Balbharti Maharashtra State Board 12th Commerce Book Keeping & Accountancy Important Questions Chapter 6 Dissolution of Partnership Firm Important Questions and Answers.

Maharashtra State Board 12th Commerce BK Important Questions Chapter 6 Dissolution of Partnership Firm

1. Objective Questions:

A. Select the most appropriate answer from the alternatives given below and rewrite the sentences.

Question 1.

_____________ means winding up of partnership firm.

(a) Dissolution

(b) Formation

(c) Retirement

(d) Death

Answer:

(a) Dissolution

Question 2.

When a partner takes over a liability, his Capital Account is _____________

(a) debited

(b) credited

(c) deducted

(d) none of these

Answer:

(b) credited

![]()

Question 3.

Dissolution expenses are debited to the _____________ Account.

(a) Profit and Loss

(b) Trading

(c) Capital

(d) Realisation

Answer:

(d) Realisation

Question 4.

The debit balance on Realisation A/c indicates _____________

(a) profit

(b) loss

(c) gain

(d) deficiency

Answer:

(b) loss

Question 5.

The partner who is unable to pay his liabilities is called an _____________ partner.

(a) solvent

(b) working

(c) insolvent

(d) sleeping

Answer:

(c) insolvent

Question 6.

Debit balance of insolvent Partner’s Capital Account is known as _____________

(a) capital deficiency

(b) capital surplus

(c) profit

(d) loss

Answer:

(a) capital deficiency

B. Give the word/term/phrase which can substitute each of the following statements.

Question 1.

The account records all realisable assets and external liabilities of the firm on dissolution.

Answer:

Realisation Account

Question 2.

The partner who bears capital deficiency of an insolvent partner.

OR

The person who bears insolvency loss of an insolvent partner.

Answer:

Solvent Partner

![]()

Question 3.

Account to which the ultimate unpaid balances on the outside liability accounts are transferred on dissolution.

Answer:

Deficiency Account

C. State whether the following statements are True or False with reasons.

Question 1.

The cash and bank balances are not transferred to the Realisation A/c.

Answer:

This statement is True.

Cash or bank balance are liquid assets. They cannot be sold or realised. The cash and/or bank balances are recorded in the Cash and/or Bank Account. All cash and/or bank transactions, at the time of Realisation, are recorded in the Cash and Bank Accounts. Therefore, Cash and Bank balances are not transferred to Realisation Account.

Question 2.

On dissolution, sundry debtors are transferred to Realisation A/c at their net figure.

Answer:

This statement is False.

On dissolution, sundry debtors are transferred to Realisation A/c at their Gross value book value and not at their net figure. R.D.D. which is deducted from debtors is not an asset and therefore R.D.D. is transferred to the credit side of Realisation A/c and the remaining debtors are transferred to the debit side of Realisation A/c.

Question 3.

On dissolution of the firm, the partner’s wife loan is transferred to Realisation A/c.

Answer:

This statement is True.

A loan taken from the partner’s wife is an external liability and it is a third party’s liability. So, the partner’s wife’s loan is transferred to Realisation A/c at the time of dissolution of the firm.

Question 4.

A liability that is not shown in the Balance Sheet on the date of dissolution cannot be repaid.

Answer:

This statement is False.

Liability of the firm which is not yet recorded in the book of accounts is called unrecorded liability. At the time of dissolution unrecorded liability is supposed to be paid though it is not shown in the Balance Sheet.

![]()

Question 5.

A debit balance of Realisation A/c indicates profit on realisation.

Answer:

This statement is False.

A debit balance of Realisation A/c means payment is more than the receipt. When payments exceed receipts there is a loss. Hence, debit balance on realisation account indicates loss on realisation and not profit.

D. Answer in one sentence only.

Question 1.

What is Realisation Account?

Answer:

An account that is opened by the firm at the time of its dissolution to determine profit or loss on realisation of assets and payment of liabilities is known as Realisation Account.

Question 2.

Why is the Realisation Account opened?

Answer:

Realisation Account is opened to find out profit or loss made on the sale of assets and discharge of liabilities of the partnership firm.

Question 3.

What are realisation or dissolution expenses?

Answer:

The expenses incurred by the firm to realise the assets and to liquidate the liabilities of the firm on its dissolution are called realisation or dissolution expenses.

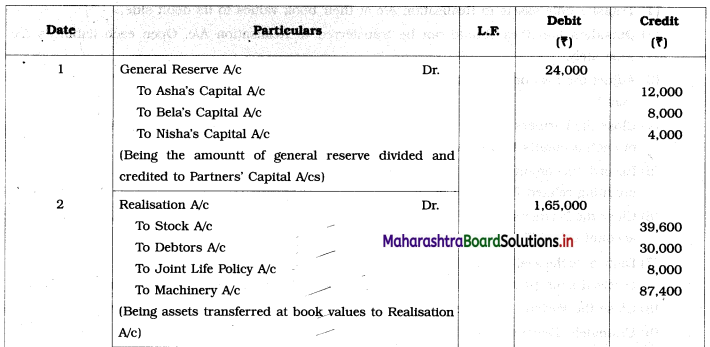

Solved Problem

Question 1.

