Balbharti Maharashtra State Board 11th Commerce Book Keeping & Accountancy Important Questions Chapter 6 Bank Reconciliation Statement Important Questions and Answers.

Maharashtra State Board 11th Commerce BK Important Questions Chapter 6 Bank Reconciliation Statement

1. Answer in one sentence.

Question 1.

What is a Bank Reconciliation Statement?

Answer:

Bank Reconciliation Statement is a statement that shows the causes of disagreement between the balance shown by passbook and the balance shown by Cash Book under the column as on a particular date.

Question 2.

What is a Bank passbook?

Answer:

A Bank passbook is a copy of a Customer’s A/c in the Bank’s ledger.

![]()

Question 3.

What do you mean by the debit balance of Pass Book?

Answer:

Debit balance of passbook means overdraft as per passbook.

Question 4.

Which account is opened by a trader in Bank for his business operation?

Answer:

A current account is opened by a trader in Bank for his business operation.

Question 5.

On which side of the Cash Book interest on investment is to be shown?

Answer:

Interest on investment is to be shown on the debit/receipt side in the Cash Book.

Question 6.

On which side of the passbook, the direct deposit made by a customer is recorded?

Answer:

A direct deposit made by a customer is recorded on the credit side of the passbook.

Question 7.

What does the credit balance of Cash Book indicate?

Answer:

A credit balance of Cash Book indicates overdraft as per Cash Book.

2. Give one word/term/phrase which can substitute each of the following statements:

Question 1.

Excess of a total of debit side over a total of credit side of Cash Book, Bank column.

Answer:

Bank Balance as per Cash Book

Question 2.

An unfavourable balance is shown by the passbook.

Answer:

Overdraft

![]()

Question 3.

A copy of the customer’s account issued by the bank.

Answer:

Pass Book

Question 4.

Booklet or a statement that is used to record the banking transactions.

Answer:

Pass Book

Question 5.

The credit balance of the bank column of the Cash Book.

Answer:

Overdraft

Question 6.

Refusal by the bank to make payment of a cheque.

Answer:

Dishonour of Cheque

Question 7.

Document used to withdraw cash from the bank.

Answer:

Withdrawal Slip

Question 8.

Excess of a total of credit side over a total of debit side in the passbook.

Answer:

Balance as per Pass Book

![]()

Question 9.

Document used by the account holder to deposit cash and/or cheques into the bank.

Answer:

Pay-in-Slip

Question 10.

Document used by the account holder to withdraw cash from the bank and for making payment to outside parties through the bank.

Answer:

Cheque

3. Do you agree or disagree with the following statements:

Question 1.

Bank Reconciliation Statement is prepared by Bank.

Answer:

Disagree

Question 2.

Overdraft Facility is available to savings Bank Account.

Answer:

Disagree

Question 3.

The bank account holder can make payments to a third party by use of a pay-in slip.

Answer:

Disagree

![]()

Question 4.

Bank does not charge any interest on an overdraft balance.

Answer:

Disagree

Question 5.

Credit balance in Pass Book represents overdraft balance.

Answer:

Disagree

Question 6.

In the cash book of a trader Bank record the entries.

Answer:

Disagree

Question 7.

In the passbook, entries are made by the account holder.

Answer:

Disagree

Question 8.

Through mobile banking account holder can deposit physical cash into his account.

Answer:

Disagree

Question 9.

The right-hand side of the pay-in-slip is known as a counterfoil.

Answer:

Disagree

![]()

Question 10.

A cash withdrawal slip is used to deposit a cheque or cash into a bank account.

Answer:

Disagree

4. Select the most appropriate alternative from those given and rewrite the following statements:

Question 1.

Pass Book is _____________ of account holders transactions with bank.

(a) an extract

(b) balance sheet

(c) balance

(d) mode

Answer:

(a) an extract

Question 2.

When cheque is _____________ into bank Cash Book is debited.

(a) written

(b) issued

(c) deposited

(d) dishonoured

Answer:

(c) deposited

Question 3.

Overdraft facility is allowed to _____________ account.

(a) saving

(b) recurring

(c) current

(d) fixed deposit.

Answer:

(c) current

Question 4.

Overdraft means _____________ balance of Pass Book.

(a) opening

(b) debit

(c) credit

(d) closing

Answer:

(b) debit

![]()

Question 5.

Interest on bank overdraft is recorded on _____________ side of Pass Book.

(a) debit

(b) credit

(c) any

(d) both

Answer:

(a) debit

Question 6.

Credit balance in the Pass Book represents _____________

(a) overdraft

(b) bank balance

(c) loan borrowed

(d) negative

Answer:

(b) bank balance

Question 7.

Direct deposit by a customer will be recorded on _____________ side of Pass Book.

(a) debit

(b) credit

(c) left hand

(d) any

Answer:

(b) credit

Question 8.

Normally the Bank Reconciliation Statement is prepared at the end of a _____________

(a) day

(b) week

(c) year

(d) month

Answer:

(d) month

![]()

Question 9.

Bank charges charged by bank are recorded on _____________ side of Pass Book.

(a) debit

(b) credit

(c) any

(d) both

Answer:

(a) debit

5. Complete the following statements:

Question 1.

Bank issue _____________ to current account holders as record or summary for bank transactions.

Answer:

Bank statement

Question 2.

To deposit cash or cheque _____________ is used.

