Balbharti Maharashtra State Board 12th Commerce Book Keeping & Accountancy Important Questions Chapter 1 Introduction to Partnership and Partnership Final Accounts Important Questions and Answers.

Maharashtra State Board 12th Commerce BK Important Questions Chapter 1 Introduction to Partnership and Partnership Final Accounts

I. Objective Questions:

A. Select the most appropriate alternatives from the following & rewrite the sentences:

Question 1.

When dates of drawings are not given, interest on drawings is charged for _____________ months.

(a) three

(b) six

(c) nine

(d) twelve

Answer:

(b) six

Question 2.

A debit balance of the partner’s current account will appear on the _____________ side of the Balance Sheet.

(a) assets

(b) liabilities

(c) debit

(d) credit

Answer:

(a) assets

![]()

Question 3.

The interest on partner’s capital is credited to _____________ Account.

(a) Trading

(b) Profit and Loss

(c) Capital

(d) Cash

Answer:

(c) Capital

Question 4.

Under fixed capital method, salary or commission to partner is credited to _____________ Account.

(a) Partner’s Capital

(b) Partner’s Current

(c) Partner’s Drawings

(d) Partner’s Salary

Answer:

(b) Partner’s Current

Question 5.

If fixed capital method is adopted, net divisible profit is transferred to _____________ Account.

(a) Partner’s Current

(b) Partner’s Capital

(c) Profit and Loss

(d) Trading

Answer:

(a) Partner’s Current

Question 6.

A statement showing financial position of a business is called a _____________

(a) Balance Sheet

(b) Trial Balance

(c) Capital A/c

(d) Trading A/c

Answer:

(a) Balance Sheet

Question 7.

Wages paid for Installation of machinery should be debited to _____________ Account.

(a) Machinery

(b) Wages

(c) Trading

(d) Profit and Loss

Answer:

(a) Machinery

Question 8.

All indirect expenses are debited to _____________ Account.

(a) Trading

(b) Capital

(c) Profit and Loss

(d) Current

Answer:

(c) Profit and Loss

![]()

Question 9.

Return outwards are deducted from _____________

(a) Purchase

(b) Sales

(c) Capital

(d) Debtors

Answer:

(a) Purchase

Question 10.

Debit balance of Trading Account indicates _____________

(a) Gross Profit

(b) Gross Loss

(c) Net Profit

(d) Net Loss

Answer:

(b) Gross Loss

Question 11.

Credit balance of Profit and Loss Account indicates _____________

(a) Gross Profit

(b) Gross Loss

(c) Net Profit

(d) Net Loss

Answer:

(c) Net Profit

Question 12.

Income received in advance is shown on _____________ side of the Balance Sheet.

(a) Debit

(b) Credit

(c) Assets

(d) Liabilities

Answer:

(d) Liabilities

Question 13.

Amount irrecoverable from debtors is known as _____________

(a) discount

(b) bad debts

(c) allowance

(d) none of these

Answer:

(b) bad debts

Question 14.

Trading Account is prepared on the basis of _____________ expenses.

(a) indirect

(b) direct

(c) revenue

(d) capital

Answer:

(b) direct

![]()

Question 15.

Royalty paid on production is shown in the _____________

(a) Balance Sheet

(b) Trading A/c

(c) Profit and Loss A/c

(d) Partner’s Current Account

Answer:

(b) Trading A/c

Question 16.

Prepaid expenses are shown on the _____________ side of the Balance Sheet.

(a) Assets

(b) Liabilities

(c) Debit

(d) Credit

Answer:

(a) Assets

Question 17.

Advertisement expenditure to be written off yet will appear on the _____________ side of Balance Sheet.

(a) Debit

(b) Liabilities

(c) Assets

(d) Credit

Answer:

(c) Assets

Question 18.

_____________ is the list of all ledger balances.

(a) Balance Sheet

(b) Trial Balance

(c) Trading A/c

(d) Profit and Loss A/c

Answer:

(b) Trial balance

Question 19.

Final accounts are prepared on the basis of _____________ and adjustments.

(a) Trial balance

(b) Trading A/c

(c) Profit and Loss A/c

(d) Capital A/c

Answer:

(a) Trial balance

![]()

Question 20.

The personal medical bill of a partner paid from the business is known as _____________ of the partner.

(a) capital

(b) profit

(c) cash

(d) drawings

Answer:

(d) drawings

B. Write the word/phrase/term, which can substitute each of the following sentences.

Question 1.

The capital method in which the partner’s Current Account is opened.

Answer:

Fixed Capital Method

Question 2.

The capital method in which the partner’s Current Account is not opened.

Answer:

Fluctuating Capital Method

Question 3.

Method of Capital Account in which capital balances of partners change every year.

Answer:

Fluctuating Capital Method

Question 4.

Expenses that are due but not paid at the end of the year.

Answer:

Outstanding/Unpaid expenses

Question 5.

A provision that is created on sundry debtors for likely bad debts.

Answer:

Reserve for Doubtful Debts

![]()

Question 6.

Income is received before it is due.

Answer:

Income received in advance

Question 7.

The stock is valued at cost price or market price whichever is less.

Answer:

Closing stock

Question 8.

Reduction in the value of fixed assets due to its continuous use.

Answer:

Depreciation

Question 9.

The transport expenses incurred to carry the goods purchased by the firm.

Answer:

Carriage Inward

Question 10.

Income due but not received.

Answer:

Accrued income

Question 11.

Account prepared on the basis of direct expenses and incomes.

Answer:

Trading Account

![]()

Question 12.

Account prepared on the basis of indirect expenses and incomes.

Answer:

Profit and Loss Account

Question 13.

The transport expenses are paid to Railway, the Airways company, or the Shipping company.

Answer:

Freight

C. State whether the following statements are True or False with reasons:

Question 1.

The partnership agreement must be in written form.

Answer:

This statement is Raise.

A partnership agreement can be in oral or written form. It is advisable to have a partnership agreement in written form, to avoid future conflicts and disputes among the partners. However, it is not compulsory.

Question 2.

There is no limit to a maximum number of partners in a firm.

Answer:

This statement is Raise.

Minimum two persons are required to form the partnership firm. As per the provisions made under the Companies Act 2013 (amended in 2014) the maximum number of partners in a firm is restricted to 50.

Question 3.

Partners are entitled to get a salary or commission.

Answer:

This statement is False.

In Partnership Deed when it is clearly mentioned that all partners or specific partners are entitled to salary or commission then only partners are entitled to get salary or commission. When partnership deed remains silent on salary or commission, then partners are not able to get any salary or commission.

Question 4.

Closing stock is always valued at market price.

Answer:

This statement is False.

As per the conservatism concept, the closing stock is always valued at cost price or market price whichever is less. If the market price of closing stock is greater than its cost then closing stock is recorded at cost.

![]()

Question 5.

The trial balance is the basis of the Final Account.

Answer:

This statement is True.

Based on the Trial balance and other adjustments, one can prepare Final Accounts. So, the Trial balance is the basis of Final Accounts.

Question 6.

Return inward is deducted from purchases.

Answer:

This statement is False.

Return inward means Sales return and it is to be deducted from sales, not from purchase. Return outward is deducted from purchases.

Question 7.

Discount allowed to Debtors is called as Bad debts.

Answer:

This statement is False.

Discount allowed to Debtors is an expense for the business while Bad debts mean irrecoverable amount from debtors and is a loss to the business. Thus, both have different meanings so, we cannot say that discount allowed to debtors is called as Bad debt.

D. Complete the Sentences.

Question 1.

Documentation charges paid for purchasing a building is debited to _____________ Account.

Answer:

Building

Question 2.

Credit balance of Trading Account indicates _____________

Answer:

Gross Profit

Question 3.

Receivable income is shown on _____________ side of the Balance Sheet.

Answer:

Assets

![]()

Question 4.

Trademark, Copyright, Patents are the examples of _____________ asset.

Answer:

intangible

Question 5.

Balance Sheet is a _____________ but it is not an _____________

Answer:

Statement, Account

Question 6.

Profit and Loss Account is a _____________ Account.

Answer:

Nominal

Question 7.

The income which is due but not yet received is called _____________ income.

Answer:

accrued/receivable

Question 8.

The statement showing list of all ledger balances is known as _____________

Answer:

Trial balance

Question 9.

Debit balance of Profit and Loss Account means _____________

Answer:

Net Loss

![]()

Question 10.

Interest on capital is an _____________ for the partner.

Answer:

income

Question 11.

Income accured but not received is _____________ for firm.

Answer:

an asset

Question 12.

Sale of scrap is recorded on _____________ side of _____________ Account.

Answer:

Credit, Profit and Loss

Question 13.

General reserve is recorded in _____________ side of _____________

Answer:

Liability, Balance Sheet

Question 14.

Provision for doubtful debts recorded in _____________ side of _____________ when it is given in the Trial balance only.

Answer:

Liability, Balance Sheet

Question 15.

Provident fund amount is a _____________ for the firm.

Answer:

Liability

![]()

E. Answer in one sentence only:

Question 1.

Define: ‘Partnership’ as per the Indian Partnership Act 1932.

Answer:

As per the Indian Partnership Act 1932, “partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any one of them acting for all”.

Question 2.

State the two-fold capacities of each partner who works in a business.

Answer:

Each partner works in two-fold capacities viz. Principal and Agent in a business.

Question 3.

As per Income Tax Act 1961, write the dates for Financial or Accounting Year.

Answer:

As per Income Tax Act, 1961, the Financial or Accounting year starts from 1st April of the current year to 31st March of next year. [e.g. 01/04/2019 to 31/03/2020].

Question 4.

How many effects for the hidden adjustment given in the Trial balance are to be passed?

Answer:

Two effects for every hidden adjustment, given in the Trial balance are to be passed, though no special instruction is given in the problem.

F. Do you agree/disagree with the following statements.

Question 1.

A profit and Loss Account is a Real Account.

Answer:

Disagree

Question 2.

Carriage outward means carriage on sales.

Answer:

Agree

![]()

Question 3.

Adjustments are recorded in Partners Current Account in Fluctuating Capital method.

Answer:

Disagree

Question 4.

Outstanding incomes are treated as an asset.

Answer:

Agree

Question 5.

The balance Sheet is an account.

Answer:

Disagree

Question 6.

R.D.C. is created on creditors.

Answer:

Agree

Question 7.

Depreciation is calculated on fixed assets.

Answer:

Agree

Question 8.

Copyright is a visible asset.

Answer:

Disagree

Question 9.

Interest on drawings is an income for the firm.

Answer:

Agree

Question 10.

Interest on a Partner’s Loan to the firm is always to be allowed.

Answer:

Agree

![]()

Question 11.

All indirect expenses are debited to Trading Account.

Answer:

Disagree

Question 12.

Capital Account always shows a credit balance.

Answer:

Disagree

Question 13.

Trading Account is prepared to know the profit or loss of the firm.

Answer:

Disagree

Question 14.

Final Accounts are prepared on the basis of Trial Balance and adjustments given.

Answer:

Agree

Question 15.

Royalty paid on production is shown in the Trading Account.

Answer:

Agree

Solved Problems

Question 1.

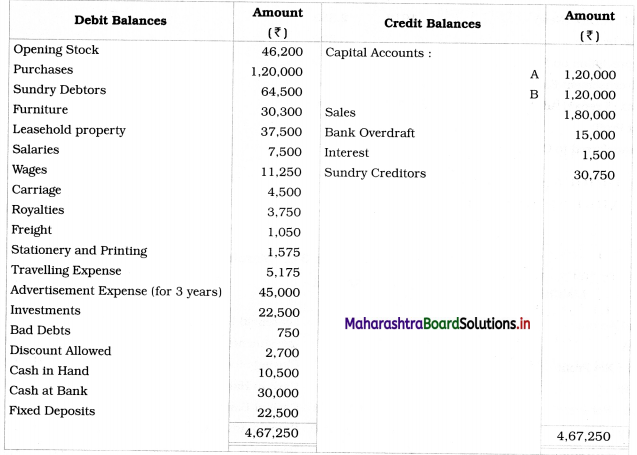

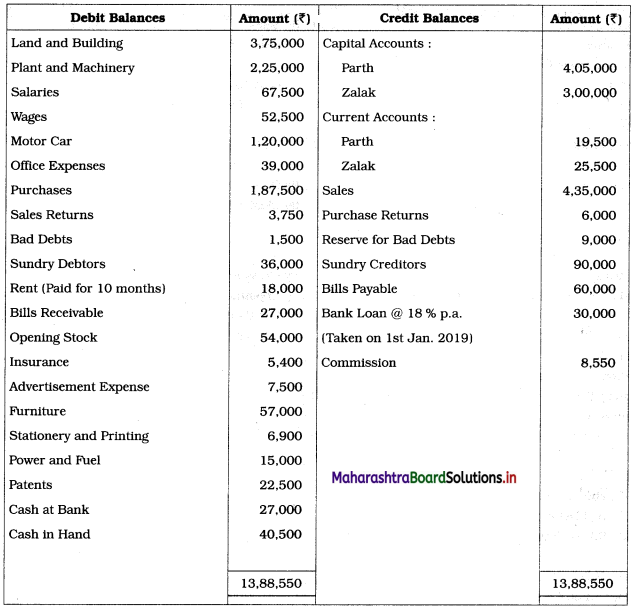

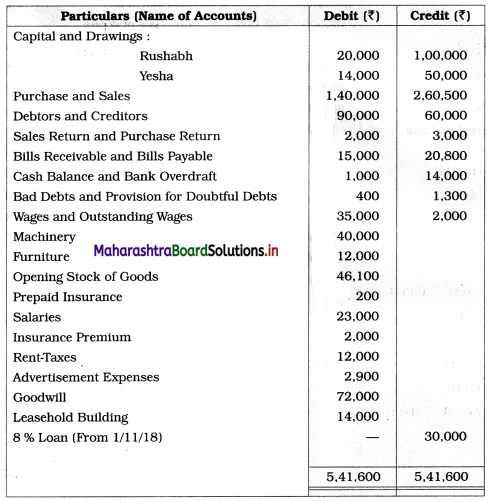

From the following Trial Balance and Adjustments prepare Trading and Profit and Loss Account and Balance Sheet as on 31st March 2019 for Mr. A and B.

Trial Balance as of 31st March, 2019

Adjustments:

1. Closing stock: Cost price ₹ 60,000, Market price ₹ 52,500.

2. Interest on fixed deposit ₹ 1800 is still outstanding.

3. Provide R.D.D. at 2.5 % on sundry debtors.

4. Depreciate furniture by 5 %.

5. Goods of ₹ 12,000 were destroyed by fire and the insurance company accepted the claim of ₹ 9,000 only.

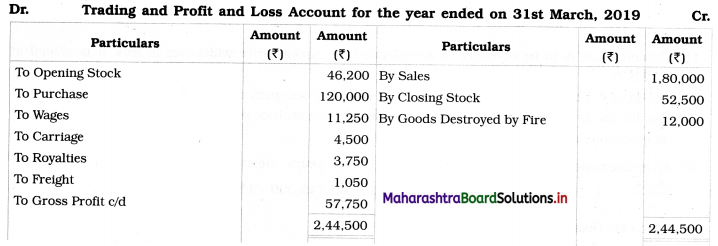

Solution:

In the books of Mr. A and Mr. B

Balance Sheet as of 31st March 2019

Working Notes:

1. Closing stock is to be considered at a cost price or market price whichever is less. It is valued at ₹ 52,500.

2. Goods of ₹ 12,000 were destroyed and the insurance company accepted a claim of ₹ 9,000, which means ₹ 3,000 is a loss for the firm. The insurance company accepted the claim, (not yet paid the amount) therefore, it is recorded on the Asset side of the Balance Sheet.

3. Advertisement expense ₹ 45,000 is given for 3 years means for one year, we have to take 45000/3 = ₹ 15,000 as advt. exp. and ₹ 30,000 (45,000 – 15,000) is to be taken as prepaid advt. exp. (Asset side)

![]()

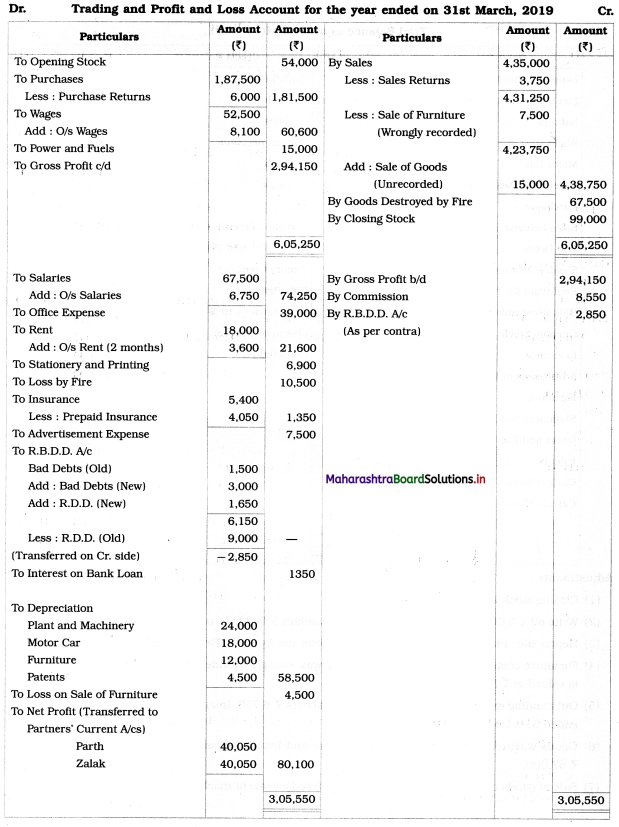

Question 2.

From the following Trial Balance of Parth and Zalak and given Adjustments, prepare Final Accounts for the year ending on 31st March 2019.

Trial Balance as of 31st March 2019

Adjustments:

1. Closing stock is valued at ₹ 99,000.

2. Write off ₹ 3,000 as further bad debts and maintain 5% R.D.D. on debtors.

3. Depreciate Plant and Machinery by 10%, Motor car by 15%, Patents by 20%.

4. Furniture costing ₹ 12,000 sold for ₹ 7,500 was wrongly included in sales and the remaining furniture is valued at ₹ 33,000.

5. Outstanding expenses are Wages ₹ 8,100, Salaries ₹ 6,750. The insurance premium is paid for the year ended 31st December 2019.

6. Goods worth ₹ 67,500 were destroyed by fire and the insurance company accepted the claim for only ₹ 57,000.

7. Sale of goods of ₹ 15,000 was wrongly considered as the sale of machinery.

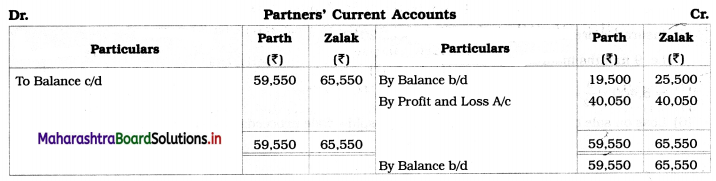

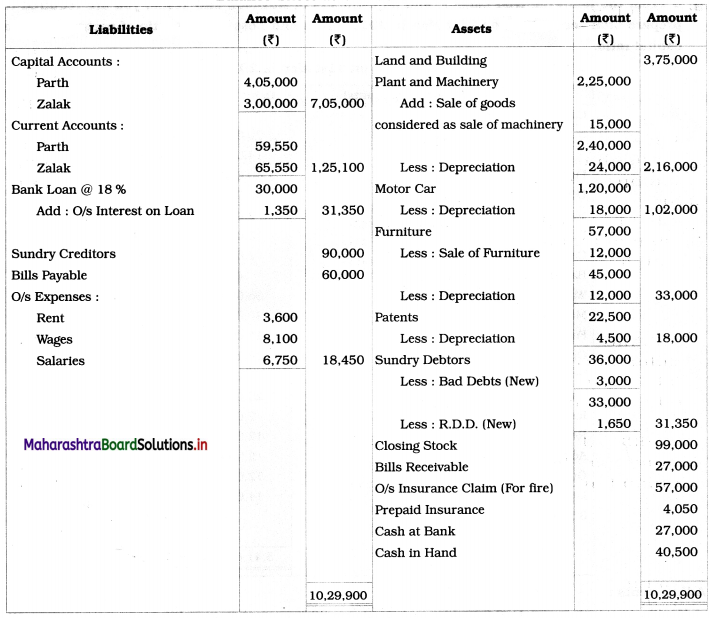

Solution:

In the books of Parth and Zalak

Balance Sheet as of 31st March 2019

Working Notes:

1. Interest on loan @18 % is calculated for 3 months, (i.e. 1/1/2019 to 31/3/2019)

I = \(\frac{\text { PRN }}{100}\)

= 30,000 × \(\frac{18}{100} \times \frac{3}{12}\)

= ₹ 1,350

2. Net loss by fire = 67,500 – 57,000 = ₹ 10,500

3. Depreciation on furniture = Book value – Value given in adj.

= 45,000 – 33,000

= ₹ 12,000

4. Rent is paid for 10 months i.e. 2 months rent is outstanding.

5. Insurance premium is paid upto 31st Dec., 2019. i.e. 9 months insurance premium is prepaid.

= 5,400 × \(\frac{9}{12}\)

= ₹ 4,050

6. Loss on sale of furniture = Cost of furniture sold – Sale proceeds of furniture

= 12,000 – 7,500

= ₹ 4,500

![]()