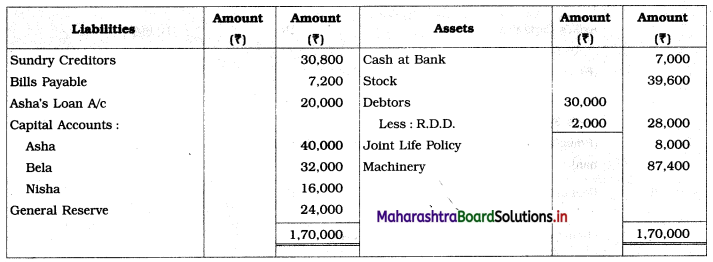

Asha, Bela, and Nisha were partners sharing profits and losses in the ratio of 3 : 2 : 1. On 31st March 2020 their Balance Sheet was as follows:

Balance Sheet as of 31st March 2020

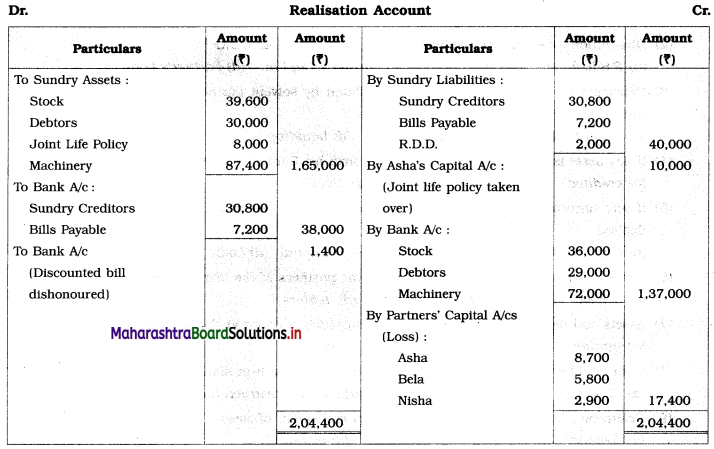

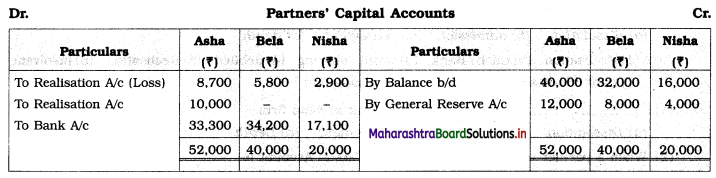

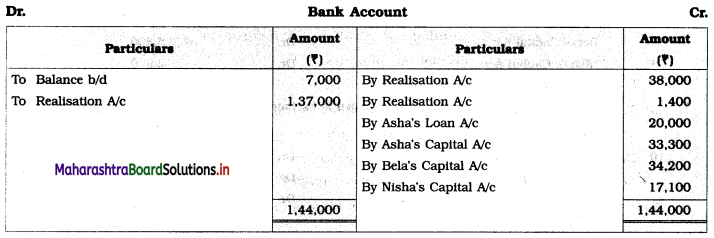

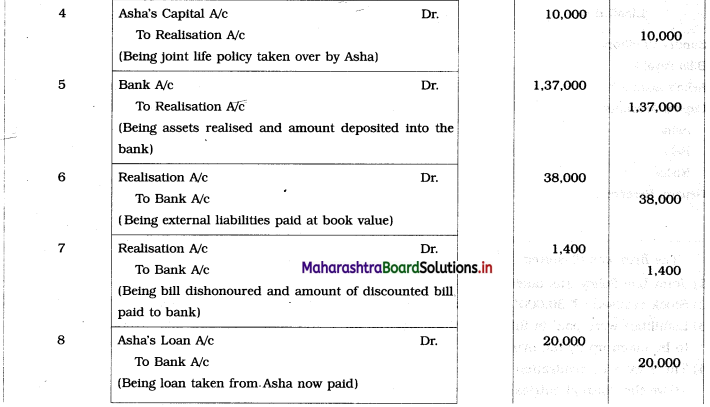

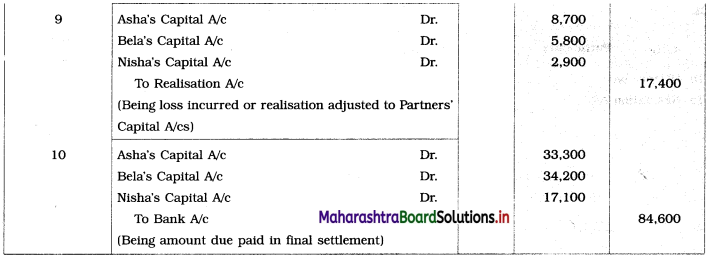

The firm was dissolved on 31st March 2020 and the assets realised as follows:

1. Joint Life Policy was taken over by Asha at ₹ 10,000.

2. Stock realised: ₹ 36,000, Debtors realised: ₹ 29,000, Machinery was sold for ₹ 72,000.

3. Liabilities were paid in full. In addition, one bill for ₹ 700 under discount was dishonoured and had to be taken up by the firm.

4. There were no realisation expenses.

Give the Journal entries and prepare necessary Ledger Accounts to close the books of the firm.

Solution:

In the Journal of Partnership Firm

Ledger Accounts:

In the books of Partnership Firm