Balbharti Maharashtra State Board 11th Commerce Book Keeping & Accountancy Important Questions Chapter 8 Rectification of Errors Important Questions and Answers.

Maharashtra State Board 11th Commerce BK Important Questions Chapter 8 Rectification of Errors

1. Answer in One Sentence:

Question 1.

What is an Arithmetical error?

Answer:

An error committed to totaling the amount columns of journal and ledger is called arithmetical error.

Question 2.

What do you mean by one-sided errors?

Answer:

One-sided errors are those errors that either affect the debit or credit aspect of the transaction. It affects the agreement of the trial balance.

![]()

Question 3.

What do you mean by two-sided errors?

Answer:

Two-sided errors are those errors that affect both the aspects of a transaction i.e. debit and credit. It does not affect the agreement of the trial balance.

Question 4.

What is a suspense account?

Answer:

An account that is opened to transfer the difference in the totals of the trial balance is known as a suspense account.

Question 5.

What are accounting errors?

Answer:

Mistakes or errors committed while writing the books of accounts are known as accounting errors.

2. Give one word/term or phrase for each of the following statements.

Question 1.

Transactions remained to be recorded at all in the books of account.

Answer:

Errors of omission

Question 2.

Errors are always rectified by passing rectification entries.

Answer:

Two-sided errors

![]()

Question 3.

Errors that affect the debit and credit side unequally.

Answer:

One-sided errors

Question 4.

Errors that affect the debit and credit side equally.

Answer:

Two-sided errors

Question 5.

An error in which the transaction is entered in the original book but not posted into the ledger.

Answer:

The error of posting/partial omission

Question 6.

Error in the process of transferring the entry from original books into the ledger.

Answer:

Error of posting

Question 7.

Errors can be rectified without passing rectification entries.

Answer:

One-sided errors

3. Select the most appropriate alternative from those given below and rewrite the sentence.

Question 1.

Wages paid for the installation of machinery wrongly debited to wages account is an error of ___________

(a) omission

(b) principle

(c) commission

(d) duplication

Answer:

(b) principle

Question 2.

If the trial balance shows a short credit the suspense account will have a ___________ balance.

(a) debit

(b) zero

(c) credit

(d) nil

Answer:

(c) credit

![]()

Question 3.

If the trial balance does not agree the difference of the trial balance is placed in ___________ account.

(a) Personal

(b) Suspense

(c) Rectification

(d) Real

Answer:

(b) Suspense

Question 4.

Errors which compensate the effect of each other are called ___________ errors.

(a) compensating

(b) one-sided

(c) two sided

(d) clerical

Answer:

(a) compensating

Question 5.

One sided errors are disclosed by ___________

(a) Trial Balance

(b) Suspense Account

(c) Journal

(d) Ledger Account

Answer:

(a) Trial Balance

4. State whether the following statements are True or False with reasons.

Question 1.

Errors of principle are not disclosed by the Trial Balance.

Answer:

This statement is True.

The error of Principle is those where some basic principles of bookkeeping and accountancy are not Properly Followed while recording a business transaction. Such errors can be rectified by passing journal entries.

Eg.: Capital expender showed as revenue expenditure or vice versa. It won’t affect the Trial balance. If will agreed.

Question 2.

Transaction not recorded in the books is an error of principle.

Answer:

This statement is False.

Transaction not recorded in the books is an error of omission and not an error of principle.

Question 3.

If the purchase hook is undermasted, the purchase account is debited in rectification.

Answer:

This statement is True.

Purchases are expenses. All expenses are debited as per the rule of nominal account. When purchases are underacted they can be corrected by debiting in rectification.

![]()

Question 4.

When a transaction is not recorded according to the principles of book-keeping the error is said to be an error of principle.

Answer:

This statement is True.

The error of Principle is those where some basic principles of bookkeeping and accountancy are not properly followed while recording a business transaction.

Eg.: Capital expenditure is shown as revenue expenditure or Vice-a-Varsa and they are called an error of principle.

Question 5.

The error of omission is disclosed by the Trial Balance.

Answer:

This statement is False.

The complete omission of a transaction will bot disclosed by a trial balance. Trial balance, balances will be agreed with such errors. So the omission of transaction or an error of omission will not be disclosed by Trial Balance.

5. Do you agree or disagree with the following statements.

Question 1.

A temporary account opened to rectify the entry is known as suspense A/c.

Answer:

Agree

Question 2.

Rectified entries are passed in Ledger.

Answer:

Disagree

Question 3.

Compensating errors affect the agreement of Trial Balance.

Answer:

Disagree

Question 4.

There is only one type of error.

Answer:

Disagree

![]()

Question 5.

Transaction recorded without following the accounting principles and rules are known as Errors of Principle.

Answer:

Agree

6. Complete the following sentences.

Question 1.

___________ sided errors affect the total of Trial Balance.

Answer:

One

Question 2.

___________ sided errors do not affect the Trial Balance.

Answer:

Two

Question 3.

One sided error do not require ___________ entry.

Answer:

Rectification

Question 4.

Errors which are committed in writing the accounts are called error of ___________

Answer:

Posting

Question 5.

Under casting of Sales book is corrected by ___________ Sales Account.

Answer:

Crediting

![]()

Question 6.

The disagreement of Trial Balance indicates that an ___________ has been committed.

Answer:

Error

Question 7.

An asset has been purchased for the firm. However, the amount was debited to the purchase account. It is an error of ___________

Answer:

Principle

Question 8.

___________ account is necessary for rectification of one-sided error.

Answer:

Suspense A/c

Question 9.

An item of ₹ 95 has been debited to a personal account as ₹ 59. It is an error of ___________

Answer:

Commission

Question 10.

Rectification entries are passed in ___________

Answer:

Journal Proper

Question 11.

Two sided errors are rectified by passing ___________ entry.

Answer:

Rectification

Question 12.

If the Trial Balance does not tally, its difference is transferred to ___________ Account.

Answer:

Suspense

![]()

Question 13.

Under casting of an account is ___________ sided error.

Answer:

One

Question 14.

If the transaction is not at all recorded in the books, it is called an error of ___________

Answer:

Complete Omission

Question 15.

If the total balance shows short a credit, the suspense account will have a ___________ balance.

Answer:

Credit

Question 16.

An error that affects debit as well as credit side, it is called as ___________ errors.

Answer:

Two-Sided

Question 17.

Wages paid for installation of machinery debited to Wages Account is an error of ___________

Answer:

Principle

Question 18.

Errors which cancel out the effect of one another is called ___________ errors.

Answer:

Compensating

Question 19.

One sided errors are disclosed by ___________

Answer:

Trial Balance

![]()

Question 20.

In an error of omission, the debit and credit are ___________

Answer:

Equal

Practical Problems

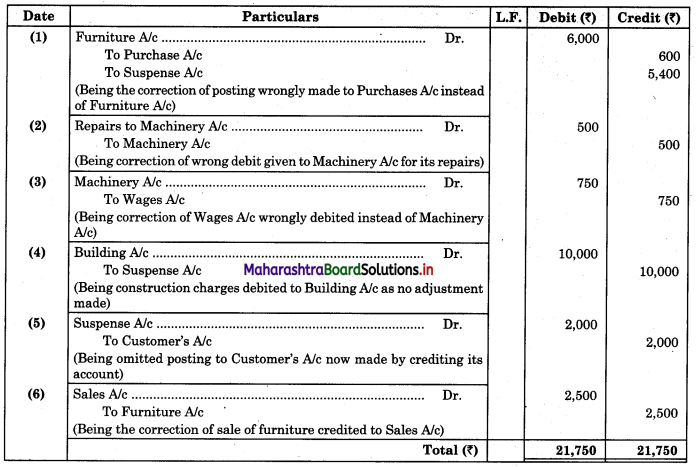

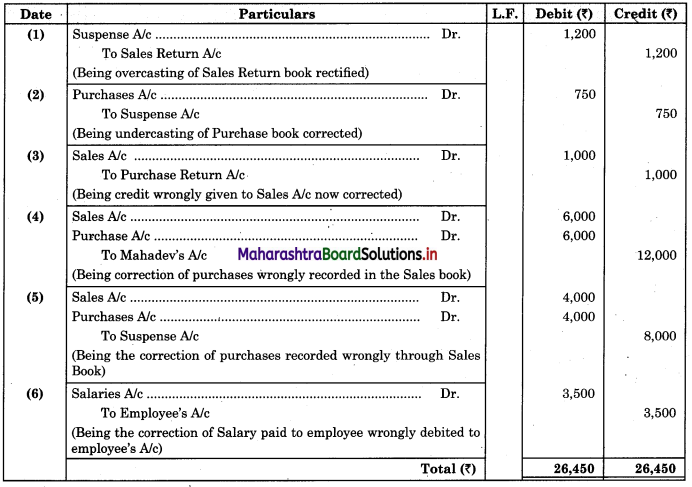

Question 1.

The trial balance of Sagar did not agree. It showed an excess credit of ₹ 7,550. Sagar put the difference to the suspense account. He located the following errors:

1. Sales return book was overcast by ₹ 1,200.

2. Purchase book was undercast by ₹ 750.

3. Goods returned to Mahesh ₹ 1,000 were recorded through the sales book.

4. Credit purchases from Mahadev ₹ 6,000 were recorded through the sales book.

5. Credit purchases from Damodhar ₹ 4,000 were recorded through the sales book. However, Damodhar’s account was correctly credited.

6. Salary paid ₹ 3,500 was debited to the employee’s personal account.

Give journal entries to rectify the above errors and prepare Suspense Account.

Solution:

Journal Proper

![]()

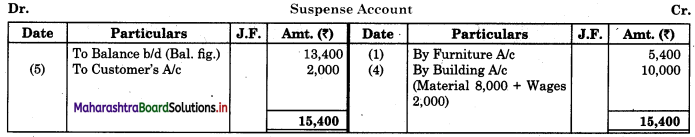

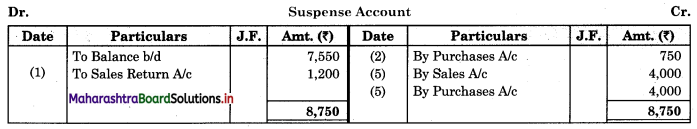

Question 2.

The trial balance of Radhika did not agree. Radhika put the difference to the suspense account. Subsequently, she located the following errors.

1. Furniture purchased for ₹ 6,000 was posted to the purchases account as ₹ 600.

2. Repairs to Machinery ₹ 500 were debited to the Machinery account.

3. Wages paid for the installation of Machinery ₹ 750 was posted to wages account.

4. Purchased material ₹ 8,000 and Wages ₹ 2,000 were used for construction of the building. No adjustment was made in the books.

5. Total of sales returns book ₹ 2,000 was not posted to the ledger.

6. Old Furniture sold to Dinesh at its book value of ₹ 2,500 was recorded through sales book.

Give journal entries and prepare Suspense Account.

Solution:

Journal Proper