Balbharti Maharashtra State Board 12th Commerce Book Keeping & Accountancy Important Questions Chapter 3 Reconstitution of Partnership (Admission of Partner) Important Questions and Answers.

Maharashtra State Board 12th Commerce BK Important Questions Chapter 3 Reconstitution of Partnership (Admission of Partner)

1. Objetive type questions.

A. Select appropriate alternatives from those given below and rewrite the sentences.

Question 1.

If an asset is depreciated, Revalutation Account is ______________

(a) debited

(b) credited

(c) debited and credited

(d) none of these

Answer:

(a) debited

Question 2.

______________ Account is debited when unrecorded liability is brought into business.

(a) Liability

(b) Revaluation

(c) Capital

(d) Current

Answer:

(b) Revaluation

![]()

Question 3.

The proportion in which old partners make a sacrifice is called ______________ Ratio.

(a) Capital

(b) Gaining

(c) Sacrifice

(d) New

Answer:

(c) Sacrifice

Question 4.

The ______________ Ratio is useful for making adjustment for goodwill among the old partners.

(a) New

(b) Sacrifice

(c) Old

(d) Profit and Loss

Answer:

(b) Sacrifice

Question 5.

Krishna and Balram, who are equal partners, admit Arjun into a partnership for 1/4th share, their new profit sharing ratio will be ______________

(a) 3 : 3 : 1

(b) equal

(c) 3 : 3 : 2

(d) 2 : 2 : 1

Answer:

(c) 3 : 3 : 2

Question 6.

In case of admission of a partner, the profit or loss on revaluation of assets and liabilities is shared by ______________ partners.

(a) all

(b) old

(c) new

(d) none of these

Answer:

(b) old

Question 7.

When the reserve funds is distributed to old partners, the ______________ Account is debited.

(a) Capital

(b) Current

(c) Reserve Fund

(d) Profit and Loss

Answer:

(c) Reserve Fund

![]()

Question 8.

Goodwill brought in by a new partner is shared by the old partners in their ______________ Ratio.

(a) New

(b) Gain

(c) Sacrifice

(d) Balance of 1

Answer:

(c) Sacrifice

Question 9.

______________ Ratio is a ratio surrendered by old partners in favour of a new partner.

(a) Sacrifice

(b) Gain

(c) New

(d) Old

Answer:

(a) Sacrifice

Question 10.

When goodwill is written off, partners’ capital accounts are ______________

(a) credited

(b) debited

(c) increase

(d) none of these

Answer:

(b) debited

Question 11.

X and Y are equal partners, admit Z into the partnership. If Z’s share is 1/5th, the new profit sharing ratio of the partners will be ______________

(a) 3 : 2 : 1

(b) 4 : 2 : 1

(c) 3 : 3 : 2

(d) 2 : 2 : 1

Answer:

(d) 2 : 2 : 1

Question 12.

A and B who are equal partners admit C into the partnership for 1/7th share. The new profit sharing ratio of the partners will be ______________

(a) 3 : 3 : 2

(b) 3 : 3 : 1

(c) 1 : 2 : 3

(d) 4 : 2 : 1

Answer:

(b) 3 : 3 : 1

![]()

Question 13.

If prepaid expenses are to be recorded in the books of account, they should be shown on the ______________ side of Revaluation A/c.

(a) debit

(b) credit

(c) liabilities

(d) assets

Answer:

(b) credit

Question 14.

If an asset is appreciated, Revaluation Account is ______________

(a) debited

(b) credited

(c) depreciated

(d) neutralised

Answer:

(b) credited

B. Write a word/phrase/term which can substitute each of the following statements.

Question 1.

The account shows the change in the values of assets.

Answer:

Revaluation Account or Profit and Loss Adjustment Account

Question 2.

The credit balance of the Revaluation Account.

Answer:

Profit on Revaluation Account

Question 3.

Excess of actual capital over proportionate capital.

Answer:

Surplus Capital

Question 4.

Name of an intangible asset having a value.

Answer:

Goodwill

![]()

Question 5.