Answer:

Pay in Slip

Question 3.

Directly deposited by a customer in bank account appears an _____________ side of pass book.

Answer:

Credit

Question 4.

____________ is an unfavorable balance as per Pass Book.

Answer:

overdraft

Question 5.

Check deposited into Bank but not cleared is called _____________ cheque.

Answer:

Dishonoured

Question 6.

Expenses paid by the Bank as per standing instructions will be recorded at _____________ side of the passbook.

Answer:

Debit

![]()

Question 7.

Dividend collected by the bank will be recorded at _____________ side of cash book.

Answer:

Debit

Question 8.

_____________ type of bank account is open by trader.

Answer:

Current

6. State whether the following statements are True or False with reasons:

Question 1.

Bank Reconciliation Statement is prepared by the Bank.

Answer:

This statement is False.

A Bank Reconciliation statement shows the causes of disagreement between the balances shown by the bank passbook and the bank balance shown by the cash book, for a particular period of time generally a month. It is prepared by the trader as he has both the books to compare and find the differences.

Question 2.

Bank Reconciliation Statement is prepared at the end of every month.

Answer:

This statement is True.

Monthly preparation of Bank Reconciliation Statement assists in the regular monitoring of cash flows of a business and identification of accounting errors.

Question 3.

Overdraft facility is allowed to Proprietor’s Personal A/c.

Answer:

This statement is False.

Overdraft facility is allowed only to business current A/c and not to Proprietor’s Personal A/c.

![]()

Question 4.

The debit balance of Pass Book represents overdraft.

Answer:

This statement is True.

Debit Column of a passbook means withdrawals from the bank, When withdrawals are more than deposits it means the excess amount is withdrawn from the bank. It is a temporary loan payable by the trader to the bank. So the debit balance of Pass Book represents overdraft.

Question 6.

Bank charges debited by Bank increase bank balance as per Pass Book.

Answer:

This statement is False.

Bank charges are expenses for the business. Expenses decrease the bank balance as per Pass Book. Bank charges debited by the bank decrease the bank balance as per Pass Book.

Question 6.

Interest credited in PassBook is an income to the customer.

Answer:

This statement is True.

All incomes are shown on the credit side of the passbook. It is a deposit. So Interest Credited in Passbook is an income to the customer.

Question 7.

Bank Reconciliation Statement is prepared to detect the errors that take place in accounting.

Answer:

This statement is True.

A businessman maintains a cash book with a bank column to record his bank transactions whereas the bank also maintains a customer’s ledger account and issues him a Bank statement. There could be differences as per the bank balance in the cash book and bank balance in the passbook. To detect the errors that take place in accounting Bank Reconciliation Statement is prepared.

Question 8.

Overdraft as per Cash Book means debit balance as per Cash Book.

Answer:

This statement is False.

Overdraft as per Cash Book means credit balance as per cash book. Cashbook debit means deposits. When cash book debit balance is greater it means Bank Balance as per Cash Book.

![]()

Question 9.

Cheque deposited into Bank increases the Bank balance as per Cash Book.

Answer:

This statement is True.

The Debit side of the cash book means deposits. So cheque deposited into the Bank increases the Bank Balance as per Cash Book.

Question 10.

Payments made by the bank as per standing instructions are recorded on the Debit balance of the Pass Book.

Answer:

This statement is True.

The Debit side of the passbook represents payments. So any payments made by the bank, Bank debits the customer’s account and records on the Debit side of the passbook.

Question 11.

Bank column in Cash Book represents Proprietor’s Savings A/c.

Answer:

This statement is False.

Cashbook records only business transactions and not the personal A/c of the trader. The Bank column in Cash Book represents Business Current A/c and not the proprietor’s savings A/c.

7. Correct and rewrite the following statements.

Question 1.

Overdraft as per cash book means debit balance as per cash book.

Answer:

Normal bank balance as per cash book means debit balance as per cashback.

Question 2.

Bank column in cash book represents proprietors saving A/c.

Answer:

The Bank column in cashback represents the business’s current account.

Question 3.

Fixed deposit A/c is opened by traders for day-to-day business bank transactions.

Answer:

The current account is opened by traders for day-to-day business bank transactions.

![]()

Question 4.

The bank account is a real account.

Answer:

A bank account is a personal account

Question 5.

Interest charged by the bank on overdraft A/c is income for the business.

Answer:

Interest charged by the bank on overdraft A/c is an expense for the business.

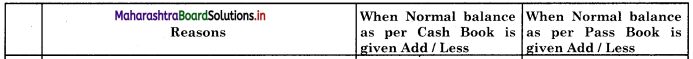

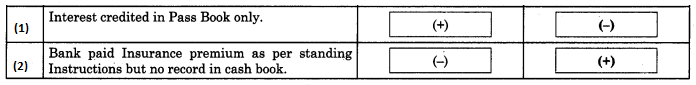

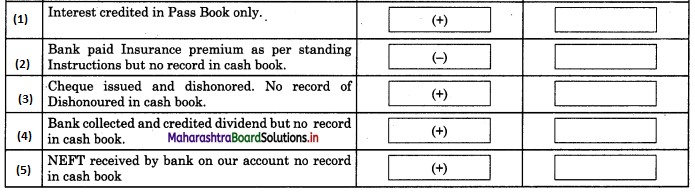

8. Complete the following table.

Question 1.

Answer: