Correspondence with Members 12th Secretarial Practice Chapter 6 Solutions Maharashtra Board

Balbharti Maharashtra State Board Class 12 Secretarial Practice Solutions Chapter 6 Correspondence with Members Textbook Exercise Questions and Answers.

Class 12 Secretarial Practice Chapter 6 Exercise Solutions

1A. Select the correct answer from the options given below and rewrite the statements.

Question 1.

Directors are the ____________

(a) paid employee of the company

(b) representatives of the shareholders

(c) creditors of the company

Answer:

(b) representatives of the shareholders

Question 2.

The dividend is to be paid to the shareholders within ____________ days from the date of declaration.

(a) 30

(b) 40

(c) 20

Answer:

(a) 30

![]()

Question 3.

Registered shareholders receive dividend through ____________ warrant.

(a) share

(b) debenture

(c) dividend

Answer:

(c) dividend

Question 4.

Shares issued free of cost to the shareholders are known as ____________ shares.

(a) preference

(b) equity

(c) bonus

Answer:

(b) equity

Question 5.

Share Certificate should be ready for delivery by the company within ____________ months after the allotment of shares.

(a) 3

(b) 5

(c) 2

Answer:

(c) 2

Question 6.

Secretarial correspondence with members should be ____________

(a) lengthy

(b) shortcut

(c) prompt and precise

Answer:

(c) prompt and precise

Question 7.

Dividend is recommended by ____________

(a) Board of Directors

(b) shareholders

(c) Depositors

Answer:

(a) Board of Directors

![]()

Question 8.

Dividend is paid out of ____________ of the company.

(a) Capital

(b) Building Fund

(c) Profit

Answer:

(c) Profit

Question 9.

____________ is issued by the company to its registered shareholders after the declaration of dividend at the Annual General Meeting of the company.

(a) Dividend Warrant

(b) Interest Warrant

(c) Share Warrant

Answer:

(a) Dividend Warrant

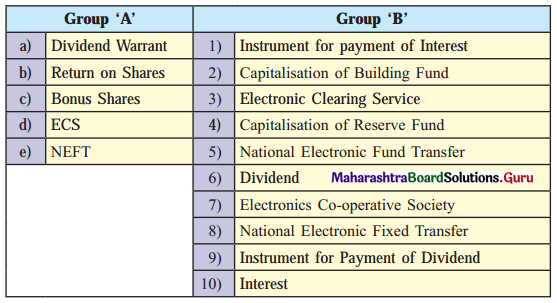

1B. Match the pairs.

Question 1.

Answer:

| Group ‘A’ | Group ‘B’ |

| (a) Dividend Warrant | (9) Instrument for Payment of Dividend |

| (b) Return on Shares | (6) Dividend |

| (c) Bonus Shares | (4) Capitalisation of Reserve Fund |

| (d) ECS | (3) Electronic Clearing Service |

| (e) NEFT | (5) National Electronic Fund Transfer |

1C. Write a word or term or a phrase which can substitute each of the following statements.

Question 1.

Shares given free of cost to the existing equity shareholders.

Answer:

Bonus shares

Question 2.

Instrument for payment of dividend.

Answer:

Dividend Warrant

Question 3.

The shareholders to whom the bonus shares are issued.

Answer:

Equity shareholders

Question 4.

The authority which recommends the rate of dividend.

Answer:

Board of Directors

![]()

Question 5.

An officer who comes into contact with all the members of the company through correspondence.

Answer:

Secretary

Question 6.

A special kind of cheque issued by a company on its banker to pay certain sum of money as dividend to its members.

Answer:

Dividend warrant

1D. State whether the following statement are True or False.

Question 1.

Bonus shares are issued to existing equity shareholders.

Answer:

True

Question 2.

Building fund is used for issue of bonus shares.

Answer:

False

Question 3.

Bonus shares means capitalisation of reserve fund.

Answer:

True

Question 4.

Registered shareholder gets dividend through dividend coupons.

Answer:

True

Question 5.

Dividend is the portion of the profits of the company which is allotted to the holders of the debentures of the company.

Answer:

True

![]()

Question 6.

Every company must issue or dispatch a share certificate to the allottee within three months after allotment of shares.

Answer:

False

Question 7.

A complaint letter should not be replied promptly.

Answer:

True

1E. Find the odd one.

Question 1.

Secrecy, Dividend, Interest

Answer:

Secrecy

Question 2.

Bonus Letter, Dividend Letter, Board of Directors

Answer:

Board of directors

Question 3.

Dividend Warrant, Interest Warrant, Demat

Answer:

Demat

![]()

Question 4.

Secretary, Board of Directors, Dividend, Lucid Language

Answer:

Lucid Language

1F. Complete the sentences.

Question 1.

Dividend is recommended by ____________

Answer:

Board of Directors

Question 2.

A company capitalises its Reserve Fund for issue of ____________ shares.

Answer:

Bonus

Question 3.

Payment of dividend must be made within ____________ days of its declaration.

Answer:

30

Question 4.

Dividend is approved by the ____________ in the Annual General Meeting.

Answer:

Shareholders

![]()

Question 5.

The ____________ has to communicate the decisions of the management to the members by conducting correspondence.

Answer:

Secretary

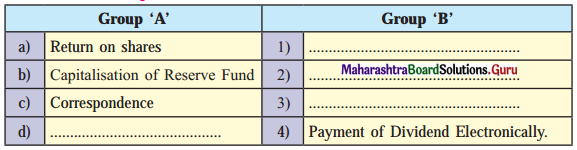

1G. Select the correct option from the bracket.

Question 1.

(Written communication, Bonus shares, Dividend, ECS)

Answer:

| Group ‘A’ | Group ‘B’ |

| (a) Return on shares | (1) Dividend |

| (b) Capitalisation of Reserve Fund | (2) Bonus shares |

| (c) Correspondence | (3) Written communication |

| (d) ECS | (4) Payment of Dividend Electronically |

1H. Answer in one sentence.

Question 1.

What is dividend warrant?

Answer:

Dividend warrant is written order given by the company to its banker to pay amount mentioned in it to the shareholder whose name is specified therein.

Question 2.

What is capitalization of reserve?

Answer:

Capitalization of reserves is the use of corporate reserves to pay a bonus to the shareholders in the form of additional shares.

Question 3.

What is Dividend?

Answer:

Dividend is the portion of profits of the company which is distributed to the shareholders of the company.

![]()

Question 4.

Who recommends the rate of dividend?

Answer:

The Board of Directors of the company recommends the rate of dividend.

Question 5.

Which type of shareholders enjoys the benefit of Bonus Shares?

Answer:

Equity share holders enjoy the benefit of bonus shares.

Question 6.

What is meant by payment of dividend electronically?

Answer:

Payment of dividend electronically means transfer of dividend amount through ECS (Electronic Clearing Service) NEFT(National Electronic Fund Transfer) etc.

1I. Correct the underlined word and rewrite the following sentences.

Question 1.

Dividend is recommended by shareholders.

Answer:

Dividend is recommended by shareholder.

Question 2.

The person who purchases shares of the company is called Depositor.

Answer:

The person who purchases shares of the company is called shareholder.

Question 3.

Bonus shares are issued as a free gift to the preference shareholders.

Answer:

Bonus shares are issued as a free gift to the equity shareholders.

![]()

Question 4.

Payment of dividend must be made within 21 days of its declaration.

Answer:

Payment of dividend must be made within 30 days of its declaration.

Question 5.

A company must issue the Share Certificate within three months of allotment of shares.

Answer:

A company must issue the Share Certificate within two months of allotment of shares.

1J. Arrange in proper order.

Question 1.

(a) Allotment of shares

(b) Application for shares

(c) Share certificate

Answer:

(a) Application for shares

(b) Allotment of shares

(c) Share certificate

Question 2.

(a) Member

(b) Applicant

(c) Bonus shares

Answer:

(a) Applicant

(b) Member

(c) Bonus shares

2. Explain the following terms/concepts.

Question 1.

Capitalisation of Reserve

Answer:

Capitalisation of reserves is the use of corporate reserves to pay a bonus to the shareholders in the form of additional shares. It is distributed to equity shareholders in pre-determined ratio.

![]()

Question 2.

Bonus Shares

Answer:

Bonus shares are fully paid up shares given by a company as a gift out of its accumulated profits or reserves to the existing equity share holders in proportion of shares held by them. It is given free of cost and also known as capitalization of reserves.

Question 3.

Dividend Warrant

Answer:

Dividend warrant is written order given by the company to its banker to pay amount mentioned in it to the shareholder whose name is specified therein. Dividend can be paid through Dividend warrant or by means of electronic mode ECS or NEFT etc. to those shareholders who are registered members i.e their names appear in the Register of members.

3. Answer in brief.

Question 1.

Which precautions are to be taken by the Secretary while corresponding with members?

Answer:

The Secretary has to communicate the decisions of the Management and other information to the members through correspondence. The Secretary should be very cautious and careful while corresponding with members of the company. Writing letters to the members is a challenging task and it requires skills, knowledge and techniques.

Following are the precautions that are needed to be taken by the secretary while writing different letters on different occasions:

(i) Correct Information:

The Secretary should always provide correct, up- to date and factual information to the members. Due care should be taken while giving facts and figures.

(ii) Lucid Language:

The Secretary must use simple words and sentences and adopt convincing style while writing letters to the members. The use of simple language makes it easy to understand. Technical words, long sentences should be avoided in the letter.

(iii) Prompt Response:

The Secretary must be prompt in sending replies to the letters received from the members. Any questions or queries raised by the members must be replied promptly by the Secretary. Complaint letters should be attended to without any delay.

(iv) Secrecy:

The Secretary should not disclose any confidential information of the company to the members. The Secretary should tactfully answer letters without giving any secret information of the company.

![]()

(v) Politeness (Courtesy):

A courteous letter shows sympathy, respect mutual understanding and consideration for the receiver. Use of courteous language means using polite words. A complaint letter should be replied politely. Rude language should be strictly avoided as it spoils image of the company.

(vi) Legal matters:

The Secretary should compulsorily follow provisions of the Companies Act, 2013 with latest amendments and other relevant laws. If necessary, secretary should consult with legal advisor on certain matters before drafting.

(vii) Consideration:

The Secretary should give importance and consideration to the reader and write the contents keeping in mind the problems of the member. While sending negative replies, he should draft these letters more carefully, so that members should not be hurt. Secretary should make the member feel that the management honestly regrets refusal.

(viii) Image of the Company:

The Secretary should try to project good image of the company in every situation. While drafting the letters, Secretary has to try his best to remove their doubts, queries and difficulties in a polite and courteous manner.

Question 2.

What are the circumstances under which Secretary undertakes correspondence with members?

Answer:

The following are the various occasions when the Secretary writes the letters to the members of the company:

- Allotment Letter when shares are issued to an applicant.

- Letter of Regret when shares are not issued to an applicant for any reason.

- Letter for issue of Share Certificate to the allotted members.

- Letter for Payment of Dividend through Dividend Warrant or Electronic Payment of Dividend.

- Letter for issue of Bonus Shares or rights issue.

- Reply letter to the query of the member on low rate of dividend.

- Approval of Transfer of Shares after serving lodgement notice to the transferor as well as the transferee.

- Refusal of Transfer of Shares, if call money is unpaid or any lien.

- Notice and Agenda of General Meeting.

- Reply to certain queries raised by the members.

- Letters to legal representatives regarding Transmission of Shares.

- Notice of loss of Share Certificate.

![]()

4. Justify the following statements.

Question 1.

The Company Secretary should take certain precautions while corresponding with members.

Answer:

- The Secretary has to communicate the decisions of the management and other information to the members through correspondence and hence, should be very cautious and careful while corresponding with members of the company. The Secretary should take precautionary measures while writing the letter by giving due respect to the members, and also provide complete and correct information techniques.

- The Secretary should always provide correct, up- to date and factual information to the members.

- The language used should be simple and convincing.

- The Secretary must be prompt in sending replies to the letters received from the members.

- He should compulsorily follow provisions of the Companies Act, 2013 with latest amendments and other relevant laws.

- The Secretary should try to project good image of the company in every situation.

- Thus, it is rightly said that, the Company Secretary should take certain precautions while corresponding with members.

Question 2.

There are certain circumstances when a Secretary has to correspond with members.

Answer:

- Secretary correspond with members on behalf of the company.

- Secretary acts as a link between the company and its members.

- When the shares are allotted to the members they are been informed through the allotment letter. Similarly, if the application of shares has been rejected then members are been informed by the regret letter.

- Secretary also informs members through letters on various occasions like issue of share certificate, payment of dividend, issue of bonus share, reply to the query raised by the member, etc.

- Thus, it is rightly said that, there are certain circumstances when a Secretary has to correspond with members.

5. Attempt the following.

Question 1.

Write a letter to the shareholder regarding issue of Bonus Shares.

Answer:

YASH INDUSTRIES LIMITED

Registered Office: 102, New MIDC, Usha Tower, Shahu Chowk, Mumbai – 400 031.

CIN : L40407 MH 2005 PLC710007

Tel. No.: 022-23252323

Fax No.: 022-23600445

Ref. No.: Y/MR-B/5/19-20

Website: www.yashindustrieslimited.com

Email: yash30@gmail.com

Date: 16th October, 2019

Ms. Yukta Shroff

715, Narayan Peth,

Laxmi Road,

Pune – 411 038.

