Balbharti Maharashtra State Board Class 12 Economics Important Questions Chapter 8 Public Finance in India Important Questions and Answers.

Maharashtra State Board 12th Economics Important Questions Chapter 8 Public Finance in India

1. A. Choose the correct option:

Question 1.

Optional functions of Government.

(a) Protection from external attack.

(b) Provision of education and health services.

(c) Provision of social security measures.

(d) Collection of tax.

Options :

(1) b and c

(2) a, b and c

(3) b,c and d

(4) All of the above

Answer:

(1) b and c

![]()

Question 2.

Public finance is……………..

(a) one of the old branches of economics, which highlights the role of government

(b) a study of the principles of income and expenditure of the government

(c) also a part of the study of political science

(d) less elastic in supply

Options :

(1) a and b

(2) a, b and c

(3) a and d

(4) b, c and d

Answer:

(2) a, b and c

Question 3.

Non tax revenue includes

(a) Prices of public goods and services

(b) Gifts, Grants and Donations

(c) Goods and Service Tax (GST)

(d) Fines and penalties

Options :

(1) a, b and d

(2) a, b and c

(3) b and d

(4) a and c

Answer:

(1) a, b and d

Question 4.

The examples of revenue expenditure …………..

(a) administration cost of the government

(b) huge investments in different developmental projects

(c) salaries, allowances and pensions of government employees

(d) medical and public health services

Options :

(1) a, b and c

(2) a and b

(3) c and d

(4) a, c and d

Answer:

(4) a, c and d

Question 5.

Reasons for growth in public expenditure.

(a) increase in the activities of the government

(b) rapid increase in population

(c) spread of democracy

(d) industrial development

Options :

(1) a, b and c

(2) b, c and d

(3) a, c and d

(4) a, b, c and d

Answer:

(4) a, b, c and d

(B) Complete the Correlation .

(1) Direct Tax : Wealth Tax :: …………….. : Excise Duty

(2) High degree of credit: Public finance:: Limited Credit: ……………..

(3) Expenditure on education : Developmental expenditure :: War expenditure :……………..

(4) Internal debt : Government borrows from its citizens :: …………….. : Government borrows from World Bank

(5) Surplus budget : Government Receipts Government Expenditure:: ……………..: Government Receipts Government Expenditure

(6) Optional function : Provision of social security :: ……………..: Protection from external attacks

(7) Progressive Tax : Tax rate increases with . increase in income :: ………………. : Tax rate decreases with rise in income :

(8) Old age pension : Revenue expenditure :: Investment in machines : ……………….

Answers:

- indirect tax

- Private finance

- Non-developmental expenditure

- External debt

- Deficit budget

- Obligatory function

- Regressive Tax

- Capital expenditure

(C) Give economic terms.

(1) The expenditure which is incurred by the public authority for promoting social and economic welfare.

Answer:

Public Expenditure

(2) A financial statement showing the expected receipts and proposed expenditure of the government in a financial year.

Answer:

Budget

(3) A compulsory contribution to the government by a person without receiving any direct or proportionate benefit in return.

Answer:

Tax

(4) Borrowings of the government from financial institutions within the country.

Answer:

Internal Debt

(5) The financial policy implemented by the government which deals with public expenditure, public revenue and public debt.

Answer:

Fiscal Policy

(6) The type of budget where estimated revenue and expenditure of the government are equal.

Answer:

Balanced Budget

(7) The aggregate collection of income with the government through various sources.

Answer:

Public revenue

(8) It is paid by the tax payer on his income and property.

Answer:

Direct Tax

(9) It is a category of tax which is levied at the same and constant rate on all income.

Answer:

Proportionate tax

(10) Revenue received by the government administration, other than taxes.

Answer:

Non Tax Revenue

(D) Find the odd word out.

(1) Fees, Fines and penalties, Excise duty, Special levy.

Answer:

Excise duty

(2) Revenue expenditure, Capital expenditure, Labour expenditure, Developmental expenditure

Answer:

Labour expenditure

(3) Public expenditure, Public park, Public revenue, Public debt.

Answer:

Public park

(4) Service tax, Entry tax, Entertainment tax, Wealth tax

Answer:

Wealth tax

(5) R.B.I, Foreign Banks, IMF, World Bank

Answer:

R.B.I.

(6) Deficit budget, Zero budget, Balanced budget, Surplus budget

Answer:

Zero budget

(7) Inflation, Depression, Rising prices, Reduce purchasing power

Answer:

Depression

(8) Earthquakes, Floods, Cyclones, Social unrest

Answer:

Social unrest

(9) Public health, Social welfare, Spread of education, Donations

Answer:

Donations

(10) Defence, Infrastructure, Registration fees, Health care

Answer:

Registration fees

(E) Complete the sentences .

Question 1.

Obligatory function of the government includes …………..

(a) provision of education and health services ?

(b) maintaining internal law and order

(c) provision of social security

(d) construction of public park and garden

Answer:

(b) maintaining internal law and order

Question 2.

There is a continuous growth in public expenditure

(a) only because of growing population

(b) only because of increase in defence expenditure

(c) only due to inflation

(d) due to all the above mentioned factors

Answer:

(d) due to all the above mentioned factors

Question 3.

Capital expenditure of the government is ……………

(a) pensions of government employees

(b) administration cost of the government

(c) investment in different developmental projects

(d) war expenditure

Answer:

(c) investment in different developmental projects

Question 4.

The expenditure which results in generation of employment is

(a) development expenditure

(b) non-development expenditure

(c) revenue expenditure

(d) capital expenditure

Answer:

(a) development expenditure

Question 5.

Tax is paid by a tax payer because .

(a) he gets good benefits of it

(b) it is owner’s pride and neighbour’s envy

(c) it is a compulsory contribution to the government

(d) he gets good publicity

Answer:

(c) it is a compulsory contribution to the government

Question 6.

Direct tax is paid by the tax-payer .

(a) on sale and purchase of a commodity

(b) on his income and property

(c) which is levied on goods and services

(d) and shifted to other person

Answer:

(b) on his income and property

Question 7.

In case of regressive tax, the larger the income of a tax-payer.

(a) smaller is the proportion of tax levied

(b) tax is levied at the constant rate

(c) greater is the proportion of tax levied

(d) zero tax is levied

Answer:

(a) smaller is the proportion of tax levied

Question 8.

Special assessment, fines and penalties are examples of

(a) direct tax

(b) indirect tax

(c) non-tax revenue

(d) tax revenue

Answer:

(c) non-tax revenue

Question 9.

External debt of the government means

(a) loans from IMF, World bank, etc.

(b) borrowings from the citizens of a country

(c) borrowings from financial institutions in a country

(d) borrowings from Reserve Bank of India

Answer:

(a) loans from IMF, World bank, etc.

Question 10.

The capital budget consists of

(a) capital receipts and revenue receipts

(b) tax revenue and non-tax revenue

(c) revenue receipts and revenue expenditure

(d) capital receipts and capital payments

Answer:

(d) capital receipts and capital payments

(F) Choose the wrong pair :

I.

| Group ‘A’ | Group ‘B’ |

| 1. Direct Tax | (a) Wealth tax |

| 2. Hugh Dalton | (b) Definition of public finance |

| 3. GST | (c) Non-tax revenue |

| 4. External Debt | (d) Foreign Government |

Answer:

(3) – c

II.

| Group ‘A’ | Group ‘B’ |

| 1. Revenue expenditure | (a) Administration cost of Government |

| 2. Capital expenditure | (b) Repayment of Government loan |

| 3. Development expenditure | (c) Expenditure on education |

| 4. Non- developmental expenditure | (d) Expenditure on social welfare |

Answer:

(4) – d

III.

| Group ‘A’ | Group ‘B’ |

| 1. Balanced budget | (a) Advocated by Adam Smith |

| 2. Public revenue | (b) expenditure of the government |

| 3. A deficit budget | (c) useful in depression period |

| 4. Surplus budget | (d) Receipts > Expenditure |

Answer:

(2) – b

![]()

(F) Choose the right group of pairs :

I.

| Group ‘A’ | Group ‘B’ |

| 1. Budget | (a) Simplifying tax system |

| 2. Financial administration | (b) Use of foreign currency |

| 3. External debt | (c) Annual financial statement |

| 4. GST | (d) Implementation of revenue |

Options :

(a) (1) – d, (2) – c, (3) – b, (4) – a

(b) (1) – c, (2) – d, (3) – a, (4) – b

(c) (1) – d, (2) – c, (3) – a, (4) – b

(d) (1) – d, (2) – b, (3) – c, (4)-a

Answer:

(c) (1) – d, (2) – c, (3) – a, (4) – b

II.

| Group ‘A’ | Group ‘B’ |

| 1. Fines and Penalties | (a) Use of domestic currency |

| 2. Tax | (b) Violation of the law |

| 3. internal debt | (c) French word |

| 4. Bougette | (d) Major source of government revenue |

Options : (a) (1) – c, (2) – b, (3) – d, (4) – a

(b) (1) – b, (2) – d, (3) – a, (4) – c

(c) (1) – b, (2) – c, (3) – d, (4) – a

(d) (1) – d, (2) – c, (3) – a, (4) – b

Answer:

(b) (1) – b, (2) – d, (3) – a, (4) – c

III.

| Group ‘A’ | Group ‘B’ |

| (1) Budget | (a) Simplifying tax system |

| (2) Financial administration | (b) Use of foreign currency |

| (3) External debt | (c) Annual financial statement |

| (4) GST | (d) Implementation of revenue |

Options :

(a) (1) – c, (2) – d, (3) – b, (4) – a

(b) (1) – c, (2) – b, (3) – a, (4) – d

(c) (1) – b, (2) – c, (3) – d, (4) – a

(d) (1) – d, (2) – c, (3) – b, (4)-a

Answer:

(a) (1) – c, (2) – d, (3) – b, (4) – a

2.[A] Identify and explain the concept from given illustrations.

Question 1.

internal law and order to avoid social unrest.

Answer:

Concept: Obligatory Function.

Explanation : Obligatory functions are those functions which must be performed by government for socio-economic welfare and to avoid social unrest and to establish social justice in a country.

Question 2.

Sanjay paid charges to traffic police for jumping signal.

Answer:

Concept: Fine and penalty

Explanation : The government imposes fines and penalties on those who violate the laws of a country.

Traffic police charges fine and collects money for violating traffic rule.

