Balbharti Maharashtra State Board Class 10 Maths Solutions covers the Problem Set 4B Algebra 10th Class Maths Part 1 Answers Solutions Chapter 4 Financial Planning.

10th Standard Maths 1 Problem Set 4B Chapter 4 Financial Planning Textbook Answers Maharashtra Board

Class 10 Maths Part 1 Problem Set 4B Chapter 4 Financial Planning Questions With Answers Maharashtra Board

Financial Planning Class 10 Problem Set 4b

Question 1.

Write the correct alternative for the following questions.

i. If the Face Value of a share is ₹ 100 and Market value is ₹ 75, then which of the following statement is correct?

(A) The share is at premium of ₹ 175

(B) The share is at discount of ₹ 25

(C) The share is at premium of ₹ 25

(D) The share is at discount of ₹ 75

Answer:

(B)

ii. What is the amount of dividend received per share of face value ₹ 10 if dividend declared is 50%.

(A) ₹ 50

(B) ₹ 5

(C) ₹ 500

(D) ₹ 100

Answer:

Dividend = 10 × \(\frac { 50 }{ 100 } \) = ₹ 5

(B)

iii. The NAV of a unit in mutual fund scheme is ₹ 10.65, then find the amount required to buy 500 such units.

(A) 5325

(B) 5235

(C) 532500

(D) 53250

Answer:

(A)

iv. Rate of GST on brokerage is _______

(A) 5%

(B) 12%

(C) 18%

(D) 28%

Answer:

(C)

v. To find the cost of one share at the time of buying the amount of Brokerage and GST is to be ______ MV of share.

(A) added to

(B) subtracted from

(C) Multiplied with

(D) divided by

Answer:

(A)

Problem Set 4b Algebra Class 10 Question 2. Find the purchase price of a share of FV ₹ 100 if it is at premium of ₹ 30. The brokerage rate is 0.3%.

Solution:

Here, Face Value of share = ₹ 100,

premium = ₹ 30, brokerage = 0.3%

MV = FV + Premium

= 100 + 30

= ₹ 130

Brokerage = 0.3% of MV

= \(\frac { 0.3 }{ 100 } \) × 130 = ₹ 0.39

Purchase price of a share = MV + Brokerage

= 130 + 0.39

= ₹ 130.39

Purchase price of a share is ₹ 130.39.

Question 3.

Prashant bought 50 shares of FV ₹ 100, having MV ₹ 180. Company gave 40% dividend on the shares. Find the rate of return on investment.

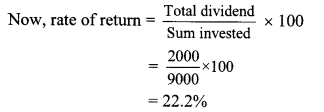

Solution:

Here, Number of shares = 50, FV = ₹ 100,

MV = ₹ 180, rate of dividend = 40%

∴ Sum invested = Number of shares × MV

= 50 × 180

= ₹ 9000

Dividend per share = 40% of FV

= \(\frac { 40 }{ 100 } \) × 100

Dividend = ₹ 40

∴ Total dividend on 50 shares = 50 × 40

= ₹ 2000

∴ Rate of return on investment is 22.2%.

Question 4.

Find the amount received when 300 shares of FV ₹ 100, were sold at a discount of ₹ 30.

Solution:

Here, FV = ₹ 100, number of shares = 300,

discount = ₹ 30

MV of 1 share = FV – Discount

= 100 – 30 = ₹ 70

∴ MV of 300 shares = 300 × 70

= ₹ 21,000

∴ Amount received is ₹ 21,000.

Question 5.

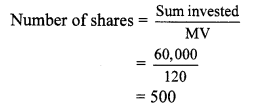

Find the number of shares received when ₹ 60,000 was invested in the shares of FV ₹ 100 and MV ₹ 120.

Solution:

Here, FV = ₹ 100, MV = ₹ 120,

Sum invested = ₹ 60,000

∴ Number of shares received were 500.

Question 6.

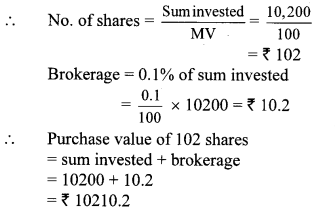

Smt. Mita Agrawal invested ₹ 10,200 when MV of the share is ₹ 100. She sold 60 shares when the MV was ₹ 125 and sold remaining shares when the MV was ₹ 90. She paid 0.1% brokerage for each trading. Find whether she made profit or loss? and how much?

Solution:

For purchasing shares:

Here, sum invested = ₹ 10,200, MV = ₹ 100

For selling shares:

60 shares sold at MV of ₹ 125.

∴ MV of 60 shares = 125 × 60

= ₹ 7500

Brokerage = \(\frac { 0.1 }{ 100 } \) × 7500 = ₹ 7.5

∴ Sale value of 60 shares = 7500 – 7.5 = ₹ 7492.5

Now, remaining shares = 102 – 60 = 42

But 42 shares sold at MV of ₹ 90.

∴ MV of 42 shares = 42 × 90 = ₹ 3780

∴ Brokerage = \(\frac { 0.1 }{ 100 } \) × 3780 = ₹ 3.78

∴ Sale value of 42 shares = 3780 – 3.78 = ₹ 3776.22

Total sale value = 7492.5 + 3776.22 = ₹ 11268.72

Since, Purchase value < Sale value

∴ Profit is gained.

∴ Profit = Sale value – Purchase value

= 11268.72 – 10210.2

= ₹ 1058.52

∴ Smt. Mita Agrawal gained a profit of ₹ 1058.52.

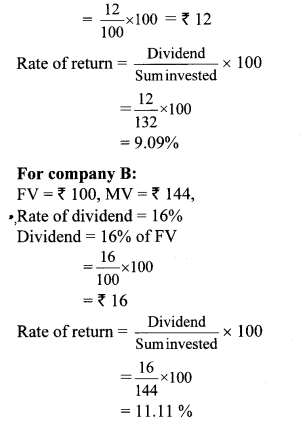

Question 7. Market value of shares and dividend declared by the two companies is given below.

Face value is same and it is 7 100 for both the shares. Investment in which company is more profitable?

i. Company A – ₹ 132,12%

ii Company B – ₹ 144,16%

Solution:

For company A:

FV = ₹ 100, MV = ₹ 132,

Rate of dividend = 12%

Dividend = 12% of FV

∴ Rate of return of company B is more.

∴ Investment in company B is more profitable.

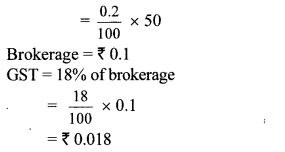

Question 8. Shri. Aditya Sanghavi invested ₹ 50,118 in shares of FV ₹ 100, when the market value is ₹ 50. Rate of brokerage is 0.2% and Rate of GST on brokerage is 18%, then How many shares were purchased for ₹ 50,118?

Solution:

Here, FV = ₹ 100, MV = ₹ 50

Purchase value of shares = ₹ 50118,

Rate of brokerage = 0.2%, Rate of GST = 18%

Brokerage = 0.2% of MV

∴ 1000 shares were purchased for ₹ 50,118.

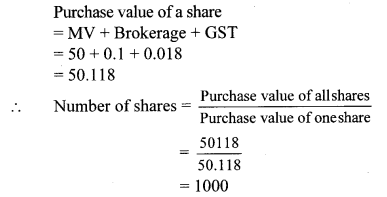

Question 9. Shri. Batliwala sold shares of ₹ 30,350 and purchased shares of ₹ 69,650 in a day. He paid brokerage at the rate of 0.1% on sale and purchase. 18% GST was charged on brokerage. Find his total expenditure on brokerage and tax.

Solution:

Total amount = sale value + Purchase value

= 30350 + 69650

= ₹ 1,00,000

Rate of Brokerage = 0.1 %

Brokerage = 0.1 % of 1,00,000

= \(\frac { 0.1 }{ 100 } \) × 1,00,000

= ₹ 100

Rate of GST = 18%

∴ GST = 18 % of brokerage

= \(\frac { 18 }{ 100 } \) × 100

∴ GST = ₹ 18

Total expenditure on brokerage and tax

= 100 + 18 = ₹ 118

∴ Total expenditure on brokerage and tax is ₹ 118.

Alternate Method:

Brokerage = 0.1 %, GST = 18%

At the time of selling shares:

Total sale amount of shares = ₹ 30,350

Brokerage = 0.1% of 30,350

For purchasing shares:

Total purchase amount of shares = ₹ 69,650

Brokerage = 0.1% of 69,650

= \(\frac { 0.1 }{ 100 } \) × 69650

= ₹ 69.65

GST = 18% of 69.65

= \(\frac { 18 }{ 100 } \) × 69.65

= ₹ 12.537

∴ Total expenditure on brokerage and tax = Brokerage and tax on selling + Brokerage and tax on purchasing

= (30.35 + 5.463) + (69.65 + 12.537)

= ₹ 118

∴ Total expenditure on brokerage and tax is ₹ 118.

Question 10. Sint. Aruna Thakkar purchased 100 shares of FV 100 when the MV is ₹ 1200. She paid brokerage at the rate of 0.3% and 18% GST on brokerage. Find the following –

i. Net amount paid for 100 shares.

ii. Brokerage paid on sum invested.

iii. GST paid on brokerage.

iv. Total amount paid for 100 shares.

Solution:

Here, FV = ₹ 100,

Number of shares = 100, MV = ₹ 1200

Brokerage = 0.3%, GST = 18%

i. Sum invested = Number of shares × MV

= 100 × 1200 = ₹ 1,20,000

∴ Net amount paid for 100 shares is ₹ 1,20,000.

ii. Brokerage = 0.3% of sum invested

= \(\frac { 0.3 }{ 100 } \) × 1,20,000 = ₹ 360

∴ Brokerage paid on sum invested is ₹ 360.

iii. GST = 18% of brokerage

= \(\frac { 18 }{ 100 } \) × 360 = ₹ 64.80

∴ GST paid on brokerage is ₹ 64.80.

iv. Total amount paid for 100 shares

= Sum invested + Brokerage + GST

= 1,20,000 + 360 + 64.80

= ₹ 1,20,424.80

∴ Total amount paid for 100 shares is ₹ 1,20,424.80.

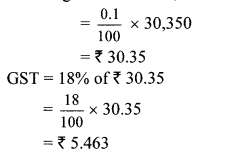

Question 11. Smt. Anagha Doshi purchased 22 shares of FV ₹ 100 for Market Value of ₹ 660. Find the sum invested. After taking 20% dividend, she sold all the shares when market value was ₹ 650. She paid 0.1% brokerage for each trading done. Find the percent of profit or loss in the share trading. (Write your answer to the nearest integer)

Solution:

For purchasing shares:

Here, FV = ₹ 100, MV = ₹ 660, Number of shares = 22, rate of brokerage = 0.1%

Sum invested = MV × Number of shares

= 660 × 22

= ₹ 14,520

Brokerage = 0.1 % of sum invested

= \(\frac { 0.1 }{ 100 } \) × 14520 = ₹ 14.52

∴ Amount invested for 22 shares

= Sum invested + Brokerage

= 14520 + 14.52

= ₹ 14534.52

For dividend:

Rate of dividend = 20%

∴ Dividend per share = 20 % of FV

∴ Percentage of profit in the share trading is 1 % (nearest integer).

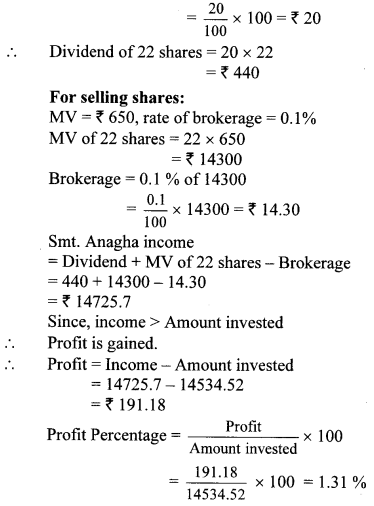

Alternate Method:

For purchasing share:

Here, FV = ₹ 100, MV = ₹ 660, Number of shares = 22, rate of brokerage = 0.1%

Sum invested = MV × Number of shares

= 660 × 22

= ₹ 14,520

Brokerage = 0.1 % of MV

= \(\frac { 0.1 }{ 100 } \) × 660 = ₹ 0.66

Amount invested for 1 share = 660 + 0.66

= ₹ 660.66

For dividend:

Rate of dividend = 20%

Dividend = 20% of FV = \(\frac { 20 }{ 100 } \) × 100 = ₹ 20

For selling share:

MV = ₹ 650, rate of brokerage = 0.1%

Brokerage = 0.1 % of MV

= \(\frac { 0.1 }{ 100 } \) × 650 = ₹ 0.65 100

Amount received after selling 1 share

= 650 – 0.65 = 649.35

∴ Amount received including divided

= selling price of 1 share + dividend per share

= 649.35 + 20

= ₹ 669.35

Since, income > Amount invested

∴ Profit is gained.

∴ profit = 669.35 – 660.66 = ₹ 8.69

Profit Percentage = \(\frac { 8.69 }{ 660.66 } \) × 100= 1.31%

∴ Percentage of profit in the share trading is 1 % (nearest integer).

Class 10 Maths Digest