Sub.: Issue of Bonus Shares

Dear Madam,

I am directed by the Board of Directors to inform you that in accordance with the resolution passed in the Extra-ordinary General Meeting of the company held on 14th October, 2019, shareholders have unanimously approved the recommendation of Board of Directors to issue Bonus Shares. Bonus Shares are issued in the ratio of 1:1, i.e. one additional equity share for every equity share held as on 13th October, 2019.

The Details of issue of Bonus Shares are as follows:

| 1 | 2 | 3 | 4 | 5 |

| No. of Shares held on record date | No. of Bonus Shares Issued/Allotted | D.P. ID No. Credited to Demat Account No. | Client ID No. Credited to Demat Account No. | Date of Credit to Demat A/c |

| 25 | 25 | IN 300100 | 10116061 | 31-10-2019 |

The Company has complied with the provisions for the issue of Bonus Shares.

The Bonus Shares issued will rank pari passu /equal with the existing equity shares.

Thanking you,

Yours faithfully,

For Yash Industries Limited

Sign

(Mr. S. R. Naik)

Company Secretary

Question 2.

Write a letter to the member for the issue of Share Certificate.

Ans.

COMFORT MOTORS LTD.

Registered Office : A/30, Aurora Towers, M. G. Road, Camp, Pune 411 012.

CIN : U12111 MH 2000 PCL300477

Tel. No.: 020-80032844

Fax No.: 020-50063015

Ref. No.: C/MR-SC/30/19-20

Website: www.comfortmotorsltd.com

Email: comfort31@gmail.com

Date: 12th November, 2019

Mr. Jayant Modi

Abhiman Apartment

30, L. B. Road,

Pune-411 001.

Sub.: Issue of Share Certificate

Dear Sir,

As per your Request Application No. 50, I am, hereby, authorized by the Board to issue you a Share Certificate. The said Share Certificate will be delivered to you within 15 days from the date of this letter by registered post to your registered address as mentioned in the Register of Members.

| 1 | 2 | 3 | 4 | |

| Folio No. | Share Certificate Numbers | Distinctive Numbers | Total No. of Shares | |

| From | To | |||

| 1006 | 9630 | 301 | 400 | 100 |

It shall always be our endeavor/attempt to provide best of our services to you.

Thanking you,

Yours faithfully,

For Comfort Motors Ltd.

Sign

Mr. Anand Swami

Company Secretary

![]()

Question 3.

Write a letter to the member for the payment of dividend through Dividend Warrant.

Answer:

ANMOL STEEL INDUSTRIES LIMITED

Registered Office : 30, Anmol Niwas, J. M. Road, Nariman Point, Mumbai – 400 020.

CIN : L30408 MH 2003 PLC110845

Tel. No.: 022-97675877

Fax No.: 022-30010331

Ref. No.: A/MR-D/7/19-20

Website: www.anmolindustrieslimited.com

Email: anmol5@gmail.com

Date: 7th May, 2019

Mrs. Jyoti Surti 12, Laxmi Niwas,

Amrapali Marg, Bandra,

Mumbai – 400 050.

Sub.: Payment of Dividend on Equity Shares

(Equity Shares of ₹ 10 each at par)

Dear Madam,

As per the instructions issued by the Board of Directors it is being conveyed to you that in the, Final Dividend @ ₹ 2.5 per equity share of ₹ 10/- each has been approved by the members for the year ending 31st March, 2019 in the 31st Annual General Meeting held on 20th April, 2019.

Your company has complied with all the statutory provisions (Sec. 123 of the Companies Act. 2013) relating to declaration of dividend. Details of dividend payable to you are as follows:

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

| Register Folio No. | No. of Shares held | Distinctive Numbers | Dividend Warrant No. | Gross Dividend | Income Tax Deducted (TDS) | Net Dividend | |

| From | To | ||||||

| A-30 | 100 | 301 | 400 | B-9931 | Rs.250/- | NIL | 250/- |

The ‘Dividend Warrant’ is attached herewith. Please detach the ‘Dividend Warrant’ along the perforated line.

Thanking you,

Yours faithfully,

For Anmol Steel Industries Limited.

Sign

Secretary

Encl.: Dividend Warrant

Question 4.

Write a letter to the member for the payment of Interim dividend electronically.

Answer:

GURUSAI AUTO LIMITED

Registered Office: 31, Tulsi Complex, Lodhi Road, Camp, Pune – 411 001.