The objective of taking fine is to discourage the citizens from violating the laws framed by government.

Question 3.

Government of India takes loan from World Bank for Mumbai Metro Train.

Answer:

Concept: External Debt

Explanation : When the government borrows from foreign government or international organisations like IMF, World Bank, etc., it is known as external debt.

Government needs to raise loan for investing in developmental project of a country.

Mumbai Metro Train is a project which require huge investment.

So, Government of India takes loan from World Bank.

Question 4.

Prachi can spend only ₹ 80,000/- though her income is one lakh per month.

Answer:

Concept: Disposable Income

Explanation : Disposable income refers to income which remains with a person after deducting income tax from total personal income.

So, Disposable Income = Total Personal Income – Direct Taxes (income tax)

It indicates actual spending capacity of a person.

Every person is legally bound to pay income tax because it is compulsory to the government.

Question 5.

Government of India borrowed from nationalized bank for construction of bridge.

Answer:

Concept: Internal debt

Explanation : When the government borrows from its citizens or nationalized banks, it is called internal debt.

It means borrowing within a country, for development of infrastructure facilities in a country.

Provision of infrastructure like roads, bridge energy supply, etc., require huge investment.

So, government borrows money in form of internal debt from RBI, nationalized banks or citizens of a country.

Question 6.

Jyoti purchased furniture from mall and paid tax on it.

Answer:

Concept: GST (Goods and Service Tax)

Explanation : GST is a comprehensive tax base with nationwide coverage of goods and services.

It came into effect in India from 1st July, 2017.

It is a tax on goods and services. GST simplified the tax system in a country.

(B) Distinguish between

Question 1.

Deficit Budget and Balanced Budget.

Answer:

Deficit Budget:

- When the government revenue is less than government expenditure, it is called a Deficit Budget.

- Deficit Budget would lead to increase in aggregate demand.

- Deficit Budget leads to flow of money from the government to the economy.

- It is suitable for government when the economy suffers from depression.

- The policy of deficit budget would lead to increase in employment, investment, etc.

Balanced Budget:

- When the government revenue is equal to government expenditure, it is called a Balanced Budget.

- Balanced Budget would not affect the aggregate demand in the economy.

- The flow revenue of the government is equal to meet the expenditure of the government.

- It is not possible to introduce a balanced budget under present circumstances.

- The balanced budget policy is called “Sound Finance” where the government performs only minimum functions.

Question 2.

Government Revenue (income) and Government Expenditure.

Answer:

Government Revenue (income):

- Government income refers to the revenue of the government from different sources including tax revenue, non-tax revenue, administrative revenue etc.

- E.g. Tax revenue including Direct and Indirect Tax.

- Non-tax revenue include profit from government enterprise administrative revenue like fees, fines, penalties.

- Generally government income results in transfer of purchasing power from people to government.

- Surplus income with government indicates sound financial background.

Government Expenditure:

- Government expenditure refers to the expenditure by government to perform various functions and duties.

- E.g. Revenue expenditure on health, education, defence and administration.

- Capital expenditure on roads, railways, dams, machinery and public enterprise.

- Government expenditure leads to transfer of purchasing power from government to people.

- Massive expenditure indicates more welfare to people.

![]()

Question 3.

Revenue Budget and Capital Budget.

Answer:

Revenue Budget:

- Revenue Budget consists of

(1) Revenue Receipts

(2) Revenue Expenditure - It explains how revenue is generated by government and how it is allocated among various expenditure heads.

- Revenue receipts consists of

(1) Tax Revenue

(2) Non-Tax Revenue - Revenue expenditure includes developmental and non – developmental expenditure of Central Government.

- Revenue Receipts do not create any liability of the government.

- Revenue expenditure does not lead to the creation of assets.

Capital Budget:

- Capital Budget consists of

(1) Capital Receipts

(2) Capital Expenditure - It deals with the capital aspect.

- Capital receipts consists of

(1) Borrowing

(2) Recovery of loans

(3) Disinvestment, small savings - Capital expenditure includes expenditure on land and building machinery, investment in shares, loans granted by Central Government to State.

- Capital receipt create a liability of the government.

- Capital expenditure leads to the creation of assets.

Question 4.

Surplus Budget and Balanced Budget.

Answer:

Surplus Budget:

- A Surplus Budget is that type of budget in which the estimated revenue is greater than the estimated expenditure.

- Government raises tax revenue which is more than what is required for meeting the expenditure.

- Surplus budget would lead to reduction in aggregate demand.

- It is suitable for families and not favoured for government.

- The policy of Surplus Budget would lead to unemployment and recession in the economy. ‘

Balanced Budget:

- Balanced Budget is a type of budget in which the estimated revenue of the government is equal to estimated expenditure of the government.

- Government raises revenue to such an extent which is just sufficient to meet the expenditure.

- Balanced budget would not affect the aggregate demand in the economy.

- It is not possible to introduce a balanced budget under present circumstances.

- The balanced budget policy is called ‘Sound Finance’ where the government performs only minimum function.

Question 5.

Deficit Budget and Surplus Budget.

Answer:

Deficit Budget:

- A deficit budget is one in which estimated expenditure exceeds estimated revenue.

- It leads to flow of money from government to the economy and increases aggregate demand.

- It is suitable for governments especially when the economy suffers from depression.