The account is debited when the new partner brings cash for his share of goodwill.

Answer:

Cash/Bank Account

Question 6.

The account is credited when goodwill is withdrawn by old partners.

Answer:

Cash/Bank Account

Question 7.

Profit and Loss Account appearing on the Asset side of a balance sheet.

Answer:

Undistributed Loss

Question 8.

The account is opened to record the gains and losses on revaluation.

Answer:

Profit and Loss Adjustment Account

Question 9.

Change in the relationship between the partners.

Answer:

Reconstitution of a Partnership

Question 10.

An account is credited when a new partner brings cash for his share of goodwill.

Answer:

Goodwill A/c

Question 11.

A fund created by the partnership firm out of profit as a precautionary measure.

Answer:

General Reserve/Reserve Fund

![]()

Question 12.

The ratio in which the old partners share the amount brought in by the new partner towards goodwill.

Answer:

Sacrifice Ratio

Question 13.

The ratio in which the Goodwill A/c may be written off after admission of a partner.

Answer:

New Profit and Loss Ratio

Question 14.

An account was opened for the Revaluation of Assets and Liabilities.

Answer:

Profit and Loss Adjustment A/c or Revaluation A/c

Question 15.

Debit balance of Revaluation Account.

Answer:

Loss on revaluation of assets and liabilities

Question 16.

An amount by which the actual capital of a partner exceeds his Proportionate capital.

Answer:

Surplus capital/Excess capital

Question 17.

An amount by which the proportionate capital of a partner exceeds his actual capital.

Answer:

Deficit or Deficiency in capital

C. State True or False with reasons.

Question 1.

The credit balance of the Revaluation Account means a loss on revaluation of assets and liabilities.

Answer:

This statement is False.

The credit balance of the Revaluation Account means profit on revaluation of assets and liabilities. Revaluation A/c is nominal A/c. On the credit side of this A/c, all incomes and gains are recorded. The credit balance means the credit amount is more than the debt amount. Hence, the credit balance of the Revaluation Account is profit on the revaluation of assets and liabilities.

Question 2.

If the Goodwill Account is raised up, Goodwill Account is debited.

Answer:

This statement is True.

As per the rules of Accountancy when the value of an asset increases or raises, its account is debited in the books of account. Goodwill is an Asset.

![]()

Question 3.

On admission of a partner, the amount of goodwill brought in cash is credited to Goodwill Account.

Answer:

This statement is True.

When newly admitted partner brought cash for goodwill, Cash/Bank Account is debited as it comes in and Goodwill Account is credited and afterward, Goodwill Account will be debited when benefits of Goodwill are transferred to old partners’ Capital Accounts.

Question 4.

The new partner is entitled to receive a share in the general reserve of the existing partnership firm.

Answer:

This statement is False.

General reserve is the amount kept aside from the part and current profit earned by the business for future business development purposes. Hence on this amount, the new partner has no right. Therefore new partner is not entitled to receive a share in general reserve.

Question 5.

On admission of a partner, the profit or loss on revaluation is distributed among the old partners.

Answer:

This statement is True.

At the time of admission of a new partner, existing assets and liabilities of the business are to be revalued and whatever the profit or loss is there it is to be distributed among old partners only.

Question 6.

The goodwill brought in by a new partner is shared by the old partner.

Answer:

This statement is True.

The reputation of business measured in terms of money is known as goodwill and on this, old partners have right so when goodwill is brought in by a new partner in the business, it is shared by the old partner.

Question 7.

The new ratio minus the old ratio is equal to the gain ratio.

Answer:

This statement is True.

At the time of Retirement or Death of a partner, existing partners may have some gain, which is found out by the Gain ratio = New ratio – Old ratio.

Question 8.

When a partner takes away any asset from the business, his account will be debited.

Answer:

This statement is True.

When a partner takes away any asset from the business, Asset Account will be credited and the Partner’s Account will be debited as it decreases the partner’s capital.

![]()

Question 9.

Average profit means profit that is earned over and above the normal profit.

Answer:

This statement is False.

When a firm earns extra profit over and above the normal profit because of the reputation of the firm then it is known as a super profit and not average profit.

D. Answer in one sentence.

Question 1.

What is meant by the admission of a partner?

Answer:

A process in which a new person is taken into the partnership firm as a partner is called admission of a partner.

Question 2.

In what proportion is general reserve distributed among the old partners?

Answer:

On admission of a new partner, the amount of general reserve is distributed among the old partners in their old profit sharing ratio.

Question 3.

How is the sacrifice ratio calculated?

Answer:

The sacrifice ratio is calculated by deducting the new ratio of the partner from his old ratio.

Formula:

Sacrifice ratio = Old ratio – New ratio.

Question 4.

What does credit balance on Profit and Loss Adjustment A/c or Revaluation A/c show?

Answer:

A credit balance on Profit and Loss Adjustment A/c or Revaluation A/c shows a profit on revaluation of assets and liabilities.

Question 5.

In which ratio do the old partners share the profit or loss made on revaluation of assets and liabilities of the firm?

Answer:

The profit or loss made on revaluation of assets and liabilities of the firm is shared by old partners in their old profit sharing ratio.

![]()

Question 6.

What is General Reserve or Reserve Fund?

Answer:

A fund created by keeping aside a part of profit every year to provide timely finance for unforeseen contingencies like fire, flood, earthquake, change in Government policy, etc. is called General Reserve or Reserve Fund.

Question 7.

Who shares the amount of general reserve on the admission of a new partner?

Answer:

On admission of a new partner, the amount of general reserve is shared by old partners only.

Question 8.

On what single factor does the valuation of goodwill primarily depend?

Answer:

The most important factor of the valuation of goodwill is the profit earning capacity of the firm.

Solved Problems

Question 1.

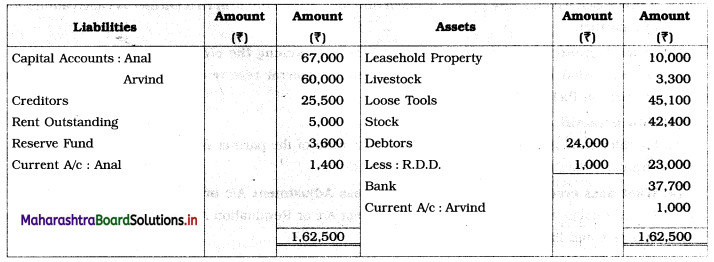

The Balance Sheet of Anal and Arvind who shared the profits in the ratio of 2 : 1 is as under:

Balance Sheet as of 31st March 2019

On 1st April 2019 Zalak was admitted as 1/4th partner on the following terms:

1. She brings equipment of ₹ 40,000 as her capital.

2. Firm’s goodwill is valued at ₹ 72,000 and Zalak agreed to bring her share in the firm’s goodwill by cheque.

3. R.D.D. should be maintained at 7.5% on debtors.

4. Increase the value of livestock by ₹ 1,300 and write off loose tools by 20%.

5. Outstanding rent paid ₹ 4,520 in full settlement.

Pass necessary journal entries to record the above scheme of admission.