CIN : L40103 MH 1999 PLC300477

Tel. No.: 020-24032844

Fax No.: 020-24356101

Ref. No.: S/MR-D/12/19-20

Website: www.gurusailimited.com

Email: sai31@gmail.com

Date: 3rd June, 2019

Mr. Jay ant Modi

15, Sagar Apartment,

Van Vihar Road,

Pune-411 030.

Sub.: Payment of Interim Dividend through Electronic Clearing Service (ECS), Direct Credit/NEFT

Dear Sir,

We are pleased to inform you that the Board of Directors of Gurusai Auto Limited in its meeting held on Thursday, 28th May 2019 has declared Interim Dividend @ ₹ 1/- (i.e. 10%) per equity share of face value of ₹ 10/- each.

As per the instructions given by you (either in person or through Depository Participant), we have remitted the amount of the Interim Dividend to your Banker for crediting your Bank Account, for electronic transfer. Your company has complied with all the provisions relating to declaration and payment of dividend.

Details of Dividend payable to you are given below:

| 1 | 2 | 3 | 4 | 5 | 6 |

| No. of Equity Shares held on Record Date (May 31st, 2019) | Dividend Per Share (₹) | Dividend Amount (₹) | DPID and Client ID No. | Date of Remittance | Bank A/c. (Bank of Baroda) |

| 500 | 1 | 500 | 12033 200074 79005 | 6th June, 2019 | 5656000 22105 (Bank of Baroda) |

Please verify the credit of amount in your Pass Book/Statement of accounts.

As per the provisions of the Income Tax Act, 1961 no tax is required to be deducted at source in respect of Dividend payment, but dividend Distribution Tax has been paid by the Company.

Thanking you,

Yours faithfully,

For Gurusai Auto Limited.

Sign

(Mr. Jitesh M. Gandhi)

Company Secretary

![]()

Question 5.

Draft a reply letter resolving the query of the member on the low rate of dividend.

Answer:

SHREE CEMENT INDUSTRIES LIMITED

Registered Office: 31, Tulsi Tower, Bandra (East), Mumbai – 400 050

CIN : L50307 MH 2000 PLC160699

Tel. No.: 022-24245025

Fax No.: 022-45456035

Ref. No.: S/MR-D/25/19-20

Website: www.shreecementindustriesltd.com

Email: shree3@gmail.com

Date: 20th April, 2019

Ms. Kishor Malpani

15/21, Lotus Apt.,

Borivali (W),

Mumbai – 400 103.

Sub.: Resolving Query on Low Rate of Dividend made by the Company.

Dear Sir,

This is to inform you that as per your letter dated 15th April, 20191 am, hereby, authorized to resolve your query regarding the low rate of dividend paid by the company to their faithful members. The reasons for the low rate of dividends are mentioned below:

- During the last year, due to the floods, the company’s factory situated at Mahim (E) was not in a condition | to operate in a full-fledged manner.

- Due to such unavoidable circumstances of natural disaster company faced huge financial losses.

- Hence, the Board of Directors has decided to transfer 12.5 crores to General Reserves which is 50%; more than the amount transferred to Reserves last year.

Hope you will be satisfied by the above information as provided by the company. We assure you that the company will easily come over from such unavoidable circumstances and will deliver/pay/declare much better! dividend in the coming years.

Thanking you,

Yours faithfully,

For Shree Cement Industries

Sign

(Mr. Suhas Bajaj)

Company Secretary

Maharashtra State Board 12th Std Secretarial Practice Textbook Solutions

- Introduction to Corporate Finance Class 12 Secretarial Practice Textbook Solutions

- Sources of Corporate Finance Class 12 Secretarial Practice Textbook Solutions

- Issue of Shares Class 12 Secretarial Practice Textbook Solutions

- Issue of Debentures Class 12 Secretarial Practice Textbook Solutions

- Deposits Class 12 Secretarial Practice Textbook Solutions

- Correspondence with Members Class 12 Secretarial Practice Textbook Solutions

- Correspondence with Debentureholders Class 12 Secretarial Practice Textbook Solutions

- Correspondence with Depositors Class 12 Secretarial Practice Textbook Solutions

- Depository System Class 12 Secretarial Practice Textbook Solutions

- Dividend and Interest Class 12 Secretarial Practice Textbook Solutions

- Financial Market Class 12 Secretarial Practice Textbook Solutions

- Stock Exchange Class 12 Secretarial Practice Textbook Solutions