- The policy of deficit budget would lead to employment and revival of economic activities.

- Deficit budget is not desirable during inflation.

Surplus Budget:

- A surplus budget is a budget in which estimated revenue are greater than estimated expenditures.

- It leads to flow of money from economy to government and lead to decrease in aggregate demand.

- It is suitable for individuals and families but not favoured for government.

- The policy of surplus budget would lead to unemployment and recession due to low investment.

- Surplus budget is advocated during inflation to reduce demand and prices by imposing high taxes.

Question 6.

Revenue Expenditure (Budget) and Capital Expenditure (Budget).

Answer:

Revenue Expenditure (Budget):

- Revenue expenditure of the government refers to expenses incurred on day-to-day functioning of the government.

- It is recurring in nature as it is incurred regularly.

- E.g. administration cost, salary, allowances, pensions of the government employees, etc.

- It does not create any asset to government.

Capital Expenditure (Budget):

- Capital expense of the government refers to expenses incurred for the development of a country.

- It is not recurring in nature as it does not incur regularly.

- E.g. investment in different developmental projects, loans granted to state government, repayment of loan, etc.

- It makes addition to the assets of the economy.

Question 7.

Obligatory functions of Government and Optional functions of Government.

Answer:

Obligatory functions of Government

- Obligatory functions are those functions which must be performed by government, by making adequate provision of resources.

- Obligatory functions are given first priority, as they are compulsory functions.

- Obligatory functions are mainly performed by public authority for the protection of their citizen.

Optional functions of Government:

- Optional functions of government are those functions which may be undertaken by government if funds permit.

- Optional functions are given second priority, as they are called discretionary functions.

- Optional functions are performed by central, state and local government for promoting economic activities and social welfare.

![]()

Question 8.

Tax revenue and Non-tax revenue.

Answer:

Tax revenue:

- Tax revenue refers to revenue received by the government through various taxes.

- Tax revenue comes from direct tax, i,e. income tax, wealth tax and indirect tax, i.e,, G.S.T.

- Tax is a major source of revenue to the government.

- Tax revenue particularly direct tax is collected to reduce economic inequality.

Non-tax revenue:

- Non-tax revenue refers to revenue received by the government from various sources, other than taxes.

- Non-tax revenue comes from fines and penalties, fees, gifts, grants, donations, borrowings, special levy, etc.

- Non- tax revenue is not a major source of revenue to the government.

- Non-tax revenue, particularly special levy, fines and penalties, etc. are collected to discourage the citizens from violating the law.

3. Answer the following questions:

Question 1.

Explain non-tax sources of revenue of the government.

Answer:

Non-tax revenue refers to the revenue received by the government from various , sources other than taxes.

The sources of non-tax revenue are as follows:

1. Fees : It refers to charges paid, in return for certain specific services rendered by the government. E.g. fees paid for registration of house, car, education fees, etc.

2. Prices of Public Goods and Services : Various types of goods and services are produced, supplied and sold by modern government to the citizens. It; is added to public revenue when people s purchase them and pay their prices.

3. Special Assessment : It is special kind of tax, which is levied by local government on the residents of a particular area. In exchange of it, government provides some special facilities to them.

4. Fines and Penalties : It is imposed by government on those who violate the laws of the country.

E.g. a traffic police charges fine and collects money if someone violates traffic rule. The objective behind collection of fines and penalties is not to earn money but to discourage the people from violating the laws framed by the government It is small source of income.

5. Gifts, Grants and Donations : The government receives gifts from its citizens and others. It is included in public revenue. The government may also get grants from foreign government and institutions for general and specific purposes.

Foreign aid is also an important form of public revenue for developing country like India. However, this source of revenue is uncertain in nature.

6. Special Levies : It refers to the charges levied by government on those commodities, whose consumption is harmful to human health.

Special levies are paid for using commodities like wine, opium and other intoxicants. Special levy is imposed, not to earn income, but to discourage the people from using harmful products.

7. Borrowings: Government borrows to raise fund because government expenditure generally exceeds government revenue, in a welfare state.

When government borrows from foreign government or international organisations, it is known as external debt. It is more popular source of public revenue for investment in development of projects. Thus, public revenue in form of non-tax sources play very important role in socio economic development of a country.

Question 2.

Explain the classification of public expenditure.

OR

Explain the budget expenditure of the government.

Answer:

Public expenditure is an important aspect which is incurred by the public authority (central, state and local government). Public expenditure is required for the protection of the citizens of a country, for satisfying social needs or collective needs and for promoting social and economic welfare of the people in a country.

Classification of public expenditure is as under:

(1) Revenue expenditure : It is the expenditure of the government to carry out day-to-day functions. It is recurring in nature. It does not create any assets to government It consists of administrative expenditure, interest payment, pensions and salaries to government employees, etc.

(2) Capital expenditure : It refers to the expenditure of the government for the development of a country.

It consists of huge investment in different developmental projects, repayment of government loans, investment on land, building, machines, etc.

It is non-recurring in nature

(3) Developmental expenditure : The expenditure which results in generation of employment and price stability, it is known as developmental expenditure.

It consists of expenditure on education, social welfare, industrial development, etc. It leads to an increase in production. It is s productive in nature.

(4) Non-developmental expenditure : It is that government expenditure which does not yield any direct productive impact on the economy. It is mainly in form of expenses on administration costs, war expenses, etc. It is unproductive in nature. It is observed that, since last 30 years, there is a tremendous growth in the total public expenditure of a country because modern government performs many functions for the social and economic development of a country.

Question 3.

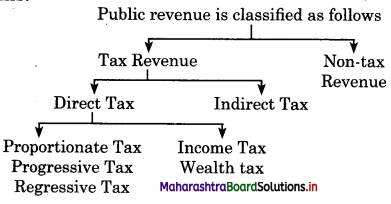

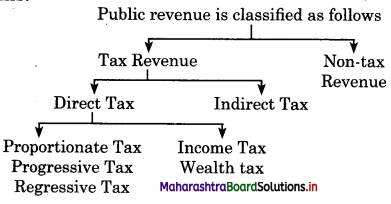

Explain the structure of Tax-revenue of the government.

Answer:

Tax is a major source of revenue to the Government

According to Prof. Taussig, “The essence of a tax as distinguished from other charges by government is the absence of a direct ‘quid pro quo’ (benefit) between the tax payer and the public authority. ”

Prof. Seligman states that, “a tax is a compulsory contribution from a person to the government, without reference to special benefits confessed. ”

Thus, every citizen of a country is legally bound to pay tax.

Tax is imposed on income, property or commodities and services.

Types of Taxes :

(1) Direct Tax : It is paid by the tax payer on his income and property. A tax-payer cannot transfer the burden of direct tax to others.

Impact and incidence of direct tax falls on the same person. E.g. Income tax, wealth tax, etc.

Direct taxes are further classified into three categories.

(i) Proportionate tax (ii) Progressive tax (iii) Regressive tax

(2) Indirect Tax : It is levied on goods and services. It is paid at the time of production or sale and purchase of a commodity or a service.

The burden of indirect tax can be shifted by the tax-payer (producers) to other persons. Hence, impact and incidence of tax are on others. E.g. GST.

Thus, major share of public revenue is the contribution by tax revenue in India.

Question 4.

Explain GST (Goods and Service Tax) in detail.

Answer:

The GST (Goods and Service Tax) came into effect in India on 1st July, 2017.

It was proposed by the Kelkar Task Force on Implementation of the Fiscal Responsibility and Budget Management (FRBM) Act in July, 2004.

GST is an indirect tax used in India on the supply of goods and services.

GST is comprehensive because it has replaced almost all indirect taxes like excise duty, entertainment tax, entry tax, etc.

GST is classified as follows :

- Central Goods and Service Tax (CGST) : It is a tax levied on interstate supplies of both goods and services by the central government which will be governed l by CGST Act.

- State Goods and Service Tax (SGST): It is received by the state in which the goods and services are consumed and not by the state where they are manufactured.

- Integrated Goods and Service Tax (IGST) : It is a tax levied on all interstate supplies of goods and services which will be governed by the IGST Act.

Benefits of GST :

- Comprehensive tax base with nation wide coverage of goods and services.

- Boost to foreign investments and export.

- Encouragement to manufacturing ‘Make in India’ campaign.

- Improvement in investment atmosphere in a country.

- Tax system in a country simplified.

- Generating more employment and poverty eradication.

Question 5.

Explain the term public debt with its types.

Answer:

Public debt policy of the government plays an important role in public finance.

Public debt refers to borrowings of the government Raising debt loan is the most common activity of a government because in a welfare state, government expenditure generally exceeds government revenue.

Public debt is classified into two types : –

(1) Internal debt : It refers to borrowings of the government to raise fund within the economy. In case of internal debt, domestic currency is used. It is less complex to manage internal debt. E.g. borrowings from RBI, nationalized banks and business organisations within a country.

(2) External debt : It refers to borrowings of the government to raise fund outside the economy. In case of external debt, foreign currency is used. It is more complex to manage external debt. E.g. borrowings from foreign government and international organisation like IMF, World Bank, etc. Government requires fund for investing in production as well as for making provision of infrastructure facilities.

Thus, public debt is more popular source of revenue for the government in the modern times.

![]()

Question 6.

Explain the developmental and non-developmental expenditures of the government.

Answer:

Developmental expenditure : The expenditure which results in generation of employment and price stability, it is known as developmental expenditure.

It consists of expenditure on education, social welfare, industrial development, etc. It leads to an increase in production. It is s productive in nature.

Non-developmental expenditure : It is that government expenditure which does not yield any direct productive impact on the economy. It is mainly in form of expenses on administration costs, war expenses, etc. It is unproductive in nature. It is observed that, since last 30 years, there is a tremendous growth in the total public expenditure of a country because modern government performs many functions for the social and economic development of a country.

Question 7.

Explain the importance of budget.

Answer:

Importance of Budget:

Budget is important in number of ways.

- Tax rates presented in the budget indicates disposable income of the tax payer. It also determines the development of business and individuals.

- Government expenditure is also a part of budget. This public expenditure on defence, administration, infrastructure, education, health care, etc. affects the lives of the citizens and overall economy.

- Government uses budget as a medium for implementing economy policies in the country.

- Budgetary actions of the government affect production size and distribution of income, utilization of human and material resources of the country.

Thus, implementing suitable budgetary policy is very important for overall development of the economy.

