Balbharti Maharashtra State Board 12th Commerce Book Keeping & Accountancy Important Questions Chapter 4 Reconstitution of Partnership (Retirement of Partner) Important Questions and Answers.

Maharashtra State Board 12th Commerce BK Important Questions Chapter 4 Reconstitution of Partnership (Retirement of Partner)

A. Select the most appropriate alternatives from those given below and rewrite the sentence.

Question 1.

A, B and C are partners sharing profits in the ratio of 5 : 3 : 2. If B retires then new ratio will be _____________

(a) 5 : 2

(b) 5 : 3

(c) 3 : 2

(d) 1 : 1

Answer:

(a) 5 : 2

Question 2.

When goodwill is raised at its full value and it is written off _____________ Account is to be credited.

(a) Cash

(b) Goodwill

(c) All Partners’ Capital

(d) Loan

Answer:

(b) Goodwill

![]()

Question 3.

Increase in the value of assets should be _____________ to Profit and Loss Adjsutment Account.

(a) debited

(b) credited

(c) added

(d) none of these

Answer:

(b) credited

Question 4.

If the goodwill is raised to the extent of retiring partner’s share _____________ account is to be debited.

(a) cash

(b) goodwill

(c) partner’s Capital

(d) retiring Partners Capital

Answer:

(b) goodwill

Question 5.

A, B and C are partners, sharing profits and losses in the ratio of \(\frac{1}{2}\), \(\frac{1}{3}\) and \(\frac{1}{6}\) respectively, if B retires, the new ratio will be _____________

(a) 4 : 1

(b) 3 : 1

(c) 3 : 2

(d) 2 : 1

Answer:

(b) 3 : 1

Question 6.

On retirement of a partner the balance on his Current Account is transferred to his _____________ Account.

(a) Drawings

(b) Capital

(c) Wife’s Loan

(d) Son’s

Answer:

(b) Capital

![]()

Question 7.

_____________ Ratio is a ratio which continuing partners are benefited on retirement of a partner

(a) New

(b) Sacrifice

(c) Gain

(d) Old

Answer:

(c) Gain

Question 8.

If Goodwill Account is raised only to the extent of retiring partner’s share, _____________ A/c is credited.

(a) Cash

(b) Goodwill

(c) All Partners’ Capital

(d) Retiring Partner’s Capital

Answer:

(d) Retiring Partner’s Capital

Question 9.

In the case of retirement of a partner, _____________ Account is opened for revaluation of the assets and liabilities.

(a) Revaluation

(b) Profit and Loss

(c) Current

(d) Trading

Answer:

(a) Revaluation

Question 10.

In the case of retirement of a partner, balance on Revaluation Account is transferred to _____________ Accounts.

(a) Retiring Partner’s Capital

(b) All Partners’ Capital

(c) New Partner’s Capital

(d) Continuing Partners’ Capital

Answer:

(b) All Partners’ Capital

![]()

Question 11.

Debit balance on Profit and Loss Suspense Account is shown in the new Balance Sheet on _____________ side.

(a) Assets

(b) Liabilities

(c) Debit

(d) None of these

Answer:

(a) Assets

B. Write the word, term, phrase, which can substitute each of the following statements.

Question 1.

The account shows the revaluation of assets and liabilities.

Answer:

Revaluation Account or Profit and Loss Adjustment Account

Question 2.

Excess of actual capital over proportionate capital.

Answer:

Surplus Capital

Question 3.

Process in which a partner leaves the firm permanently on account of old age continued sickness or loss of interest in the firm.

Answer:

Retirement of a Partner

Question 4.

The ratio in which the continuing partners share the profit ratio given up by the retiring partner.

OR

The ratio in which goodwill is credited to the retiring partners is adjusted by the continuing partners.

Answer:

Gain Ratio

OR

Benefit Ratio

![]()

Question 5.

An account to which the amount due to a partner on his retirement is transferred.

Answer:

Retiring Partner’s Loan A/c

C. State whether the following statements are true or false with reasons.

Question 1.

Amount due to a retiring partner if not paid, appears as his loan in the books of the firm.

Answer:

This statement is True.

If in Cash/Bank account, the firm has sufficient balance then the amount due to a retiring partner is paid by firm immediately. If due to insufficient fund amount due to a retiring partner is not paid and it appears as his loan in the books of the firm.

