Balbharti Maharashtra State Board 12th Commerce Book Keeping & Accountancy Important Questions Chapter 5 Reconstitution of Partnership (Death of Partner) Important Questions and Answers.

Maharashtra State Board 12th Commerce BK Important Questions Chapter 5 Reconstitution of Partnership (Death of Partner)

1. Objective questions:

A. Select the most appropriate answer from the alternative given below and rewrite the sentences.

Question 1.

Share of loss of a deceased partner till the date of death is _____________

(a) debited to Profit and Loss-Adjustment A/c

(b) credited to Profit and Loss-Adjustment A/c

(c) debited to Profit and Loss Suspense A/c

(d) credited to Profit and Loss Suspense A/c

Answer:

(d) credited to Profit and Loss Suspense A/c

Question 2.

Gain ratio is calculated on _____________

(a) admission of a partner

(b) retirement of a partner

(c) death of a partner

(d) retirement or death of a partner

Answer:

(d) retirement or death of a partner

![]()

Question 3.

Share of profit of a deceased partner till the date of death is _____________

(a) debited to Profit and Loss-Adjustment A/c

(b) credited to Profit and Loss-Adjustment A/c

(c) debited to Profit and Loss Suspense A/c

(d) credited to Profit and Loss Suspense A/c

Answer:

(c) debited to Profit and Loss Suspense A/c

Question 4.

An amount received from the Insurance Company against the joint-life policy is _____________

(a) debited to the deceased partner

(b) credited to the deceased partner

(c) credited to Continuing Partners Capital A/c

(d) credited to All Partners’ Capital A/c’s in their profit sharing ratio

Answer:

(d) credited to All Partners’ Capital A/c’s in their profit sharing ratio

Question 5.

M, N, and S are partners in a firm having joint life policy of ₹ 10,00,000 on which premium has been paid by the firm. M dies and his legal representatives want the whole amount of the policy whereas N and S want to distribute the amount among all the partners.

(a) M’s representatives are correct

(b) N and S are correct

(c) All are wrong

(d) Insurance company will decide

Answer:

(b) N and S are correct

Question 6.

X, Y, and Z share profit as 1/2, 3/10, and 1/5 and Z have expired, the new profit ratio of X and Y will be _____________ respectively.

(a) 5 : 8

(b) 5 : 3

(c) 2 : 1

(d) 5 : 2

Answer:

(b) 5 : 3

![]()

Question 7.

The interest on drawings of a deceased partner is credited to _____________

(a) Profit and Loss-Adjustment A/c

(b) Revaluation A/c

(c) Capital A/c

(d) Profit and Loss Suspense A/c

Answer:

(d) Profit and Loss Suspense A/c

Question 8.

In the case of death of a partner, a _____________ is opened for revaluation of the assets and liabilities.

(a) Profit and Loss-Adjustment A/c

(b) Profit and Loss A/c

(c) Profit and Loss Suspense A/c

(d) Executor’s Loan A/c

Answer:

(a) Profit and Loss-Adjustment A/c

Question 9.

A balance on the Deceased Partner’s Executor’s Loan Account is shown in the new Balance Sheet on _____________ side.

(a) assets

(b) credit

(c) liabilities

(d) none of these

Answer:

(c) liabilities

B. Write a word, term, phrase, which can substitute each of the following statements.

Question 1.

The account shows the revaluation of assets and liabilities.

Answer:

Revaluation A/c or Profit and Loss Adjustment A/c

Question 2.

Excess of proportionate capital over actual capital.

Answer:

Deficit

Question 3.

The account to which deceased partners’ capital balance is transferred.

Answer:

Deceased Partner’s Executor’s Loan Account

![]()

Question 4.

A person is entitled to receive the amount due to a deceased partner.

Answer:

Legal Heir/Executor/Legal Representative of a deceased partner

Question 5.

The account where the deceased partner’s share in the accrued profit from the date of the last Balance Sheet to the date of his death is adjusted.

Answer:

Profit and Loss Suspense A/c

C. State whether the following statements are True or False with reasons.

Question 1.

The death of a partner is like a compulsory retirement.

Answer:

This statement is True.

After the death of a partner, the business is not able to get any kind of services from the deceased partner and he ceases to be a partner of a firm on natural ground. Hence, we can say that the death of a partner is like a compulsory retirement.

