Balbharti Maharashtra State Board 11th Commerce Book Keeping & Accountancy Important Questions Chapter 10 Single Entry System Important Questions and Answers.

Maharashtra State Board 11th Commerce BK Important Questions Chapter 10 Single Entry System

1. Answer in One sentence only.

Question 1.

In which method statement of affairs is prepared?

Answer:

Under the Net worth method of a single entry, a statement of affairs is prepared.

Question 2.

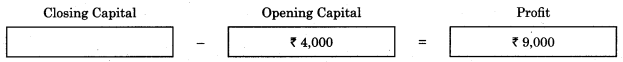

How is closing capital calculated under a single entry system?

Answer:

Under single entry system closing capital is calculated by deducting the total closing value of liabilities from the total closing value of assets.

![]()

Question 3.

Which statement is prepared under the single entry system to ascertain profit?

Answer:

A statement of profit or loss is prepared to ascertain profit under a single entry system.

Question 4.

What is a Statement of Profit or Loss?

Answer:

A statement that is prepared under a single entry system to calculate profit or loss is called a statement of profit or loss.

2. Write a word, term, or phrase which can substitute each of the following statements.

Question 1.

A system of book-keeping in which both the aspects of transactions are recorded.

Answer:

Double Entry System

Question 2.

Name the method of accounting in which only cash and personal transactions are recorded.

Answer:

Single Entry System

Question 3.

A statement is similar to the Balance sheet was prepared to ascertain the amounts of closing capital.

Answer:

Closing Statement of Affairs

![]()

Question 4.

The system of accounting is most scientific and reliable.

Answer:

Double Entry System

Question 5.

Name the statement prepared to find out profit or loss under a single entry system.

Answer:

Statement of Profit or Loss

Question 6.

Excess of opening capital over closing capital of proprietor under single entry system.

Answer:

Loss

Question 7.

Method of accounting in which real accounts and nominal accounts are not maintained.

Answer:

Single Entry System

Question 8.

A statement that shows profit or loss of business under a single entry system.

Answer:

Statement of Profit or Loss

Question 9.

An accounting system where rules of debit and credit are not followed.

Answer:

Single Entry System

Question 10.

The incomplete method of the accounting system.

Answer:

Single Entry System

![]()

Question 11.

A system of book-keeping which records only one aspect of business transactions and ignores other aspects.

Answer:

Single Entry System

Question 12.

A statement that shows the balances of various assets and liabilities at their approximate or estimated values as on a particular date.

Answer:

Statement of Affairs

3. Select the most appropriate answer from the alternatives given below and rewrite the sentence.

Question 1.

The difference between the capital at the end of the year and capital at the beginning of the year is called _____________

(a) Profit

(b) Income

(c) Drawings

(d) Expenses

Answer:

(a) Profit

Question 2.

A statement of _____________ is to be prepared in under to find out profit or loss under a single entry system.

(a) Income

(b) Affairs

(c) Revenue

(d) Profit or Loss

Answer:

(d) Profit or Loss

Question 3.

A statement of affairs is a summarised statement of an estimated _____________

(a) Financial Position

(b) Profit

(c) Income

(d) Loss

Answer:

(a) Financial Position

![]()

Question 4.

If closing capital is ₹ 30,000 and profit is ₹ 5,000 opening capital was _____________

(a) ₹ 35,000

(b) ₹ 30,000

(c) ₹ 25,000

(d) ₹ 15,000

Answer:

(c) ₹ 25,000

Question 5.

Under single Entry system, Profit = Closing Capital less _____________

(a) Opening Capital

(b) Opening Assets

(c) Opening Liabilities

(d) Drawings

Answer:

(a) Opening Capital

Question 6.

The capital at the end of the accounting year is ascertained by preparing _____________

(a) Cash Account

(b) Closing Statement of Affairs

(c) Total Debtors Account

(d) Opening Statement of Affairs

Answer:

(b) Closing Statement of Affairs

Question 7.

The capital at the beginning of the accounting year is ascertained by preparing _____________

(a) Receipt and Payment Account

(b) Cash Account

(c) Opening Statement of Affairs

(d) Closing Statement of Affairs

Answer:

(c) Opening Statement of Affairs

![]()

Question 8.

Under Single Entry System only _____________ are opened.

(a) Cash and Personal Accounts

(b) Real Accounts

(c) Nominal Accounts

(d) Real and Nominal Accounts

Answer:

(a) Cash and Personal Accounts

Question 9.

Statement of Affairs is just like _____________

(a) Profit and Loss A/c

(b) Real A/c

(c) Trading A/c

(d) Balance Sheet

Answer:

(d) Balance Sheet

Question 10.