4. State with reasons whether you agree or disagree with the following statements:

Question 1.

Tax is a major source of government revenue.

Ans. Yes, I agree with this statement.

One of the important and major source of public revenue is the tax revenue. A tax is a compulsory payment made by the citizens of the country to the government without any direct quid pro-quo. It implies that a tax has to be paid by all people and it does not involve any corresponding obligation on the part of the government i.e., government need not repay anything. Taxes are of two types (1) Direct Tax (2) Indirect Tax.

Question 2.

In Surplus budget, government revenue is greater than government expense.

Ans. Yes, I agree with this statement.

Surplus budget implies that government’s expected revenue is greater than government’s proposed expenditure.

When there is too much inflation, the government can adopt the policy of surplus budget.

In order to curb inflation, government increases revenue by levying taxes on people.

This reduces the disposable income of people and also consumption.

Since governments spending will be less than its income, aggregate demand will decrease and which will help to reduce the price and control inflation.

Question 3.

For the period of depression, deficit budget is prepared.

Answer:

Yes, I agree with this statement.

Deficit budget is one where the estimated government expenditure is more than the l expected revenue.

Normally developing countries have deficit budget.

During depression, it is used as a stabilizing tool to control economic fluctuation.

Recession occurs mainly due to lack of effective demand.

So increase in government expenditure tends to increase the income of people.

As a result, the aggregate demand increases, which will help in reducing unemployment and expanding the economic activities in the economy.

Therefore, for the period of depression deficit budget is prepared. s

Question 4.

The surplus budget creates inflationary pressure in the economy.

Answer:

No, I do not agree with this statement.

The deficit budget creates inflationary pressure in the economy.

Deficit Budget is one where the estimated government expenditure is more than expected revenue.

In order to meet the deficit, the government generally resorts to (a) borrowings from Central Bank (b) borrowings from

Commercial Banks (c) issue of new currency of the government.

This leads to increased supply of money.

As the government spend this money, there is excess supply of money without corresponding increase in the production of goods and services in short period.

As a result the prices of goods and services begin to rise.

Thus, the deficit budget creates inflationary pressure in the economy.

Question 5.

Revenue receipts and revenue expenses are known as revenue budget.

Answer:

Yes, I agree with this statement.

Revenue Budget explains how revenue is generated by the government and how it is allocated among various expenditure heads. Revenue receipts of government refers to income, which is received by government from all sources i.e., tax and non-tax revenue. These receipts do not create a liability. Revenue expenditure is the expenditure incurred for the normal running of government departments and various services.

They neither create any asset nor cause reduction in any liability of the government. E.g. expenditure on defence, police, medical public health, education, transport, etc.

Question 6.

Public finance and Private finance are same.

No, I do not agree with this statement.

There is a difference between public finance and private finance.

Public Finance : Public finance refers to income an expenditure of public authorities. The objective of public finance is to offer maximum social advantage. More credit is available in the market to increase public finance. The supply of public finance is more elastic. In case of public finance, government first determines the volume and different ways of it’s expenditure.

Private Finance : Private finance refers to income and expenditure of individual and private sector organisations. The objective of private finance is to fulfil private interest. Credit availability is limited to increase private finance. The supply of private finance is less elastic. In case of private finance, an individual considers income first and then determines the volume of expenditure.

Question 7.

There is a continuous growth in public expense in India.

Answer:

Yes, I agree with this statement.

In a developing country like India, public expense is continuously increasing.

The modern government has to perform many obligatory as well as optional functions for the social and economy development of a country.

These functions include spread of education, public health, public works, infrastructure facilities, public recreation, social welfare schemes, protection of a country, industrial development, etc.

Old functions are being performed more efficiently and new functions are added i continuously.

In addition to this, many natural and man made calamities occur frequently. So, government has to spend a huge amount for ; disaster management.

So, there is a continuous growth in the public expense in India.

Question 8.

During the period of inflation, surplus budget is advisable.

Answer:

Yes, I agree with this statement.

During inflationary period, price of commodities rises rapidly.

This rise in price can be controlled by lowering the level of effective demand in the economy.

This can be done by increasing taxes which will automatically reduce the purchasing power of the people, which will result in fall of aggregate demand.

The fall in aggregate demand will lead producers and sellers to reduce the price of l their products to increase their sale.

Thus, inflationary pressure is controlled by adopting surplus budget.

![]()

5. Study the following table figures passages and answer the following :

1.

| Trends in Public Expense | ||

| Sr. No. | Year | Total Expense (Rs. in crores) |

| 1 | 1991-92 | 72,317 |

| 2 | 2001-02 | 3,62,450 |

| 3 | 2005-06 | 5,06,123 |

| 4 | 2009-10 | 10,24,487 |

| 5 | 2015-16 | 11,95,025 |

| 6 | 2016-17 | 13,74,203 |

| 7 | 2017-18 | 14,35,233 |

| 8 | 2018-19 | 17,29,682 |

Question 1.

What was the total public expense in the year 2009-10?

Answer:

In the year 2009-10, the total public expense was ? 10,24,487 crores.

Question 2.

Calculate the difference between public expense of 1991-92 to 2001-02.

Ans. The difference between public expense of 1991-92 and 2001-02 is ? 2,90,133 crore (3,62,450 – 72,317).

Question 3.

Observe the trends in public expense from 2015 to 2019.

Ans. The year 2018-19 shows greater trend in public expense.

Question 4.

What is the tendency of trends in public expense, shown in the given table?

Ans. The given table shows that, there is a tremendous growth in the total public expense of the country over the period of time.

(2) Read the given passage and answer the questions :

“The conventional notion of social security is that the government would make periodic payments to look after people in their old age, ill-health, disability and poverty. This idea should itself change from writing a cheque for the beneficiary to institutional arrangements to care for beneficiaries, including by enabling them to look after themselves, to a large extent.

The write-a-cheque model of social security is a legacy from the rich world at the optimal phase of its demographic transition, when the working population was numerals enough and earning enough to generate the taxes to pay for the care of those not working. This model is ill-suited for less, well-off India with growing life expectancy, increasing urbanization and resultant migration. Social security under urbanization will be different from social security in a static society.

Question 1.

State the conventional notion of social security.

Answer:

The conventional notion of social security is that the government would make periodic payments to look after people in their old age, ill-health, disability and poverty.

Question 2.

What kind of conceptual change is suggested in the given paragraph?

Answer:

The given paragraph suggests that, the idea should change from writing a cheque for the beneficiary to institutional arrangement to care for beneficiaries.

It will enable them to look after themselves to a large extent.

Question 3.

WTiat is a legacy of social security from the rich world?

Answer:

The write-a-cheque model of social security i is a legacy from the rich world.

Question 4.

Which features of India make the traditional model of social security illsuited for the economy?

Answer:

Growing life expectancy, increasing urbanization and resultant migration are the features of India that make the traditional model of social security ill suited for the economy.

6. Answer in detail:

Question 1.

Explain the various types of Government budget (Union budget).

Answer:

There are three types of government budget:

(1) Balanced Budget, (2) Surplus Budget and (3) Deficit Budget.

(1) Balanced Budget : Balanced budget is a situation in which estimated revenue of the government during the year is equal to its anticipated expenditure.

For individuals and families, it is always advisable to have a balanced budget, s Classical economist advocated Balanced

Budget, which was based on the policy of “live-with-in means”. According to them i government’s revenue should not fall short of expenditure.

They favoured balanced budget because they believed that government should not interfere in economic activities and should just concentrate on the maintenance of internal and external security and provision of basic economic and social overheads.

Till 1930 generally accepted norm was that of ‘Sound Finance’ which implied that public authority should balance its budget. But the great depression of 1930’s proved that Balanced Budget was not a guarantee of stability and full employment. It was then realised that the government can play an effective role in recovery of the economy. This is because if governments expenditure exceeds its revenue, it will generate additional demand which will accelerate the pace of economic growth. It was Keynes who gave a new approach to the budgetary policy, he replaced the norm of Balanced Budget with the norm of functional finance.

(2) Surplus Budget: A surplus budget implies when the expected government revenue is greater than proposed government expenditure.

Surplus budget shows the financial soundness of the government. When there is too much inflation, the government can adopt the policy of surplus budget as it reduces aggregate demand by spending less than its income.

In periods of inflation, although there is greater employment, there is also a tendency for prices to rise rapidly. This can be checked. The inflationary gap can be corrected by lowering the level of effective demand in the economy. It can be corrected by increasing taxes. This will reduce the purchasing power of the people but increase the revenue of the government. Thus aggregate demand will fall. The inflationary gap can be corrected by lowering the level of public expenditure.

When Government reduces its expenditure the revenue with government is in excess of its expenditure.

In modern times, governments responsibilities have increased. Surplus budget will mean that the government instead of spending for the welfare of the people is busy earning and accumulating wealth. Hence, surplus budget practically is non-existing.

3. Deficit Budget: Deficit budget is one where the estimated government expenditure is more than expected revenue. Today almost all the countries of the world follow deficit budget instead of surplus or balanced budget.

Deficit Budget solves the problem of recession and depression which occurs mainly due to lack of effective demand. Increase in total expenditure of the government, increases employment and income of the people. As a result, the aggregate demand for consumer goods increases. Increase in total expenditure tends to expand aggregate economic activity in the economy.

Question 2.

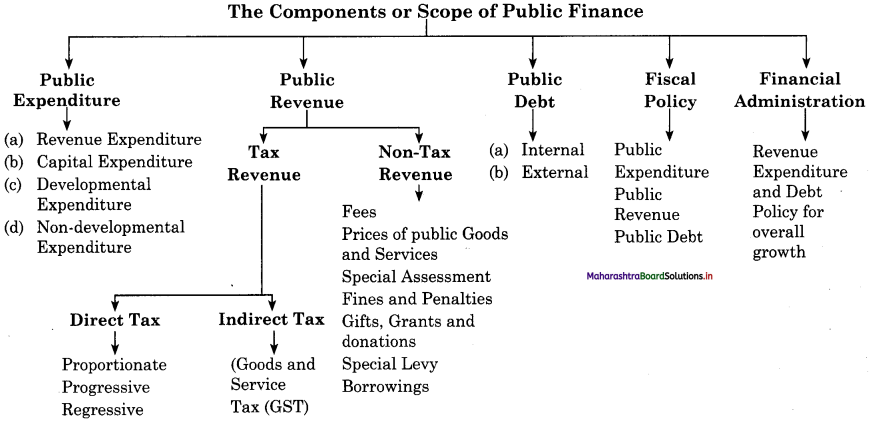

Explain components or scope of public finance in India.

OR

Explain the main components of budget.

Answer:

Public finance is one of the most important branches of economy. It highlights the role and functions of the government Government has to perform various functions like protection from external attack, generation of employment, protection of property, maintaining law and order, provision of collective needs, etc.

To perform these functions efficiently, any government needs finance which can be received from various sources.

Public finance deals with the study of principles of income and expense of the government.

The structure of public finance can be explained as follows:

The Components or Scope of Public Finance

(A) Public Expenditure : It refers to that expenditure which is incurred by the public authority (Central, State and Local Government) for promoting economic and social welfare of a country.

Public expenditure is classified as follows:

(a) Public Expenditure : It refers to expenditure on day-to-day functioning of the government. E.g. administration cost, salary allowances and pensions of government employees, etc.

It is incurred regularly but it does not create any assets to government.

(b) Capital Expenditure : It refers to the expenditure for the development of a country. E.g. investment by government in projects, provision of infrastructure, repayment of loan, etc. It does not incur regularly but it makes addition to the assets of the economy.

(c) Developmental Expenditure : It refers to that expenditure of the government, which gives productive impact to the economy.

It results into generation of employment, increase in production, etc.

(d) Non-developmental Expenditure : It refers to that government expenditure which does not yield any direct productive impact on the economy. E.g. war expenditure.

It is unproductive in nature.

![]()

(B) Public Revenue : It refers to aggregate collection of income with the government through various sources. They are classified as:

(a) Tax Revenue

(b) Non-tax Revenue

(a) Tax Revenue : There are two types of taxes collected by the government. They are as follows:

Direct tax : Direct tax is that tax which is paid by a person on whom it is legally s imposed. E.g. income tax, wealth tax, etc.

Direct tax can be proportionate – (constant rate of tax on all incomes), progressive (rate of tax increases with an increase in income) or regressive (rate of tax declines ) with rise in income. In India, we have progressive tax rate system.

Indirect tax : Indirect tax is that tax which ( is imposed on one person but can be paid by the other, e.g. GST.

A taxpayer cannot shift the burden of direct tax to others, however, in case of indirect tax, tax burden can be shifted to others.

(b) Non-tax Revenue : Non-tax revenue refers to the revenue received by the government from various sources other than taxes.

Public expenditure is an important aspect which is incurred by the public authority (central, state and local government). Public expenditure is required for the protection of the citizens of a country, for satisfying social needs or collective needs and for promoting social and economic welfare of the people in a country.

Classification of public expenditure is as under:

(1) Revenue expenditure : It is the expenditure of the government to carry out day-to-day functions. It is recurring in nature. It does not create any assets to government It consists of administrative expenditure, interest payment, pensions and salaries to government employees, etc.

(2) Capital expenditure : It refers to the expenditure of the government for the) development of a country.

It consists of huge investment in different developmental projects, repayment of government loans, investment on land, building, machines, etc.

It is non-recurring in nature

(3) Developmental expenditure : The expenditure which results in generation of employment and price stability, it is known as developmental expenditure.

It consists of expenditure on education, social welfare, industrial development, etc. It leads to an increase in production. It is s productive in nature.

(4) Non-developmental expenditure : It is that government expenditure which does not yield any direct productive impact on the economy. It is mainly in form of expenses on administration costs, war expenses, etc. It is unproductive in nature. It is observed that, since last 30 years, there is a tremendous growth in the total public expenditure of a country because modern government performs many functions for the social and economic development of a country.

(C) Public Debt:

Tax is a major source of revenue to the Government

According to Prof. Taussig, “The essence of a tax as distinguished from other charges by government is the absence of a direct ‘quid pro quo’ (benefit) between the tax payer and the public authority. ”

Prof. Seligman states that, “a tax is a compulsory contribution from a person to the government, without reference to special benefits confessed. ”

Thus, every citizen of a country is legally bound to pay tax.

Tax is imposed on income, property or commodities and services.

Types of Taxes :

(1) Direct Tax : It is paid by the tax payer on his income and property. A tax-payer cannot transfer the burden of direct tax to others.

Impact and incidence of direct tax falls on the same person. E.g. Income tax, wealth tax, etc.

Direct taxes are further classified into three categories.

(i) Proportionate tax (ii) Progressive tax (iii) Regressive tax

(2) Indirect Tax : It is levied on goods and services. It is paid at the time of production or sale and purchase of a commodity or a service.

The burden of indirect tax can be shifted by the tax-payer (producers) to other persons. Hence, impact and incidence of tax are on others. E.g. GST.

Thus, major share of public revenue is the contribution by tax revenue in India.

(D) Fiscal Policy : It is the means through s which government adjusts its spending’s c and tax rates. It helps to monitor and influence nation’s economy. It deals with public expenditure, public revenue and l public debt.

Thus, it is the financial policy implemented by the government.

(E) Financial Administration : It implies I an efficient implementation of revenue, external and debt policy of the government. It includes preparation and implementation of the government budget along with overall economic growth of a country.

![]()

Budgetary actions of the government affect production, size and distribution of income and utilization of material and human resources of a country. Thus, the scope of public finance is important in a modern economy.