Balbharti Maharashtra State Board 12th Commerce Book Keeping & Accountancy Important Questions Chapter 7 Bills of Exchange Important Questions and Answers.

Maharashtra State Board 12th Commerce BK Important Questions Chapter 7 Bills of Exchange

Objective Questions

A. Select the correct option and rewrite the sentence:

Question 1.

A bill of exchange is called a _____________ by one who is entitled to receive the amount due on it.

(a) Bills Payable

(b) Draft

(c) Bills Receivable

(d) Promissory Note

Answer:

(c) Bills Receivable

Question 2.

The person who draws a bill of exchange is called _____________

(a) Payee

(b) Drawee

(c) Endorsee

(d) Drawer

Answer:

(d) Drawer

![]()

Question 3.

A bill of exchange is required to be _____________ by drawee.

(a) drafted

(b) discounted

(c) accepted

(d) endorsed

Answer:

(c) accepted

Question 4.

A person who accepts the bill is called _____________

(a) Drawer

(b) Acceptor

(c) Payee

(d) Creditor

Answer:

(b) Acceptor

Question 5.

The person to whom the amount of the bill is made payable is called _____________

OR

_____________ is a person to whom the amount on a bill is payable.

(a) Endorsee

(b) Drawer

(c) Drawee

(d) Payee

Answer:

(d) Payee

Question 6.

When the acceptor accepts the bill with certain conditions, the acceptance is called _____________ Acceptance.

(a) Qualified

(b) General

(c) Clean

(d) Special

Answer:

(a) Qualified

Question 7.

The drawee becomes an _____________ on acceptance of a bill.

(a) acceptor

(b) owner

(c) endorser

(d) drawer

Answer:

(a) acceptor

![]()

Question 8.

Borrowing money from a bank on the security of a bill of exchange is called _____________

(a) Honouring

(b) Endorsing

(c) Discounting

(d) Retiring

Answer:

(c) Discounting

Question 9.

A bill of exchange is/can be discounted with the _____________

(a) bank

(b) payee

(c) money lenders

(d) government

Answer:

(a) bank

Question 10.

Transferring a bill of exchange before maturity to a third party is called _____________ of a bill of exchange.

(a) honouring

(b) endorsement

(c) retirement

(d) discounting

Answer:

(b) endorsement

Question 11.

The person who endorses the bill of exchange is known as _____________

(a) Drawer

(b) Endorsee

(c) Endorser

(d) Drawee

Answer:

(c) Endorser

Question 12.

A person to whom a bill of exchange is endorsed is called _____________

(a) Endorsee

(b) Drawer

(c) Endorser

(d) Payee

Answer:

(a) Endorsee

![]()

Question 13.

If a bill falls due on 15th August, payment on it must be made on _____________

(a) 14th August

(b) 16th August

(c) 13th August

(d) 17th August

Answer:

(a) 14th August

Question 14.

A bill drawn on 12th June, 2020 at two months would be payable on _____________

(a) 12th August 2020

(b) 14th August 2020

(c) 15th August 2020

(d) 16th August 2020

Answer:

(b) 14th August 2020

Question 15.

If a bill is drawn on 3rd July, 2020 for 40 days, its payment must be made on _____________

(a) 14th August 2020

(b) 15th August 2020

(c) 13th August 2020

(d) 16th August 2020

Answer:

(a) 14th August 2020

Question 16.

A bill is drawn on 23rd September, 2019 at 4 months would be payable on _____________

(a) 24th January 2020

(b) 25th January 2020

(c) 26th January 2020

(d) 25th January 2019

Answer:

(b) 25th January 2020

Question 17.

A bill is drawn on 23rd October 2016 payable after 3 months, the due date of the bill will be _____________

(a) 25th January 2017

(b) 26th January 2017

(c) 24th January 2017

(d) 25th January 2016

Answer:

(a) 25th January 2017

![]()

Question 18.

_____________ means payment of the bill before due date.

(a) Discounting of Bill

(b) Retirement of Bill

(c) Renewal of Bill

(d) Endorsement of Bill

Answer:

(b) Retirement of Bill

Question 19.

A bill of one month duration is accepted on 12th July, 2020, its due date will be _____________

(a) 12th August 2020

(b) 16th August 2020

(c) 14th August 2020

(d) 15th August 2020

Answer:

(c) 14th August 2020

Question 20.

When a bill Is dishonoured, the _____________ is held responsible for the noting charges.

(a) holder

(b) drawee

(c) drawer

(d) endorser

Answer:

(b) drawee

Question 21.

Fees charged by the Notary Public for noting facts or reasons of dishonour of bill are called _____________

(a) Discount

(b) Rebate

(c) Noting Charges

(d) Commission

Answer:

(c) Noting Charges

![]()

Question 22.

Noting charges are paid when a bill is _____________

(a) honoured

(b) dishonoured

(c) renewed

(d) retired

Answer:

(b) dishonoured

Question 23.

_____________ is done in respect of dishonour of foreign bill of exchange.

(a) Discounting

(b) Endorsement

(c) Noting

(d) Protesting

Answer:

(d) Protesting

B. Give one word/phrase/term which can substitute each of the following statements:

Question 1.

A bill of exchange is drawn and accepted for a value received.

Answer:

Trade bill

Question 2.

A person who draws a bill of exchange.

Answer:

Drawer

Question 3.

A person on whom a bill of exchange is drawn.

Answer:

Drawee

![]()

Question 4.

Payment in accordance with the apparent tenor of the bill.

Answer:

Honour

Question 5.

Non-payment in accordance with the apparent tenor of the bill.

Answer:

Dishonour

Question 6.

Acceptance without making any change in the terms of a bill.

Answer:

General acceptance

Question 7.

Acceptance with some changes as regards the terms of a bill.

Answer:

Qualified acceptance

Question 8.

A bill of which payment is to be made after the fixed period.

Answer:

After date bill

Question 9.

The bill is drawn in one country and payable in other countries.

Answer:

Foreign bill

![]()

Question 10.

Encashment of the bill before the due date.

Answer:

Discounting

Question 11.

Transfer of title of the bill from the debtor to the creditor.

Answer:

Endorsement

Question 12.

Payment of the bill before the due date.

Answer:

Retirement of bill

Question 13.

A document consists of a written order signed by the maker, directing a certain person to pay a certain sum of money on-demand or on a certain future date.

Answer:

Bill of Exchange

Question 14.

A person who accepts the bill.

Answer:

Drawee or Acceptor

Question 15.

The period for which a bill is drawn.

Answer:

Term/Tenure of a bill of exchange

Question 16.

A bill of exchange that does not contain the period for its payment.

Answer:

Demand bill/Bill at sight

![]()

Question 17.

The date on which period of the bill gets expired.

Answer:

Nominal due date

Question 18.

The date on which the payment of the bill is to be made.

Answer:

Due date or Date of maturity

Question 19.

Drawee’s signature on the face of the bill to show his consent to pay the amount of the bill.

Answer:

Acceptance of a bill of exchange

Question 20.

A bill of exchange before its acceptance.

Answer:

Draft

Question 21.

A bill is drawn, accepted, and made payable within the territory of one and the same country.

Answer:

Inland bill of exchange

Question 22.

Selling a bill to the bank before its due date for an amount slightly less than its face value.

Answer:

Discounting of a bill of exchange

Question 23.

Act of signing the bill on its back by its holder to transfer its title to a third Person.

Answer:

Endorsement of a bill of exchange

Question 24.

Discount is given by holder to acceptor on the retirement of the bill of exchange.

Answer:

Rebate

Question 25.

Non-payment of the bill on the due date.

Answer:

Dishonour of a bill of exchange

![]()

Question 26.

Recording the facts of dishonour of a bill of exchange by a Notary Public.

Answer:

Noting

Question 27.

The request by the acceptor of the bill to the drawer for issuing a new bill after canceling the old bill.

Answer:

Renewal of the bill of exchange

Question 28.

The account to which the bill is sent for collection is debited.

Answer:

Bill sent for Collection Account

Question 29.

Payment of a bill on the due date.

Answer:

Honouring of a bill of exchange

Question 30.

Drafting a new bill in cancellation of the old bill at the request of drawee.

Answer:

Renewal of the bill of exchange

Question 31.

Certificate is given by Notary Public for the fact of dishonour of the bill.

Answer:

Certificate of protest

Question 32.

The account is to be debited in case of dishonour of bill in the books of the drawer.

Answer:

Drawee’s Account

![]()

Question 33.

A foreign bill accompanied by shipping documents.

Answer:

Documentary bill

C. State True or False with reasons:

Question 1.

Bills payable are a liability.

Answer:

This statement is True.

Bill is always drawn on the debtor by the creditor. The debtor i.e. drawee has to pay the money on a future date. For the drawee or acceptor of the bill, payment of the number of Bills payable is certain and therefore, for drawee, Bills payable is a liability.

Question 2.

Drawee has no right to discount the bill with the bank.

Answer:

This statement is True.

Drawee means acceptor of a bill and for him, it is bills payable. Once he accept it, sign it, and returned it to the drawer he don’t have any bill with him to discount it with the bank. He is not the owner of the bill and hence, he has no right to discount the bill with the bank.

Question 3.

A bill of exchange needs acceptance.

Answer:

This statement is True.

A bill of exchange is drawn by the creditor on the debtor. It is signed by drawer as well as by drawee. The drawee has to give his assent to the terms and conditions of the bill by putting his signature on it. A bill without acceptance is called a draft. It becomes a valid document only when the drawee accepts it.

Question 4.

A bill can’t be deposited into the bank for collection.

Answer:

This statement is False.

When a drawer or holder of the bill needs money on the due date, he has to deposit the bill into the bank for collection purposes. So that bank can collect the amount in time. This means a bill can be deposited into the bank for collection.

![]()

Question 5.

Noting charges are payable to the Notary Public in honour of a bill.

Answer:

This statement is False.

Noting charges are payable to the Notary Public at the time of registration of a dishonoured bill, not at the time of honour of a bill.

Question 6.

A bill of exchange is a negotiable instrument.

Answer:

This statement is True.

Being a negotiable instrument, a bill of exchange is a written acknowledgment of debts and also a promise to pay the debt according to the terms of the bill and can be transferred from one person to another.

Question 7.

A bill of exchange is signed by the person on whom it is drawn.

Answer:

This statement is True.

A bill of exchange is signed by the person who draws or makes it, and the person on whom it is drawn accepts it.

Question 8.

Acceptance with some change as regards the terms of a bill is called general acceptance.

Answer:

This statement is False.

General acceptance means acceptance of a draft without any change or conditions regards the terms of a bill.

Question 9.

Drawee is a person who holds the title of the bill in due course.

Answer:

This statement is False.

A drawer is a person who holds the title of the bill in due course as drawee accepts it and returns it to the drawer.

![]()

Question 10.

A payee is an official person appointed by the Central government for noting of dishonour of the bill.

Answer:

This statement is False.

A notary public is an official person appointed by the Central government for noting of dishonour of the bill and making it legal.

D. Complete the sentences:

Question 1.

A person to whom or as per his order, amount of bill is payable is a _____________

Answer:

Payee

Question 2.

The inland bill is drawn and payable in the _____________ country.

Answer:

same

Question 3.

Discounting means encashment of the bill before its _____________

Answer:

due date

Question 4.

_____________ can transfer the ownership of the bill.

Answer:

Drawer

Question 5.

Noting charges are payable to the Notary public on _____________ of a bill.

Answer:

dishonour

![]()

Question 6.

A bill of exchange is a _____________

Answer:

negotiable instrument

Question 7.

If a discounted bill is honoured, the _____________ does not record this transaction.

Answer:

drawer

Question 8.

Days of grace are not allowed in the case of a _____________

Answer:

demand bill

Question 9.

Noting charges should be borne by _____________

Answer:

drawee

E. Answer in one sentence:

Question 1.

State the types of Bills of Exchange.

Answer:

The bills of exchange may be classified as

- Inland bills of exchange

- Foreign bills of exchange.

Question 2.

What is the Inland bill of exchange?

Answer:

A bill of exchange that is drafted, accepted, and made payable between the parties from one and the same country is called an Inland bill of exchange.

Question 3.

What is a Foreign bill of exchange?

Answer:

A bill of exchange that is drafted and accepted in one country and made payable in another country is called a Foreign bill of exchange.

![]()

Question 4.

Which are the parties to a bill of exchange?

Answer:

There are three parties to a bill of exchange, viz.,

- Drawer

- Drawee

- Payee

Question 5.

Who is the Drawer?

Answer:

The Drawer of a bill is the person who draws or makes the bill.

Question 6.

Who is the Drawee?

Answer:

The Drawee of a bill is the person on whom the bill is drawn.

Question 7.

What is a Draft?

Answer:

A bill of exchange is called a Draft before its acceptance.

Question 8.

What is an Acceptance of the Bill of Exchange?

Answer:

The act of signing the bill of exchange by the drawee with a date to show his consent to pay the amount of the bill is called an Acceptance of the Bill of Exchange.

Question 9.

What do you mean by Clean or General Acceptance?

Answer:

A Clean or General Acceptance is an acceptance where the drawee does not make any change in the terms of the bill before accepting it.

![]()

Question 10.

What is Qualified Acceptance?

Answer:

If the drawee of a bill of exchange accepts it on condition that the time or amount of the bill is changed or adds some other conditions to the bill, his acceptance is called a Qualified Acceptance.

Question 11.

What is the term of the bill of exchange?

Answer:

The period for which the bill of exchange is drawn and accepted is called the term of the bill of exchange.

Question 12.

What is the Nominal Due Date?

Answer:

The date on which the term i.e. the period of a bill of exchange gets expired is called Nominal Due Date.

Question 13.

What is the Due Date of a Bill?

Answer:

The Due Date of a Bill of Exchange is the date on which it is falling due for payment by the drawee.

Question 14.

What is Endorsing of a Bill?

Answer:

Endorsing of a Bill is the holder’s signing on its back with the intention of transferring its title or ownership to another person.

![]()

Question 15.

Who is an Endorser?

Answer:

The drawer or the holder of a bill of the exchange who transfers or endorses the same in favour of a third party is called Endorser.

Question 16.

Who is an Endorsee?

Answer:

An Endorsee is a person to whom or in whose favour a bill is endorsed or transferred.

Question 17.

What is Retirement of a Bill?

Answer:

A bill of exchange is said to be retired if its acceptor makes payment of it before its due date, usually after deducting some discount or rebate.

Question 18.

When is a bill said to be honoured?

Answer:

A bill of exchange is said to be honoured or met when the acceptor or drawee makes payment on its due date.

Question 19.

When is the bill said to be dishonoured?

Answer:

A bill of exchange is said to be dishonoured if its acceptor or drawee fails to make payment on its due date.

![]()

Question 20.

Which account is credited in the books of the drawer when the discounted bill is dishonoured?

Answer:

Cash/Bank A/c is credited in the books of the drawer when the discounted bill is dishonoured.

Question 21.

Who is a Notary Public?

Answer:

An officer appointed by the Government to certify dishonour of bills of exchange is called Notary Public.

Question 22.

Who bears the noting charges on dishonour of a bill?

Answer:

An acceptor or drawee bears the noting charges on dishonour of a bill of exchange.

Question 23.

Who pays the noting charges?

Answer:

The holder of the bill of exchange pays the noting charges.

Question 24.

What do you mean by Renewal of a Bill?

Answer:

Renewal of a Bill of Exchange means cancellation of the original bill and drafting a new bill in exchange for that by a drawer at the request of drawee.

F. Do you agree or disagree with the following statements:

Question 1.

A bill of which payment to be made after the fixed period is after date bill.

Answer:

Agree

Question 2.

Drawee can transfer the ownership of the bill.

Answer:

Disagree

Question 3.

Endorsee is a person in whose favour the bill is transferred.

Answer:

Agree

![]()

Question 4.

The drawer and payee of a bill of exchange may be one and the same person.

Answer:

Agree

Question 5.

A bill of exchange can be endorsed only once.

Answer:

Disagree

Question 6.