Question 2.

The total amount due to the deceased partner is paid in cash to the executor immediately after his death.

Answer:

This statement is False.

Depending on the availability of sufficient cash or bank balance the total amount due to the deceased partner is paid. However, it is not at all necessary to make immediate payment to the legal heir or representative of the deceased partner.

Question 3.

On the death of a partner, his share in the goodwill is divided equally among continuing partners.

Answer:

This statement is False.

On the death of a partner, his share in the goodwill is divided into the old profit ratio of continuing partners.

Question 4.

The deceased partner’s share in profit up to the date of his death will be debited to his Capital A/c.

Answer:

This statement is False.

The deceased partner’s share in profit up to the date of his death will be credited to his Capital A/c as he is entitled to receive it.

![]()

Question 5.

For a decrease in the value of assets, Revolution Account is debited.

Answer:

This statement is True.

A decrease in the value of assets means a loss to the business and in that case, Asset Account will be credited and Revaluation Account will be debited.

Question 6.

An amount due to the deceased partner appears in the Balance Sheet.

Answer:

This statement is False.

An amount due to the deceased partner is transferred to his Executor’s Account and the balance if remains in Executor’s Loan Account then appears in the Balance Sheet.

D. Fill in the blanks and rewrite the following sentence.

Question 1.

An amount due to a deceased partner is transferred to _____________ A/c.

Answer:

Executor’s Loan

Question 2.

Death of a partner is like a _____________ retirement.

Answer:

compulsory

Question 3.

Usually assets and liabilities of the firm are revalued on the _____________ of a partner.

Answer:

death

Question 4.

For increase in the value of assets, Revaluation Account is _____________

Answer:

credited

![]()

Question 5.

A partner who died is known as _____________

Answer:

deceased partner

Question 6.

A person who represent a deceased partner is known as _____________

Answer:

Legal Heir or Executor.

E. Answer in one sentence only.

Question 1.

How is the gain ratio calculated?

Answer:

The gain ratio is calculated by using the formula:

Gain Ratio = New Ratio – Old Ratio.

Question 2.

When is the gain ratio required to be calculated?

Answer:

The gain ratio is usually calculated at the time of retirement or death of a partner.

Question 3.

How would you treat general reserve on the death of a partner?

Answer:

On the death of a partner, balance in general reserve is transferred to all Partners’ Capital Accounts or Current Accounts in their old profit sharing ratio.

![]()

Question 4.

How is the amount due to a deceased partner calculated?

Answer:

The amount due to a deceased partner is calculated by adding his share in general reserve, past accumulated profit, goodwill, profit on revaluation of assets and liabilities, interest on capital, salary payable, etc. in the opening balance of capital and by deducting the share in the past accumulated loss, revaluation loss, drawings and interest on drawings from his capital balance.

Question 5.

How is an amount due to the deceased partner settled?

Answer:

The amount finally due to the deceased partner is settled by transferring the same amount to his Legal Heir or Representative’s Loan Account and the same is paid to the legal heir or representative or executor after completing all legal formalities.

Question 6.

How is the share of the deceased partner in accrued profit calculated?

Answer:

The share of the deceased partner in accrued profit is calculated on the assumed basis of average profit of the past few years and credited to the Deceased Partner’s Capital Account.

Question 7.

How is a debit balance of Profit and Loss Account dealt with on the death of a partner?

Answer:

On the death of a partner, a debit balance of the Profit and Loss Account is adjusted and transferred to all Partners’ Capital/Current Accounts in their old profit sharing ratio.

Solved Problem

Question 1.

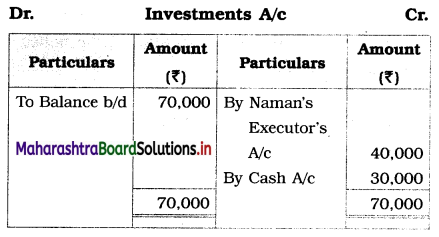

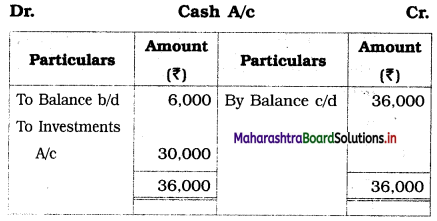

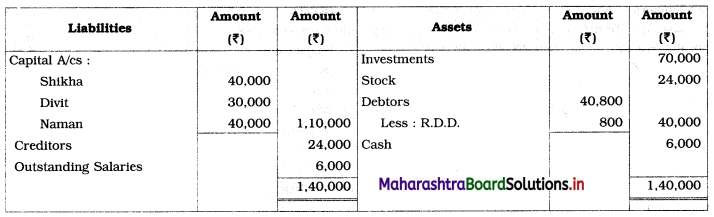

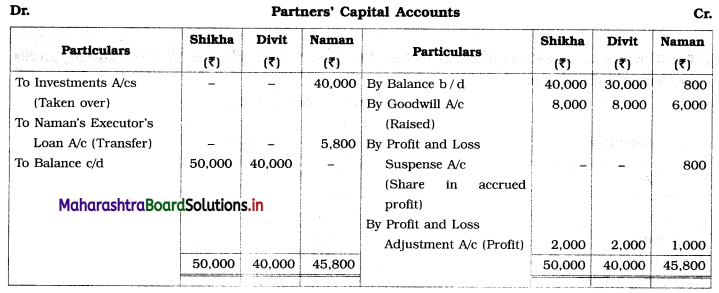

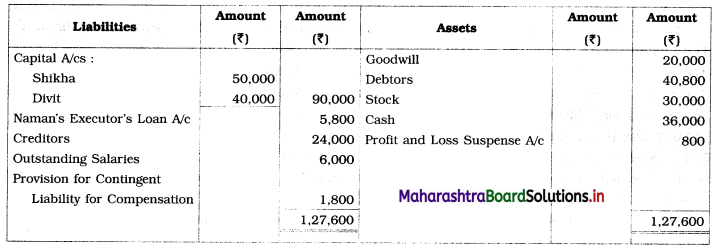

The following is the Balance Sheet of Shikha, Divit, and Naman, who were partners sharing profits and losses in the ratio of 2 : 2 : 1.

Balance Sheet as of 31st March 2020

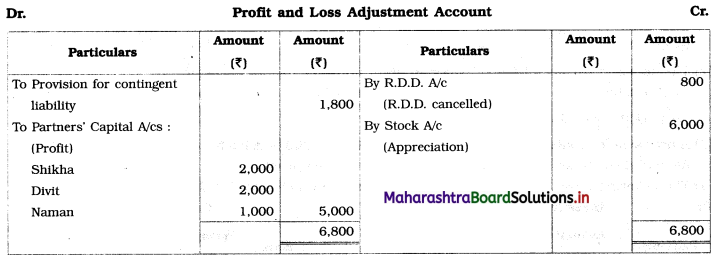

Naman died on 1st July 2020 and the following adjustments were made in the books of the firm:

1. All debtors were considered as good and the Reserve for Doubtful Debts was no longer necessary.

2. A contingent liability for compensation of ₹ 1,800 was to be provided.

3. Investments worth ₹ 40,000 were taken over by the executor of Naman and the remaining investments were sold for ₹ 30,000.

4. Stock was revalued at ₹ 30,000.

5. The goodwill of the firm was valued at ₹ 20,000 and was to be shown in the books.

6. The deceased partner’s share in profit up to the date of his death was to be calculated on the basis of the preceding year’s profit which was ₹ 16,000.

Prepare the Profit and Loss Adjustment Account, Capital Accounts of Partners, and the Balance Sheet of the new firm after the death of Naman.

Solution:

In the books of Partnership Firm

Balance Sheet as of 1st July 2020

Working Notes:

1. Goodwill valued at ₹ 20,000 is debited to Goodwill A/c and credited to all Partners’ Capital A/cs in their profit sharing ratio. Show balance in the Goodwill A/c then transfers to the Assets side of the Balance Sheet.

2. The deceased partner’s (Naman) share in profit up to the date of his death = (Preceding year’s profit) × (Proportionate profit) × Naman’s share in profit

= 16,000 × \(\frac{3}{12} \times \frac{1}{5}\)

= ₹ 800.

![]()

3. A provision for contingent liability for compensation ₹ 1,800 is debited to Profit and Loss-Adjustment A/c and then shown at the Liabilities side of the Balance Sheet.

4. The following ledger accounts are prepared to ascertain their closing balances: