणसाला आधार मिळत असतो. माणूस हा सामाजिक प्राणी आहे. तो इतर माणसांच्या सोबत व त्यांच्या आधारानेच जगत असतो. साहजिकच, या माणसांशी त्याचे काही संबंध निर्माण होतात. हे संबंध म्हणजेच नाते होय. या नात्यांमधील काही नाती ही जन्मामुळे प्राप्त होतात, तर काही नाती सहवास वा वातावरण यांमुळे निर्माण होतात. प्रस्तुत लेखात लेखिकांनी या नात्यांचे स्वरूप अत्यंत प्रभावीपणे उलगडून दाखवले आहे.

शब्दार्थ:

- वीण – कापड तयार करण्यासाठी केलेली उभ्या व आडव्या धाग्यांची रचना.

- जवळीक – आपुलकी.

- भवसागर – (भव आपल्याला दिसणारे, जाणवणारे आपल्या अवतीभवतीचे विश्व) भवरूपी सागर.

- उलघाल – उलथापालथ, धांदल, गोंधळ, कालवाकालव, तगमग, तळमळ.

- सृजन – निर्मिती.

- कानमंत्र – गुप्त सल्ला, गुप्त मंत्र.

![]()

वाक्प्रचार व त्यांचे अर्थ:

- जवळीक साधणे – सलगी प्राप्त करणे, मैत्री मिळवणे.

- तारेवरची कसरत करणे –

- कोणताही निर्णय घेताना प्रचंड गोंधळ होणे.

- घेतलेल्या निर्णयाला धरून राहताना प्रचंड तारांबळ उडणे.

- जिवाची उलघाल होणे – मनाची तगमग, तळमळ होणे ; मनात कालवाकालव होणे; जीव घाबराघुबरा होणे.

- कानमंत्र देणे –

- अत्यंत मोक्याच्या क्षणी कसे वागायचे याबाबत सल्ला देणे.

- गुप्त सल्ला देणे.

- कात टाकणे – जुन्या गोष्टींचा त्याग करून पूर्णपणे नवीन स्वरूप धारण करणे.

- उंबरठा ओलांडणे –

- मर्यादा ओलांडणे

- मर्यादित कक्षेतून अधिक व्यापक कक्षेत प्रवेश करणे.

- (या पाठानुसार अर्थ) मृत्यू पावणे.

- पिकलं पान गळणं –

- मृत्यू पावणे.

- शेवट होणे.

- नवी पालवी फुटणे –

- नवे स्वरूप मिळणे.

- नवा जन्म मिळणे.

टिपा:

1. नाळ: बाळ आईच्या पोटात वाढते. त्या वेळी बाळाच्या बेंबीतून एक नलिका येते. ती नलिका आई व बाळ यांना जोडते. या नलिकेला नाळ म्हणतात. या नाळेतून आईकडून बाळाला सर्व जीवनरस मिळतो आणि त्याचे पोषण होते.

2. कानमंत्र : मुलगा साधारणपणे आठ वर्षांचा झाला की, त्याला गुरूकडे शिक्षणासाठी पाठवले जाई. शिक्षणासाठी त्याला गुरूकडेच राहावे लागे. त्याची एक अवस्था संपून दुसरी अवस्था सुरू होई. गुरुगृही जाण्यापूर्वी त्या मुलाची मुंज केली जाई. या मुंजीत एक महत्त्वाचा विधी असे. पुढील आयुष्यात उपयोगी पडेल अशी महत्त्वाची गोष्ट वा महत्त्वाचा सल्ला मुलाच्या कानात वडील सांगत असत.

यालाच कानमंत्र असे म्हणतात. हा कानमंत्र मुलाच्या कानातच आणि इतर कोणालाही ऐकू जाणार नाही, अशा रितीने सांगितला जाई. यावरून गुपचूप दिलेल्या सल्ल्याला कानमंत्र म्हटले जाऊ लागले. ‘मननात त्रायते इति मन्त्रः।’ ही मंत्राची व्याख्या आहे. ज्याचे सतत मनन केल्याने आपले रक्षण होते, त्याला ‘मंत्र’ म्हणतात.

9th Std Marathi Questions And Answers:

- वंद्य ‘वन्दे मातरम्’ (गीत) Class 9 Question Answer

- संतवाणी (अ) जैसा वृक्ष नेणे- संत नामदेव Class 9 Question Answer

- संतवाणी (आ) धरिला पंढरीचा चोर-संत जनाबाई Class 9 Question Answer

- कीर्ती कठीयाचा दृष्टान्त Class 9 Question Answer

- नात्यांची घट्ट वीण Class 9 Question Answer

- एक होती समई Class 9 Question Answer

- हास्यचित्रांतली मुलं (स्थूलवाचन) Class 9 Question Answer