Days of grace are allowed in the case of demand bills.

Answer:

Disagree

Question 7.

The noting of dishonoured bills is compulsory.

Answer:

Disagree

Question 8.

The endorser is a creditor to the endorsee.

Answer:

Disagree

Question 9.

Bills payable are a liability.

Answer:

Agree

![]()

Question 10.

A bill of exchange is a negotiable instrument.

Answer:

Agree

Solved Problems

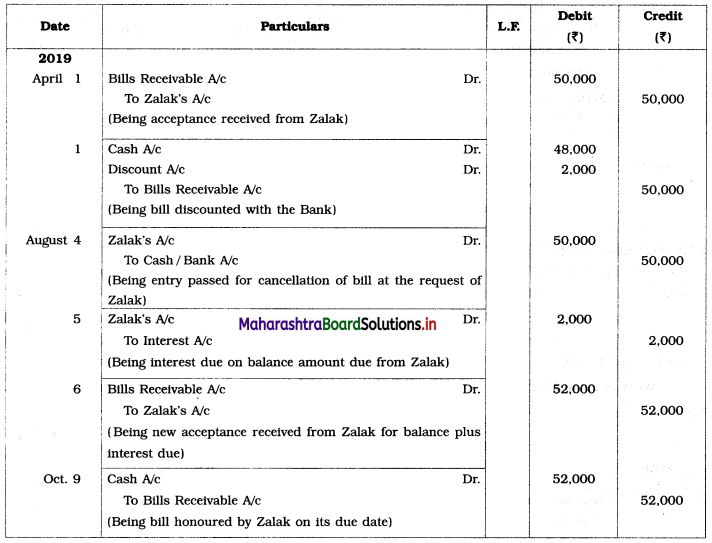

Question 1.

On 1st April 2019 Parth draws a bill for ₹ 50,000 on Zalak for 4 months period. The bill is accepted and returned to Parth. On the same date, Parth discounted the bill with his bank @ 12% p.a.

Before the due date Zalak finds herself unable to meet the bill, hence requested Parth to renew the bill for a further period of 2 months. Parth agreed and he took the bill back from the bank and received new acceptance for ₹ 52,000 including interest. This new bill is duly honoured by Zalak on the due date.

Write Journal of Parth and Zalak for the above bill transactions.

Solution:

In the books of Parth

Journal Entries

In the books of Zalak

Journal Entries

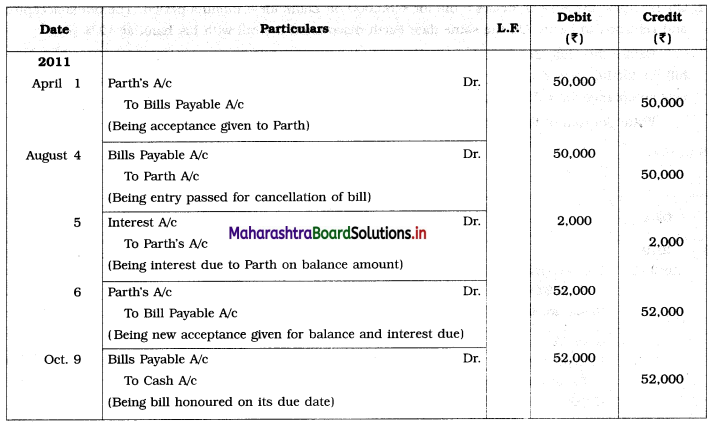

Question 2.

Prahran owes Keyur ₹ 75,000. Keyur draws a bill for ₹ 60,000 on Prihaan for 4 months period and received the cheque for the balance. The bill is duly accepted and returned by Prahran. On the same date, Keyur endorsed Prihaan’s acceptance to Monil.

On the due date, Monil informed Keyur that Prihaan dishonored his acceptance and ₹ 1,905 paid as noting charges. Keyur then drew a new bill for 3 months on Prihaan for the amount due including noting charges and interest of ₹ 2,400. On the due date, the bill was duly honoured by Prihaan.

Write Journal Entries in the books of Keyur and prepare Keyur’s account in the books of Prihaan.