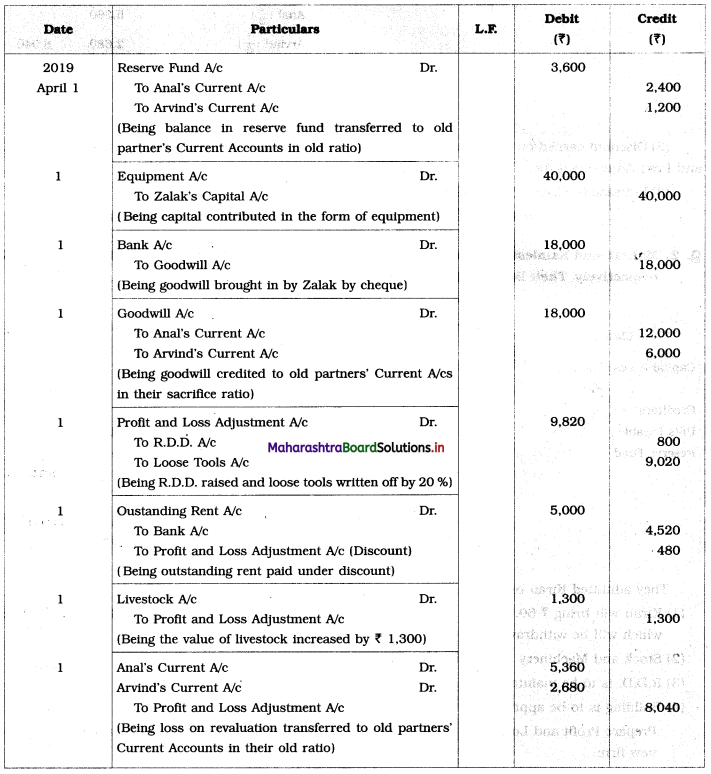

Solution:

Journal entries in the books of partnership firm

Working Notes:

1. To find out Profit or Loss made on revaluation of assets and liabilities, Profit and Loss Adjustment A/c is prepared:

2. Discount earned on payment of outstanding Rent = 5,000 – 4,520 = ₹ 800.

It is credited to Profit and Loss-Adjustment A/c.

3. Increase in RDD = New RDD – Old RDD

= 7.5% on 24,000 – 1,000.

= 1,800 – 1,000

= ₹ 800.

It is debited to Profit and Loss-Adjustment A/c

![]()

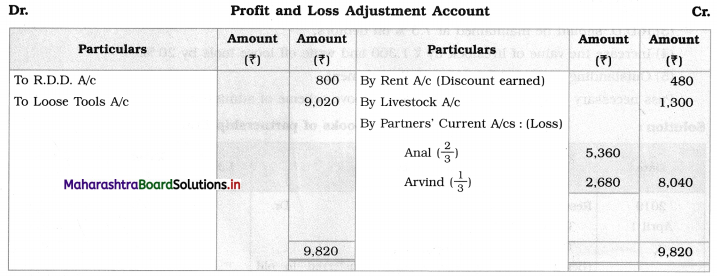

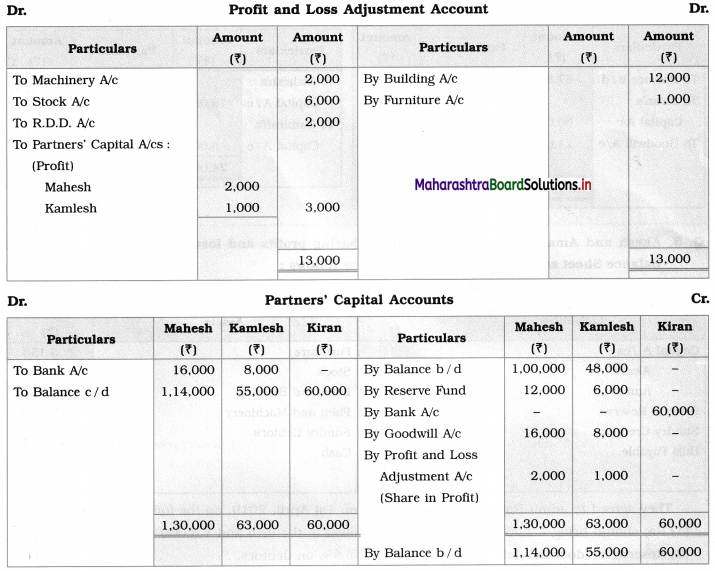

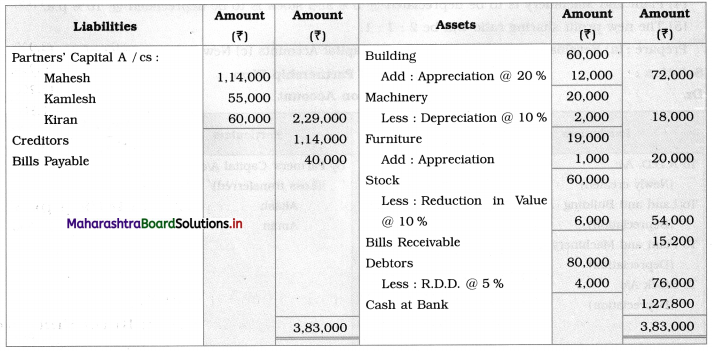

Question 2.