Question 2.

A revaluation Account is also called Realisation Account.

Answer:

This statement is False.

The changes in the values of assets or liabilities on revaluation are recorded in the Revaluation Account. At the time of dissolution of the firm, when Assets or liabilities are disposed off and whatever amounts are paid or received by the firm are recorded in the Realisation Account. So Revaluation Account and Realisation Account are not the same.

Question 3.

Profit on Revaluation Account is transferred to Continuing Partner’s Capital Account only.

Answer:

This statement is False.

Profit on revaluation of assets and liabilities is to be shared by all the partners, including retiring partners. This is because changes in the value of assets and liabilities take place due to the hard work of all the partners, including retiring partners.

Question 4.

On the retirement of a partner, the partnership deed is not changed.

Answer:

This statement is False.

On the retirement of a partner, profit and loss ratio, capital ratio, etc. may get changed. So the partnership deed is supposed to be changed.

![]()

Question 5.

A retiring partner is not entitled to share in the goodwill of the firm.

Answer:

This statement is False.

A retiring partner is entitled to get a share in the goodwill of the firm up to the date of retirement as it is his legal right.

Question 6.

If goodwill is written off, Goodwill A/c is credited in the books of the firm.

Answer:

This statement is True.

When goodwill of the firm is written off then there is no question of any balance in the Goodwill Account therefore Goodwill A/c is credited in the books of the firm.

Question 7.

Balance of Retiring Partner’s Capital Account is transferred to his Legal Heir’s Account.

Answer:

This statement is False.

If the financial position of the firm allows, the balance of the Retiring Partner’s Capital Account is given immediately to the retiring partner, otherwise, it will be transferred to Retiring Partner’s Loan Account.

Question 8.

The Capital A/c of the retiring partner always shows a debit balance.

Answer:

This statement is False.

The Capital A/c of the retiring partner may show debit or credit balance depends upon the amount withdrawn by a retiring partner.

Question 9.

Retirement of a partner leads to the dissolution of the firm unless otherwise agreed upon.

Answer:

This statement is True.

At the time of retirement of a partner, continuing partners don’t want to continue the business activities of the firm, then only it leads to the dissolution of the firm.

D. Fill in the blanks and rewrite the following sentences:

Question 1.

On retirement of a partner, partnership deed is _____________ changed.

Answer:

not

Question 2.

A retiring partner is _____________ to get his share in general reserve/accumulated profit.

Answer:

entitled

Question 3.

A _____________ balance of Revaluation Account means loss on revaluation.

Answer:

debit

![]()

Question 4.

Goodwill A/c is _____________ in the books of the firm when goodwill is written off.

Answer:

credited

Question 5.

Revaluation of Assets and Liabilities is recorded in _____________ Account.

Answer:

Revaluation

Question 6.

The amount due to a partner on his retirement is transferred to _____________ Account.

Answer:

Partner’s Capital

Question 7.

An amount payable to the retiring partner is paid off at a time is known as _____________ Method.

Answer:

Lumpsum

Question 8.

Excess of actual capital over proportional capital is known as _____________

Answer:

Surplus

Question 9.

Credit balance of Revaluation Account means _____________ on revaluation.

Answer:

Profit

![]()

Question 10.

The credit balance on the Profit and Loss Suspense Account is shown in the Balance Sheet on _____________ side.

Answer:

Liabilities

E. Answer in one sentence.

Question 1.

Who is a retiring partner?

Answer:

A partner who leaves the firm or severs his connection or relationship with other partners on account of old age or continued ill health or loss of interest in the firm or similar other reasons is called a retiring partner.

Question 2.

How would you treat general reserve on the retirement of a partner?

Answer:

General reserve appearing on the liabilities side of the Balance Sheet may be credited to all the partners’ Capital Accounts in their old profit sharing ratio or only the share of retiring partner is credited to his Capital Account, depending on the provisions made in the partnership deed.

Question 3.

When is the gain ratio calculated?

Answer:

The gain ratio is calculated when a firm raises goodwill to the extent of retiring partner’s share and then intends to write off the goodwill so raised.

Question 4.

To which account, increase in the value of assets credited at the time of retirement of a partner?