Solution:

In the books of Keyur

Journal Entries

Working Notes:

1. Amount paid by cheque = Total amount due from Prihaan – the amount of Bill accepted

= 75,000 – 60,000

= ₹ 15,000

2. Amount for which new bill is drawn = Amount of bill dishonoured + Noting charges + Interest

= 60,000 + 1,905 + 2,400

= ₹ 64,305

Note: For easy understanding, the students are advised to draft the journal entries in the journal of Prihaan first. So that they will be able to understand ledger entries of Keyur’s A/c opened in the ledger of Prihaan.

![]()

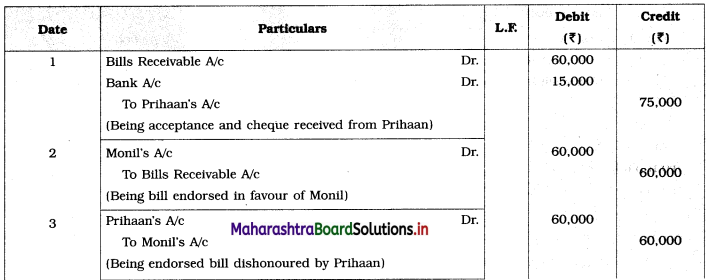

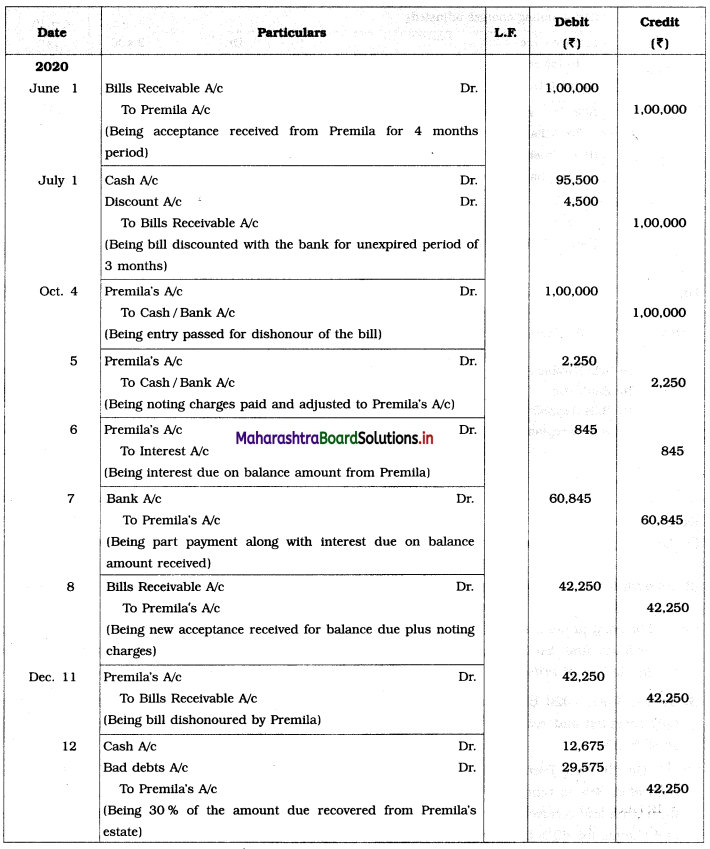

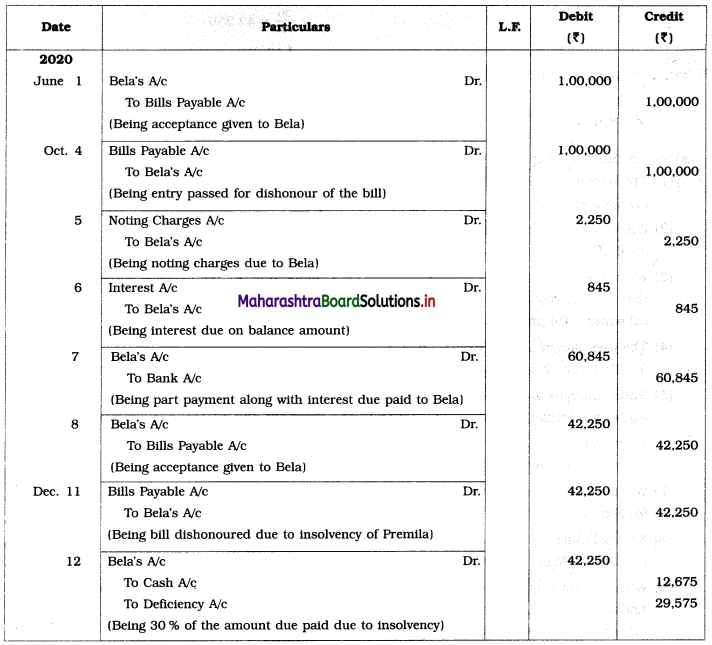

Question 3.

On 1st June, 2020 Bela draws a bill for ₹ 1,00,000 on Premila for 4 months period. The bill is duly accepted and returned to Bela. One month after the date, Bela discounted the bill with bank @ 18% p.a.

On the due date, Premila dishonoured her acceptance. Bank paid noting charges ₹ 2,250. Premila requested Bela to renew the bill for a further period of 2 months. Bela agreed and took the bill back from the bank and received new acceptance for 40% amount of the bill with the full amount of noting charges and a cheque for 60% balance plus interest @ 12% p.a.

Before the due date, Premila was declared as insolvent and 30% of the amount due could be recovered from her private estate.

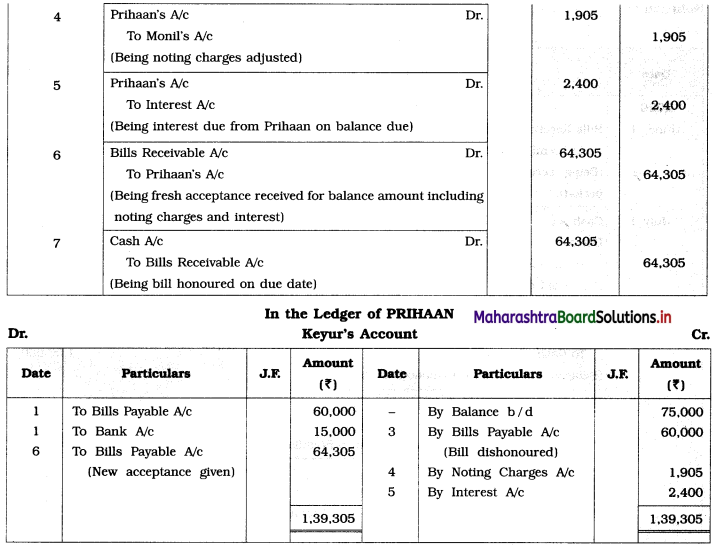

Write Journal of Bela and Premila for the above bill transactions.

Solution:

In the books of Bela

Journal Entries

In the books of Premila

Journal Entries

Working Notes:

1. Discount charged by the bank on discounting 1st bill = 1,00,000 × \(\frac{3}{12} \times \frac{18}{100}\) (Period of bill is 4 months, but it is discounted 1 month later) = ₹ 4,500

2. Amount paid by Premila to Bela in Part payment = 60% of Bill amount

= 60% of 1,00,000

= ₹ 60,000

3. Balance amount still due from Premila to Bela = 40% of Bill amount

= 40% of 1,00,000

= ₹ 40,000

4. Interest is to be calculated on total amount due from Premila = Balance due + Unpaid amount noting charges

= 40,000 + 2,250

= ₹ 42,250

Interest due = Balance amount × Unexpired period × Rate of interest

= 42,250 × \(\frac{2}{12} \times \frac{12}{100}\)

= ₹ 845

5. Amount paid by Premila to Bela = 60,000 + 845 = ₹ 60,845.

![]()

6. Amount for which new bill is drafted and accepted = ₹ 42,250.

7. Amount recovered by Bela from the property of Premila = 30% of total amount due

= \(\frac{30}{100}\) × 42,250

= ₹ 12,675

8. Bad debts incurred by Bela = Total Amount due – Amount recovered

= 42,250 – 12,675

= ₹ 29,575