Mahesh and Kamlesh are partners in a business sharing profits and losses in the ratio of 2 : 1 respectively. Their Balance Sheet as of 31st March 2019 is as follows:

Balance Sheet as of 31st March 2019

They admitted Kiran on 1st April 2019 as a partner on the following terms:

1. Kiran will bring ₹ 60,000 as his capital for 1/4th share in future profit and ₹ 24,000 as goodwill which will be withdrawn by old partners.

2. Stock and Machinery are to be depreciated by 10%.

3. R.D.D. is to be maintained at 5% on debtors.

4. Building is to be appreciated by 20% and Furniture is revalued at ₹ 20,000.

Prepare Profit and Loss Adjustment Account, Partners’ Capital Accounts, and Balance Sheet of the new firm.

Solution:

In the books of partnership firm

Balance Sheet as of 1st April 2019

Working Notes:

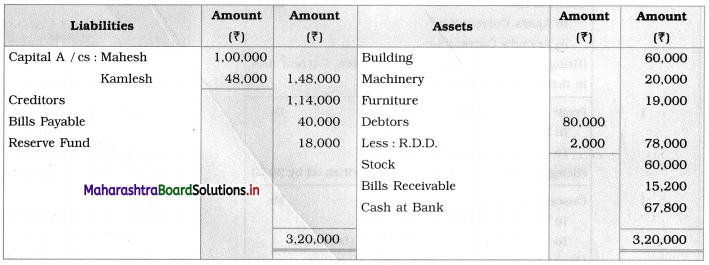

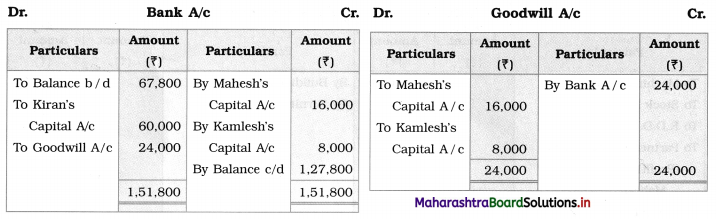

Question 3.

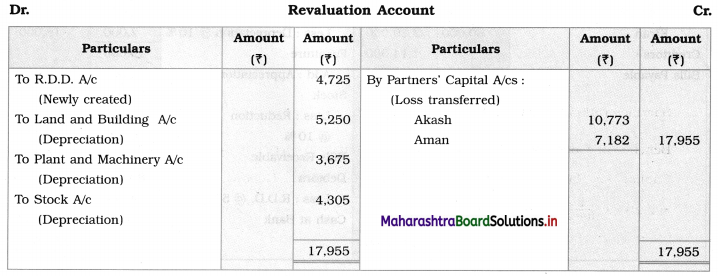

Akash and Aman are partners in firm sharing profits and losses in the ratio 3 : 2. Their Balance Sheet as of 31st March 2019 was as follows:

Balance Sheet as of 31st March 2019

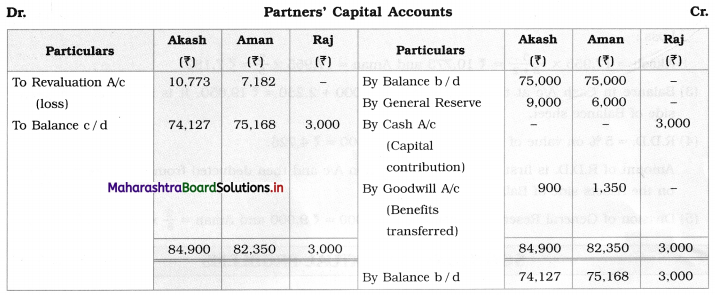

They agreed to admit Raj in their partnership on 1st April 2019, on the following terms:

1. Raj should bring ₹ 2,250, as his share of goodwill in the firm and ₹ 3,000 as his capital.

2. Reserve for doubtful debts is to be provided @ 5% on debtors.

3. Land and building are to be depreciated at 10% p.a.

4. Plant and Machinery is to be depreciated @ 5% and stock is to be depreciated @ 10% p.a.

5. The new profit sharing, the ratio will be 2 : 1 : 1.

Prepare:

(a) Revaluation Account

(b) Partners’ Capital Accounts

(c) New Balance Sheet of the firm.