Under the Net worth method, the basis for ascertaining profit or loss is the difference between _____________

(a) Capital on two dates

(b) Gross assets on two dates

(c) Liabilities on two dates

(d) Net assets on two dates

Answer:

(a) Capital on two dates

4. State True or False with reasons:

Question 1.

Statement of profit is just like Profit and Loss Account.

Answer:

This statement is False.

The profit and loss account has the debit and credit side which shows all expenses on the debit side and all incomes on the credit side and the differences are profit and loss for the year. Whereas statement of profit just adds and less income and expenses to find profit or loss.

Question 2.

The single Entry System is based on certain rules and principles.

Answer:

This statement is False.

A single Entry System is an ancient method of recording business transactions. It is a simple method of book-keeping. It is not a scientific and accurate system of Accounting. This system has no proper set of rules to be followed.

Question 3.

All transactions are recorded in the Single Entry System.

Answer:

This statement is False.

All transactions are not recorded in a single entry system. Only cash books and personal accounts of debtors and creditors are maintained. All transactions are recorded in the Double Entry System of Book-Keeping and Accountancy.

![]()

Question 4.

Arithmetical accuracy cannot be checked in Single Entry.

Answer:

This statement is True.

All transactions and accounts are not recorded in the Single Entry System. So it is impossible to prepare a Trial balance under this system without which Arithmetical accuracy cannot be checked.

Question 5.

Drawings made during the year decrease the profit under the Single Entry System.

Answer:

This statement is False.

Drawings made during the year are added to the closing capital in the statement of profit, it increases the profit under the Single Entry System.

5. Do you agree with the following statements?

Question 1.

The single Entry System of Book-keeping is a scientific method of books of accounts.

Answer:

Disagree

Question 2.

The single Entry System is useful only for large organizations.

Answer:

Disagree

Question 3.

Statement of Affairs is just like a profit and loss account.

Answer:

Disagree

Question 4.

The difference between Assets and Liabilities is called net profit.

Answer:

Disagree

![]()

Question 5.

The single Entry System follows the golden rules of accounts.

Answer:

Disagree

6. Fill in the Blanks.

Question 1.

In _____________ Book-keeping system, only Cash/Bank A/c and Personal accounts of Debtors and Creditors are opened.

Answer:

Single Entry

Question 2.

Capital is the difference between _____________ and _____________

Answer:

Assets, Liabilities

Question 3.

Single Entry System of Book-keeping is _____________ system of books of accounts.

Answer:

Conventional Accounting

Question 4.

_____________ accuracy is not guaranteed under Single Entry System.

Answer:

Arithmetical

Question 5.

In statement of profit or loss, profit on sale of assets are _____________ to closing capital.

Answer:

Added

![]()

Question 6.

Bad debts are _____________ from closing capital in statement of profit or loss.

Answer:

Deducted

Question 7.

_____________ unscientific system of Book-keeping.

Answer:

Single Entry System

Question 8.

Under the Single Entry System, profit or loss is calculated by deducting the opening capital balance from _____________ at the end of the year.

Answer:

the closing capital balance

7. Find the odd one.

Question 1.

Stock in trade, Bank overdraft, Bills receivable.

Answer:

Bank overdraft

Question 2.

Interest on Loan, Interest on Investment, Income receivable.

Answer:

Interest on Loan

Question 3.

Bad debts, Reserve for Bad debts, Reserve for a discount on creditors.

Answer:

Reserve for a discount on creditors

Question 4.

Income received in advance, Prepaid Expenses, Outstanding Expenses.

Answer:

Prepaid Expenses

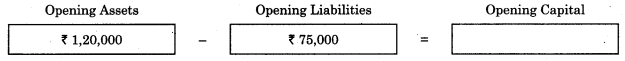

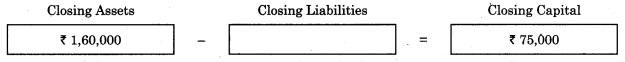

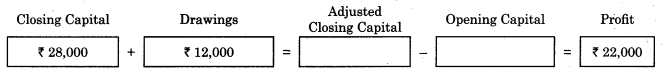

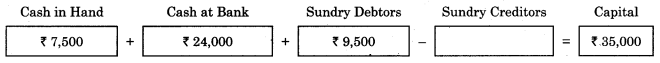

8. Complete the following table:

Question 1.

Answer:

₹ 13,000

![]()

Question 2.

Answer:

₹ 45,000

Question 3.

Answer:

₹ 85,000

Question 4.

Answer:

₹ 40,000, ₹ 18,000

![]()

Question 5.

Answer:

₹ 6,000