Answer:

An increase in the values of assets is credited to Profit and Loss-Adjustment A/c or Revaluation A/c at the time of retirement of a partner.

Question 5.

How would you adjust the retiring partner’s share of goodwill without opening Goodwill A/c?

Answer:

Adjustment of retiring partner’s share of goodwill without opening Goodwill Account is done by debiting continuing Partners’ Capital/Current Accounts in their gain ratio and crediting Retiring Partners’ Capital/Current Account with that amount.

![]()

Question 6.

To which account is the outstanding amount due to the retiring partner transferred?

Answer:

The outstanding amount due to the retiring partner is transferred to the retiring partner’s Loan Account.

Solved Problems

Question 1.

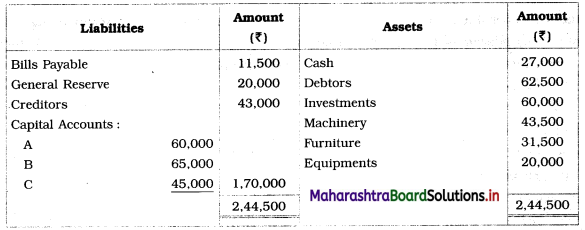

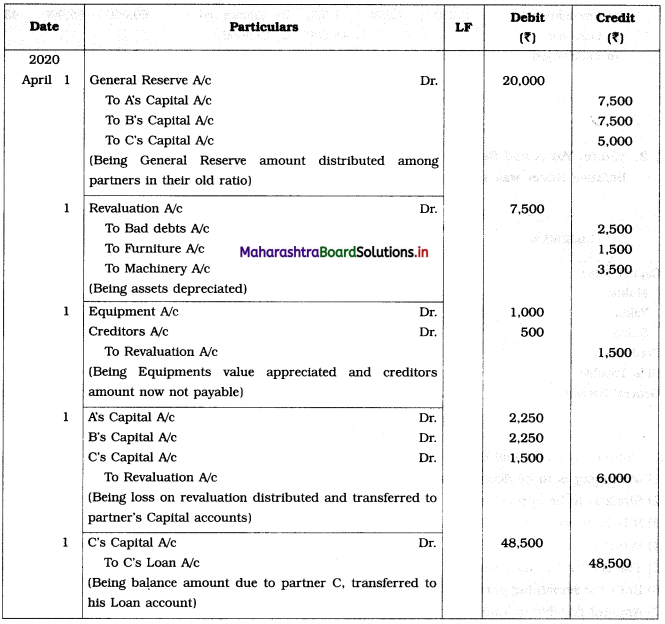

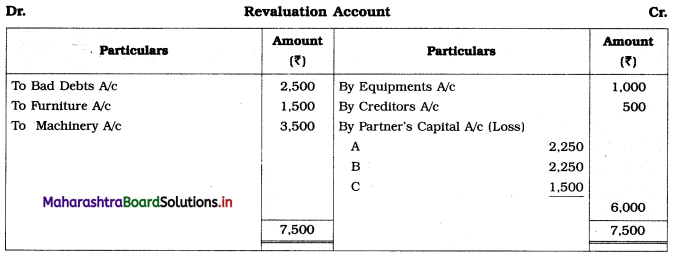

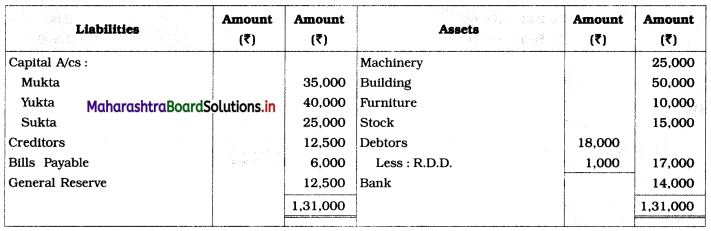

A, B, and C are partners of a firm sharing profit and loss in the 3 : 3 : 2 ratio. Their firm’s Balance Sheet as of 31st March, 2020 is as under:

Balance Sheet as of 31st March 2020

On 1st April 2020, C retired from the firm on the following terms:

1. Outstanding amount of retiring partner C be transferred to his loan account.

2. Write off ₹ 2,500 as bad debts.

3. ₹ 500 is now not payable to creditors.