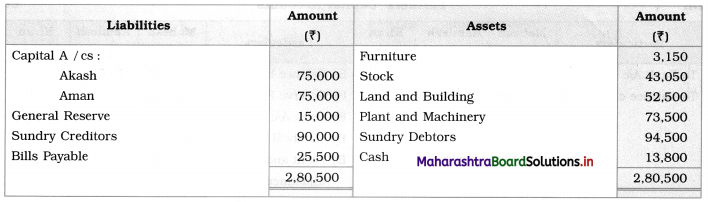

Solution:

In the books of Partnership Firm

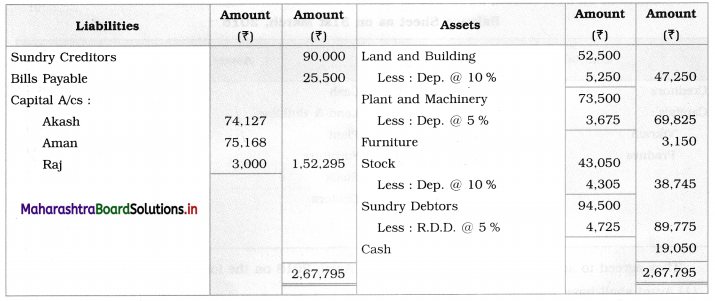

Balance Sheet as of 1st April 2019

Working Notes:

1. Calculation of sacrifice ratio of old partners:

Old ratio: Akash = \(\frac{3}{5}\) and Aman = \(\frac{2}{5}\)

New ratio: Akash = \(\frac{2}{4}\) and Aman = \(\frac{1}{4}\)

Sacrifice ratio = Old ratio – New ratio

Akash’s sacrifice ratio = \(\frac{3}{5}-\frac{2}{4}=\frac{12-10}{20}=\frac{2}{20}\)

Aman’s sacrifice ratio = \(\frac{2}{5}-\frac{1}{4}=\frac{8-5}{20}=\frac{3}{20}\)

Sacrifice ratio of Akash and Aman = \(\frac{2}{20}\) : \(\frac{3}{30}\) i.e. 2 : 3.

Benefits of Goodwill of ₹ 2,250 distributed and transferred to Akash’s Capital A/c and Aman’s Capital A/c in their sacrifice ratio (which is 2 : 3).

Goodwill credited to Akash’s Capital = 2,250 × \(\frac{2}{3+2}\) = ₹ 900

and Aman’s Capital = 2,250 × \(\frac{3}{5}\) = ₹ 1,350.

2. Debit balance of Revaluation of ₹ 17,955 indicates Loss on revaluation.

Division of Revaluation Loss:

Akash = 17,955 × \(\frac{3}{3+2}\) = ₹ 10,773

and Aman = 17,955 × \(\frac{2}{5}\) = ₹ 7,182.

3. Balance in Cash A/c at the end = 13,800 + 3,000 + 2,250 = ₹ 19,050.

It is shown on the Assets side of the Balance sheet.

![]()

4. R.D.D. = 5 % on value of Debtors = \(\frac{5}{100}\) × 94,500 = ₹ 4,725.

Amount of R.D.D. is first debited to Revaluation A/c and then deducted from the value of Debtors on the Assets side of Balance Sheet.

5. Division of General Reserve:

Akash = \(\frac{3}{5}\) × 15,000 = ₹ 9,000

and Aman = \(\frac{2}{5}\) × 15,000 = ₹ 6,000.