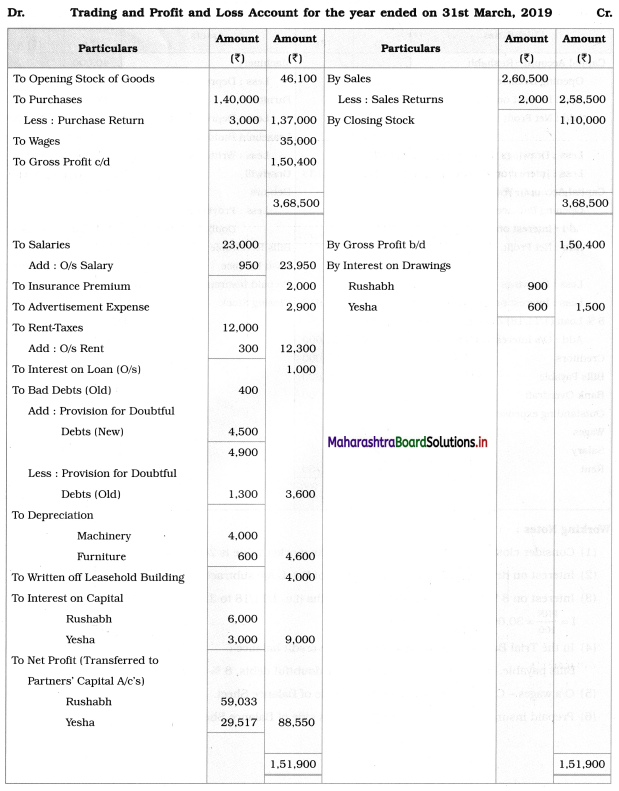

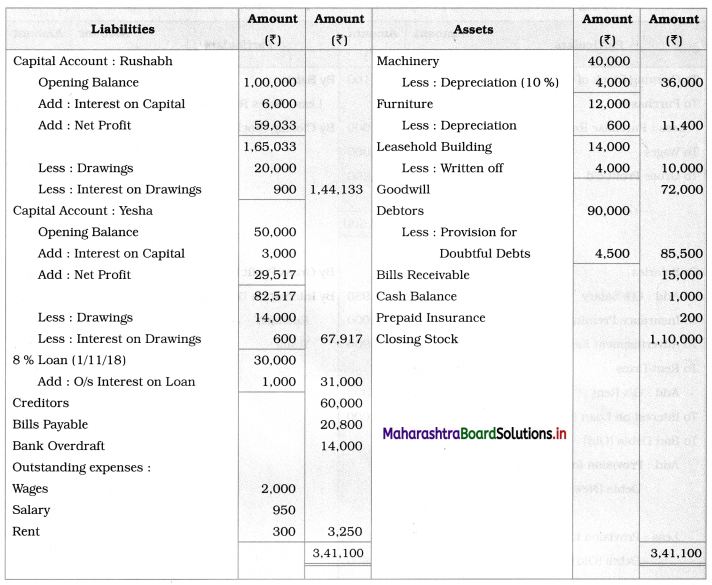

Question 3.

From the following trial balance and adjustments of Rushabh and Yesha, you are required to prepare final accounts as of 31st March 2019. The profit and Loss sharing ratio of partners is their capital ratio.

Trial Balance as of 31st March 2019

Adjustments:

1. Closing stock is ₹ 1,10,000. Its market value is 20% more than its value.

2. Calculate interest on capital @ 6% p.a.

3. Interest on drawings to be charged from partners: Rushabh ₹ 900, Yesha ₹ 600

4. Provision for doubtful debts is to be kept at 5%.

5. Outstanding expenses at the end of the year: Rent ₹ 300, Salary ₹ 950.

6. Provide depreciation at 10% on machinery and at 5% on furniture.

7. Write off ₹ 4,000 from leasehold building.

Solution:

In the books of Rushabh and Yesha

Balance Sheet as of 31st March 2019

Working Notes:

1. Consider closing stock value ₹ 1,10,000 as its market value is 20% more.

2. Interest in drawings: Record it on the Cr. side of P & L A/c subtract it from the capital. (As shown)

3. Interest on an 8 % loan is calculated for 5 months (i.e. 1/11/18 to 31/3/19)

I = \(\frac{\mathrm{PRN}}{100}\)

= 30,000 × \(\frac{8}{100} \times \frac{5}{12}\)

= ₹ 1,000

4. In the Trial Balance, the following balances have credit balance:

Bills payable, Bank Overdraft, Provision for doubtful debts, 8 % Loan, etc.

5. O/s wages – Cr. bal. – write it on the Liability side of the Balance Sheet.

6. Prepaid insurance – Dr. bal. write it on the Asset side of the Balance Sheet.