4. Assets are revalued as under:

Furniture ₹ 30,000, Machinery ₹ 40,000, Equipments ₹ 21,000.

Pass necessary journal entries in the books of a firm.

Solution:

Journal Entries in the books of Partnership firm

Working Note:

![]()

Question 2.

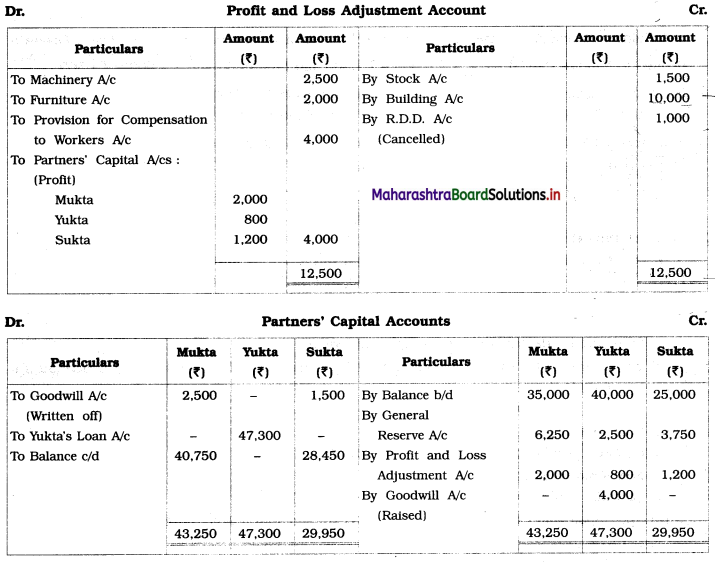

Mukta, Yukta and Sukta were partners sharing profits and losses in the ratio of 5 : 2 : 3. Their Balance Sheet was as follows:

Balance Sheet as of 31st March 2020

Yukta retired on that date on the following terms:

1. Machinery is to be depreciated by 10% and Furniture by 20%.

2. Stock is to be appreciated by 10% and Building by 20%.

3. R.D.D. is no longer necessary.

4. Provision is to be made for ₹ 4,000 being compensation to workers.

5. The goodwill of the firm is to be valued at ₹ 20,000 and Yukta’s share in it should be raised.

6. Both the remaining partners decided to write off the goodwill.

7. Amount payable to Yukta is to be kept as her Loan.

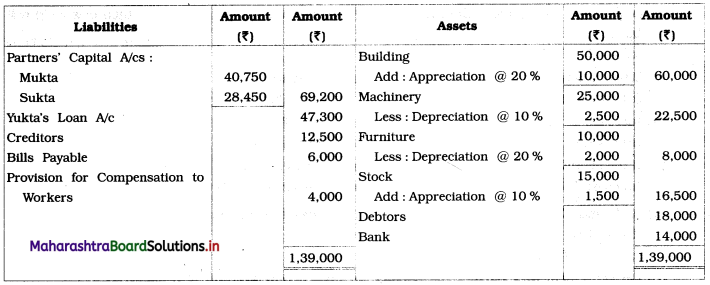

Prepare:

1. Profit and Loss Adjustment Account

2. Partners’ Capital Accounts

3. New Balance Sheet.

Solution:

In the books of partnership firm

Balance Sheet as of 1st April 2020

Working Notes:

1. Yukta’s share in firm’s Goodwill = \(\frac {2}{10}\) × 20,000 = ₹ 4,000.

Goodwill to the extent of ₹ 4,000 is credited to Yukta’s A/c and then debited to Mukta’s Capital A/c andSukta’s Capital A/c in their gain ratio which is equal to the new ratio i.e. 5 : 3.

Hence, Goodwill debited to Mukta’s Capital A/c = \(\frac {5}{8}\) × 4,000 = ₹ 2,500 and Sukta’s A/c = \(\frac {3}{8}\) × 4,000 = ₹ 1,500.

2. Provision for compensation to workers ₹ 4,000 is first debited to Profit and Loss-Adjustment A/c (as new liability is created) and then it is shown on the Liabilities side of the new Balance Sheet.

![]()

3. The cancelled R.D.D. ₹ 1,000 is credited to Profit and Loss-Adjustment A/c and Debtors to the extent of ₹ 18,000 are shown on the Assets side of the Balance Sheet.